|

市場調查報告書

商品編碼

1639541

主動資料市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Active Data Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

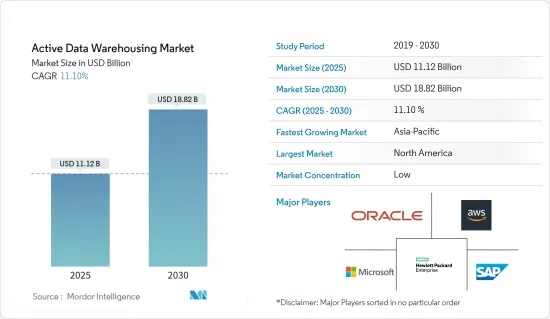

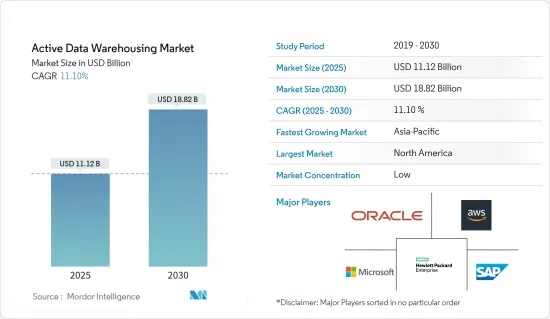

活動資料倉儲市場規模預計到 2025 年為 111.2 億美元,預計到 2030 年將達到 188.2 億美元,預測期內(2025-2030 年)複合年成長率為 11.1%。

預計新興市場的需求成長也將為預測期內的活躍資料倉儲市場提供新的機會。

主要亮點

- 在對下一代商業智慧的持續需求以及組織產生的資料量不斷增加等因素的推動下,主動資料倉儲市場正在經歷重大變化。 ADW 允許使用者即時存取大量複雜資訊。資料組織得高效且良好,因此預計將在預測期內推動市場成長。對低延遲、高速分析的需求不斷成長,加上商業智慧在企業管理中的作用日益增強,預計將顯著推動市場需求。

- 此外,據Oracle稱,在近90%的人口居住在都市區的巴西,SKY Brasil擁有約29%的直接入戶衛星服務市場佔有率。該公司選擇在與 Oracle Siebel CRM 整合的 Oracle 雲端基礎架構上運作的 Oracle 自治資料倉儲來執行即時進階行銷分析。與先前的本地解決方案相比,客戶能夠將部署和上運作時間縮短 90%,同時將基礎設施成本降低 60%。此外,ADW 與將資料集中在一處可顯著降低計算成本。

- 此外,ADW 與將資料整合到一處相結合,可顯著降低計算成本,預計這也將對市場成長產生積極影響。除了這些趨勢之外,在全球範圍內,公司間巨量資料趨勢的顯著上升正在導致對分析的需求增加,這也有望支持市場成長。市場上的供應商還採用基於資源使用的雲端資料倉儲定價模型來擴展運算能力以滿足需求,並在使用高峰時輕鬆縮減規模。這解決了供應商所需的規模經濟和客戶所需的靈活性問題。然而,固定容量的資料倉儲迫使組織購買超出其所需的運算容量。

- 由於人們對資料管理的日益關注和複雜性的增加,資料倉儲在實際應用中越來越受到關注,特別是在金融、商業、醫療保健和其他行業。企業流程的數位化導致 IT 產業採用具有資料分析功能的新技術先進業務。因此,現代資料倉儲系統促進了數位業務營運所需的即時、企業範圍的分析和資訊洞察的開發。

- 然而,主動資料倉儲市場受到實施成本高和網路威脅日益增加等多種因素的限制。

- COVID-19 對市場產生了多種影響。例如,在 Bart Works 和國際分析研究所 (IIA) 對 300 名美國分析專業人士進行的一項調查中,超過 43% 的受訪者表示他們會針對 COVID-19 問題做出實質選擇。是他們行動的一個重要因素。疫情期間,企業縮減了業務、削減成本並關閉了辦公室。在家工作範式的盛行給企業帶來了挑戰。隨著這些發展,雲端基礎的資料倉儲的採用預計將加速。這場大流行為資料倉儲實施帶來了許多好處,包括成本效率、獲得大型技能庫和增強的可擴展性。

主動資料倉儲市場趨勢

智慧型手機的普及推動市場成長

- 行動電話,尤其是智慧型手機,越來越受到不同人群的歡迎。現代資訊和通訊技術(ICT)使用戶能夠快速獲取所需的資訊。根據 GSMA 的數據,截至去年,全球活躍 iOS 和 Android 智慧型手機數量超過 62 億部,預計到 2025 年將達到 74 億部。此外,行動技術在各種電腦系統中的使用正在增加,例如資料倉儲(DW)、商業智慧(BI)系統和資料分析系統。

