|

市場調查報告書

商品編碼

1639395

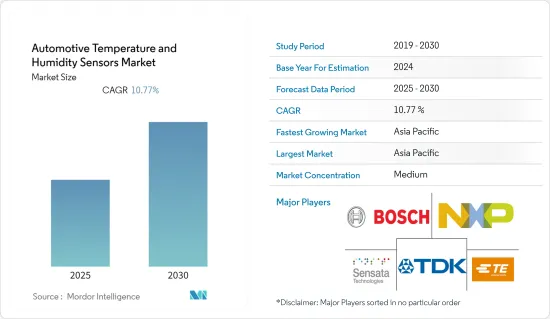

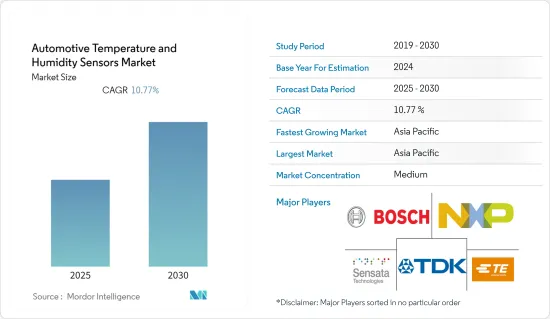

汽車溫濕度感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Automotive Temperature and Humidity Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

汽車溫濕度感測器市場預計在預測期內複合年成長率為10.77%

主要亮點

- 汽車感測器監控溫度變化、車頂和敞篷開關底盤解決方案以及座椅位置。溫度和濕度感測器整合到 HVAC 系統中,用於預防擋風玻璃起霧和能源管理。汽車經常使用濕度感測器來監測露點並改善空氣品質。感測器也放置在排氣室附近,以保持尿素品質、液位和溫度。此類感測器包括尿素泵壓力和廢氣溫度(EGTS)感測器。

- 所有汽車都配備了燃油感知器,可以不斷檢查燃油的溫度,以確定燃油是否有效使用。如果引擎冷運轉,燃料的密度會更大,燃燒時間會更長。燃料越熱,燃燒所需的時間就越短。這裡,主要問題是流入水平的變化,這可能導致汽車某些部件的損壞。此感測器監控油並確保以正確的速度和溫度注入。

- 然而,COVID-19對該市場的影響只是暫時的,因為生產和供應鏈只是停止。一旦疫情後局勢正常化,汽車溫濕度感測器的生產、供應鏈和需求將逐漸增加。 COVID-19 後的情況可能會說服公司考慮使用更先進的汽車溫度和濕度感測器來提高效率。

- 此外,雖然安全法規推動了感測器的發展,但環境法規是溫度感測器應用的關鍵促進因素。根據瑞銀預測,到 2030 年,全球自動駕駛汽車感測器半導體市場規模預計將達到 300 億美元。汽車銷量的高成長可能會導致預測期內汽車溫度和濕度感測器的潛在成長。

- 此外,根據半導體產業協會(SIA)2022年6月的研究顯示,2022年4月全球半導體產業銷售額為509億美元,比2021年4月的420億美元成長21.1%,比2021年4月成長0.7%。這一成長的主要驅動力是工廠自動化帶來的高需求以及汽車行業感測器採用量的大幅增加。

- 高系統和安裝成本預計將限制市場成長。此外,由於對具有更好技術規格的溫度和濕度感測器的需求不斷增加,預計市場將需要支援。從感測器的角度來看,潛在的組件供應鏈中斷將減少銷售和產量,從而損害市場。

汽車溫濕度感測器市場趨勢

電動和自動駕駛汽車的增加預計將推動市場發展

- 世界各地的汽車製造商都致力於車輛電氣化。汽車需要充電速度更快,一次充電可以行駛更遠的距離。這意味著車輛內部的電氣和電子電路必須能夠處理極高的功率並有效地管理損耗。預計這將對汽車溫度感測器產生積極影響,從而需要強大的溫度控管解決方案來確保安全關鍵應用的持續運作。

