|

市場調查報告書

商品編碼

1639434

全球合成橡膠-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Fluoro Elastomers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

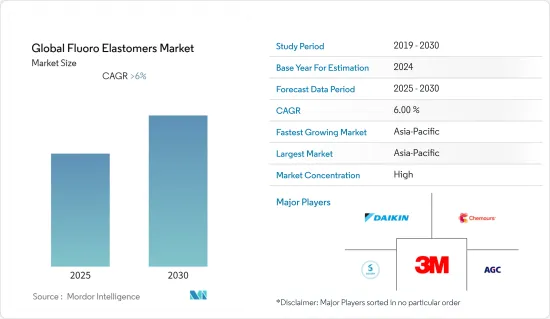

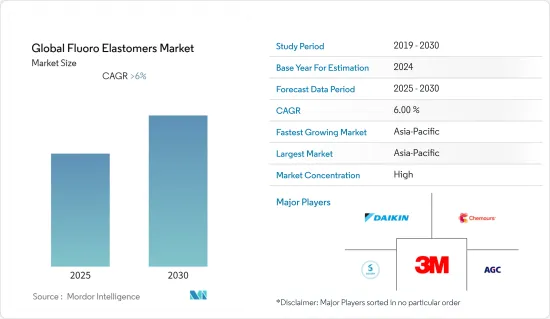

預計全球合成橡膠市場在預測期內複合年成長率將超過 6%。

COVID-19 的爆發導致世界各地的營運關閉、製造活動和供應鏈中斷以及生產暫停,對市場產生了負面影響。然而,情況發生了逆轉,並在預測期內恢復了市場的成長軌跡。

主要亮點

- 市場成長的關鍵因素是密封應用的使用量增加以及汽車產業應用的快速增加。

- 日益嚴格的環境法和危險的工作條件可能會減緩市場成長。

- 未來幾年,市場應該能夠利用全氟化碳合成橡膠的新用途。

- 亞太地區在市場上佔據主導地位,預計在預測期內仍將保持最高的複合年成長率。

合成橡膠市場趨勢

氟碳合成橡膠需求增加

- 氟碳合成橡膠是含氟量較高的碳基聚合物。用於需要耐受刺激性化學物質和臭氧的地方。然而,也有一些特殊等級的碳氟化合物,其氟含量高並具有低溫性能。

- 氟碳合成橡膠在密封件製造中發揮至關重要的作用。由於氟碳橡膠具有廣泛的化學相容性、較寬的溫度範圍、較低的壓縮永久變形和優異的老化性能,是多年來開發的最重要的合成橡膠。

- 碳氟化合物比合成橡膠更能耐受多種化學品,並且在高溫下具有卓越的性能。因此,在全球範圍內,由碳氟化合物製成的 O 形環和其他客自訂密封件比其他類型的合成橡膠使用得更頻繁。

- 這些合成橡膠在暴露於汽油、紫外線或臭氧時不會膨脹或分解。氟碳合成橡膠在 4°F 時硬化,但可以在較低溫度下使用。然而,這些化合物不適合在低溫下需要良好柔韌性的應用。

- 此外,還有其他具有不同單體成分和氟含量的材料(65-71%,以提高對低溫、高溫和化學品的耐受性)。氟碳合成橡膠具有低透氣滲透性,使其適用於真空服務應用和許多其他工業應用。

- 國防部使用氟碳合成橡膠製造高性能機械,這些機械需要在極端耐用條件下保持穩定的優質零件。氟碳合成橡膠也為航太和汽車產業提供解決方案。

- 在美國,2021 年飛機數量增加,通用航空公司機隊持有至 204,405 架飛機,租賃持有機隊減少至 5,815 架。美國是世界上最大的航空市場之一。美國航空公司運送的旅客數量比其他國家的航空公司都要多,而且世界十大收益航空公司中約有一半位於美國。

- 中國國內商業航空業的蓬勃發展是收入、旅遊業和商業活動不斷成長的結果,所有這些都是國內和國際旅行的驅動力。中國民航局宣布,2035年,大型商業服務機場總合將達到450個。換句話說,民航預計將繼續成長。