- 行動電話充當資料庫並儲存大量用戶資料。可以根據使用者核准的條款和條件對儲存的資料進行分析。可以透過各種活躍的資料倉儲來搜尋和分析資料,以收集多種使用者特徵。智慧型手機用戶需要大量的雲端資料庫來進行資料訪問,因此需要資料倉儲解決方案並推動市場成長。

- 此外,由於中國、巴西和印度等新興國家智慧型手機使用量的增加和社群媒體流量的增加,資料流也隨之增加,因此需要更多的功能,例如即時資料儲存。

- 此外,各國智慧型手機使用量的增加預計也將推動市場成長。例如,根據資訊和廣播部的數據,2022年11月,印度行動電話用戶數將超過12億,其中智慧型手機用戶達到6億。此外,除了相對較低的資料通訊費用外,智慧型手機的普及也導致人們在行動裝置上消費更多的資訊和娛樂。

預計北美將佔據較大市場佔有率

- 與歐洲和亞洲的組織相比,美國的組織在多個行業中顯著採用了分析。由於龐大的需求和供應商的存在,美國被認為是市場上的重要國家。此外,根據 GSMA 的數據,北美去年擁有 3.29 億行動服務用戶,佔總人口的 84%。由於該地區大多數新的獨特客戶來自美國,該地區通訊業者的整體潛在市場已接近飽和狀態。到 2025 年,該地區預計將成長 1,200 萬用戶,其中 75% 將由美國提供。

- 該國的消費者也重視即時回應問題的供應商。因此,許多零售公司正在採用主動資料倉儲的概念來支援忠誠度管理應用程式,這些應用程式在保留消費者方面發揮關鍵作用。

- 行動寬頻的普及導致巨量資料分析和雲端運算的成長。據估計,美國將成為資料倉儲部署的潛在市場,到 2022 年,大量公司將採用分析技術,促使多家公司從本地部署轉向基於雲端基礎的部署。此外,由於貿易活動的增加和該國公司數量的增加,物流活動預計也會增加。然而,不斷增加的公共債務預計將推高通貨膨脹並限制小販的活動。

- 據微軟稱,人工智慧驅動的虛擬代理正在為新興管道做出巨大貢獻。自然語言處理和機器學習等功能能夠提供 24/7 的智慧、對話式和敏捷解決方案。這表明公司重視並投資於提高客戶滿意度。因此,對此類複雜平台和分析的需求可能會繼續以穩定的速度資料。

- 市場的另一個主要驅動力是對具有 BI 功能的解決方案的需求不斷成長。該市場是由政府舉措和醫生增加資料分析來推動的,以改善疾病檢測和預防等基層醫療。因此,許多醫療保健組織正在增加在積極的資料倉儲方面的支出,以進一步節省成本。在預測期內,保險公司和其他 BFSI 公司對即時分析和 BI 的需求不斷增加,預計將加強美國對 ADW 的需求。

主動資料倉儲產業概述

主動資料倉儲市場高度細分,來自微軟公司、甲骨文公司和 SAP SE 等國內外參與企業的激烈競爭。科技的進步也為企業帶來了顯著的競爭優勢,市場上也出現了多種聯盟。

2022 年 5 月,戴爾技術公司和 Snowflake Inc. 宣布就一個新計劃建立合作夥伴關係,將其本地儲存產品組合中的資料與 Snowflake 資料雲端連接起來。該雲端原生平台稱為 Snowflake Data Cloud,旨在消除對單獨資料湖和倉庫的需求,同時實現整個企業的安全資料共用。聚合來自各種軟體即服務和雲端平台的資料集,並將其提供給所有使用者。同樣在 2022 年 5 月,Oracle 和著名企業雲端資料管理供應商 Informatica 宣佈建立策略合作關係,使 Informatica 的資料整合和管治解決方案能夠在 Oracle 雲端基礎架構上使用。此外,Oracle 還指定 Informatica 為 OCI 上資料倉儲和 Lakehouse 解決方案的首選企業雲端資料管治和整合合作夥伴。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 各行業擴大採用商業智慧和巨量資料分析解決方案

- 智慧型手機的普及可能會推動市場成長

- 市場問題

- 實施需要大量資源和時間消耗

- 日益增加的網路威脅可能會抑制市場成長

第6章 市場細分

- 依部署類型

- 本地

- 雲

- 混合

- 按公司規模

- 小型企業

- 主要企業

- 按行業分類

- BFSI

- 製造業

- 醫療保健

- 零售

- 其他行業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 其他亞太地區

- 其他

- 北美洲

第7章 競爭格局

- 公司簡介

- Treasure Data Inc.

