|

市場調查報告書

商品編碼

1639507

事件回應服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Incident Response Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

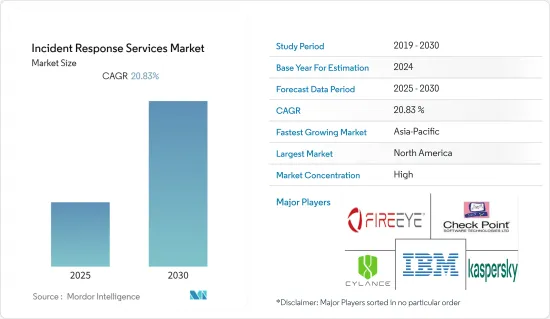

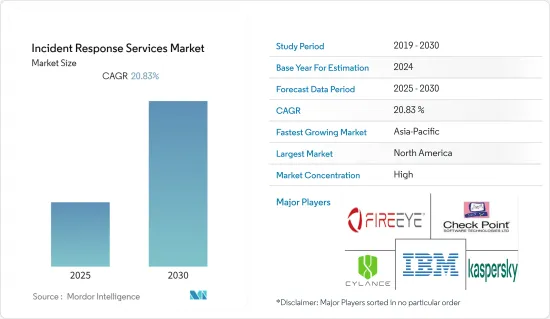

預計預測期內事件回應服務市場複合年成長率將達到 20.83%。

主要亮點

- 事件回應服務是由供應商提供的服務,在發生網路攻擊時遵循預先定義和有組織的程序和方法。這些也被稱為網路事件、資訊科技 (IT) 事件或安全事件。

- 網路威脅是試圖利用間諜軟體、惡意軟體和網路網路釣魚來破壞或破壞資訊系統或竊取關鍵資訊。事件回應解決方案可協助企業監控其網路和端點,以防止進階入侵和詐欺活動。

- 市場主要企業提供的事件回應服務包括違規調查(確定威脅是外部威脅還是相關人員,並確定違規的範圍和時間線)、取證服務(確定調查持續時間)和事件回應服務(確定調查的持續時間)。

- 預計在預測期內,各種因素(例如安全漏洞數量的增加、政府法規和公司合規要求的嚴格化、網路攻擊的日益複雜化以及事件發生後的巨大財務損失)將為市場成長提供巨大的空間。

- 隨著攻擊的複雜程度和頻率不斷成長,越來越多的組織開始優先考慮事件回應團隊,以幫助減輕安全威脅對任何組織的影響。

- 隨著 COVID-19 成為現實,世界各地的組織都積極應對疫情期間激增的網路威脅。疫情期間,世界各地的企業都在爭取對網路風險並確保在家工作(WFH)環境,用於減輕網路威脅的支出也激增。

事件回應服務市場趨勢

BFSI 部門推動市場成長

- BFSI 產業是多次遭受資料外洩和網路攻擊的關鍵基礎設施產業之一。

- 人們注意到金融服務機構比其他行業更容易受到網路攻擊。預計這將推動對能夠處理安全漏洞、安全和 IT 事件調查以及取證回應等關鍵事件的事件回應 (IR) 解決方案的需求。

- 在 BFSI 領域營運的公司正致力於採用最新技術來保護其 IT 流程和系統,保護客戶敏感資料,並遵守政府法規。

- 例如,2017 年 7 月,CIB Bank Ltd. 與 Kyndryl 簽署了為期三年的技術服務協議,以實現其貸款工作流程和底層平台的現代化和營運。這樣做是為了改善銀行的經營模式及其最重要業務的可用性。

- 由於保單持有人擁有大量個人識別資訊 (PII),網路犯罪分子對 BFSI 行業的保險領域非常感興趣。一旦獲得 PII,網路犯罪分子就可以從事邪惡活動,例如以保單持有人的名義開設信用卡、銀行帳戶和申請貸款。

亞太地區將經歷最高成長

- 全球近三分之一的人口生活在亞太地區,世界各地的人們都把目光瞄準了這個地區。亞太地區是人力資源的熱點地區,大部分竊盜行為都集中在個人資訊上。

- 由於印度與擁有最多國有企業的中國關係密切,印度成為網路攻擊最突出的目標之一。儘管網路攻擊的增加促使中國加強了防禦能力,但中國仍被視為世界其他地區網路攻擊的主要來源。