- 此外,汽車產業的快速電氣化也增加了對濕度感測器的需求。隨著電動車 (EV) 和混合動力電動車的普及,對電池管理系統的需求正在迅速增加。濕度感測器是電池管理系統的重要組成部分,因為它們透過了解鋰離子電池的電流、電壓、濕度和溫度來提高電動車的安全性。

- 此外,通風過程僅在濕度水平升至閾值以上時啟動,這可以減少電力消耗並提高電動車的整體效率。這促進了溫度和濕度感測器的市場成長。

- 根據 EV-volumes.com 統計,特斯拉 2021 年銷量約 936,200 輛,被 EV Volumes 評為全球最暢銷的電動車製造商。以銷量計算,特斯拉的市場佔有率為 14%。亞軍是比亞迪和大眾集團。此外,隨著中國電動車市場的成長,2021年登記的插電式電動車數量增加。電動車的興起和普及預計將推動全球對溫度和濕度感測器的需求。

- 此外,自動駕駛汽車的日益普及預計也將對市場產生積極影響,因為自動駕駛汽車配備了某些感測器,例如冷卻液溫度感測器和進氣溫度感測器。 2020 年 5 月,沃爾沃宣布推出一款配備LiDAR的汽車,用戶可以在高速公路上自動駕駛,無需人工干預。

亞太地區實現顯著成長

- 亞太地區的成長是由中國和印度等國家不斷成長的汽車工業所推動的。預計該地區的安全法規和排放法規將在預測期內顯著提振市場。

- 該地區快速的都市化也增加了污染水平,增加了對在引擎和排氣裝置中配備溫度感測器的省油車的需求。Panasonic和 TDK 等市場主要企業均位於日本。

- 此外,亞太地區汽車溫度感測器市場也受益於持續的污染控制以及對 ECU 等安全設備不斷成長的需求。此外,快速的都市化導致排放氣體增加,增加了對在引擎和排氣裝置中配備溫度感測器的省油車的需求。

- 亞太地區新興經濟體的電動車普及率不斷提高,這也將支持預測期內的市場成長。例如,中國是感測器生產和消費大國,在全球市場中佔有重要地位。

- 根據中國工業協會統計,中國乘用車年產量超過日本、德國、印度和韓國的總和。 2021年,中國汽車銷量將躍居世界第一。汽車數量的增加預計將導致該地區對溫度和濕度感測器等感測器的需求增加。

汽車溫濕度感測器產業概況

汽車溫度和濕度感測器市場的競爭溫和,並且在過去十年中加劇。然而,隨著技術創新和永續產品的興起,許多公司正在探索新市場、贏得新契約並提高市場佔有率,以保持在全球市場的地位。

- 2022 年 11 月 - TDK 公司宣布推出適用於非安全車輛的汽車高溫感測器平台解決方案 InvenSense IAM~20380HT,並擴展其 ASIL 和非 ASIL 感測器的智慧汽車產品線。 IAM~20380HT 是一款獨立的陀螺儀感測器,可在較寬的溫度範圍內工作,並為各種汽車應用提供高精度的測量資料。

- 2022 年 6 月 - 瑞薩電子推出新系列溫度和相對濕度感測器及相關產品。此相對溫度和濕度感測器在小型封裝中實現了高精度、快速測量響應時間和超低功耗,支援針對行動裝置和惡劣環境的產品開發。這些感測器還可用於汽車和其他行業。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概覽(涵蓋 COVID-19 的影響)

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 汽車電子元件增加

- 電動車和自動駕駛汽車的成長

- 市場限制因素

- 汽車OEM面臨成本壓力

第6章 市場細分

- 類型

- 例行(溫度、濕度)

- 數字(溫度、濕度)

- 車型

- 客車

- 商用車

- 應用程式類型

- 動力傳動系統

- 車身電子產品

- 替代燃料汽車

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Delphi Automotive LLP

- TDK Corporation

- TE Connectivity Ltd.

- Sensata Technologies Inc.