- 截至2021年6月,中國營運的通用航空飛機數量為3,066架,較2020年成長4%。自2014年以來,我國通用航空飛機保有量穩定成長近103%。

- 由於這些因素,預計在預測期內全球合成橡膠市場將成長。

亞太地區主導市場

- 預計亞太地區將主導市場。中國和印度是該地區最大的經濟體。該國的製造業是世界上最大的製造業之一,對合成橡膠產生了巨大的需求。

- 合成橡膠在工業和化學加工行業中用於製造液壓 O 形圈密封件、止回閥球、隔膜、工業輥套、V 形圈封隔器等。

- 根據國家統計局的數據,2021年中國製造業產值將成長至31.4兆元(4.64兆美元),約佔全球製造業的30%。

- 近年來,中國飛機工業經歷了顯著成長。據波音公司稱,中國航空公司將需要8,700架新飛機,比上年度預期的8,600架增加1.2%。預計到2040年將達到1.47兆美元。

- 根據OICA統計,2021年汽車總產量為8,015萬輛,與前一年同期比較增加3%。由於這些因素,預計該地區的合成橡膠市場在預測期內將穩定成長。

合成橡膠行業概況

合成橡膠市場已部分整合。該市場的主要企業(排名不分先後)包括 3M、大金工業有限公司、索爾維、科慕公司和 AGC 公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大密封應用的應用範圍

- 汽車產業應用快速成長

- 抑制因素

- 日益嚴格的環境法規與危險的工作環境

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 產品類型

- 氟碳合成橡膠

- 矽橡膠

- 全氟碳合成橡膠

- 目的

- 隔膜

- 閥門

- O 型環、密封件、密封劑

- 其他用途(燃油軟管、接頭)

- 最終用戶產業

- 車

- 航太

- 石油和天然氣

- 工業的

- 其他最終用戶產業(化學、國防)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 其他

- 巴西

- 沙烏地阿拉伯

- 南非

- 其他

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- AGC Inc.

- All Seals Inc.

- Daikin Industries Ltd

- Eagle Elastomer Inc.

- Freudenberg Sealing Technologies

- GARLOCK

- Gujarat Fluorochemicals Limited

- HaloPolymer

- KUREHA CORPORATION

- LANXESS

- Minor Rubber Products

- Parker Hannifin Corp.

- Precision Associates, Inc.

- Shanghai Fluoron Chemicals Co.Ltd.

- Solvay

- Stockwell Elastomerics Inc.

- The Chemours Company

- Trp Polymer Solutions Limited

- Zhonghao Chenguang Research Institute of Chemical Industry

- Zrunek Gummiwaren GmbH

第7章 市場機會及未來趨勢

- 全氟碳合成橡膠的新應用

The Global Fluoro Elastomers Market is expected to register a CAGR of greater than 6% during the forecast period.

Due to the COVID-19 outbreak, there were nationwide lockdowns around the world, disruptions in manufacturing activities and supply chains, and production halts that negatively impacted the market. However, the conditions started recovering, restoring the market's growth trajectory during the forecast period.

Key Highlights

- The major factors driving the market's growth are rising usage in sealing applications and the surge in applications in the automotive industry.

- Environmental laws that are getting stricter and dangerous working conditions are likely to slow the growth of the market.

- In the coming years, the market should be able to take advantage of new ways to use perfluorocarbon elastomers.

- The Asia-Pacific region is expected to dominate the market and to register the highest CAGR during the forecast period.

Fluoroelastomers Market Trends

Increasing Demand for Fluorocarbon Elastomers

- Fluorocarbon elastomers are carbon-based polymers that have a lot of fluorine added to them. They are used in places where they need to be resistant to harsh chemicals and ozone. There are, however, specialty-grade fluorocarbons that can provide high fluorine content with low-temperature properties.

- Fluorocarbon elastomers have become of vital importance in seal manufacturing. Due to its wide chemical compatibility, wide temperature range, low compression set, and excellent aging characteristics, fluorocarbon rubber is the most significant single elastomer developed over the years.

- Fluorocarbons are more resistant to a wider range of chemicals and work better at high temperatures than elastomers. Because of this, O-rings and other custom seals made from fluorocarbons are used more often than other types of elastomers around the world.

- These elastomers are very resistant to swelling and breaking down when they are exposed to gasoline, UV light, and ozone. Fluorocarbon elastomers can get hard at 4 °F, but they can still be used at low temperatures. However, these compounds are not ideal for applications that need good flexibility at low temperatures.