- 在印度,馬哈拉斯特拉邦拉邦網路安全部門注意到,為中國政府工作的中國駭客正將印度更多地區作為目標。根據英國銀行家協會(BBA)報告,截至2021年3月,全球30%的網路攻擊源自中國。

- 同時,澳洲去年9月通過了更嚴格的網路安全法,以確立其安全功能。這將確保通訊供應商共用其組織內有關違規行為的任何資料,以設計和實施強大的 IR 計劃。任何此類違法行為都將導致「高達數億美元的」罰款。

事件回應服務業概況

該市場由 IBM、思科、英特爾、賽門鐵克、戴爾、BAE 系統和 Check Point 軟體技術等主要企業主導,是全球最大的檢測、管理和恢復安全攻擊和網路漏洞相關損失的解決方案提供商。

2022 年 6 月,Kyndryl 與 Veritas Technologies 宣佈建立全球夥伴關係,幫助企業在多重雲端環境中保護和恢復其關鍵資料,包括防止勒索軟體攻擊,並幫助他們最有效地管理資料,實現數位轉型。

2022 年 8 月,卡巴斯基與微軟合作,為 Microsoft Sentinel 用戶提供威脅情報和可操作的背景資訊,以幫助調查和應對攻擊。這種整合使企業安全團隊能夠擴展其網路威脅偵測能力,並提高初始警報分類、威脅搜尋和事件回應的有效性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 市場定義和範圍

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- BFSI 領域安全漏洞數量的增加正在推動市場

- 企業合規要求的提高預計將推動市場成長

- 市場限制

- 整合、互通性問題和可靠性問題可能會阻礙市場成長

- COVID-19 對市場的影響

第6章 市場細分

- 按公司規模

- 中小企業

- 大型企業

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 產業

- 政府

- 運輸

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第7章 競爭格局

- 公司簡介

- CrowdStrike Holdings, Inc.

- Check Point Software Technologies

- Cylance Inc.

- FireEye

- Kaspersky Lab

- Rapid7

- IBM Corporation

- NCC Group

- Optiv Security, Inc.

- Secureworks Inc.

- Trustwave Holdings

- KPMG International ltd.

- Deloitte Touche Tohmatsu Ltd.

- Ernst & Young

第8章投資分析

第9章 市場機會與未來趨勢

The Incident Response Services Market is expected to register a CAGR of 20.83% during the forecast period.

Key Highlights

- Incident response services refer to services provided by vendors who follow a predefined and organized set of procedures and approaches in the event of cyberattacks. These are also known as cyber incidents, "information technology (IT) incidents, and security incidents.

- Cyberthreats are attempts from the internet to damage or disrupt information systems and hack critical information using spyware, malware, and phishing. Incident response solutions help enterprises monitor networks and endpoints for advanced intrusions and fraudulent activities.

- Incident response services offered by the key players in the market comprise a wide variety of capabilities such as breach investigation (to identify if the threat is from an external source or an insider and also to determine the scope and timeline of the breach), forensic services (collection of digital pieces of evidence to be used as part of an investigation), handling chain-of-custody, examination, and analysis of applications, data, networks, and endpoint systems.

- Various factors such as the increasing number of security breaches, increasingly stringent government regulations and compliance requirements by enterprises, a rise in the sophistication level of cyber-attacks, and heavy financial losses post-incident occurrence, among others, are anticipated to provide significant scope for the market's growth over the forecast period.

- With the increasing sophistication and frequency of attacks, more organizations are beginning to prioritize incident response teams that can help mitigate the impact of security threats on any organization.

- With COVID-19 becoming a reality, organizations across the world responded proactively to cyber threats that witnessed a spike during the pandemic. Enterprises around the globe scrambled to tackle cyber risks and secure work-from-home (WFH) conditions amidst the pandemic, and spending on mitigating cyber threats soared.