- Cloudera Inc.

- Snowflake Computing Inc.

- Oracle Corporation

- Hewlett Packard Enterprise Company

- Microsoft Corporation

- SAP SE

- Amazon Web Services, Inc.

- VMware Inc.(Pivotal Software Inc.)

- Huawei Technologies Co. Ltd

- Teradata Corporation

- Kognitio Ltd

- IBM Corporation

第8章投資分析

第9章市場的未來

The Active Data Warehousing Market size is estimated at USD 11.12 billion in 2025, and is expected to reach USD 18.82 billion by 2030, at a CAGR of 11.1% during the forecast period (2025-2030).

Additionally, the growth in demand from developing nations is anticipated to open up new opportunities for the active data warehousing market throughout the projection period.

Key Highlights

- The active data warehousing market is poised for a significant shift, owing to factors like the ongoing demand for next-gen business intelligence coupled with the growing amount of data organizations generate. ADW allows users to access an enormous range of complex information in real-time. The data is organized efficiently and relevantly, which is anticipated to aid market growth over the forecast period. The rising demand for low latency and high-speed analytics, combined with the growing role of business intelligence in enterprise management, is expected to drive the market demand significantly.

- Further, according to Oracle, in Brazil, with nearly 90% of the population living in urban areas, SKY Brasil has approximately 29% market share for direct-to-home satellite services. The company opted for Oracle's Autonomous Data Warehouse running on Oracle Cloud Infrastructure, integrated into Oracle's Siebel CRM, to perform real-time, sophisticated marketing analytics. The deployer achieved 90% less time in deployment and commencing production than its previous on-premise solution while realizing 60% of infrastructure cost savings. Furthermore, ADW significantly diminishes the cost of computing, coupled with combining data in a single location, which is further projected to impact market growth positively.

- Additionally, ADW substantially decreases the cost of computing, coupled with combining data in a single location, which is also expected to impact the market growth positively. Along with these factors, globally, the significant rise in the Big Data trend in organizations is leading to the increasing demand for analytics, which is also projected to aid market growth. Also, to scale the computing capacity to match the demand and effortlessly scale back down when the usage peaks, vendors in the market have been following resource usage-based models for the pricing of cloud data warehousing. It addresses the issues of economies of scale that vendors may look for and the flexibility that clients demand. However, fixed-capacity data warehouses force organizations to buy more computing capacity than needed.

- Data warehousing has generated a lot of interest in real-world applications, notably in finance, business, healthcare, and other industries, as a result of growing concerns about data management and rising complexity. Digitalizing corporate processes led to the adoption of new technologically advanced operations with data analytics capabilities in the IT industry. As a result, modern data warehouse systems facilitate the development of the real-time, enterprise-scale analytics and information insights required for digital business operations.

- However, the market for active data warehousing is being restrained by various factors, including high installation costs and increased cyber threats.

- COVID-19 created a mixed impact on the market. For instance, in a survey of 300 analytics professionals in the US, Burtch Works and the International Institute for Analytics (IIA) revealed that over 43% of respondents said that analytics was a crucial factor in their actions to make essential choices in response to the COVID-19 problem. Companies scaled back operations due to the pandemic epidemic, reduced expenses, and closed offices. The widespread adoption of the work-from-home paradigm presents another difficulty for firms. Cloud-based data warehouse installations are anticipated to be accelerated by such developments. The pandemic provided numerous advantages for adopting data warehousing, including cost-effectiveness, access to a large skill pool, and enhanced scalability.

Active Data Warehousing Market Trends

Rising Penetration of Smartphones may Drive the Market Growth

- Mobile phones, especially smartphones, are becoming increasingly widespread among various people. Users may get essential information rapidly owing to modern information and communication technology (ICT). According to the GSMA, there are more than 6.2 billion active iOS and Android smartphones worldwide as of last year, and it is expected to reach 7.4 billion by 2025. Additionally, the usage of mobile technology is increasing across a range of computer systems, including Data Warehouse (DW), Business Intelligence (BI) systems, and Data Analytic systems.

- Mobile phones act as a database, where a considerable amount of user data is stored. The stored data can be subjected to analysis as per the T&C approval by the user. The data can be retrieved and analyzed by various active data warehouses to collect multiple traits of the user. Smartphone users need a vast cloud database for data access, thereby needing data warehousing solutions, driving market growth.

- Further, an increasing data stream necessitates more capabilities, including real-time data storage, as a result of the rising smartphone usage in emerging nations like China, Brazil, and India, as well as the increased social media traffic.