- Robert Bosch GmbH

- NXP Semiconductor NV

- Continental AG

- Amphenol Advanced Sensors Germany GmbH

- Panasonic Corporation

- QTI Sensing Solutions

- Murata Corporation

- Analog Devices Inc.

第8章投資分析

第9章 未來的機會

簡介目錄

Product Code: 49221

The Automotive Temperature and Humidity Sensors Market is expected to register a CAGR of 10.77% during the forecast period.

Key Highlights

- Several automotive sensors monitor temperature changes, chassis solutions for roof and convertible switches, and seat position. Temperature and Humidity sensors are integrated into HVAC systems to prevent the fogging of windscreens and energy management. Vehicles frequently use humidity sensors to monitor the dew point and improve air quality. The sensors are also placed near the exhaust chamber to maintain urea quality, level, and temperature. Some of these sensors include urea pump pressure and exhaust gas temperature (EGTS) sensors.

- Every automobile is equipped with a fuel sensor to constantly check the fuel's temperature to determine whether the fuel utilization is efficient. If the engine's power is cold, a more extended period is taken to burn due to its high density. If the fuel is warm, it will take less time to burn. Here, the main problem is the varying inflow levels which could lead to the injury of certain parts of an automobile. This sensor will monitor the petroleum and ensures that injected at the right speed and temperature.

- However, the effects of COVID-19 on this market are only transient because only the production and supply chain is stalled. As the post-pandemic situation normalized, the production, supply chains, and demand for automotive temperature and humidity sensors gradually increased. The post-COVID-19 case will persuade companies to consider more advanced automotive temperature and humidity sensors to boost efficiency.

- Moreover, while safety regulations have boosted the growth of sensors, environmental regulations have been a significant driver for temperature sensor applications. And as per UBS, the global market for sensor semiconductors in autonomous vehicles is expected to reach a value of USD 30 billion by 2030. High growth in automotive sales may lead to potential growth for the automotive temperature and humidity sensors during the forecast period.

- Further, as per the study conducted by the Semiconductor Industry Association, In June 2022, The Semiconductor Industry Association (SIA) reported that sales for the semiconductor industry worldwide were USD 50.9 billion in April 2022, an increase of 21.1% over the USD 42.0 billion in April 2021 and 0.7% over the USD 50.6 billion in March 2022. The growth is mainly driven by the high demand from factory automation and a significant increase in the adoption of sensors in the automotive industry.

- It is anticipated that the high cost of the systems and installations is anticipated toThe restrict the market growth. Additionally, it is expected that the market will need help due to the growing demand for temperature and humidity sensors with better technical specifications. Potential component supply chain disruptions harm the market by reducing sales and production from a sensor standpoint.

Automotive Temperature and Humidity Sensors Market Trends

Rise in Electric and Autonomous Driving Vehicle is Expected to Drive the Market

- Automotive manufacturers all over the world are focusing on vehicle electrification. Cars need to charge more quickly and have a more extended range on a single charge. This implies electrical and electronics circuits within the vehicle should be able to handle extremely high power and manage losses effectively, creating a need for robust thermal-management solutions to ensure that safety-critical applications remain operational and are expected to impact automotive temperature sensors positively.

- Moreover, The demand for humidity sensors is increasing due to the automotive industry's quick electrification. The need for battery management systems is growing sharply as electric vehicles (EV) and hybrid electric vehicles gain popularity. Humidity sensors are an essential part of battery management systems because they increase the safety of electric vehicles by keeping track of the lithium-ion batteries' current, voltage, humidity, and temperature.

- Additionally, it starts the ventilation process only when the humidity level rises above the threshold, reducing power consumption and boosting the overall effectiveness of electric vehicles. This enables the market growth for humidity and temperature sensors.

- According to EV-volumes.com, Tesla was named the best-selling electric vehicle manufacturer in the world by EV Volumes after selling nearly 936,200 units in 2021. Tesla's market share is 14% based on its sales volume. Among the runners-up were BYD and Volkswagen Group. Also, registrations of plug-in electric vehicles increased in 2021, with the Chinese electric vehicle market growth. Such rise and adoption of EVs will boost the global demand for temperature and humidity sensors.