Incident Response Services Market Trends

BFSI Sector to Drive the Market Growth

- The BFSI sector is one of the critical infrastructure sectors that has suffered several data breaches and cyberattacks, owing to the large customer base that the industry serves and the financial information that is at stake.

- Financial service institutions have been identified as being more susceptible to cyber attacks as compared to other industries. This is expected to drive the demand for incident response (IR) solutions capable of dealing with a crisis event such as a security breach, a security- or IT-incident investigation, and a forensic response.

- Enterprises operating in the BFSI sector are focused on implementing the latest technology to secure their IT processes and systems, secure customer-critical data, and comply with government regulations.

- These businesses have to take a defensive and proactive approach to data security because technology is getting better, regulations are getting stricter, and customer expectations are getting higher.For example, in July of 2017, CIB Bank Ltd. signed a three-year technology services agreement with Kyndryl to modernize and run its lending workflows and the platform underneath them. This was done to improve the bank's business model and the availability of its most important operations.

- Due to the large amount of personally identifiable information (PII) about policyholders, cybercriminals are drawn to the insurance sector of the BFSI industry. Once the PII is obtained, a cyber-criminal can be involved in malicious activities such as opening credit cards or bank accounts and applying for loans, amongst many other crimes, in the respective policyholder's name.

Asia Pacific to Witness the Highest Growth

- Since nearly one-third of the world's population lives in the Asia-Pacific region, people from all over the world are always after it.It has turned out to be a good source of human capital, and most of the thefts are focused on personal information.

- India has been one of the most well-known targets of cyber attacks because of its close ties to China, which has the most state-run actors.Although growing cyberattacks have propelled China to strengthen its defensive capabilities, the country has been recognized as a major source of origin for cyberattacks in other parts of the world.

- In India, the state of Maharashtra's cybersecurity cell noticed that Chinese hackers working for the Chinese government were targeting more areas of India.According to a report from the British Bankers' Association (BBA), 30% of cyberattacks around the world came from China as of March 2021.

- On the other hand, Australia passed a tougher cybersecurity law in September last year to establish its security features. This ensures that telecommunications providers share any data regarding breaches within their organizations and design and implement robust IR programs. Such a breach would result in fines "amounting to hundreds of millions of dollars.

Incident Response Services Industry Overview

The market is dominated by key players like IBM, Cisco, Intel, Symantec, Dell, BAE Systems, and Check Point Software Technologies that help enterprises globally detect, manage, and recover from losses regarding security attacks and network breaches.

In June 2022, Kyndryl and Veritas Technologies announced a global partnership to help enterprises protect and recover their critical data across multi-cloud environments, including ransomware attacks, and manage their data most efficiently to enable digital transformation.

In August 2022, Kaspersky and Microsoft partnered to deliver threat intelligence to Microsoft Sentinel users with actionable context for attack investigation and response. With this integration, enterprise security teams can extend cyber threat detection capabilities and increase the effectiveness of initial alert triage, threat hunting, or incident response.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Security Breaches in BFSI sector to drive the market

- 5.1.2 Increasing Compliance Requirements by Enterprises is expected to flourish the market

- 5.2 Market Restraints

- 5.2.1 Integration, Interoperability Issues, and Reliability Concerns may hinder the market growth

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Size of Enterprise

- 6.1.1 Small and Medium Enterprises

- 6.1.2 Large Enterprises

- 6.2 By End-User Industry

- 6.2.1 IT and Telecom

- 6.2.2 BFSI

- 6.2.3 Industrial

- 6.2.4 Government

- 6.2.5 Transportation

- 6.2.6 Healthcare

- 6.2.7 Other End-User Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CrowdStrike Holdings, Inc.

- 7.1.2 Check Point Software Technologies

- 7.1.3 Cylance Inc.

- 7.1.4 FireEye

- 7.1.5 Kaspersky Lab

- 7.1.6 Rapid7

- 7.1.7 IBM Corporation

- 7.1.8 NCC Group

- 7.1.9 Optiv Security, Inc.

- 7.1.10 Secureworks Inc.

- 7.1.11 Trustwave Holdings

- 7.1.12 KPMG International ltd.

- 7.1.13 Deloitte Touche Tohmatsu Ltd.

- 7.1.14 Ernst & Young