- Additionally, some of the other materials are also present with a differing composition of monomers and fluorine content (65-71% for improved resistance against low and high temperatures or chemicals). Fluorocarbon elastomers provide low gas permeability, making them suitable for vacuum service applications and many other industrial applications.

- The Ministry of Defense uses fluorocarbon elastomers to build high-performance machinery that needs premium quality components to provide stability in extreme endurance conditions. Fluorocarbon elastomers also offer a solution to the aerospace and automotive industries.

- In the United States, the number of aircraft increased in 2021; the general aviation fleet was 204,405 and the for-hire carrier fleet decreased to 5,815 aircraft. The United States has one of the world's largest aviation markets. More people are transported by U.S. airlines than by airlines from any other nation, and about half of the top ten revenue-generating airlines in the globe are based in the United States.

- A thriving domestic Chinese commercial aviation industry is the result of rising incomes, tourism, and business activity, which are all driving factors in domestic and international travel. The Civil Aviation Administration of China says that by 2035, there will be a total of 450 large commercial service airports. This means that commercial aviation is expected to keep growing.

- By June 2021, there were 3,066 general aviation aircraft operating in China, an increase of four percent compared to 2020. Since 2014, the number of general aviation aircraft in China has grown steadily by nearly 103 percent.

- Owing to all these factors, the market for fluoroelastomers is expected to grow across the world during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market. China and India are among the region's largest economies. The country's manufacturing sector has become one of the biggest production houses in the world, thus providing huge demand for fluoroelastomers.

- Fluoroelastomers are used in the industrial and chemical processing industries to make things like hydraulic O-ring seals, check valve balls, diaphragms, industrial roll covers, V-ring packers, and so on.

- According to the National Bureau of Statistics, China's manufacturing output grew to CNY 31.4 trillion (USD 4.64 trillion) in 2021, up from around 30% of the global manufacturing sector.

- The Chinese aircraft industry has depicted significant growth over the years. According to Boeing, Chinese airlines will need 8,700 new airplanes, 1.2% more than its previous prediction of 8,600 planes made the previous year. These would be worth USD 1.47 trillion by 2040.

- Nearly 60% of the world's cars are made in this area, making it the biggest center for making cars.According to OICA, the total production of vehicles stood at 80.15 million units in 2021, an increase of 3% compared to the previous year.

- Due to all these factors, the fluoroelastomers market in the region is expected to have steady growth during the forecast period.

Fluoroelastomers Industry Overview

The fluoroelastomers market is partially consolidated in nature. Some of the major players (not in any particular order) in the market include 3M, Daikin Industries Ltd, Solvay, The Chemours Company, and AGC Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Usage in Sealing Applications

- 4.1.2 Surging Applications in the Automotive Industry

- 4.2 Restraints

- 4.2.1 Increasingly Stringent Environmental Regulations and Hazardous Working Conditions

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Fluorocarbon Elastomers

- 5.1.2 Fluorosilicone Elastomers

- 5.1.3 Perfluorocarbon Elastomers

- 5.2 Application

- 5.2.1 Diaphragms

- 5.2.2 Valves

- 5.2.3 O-rings, Seals, and Sealants

- 5.2.4 Other Applications (Fuel Hoses, Joints)

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace

- 5.3.3 Oil and Gas

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries (Chemical, Defense)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 South Africa

- 5.4.4.4 Rest of the World

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 All Seals Inc.

- 6.4.4 Daikin Industries Ltd

- 6.4.5 Eagle Elastomer Inc.

- 6.4.6 Freudenberg Sealing Technologies

- 6.4.7 GARLOCK

- 6.4.8 Gujarat Fluorochemicals Limited

- 6.4.9 HaloPolymer

- 6.4.10 KUREHA CORPORATION

- 6.4.11 LANXESS

- 6.4.12 Minor Rubber Products

- 6.4.13 Parker Hannifin Corp.

- 6.4.14 Precision Associates, Inc.

- 6.4.15 Shanghai Fluoron Chemicals Co.Ltd.

- 6.4.16 Solvay

- 6.4.17 Stockwell Elastomerics Inc.

- 6.4.18 The Chemours Company

- 6.4.19 Trp Polymer Solutions Limited

- 6.4.20 Zhonghao Chenguang Research Institute of Chemical Industry

- 6.4.21 Zrunek Gummiwaren GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Novel Applications of Perfluorocarbon Elastomers