- Moreover, the growing smartphone usage across various countries is anticipated to drive market growth. For instance, according to the Ministry of Information and Broadcasting, in November 2022, India had more than 1.2 billion mobile phone subscribers, including 600 million smartphone users. Furthermore, it was mentioned that in addition to having relatively cheap data rates, the widespread usage of smartphones has led to individuals consuming a lot of information and entertainment on their mobile devices.

North America is Expected to Hold a Significant Market Share

- The United States organizations are significant adopters of analytics across several verticals, compared with European or Asian organizations. The United States is considered an essential country in the market because of the considerable demand and presence of vendors. Also, according to GSMA, there were 329 million mobile service subscribers in North America last year, or 84% of the total population. With most of the region's new unique customers coming from the United States, the total addressable market for the operators in the area is approaching close to saturation. The United States would provide 75% of the 12 million more users anticipated in the region by 2025.

- Also, consumers in the country value vendors that provide real-time assistance with their issues; hence, many retail organizations are adopting active data warehousing concepts to enhance loyalty management applications that play a crucial role in retaining consumers.

- The growth of mobile broadband led to increased Big Data analytics and cloud computing in the country. The United States, with a considerable number of analytics adopters in 2022, encouraged multiple enterprises to switch from on-premise to cloud-based deployment, which is estimated to be an addressable market for data warehouse installations. Furthermore, logistics activities are expected to increase with the rise in trade activities and the growing number of businesses in the country. However, the ever-increasing public debt of the country is expected to drive the inflation rate up, thus curtailing small vendors' activities.

- As per Microsoft, AI-driven virtual agents have contributed significantly toward emerging channels. Features like natural language processing and machine learning possess capabilities to deliver smart, conversational, and fast solutions 24/7. It indicates the importance and spending that companies direct toward improving customer satisfaction. Therefore, the demand for such sophisticated platforms and analytics will continue to help register a steady growth rate of active data warehousing.

- Another key driver in the market is the increasing need for solutions with BI capabilities. Government initiatives and increased data analytics physicians use for improved primary care, such as the detection and prevention of diseases, are driving the market. Thus, many healthcare organizations have started spending more on active data warehousing to increase cost savings. Over the forecast period, the increasing demand for real-time analytics and BI from insurance and other BFSI companies is expected to bolster the demand for ADW in the United States.

Active Data Warehousing Industry Overview

The Active Data Warehousing Market is highly fragmented, with several domestic and international players in a fairly-contested market space, including Microsoft Corporation, Oracle Corporation, SAP SE, etc. Technological advancements are also bringing considerable competitive advantage to companies, and the market is also witnessing multiple partnerships.

In May 2022, Dell Technologies Inc. and Snowflake Inc. announced a partnership on a new project to link data from its on-premises storage portfolio with the Snowflake Data Cloud. A cloud-native platform called Snowflake Data Cloud is intended to do away with the need for separate data lakes and warehouses while enabling safe data sharing throughout enterprises. It allows users to aggregate datasets from various software-as-a-service and cloud platforms and make them available to any user. Also, in May 2022, Oracle and Informatica, a prominent provider of enterprise cloud data management, announced a strategic relationship that will enable Informatica's data integration and governance solutions to be used with Oracle Cloud Infrastructure. Additionally, Oracle has designated Informatica as a recommended partner for enterprise cloud data governance and integration for data warehouse and lakehouse solutions on OCI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Adoption of Business Intelligence and Big Data Analytics Solutions in Various Industries

- 5.1.2 Rising Penetration of Smartphones may Drive the Market Growth

- 5.2 Market Challenges

- 5.2.1 High Consumption of Resources and Time Required for Implementation

- 5.2.2 Growing Cyber Threats may Restrain the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Type of Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.1.3 Hybrid

- 6.2 By Size of Enterprise

- 6.2.1 Small and Medium-sized Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Industry Vertical

- 6.3.1 BFSI

- 6.3.2 Manufacturing

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Other Industry Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Treasure Data Inc.

- 7.1.2 Cloudera Inc.

- 7.1.3 Snowflake Computing Inc.

- 7.1.4 Oracle Corporation

- 7.1.5 Hewlett Packard Enterprise Company

- 7.1.6 Microsoft Corporation

- 7.1.7 SAP SE

- 7.1.8 Amazon Web Services, Inc.

- 7.1.9 VMware Inc. (Pivotal Software Inc.)

- 7.1.10 Huawei Technologies Co. Ltd

- 7.1.11 Teradata Corporation

- 7.1.12 Kognitio Ltd

- 7.1.13 IBM Corporation