- Furthermore, The increasing adoption of autonomous cars is also expected to positively impact the market as there specific sensors on an autonomous vehicle, such as a Coolant temperature sensor or an Intake Air Temperature sensor. In May 2020, Volvo announced LIDAR-equipped cars, where the company mentioned that users could drive themselves on highways with no human intervention; the company started its production line in 2022.

Asia Pacific to Witness the Significant Growth

- The growth in the Asia-Pacific region owes to the growing automotive industry in countries such as China and India. The region's safety and emission control regulations are expected to boost the market during the forecast period significantly.

- Rapid urbanization in the region has also resulted in increased pollution levels, thereby propelling the demand for fuel-efficient vehicles that are equipped with a temperature sensor in the engine and exhaust. Major companies in the market, such as Panasonic and TDK, are based out of Japan.

- In addition, the Asia-Pacific automotive temperature sensor market benefits from ongoing pollution regulations and rising demand for safety devices like ECU. Additionally, rapid urbanization has increased emissions, driving demand for fuel-efficient cars with temperature sensors in the engine and exhaust.

- The growing adoption of electric vehicles in the developing countries of Asia Pacific also favors market growth over the forecast period. For Instance, China is the primary producer and consumer of sensors and holds a prominent position in the global market.

- China made up about 32.5% of the world's auto production in 2021; according to the China Association of Automobile Manufacturers (CAAM), China's annual production of passenger cars had surpassed that of Japan, Germany, India, and South Korea put together. In 2021, China ranked first in the world for automobile sales. Such a rise in vehicles will bring more demand for sensors such as temperature and humidity sensors in the region.

Automotive Temperature and Humidity Sensors Industry Overview

The automotive temperature and humidity sensors market is moderately competitive and has gained a competitive edge in the past decade. However, with increased innovations and sustainable products, to maintain their position in the global market, many companies are increasing their market presence by securing new contracts by tapping new markets.

- November 2022 - TDK Corporation announces the release of the InvenSense IAM-20380HT high-temperature automotive sensor platform solution for non-safety automotive applications, as well as the expansion of the Smart Automotive line of ASIL and non-ASIL sensors. The IAM-20380HT is a standalone gyroscope sensor that can function in a wide temperature range and deliver precise measurement data for various automotive applications.

- June 2022 - Renesas Electronics has unveiled a new family of temperature and relative humidity sensors and related products. The recent relative humidity and temperature sensors provide high accuracy, rapid measurement response time, and ultra-low power consumption in a small package size to support deployment in portable devices or products made for harsh environments. These sensors can be used in automotive and other industries as well.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Covers the Impact of COVID-19)

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Number of Electronic Components in Automotive

- 5.1.2 Growth in Electric and Autonomous Driving Vehicles

- 5.2 Market Restraints

- 5.2.1 Cost Pressure on Automotive OEM

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Conventional (Temperature, Humidity)

- 6.1.2 Digital (Temperature, Humidity)

- 6.2 Vehicle Type

- 6.2.1 Passenger Cars

- 6.2.2 Commercial Vehicles

- 6.3 Application Type

- 6.3.1 Power Train

- 6.3.2 Body Electronics

- 6.3.3 Alternative Fuel Vehicles

- 6.3.4 Other Application Types

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 United Arab Emirates

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Delphi Automotive LLP

- 7.1.2 TDK Corporation

- 7.1.3 TE Connectivity Ltd.

- 7.1.4 Sensata Technologies Inc.

- 7.1.5 Robert Bosch GmbH

- 7.1.6 NXP Semiconductor N.V.

- 7.1.7 Continental AG

- 7.1.8 Amphenol Advanced Sensors Germany GmbH

- 7.1.9 Panasonic Corporation

- 7.1.10 QTI Sensing Solutions

- 7.1.11 Murata Corporation

- 7.1.12 Analog Devices Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OPPORTUNITIES

02-2729-4219

+886-2-2729-4219