|

市場調查報告書

商品編碼

1637864

氫氧化鋁 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Aluminum Hydroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

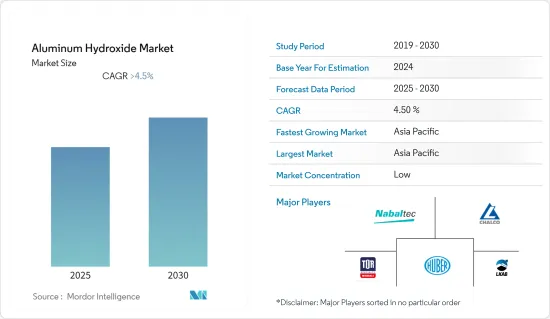

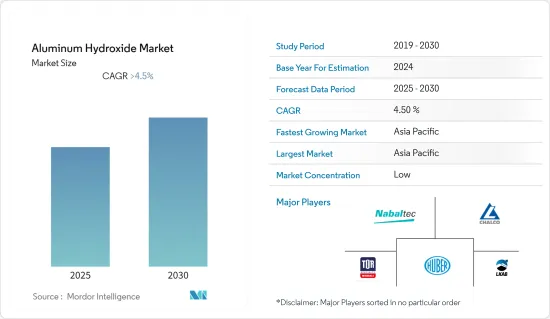

氫氧化鋁市場預計在預測期內複合年成長率將超過 4.5%

主要亮點

- COVID-19 對工業成長影響不大,生產暫時停止。但疫情過後,各產業氫氧化鋁消費量逐漸增加。

- 推動市場研究的關鍵因素包括聚合物在應用中的使用增加(主要作為阻燃劑)以及建築施工安全標準的提高。主要由於接觸氫氧化鋁而增加的健康風險預計將阻礙市場成長。

- 在預測期內,電池和化學品使用量的增加預計將成為所研究市場的成長機會。由於對塑膠的需求迅速成長,亞太地區在全球氫氧化鋁產業中佔據主導地位,尤其是在中國和印度等國家。

氫氧化鋁市場趨勢

塑膠領域主導市場

- 三穗氧化鋁主要用作塑膠中的阻燃劑。 Sansui 生產的氧化鋁近 40% 用於塑膠產業。在熱塑性塑膠中,阻燃劑在擠出過程中以熔融狀態添加到聚合物基體中,而在熱固性塑膠中,阻燃劑透過縮聚或接枝聚合添加到聚合物結構中。

- 塑膠因其成本低、重量輕、耐用和防水等優點而被應用於各種最終用戶行業。主要最終用戶行業包括汽車/運輸、建築和電氣/電子。

- 汽車產業對輕質、耐火材料的需求不斷成長,以提高效率和設計靈活性,這是塑膠市場成長的關鍵驅動力。高性能塑膠被製造商列為具有與鋼相當的設計優勢和強度。這有助於減輕整體重量並減少溫室氣體 (GHG)排放。

- 出於健康、安全和回收的原因,電氣行業正在尋求使用鹵素作為阻燃劑的替代品。專門為滿足這些需求而開發的無鹵材料將廣泛用於電氣應用,例如電路斷流器、接觸器、變壓器、馬達等的絕緣體和外殼。

- 2021年全球塑膠產量約3.907億噸,每年成長4%。塑膠需求暫時持續成長,預計2050年產量將達5.89億噸。對環保解決方案(例如永續塑膠包裝)的需求預計也會成長。

- 中國是塑膠生產大國,產量約佔全球的32%。儘管受到疫情的經濟影響,2020年中國塑膠製品產量仍有所成長。目前中國每月生產塑膠製品600萬噸至800萬噸。

- 此外,印度塑膠工業自成立以來發展迅速,目前已成為世界塑膠生產的主要參與者,擁有超過20,000個加工單位。這是一個價值數十億美元的產業,也是印度經濟的主要貢獻者,僱用了約 400 萬人。它也是全球供應商,2021年印度聚合物出口量達到約150萬噸。

- 預計亞太地區和歐洲聚合物生產活動的增加將在預測期內推動氫氧化鋁市場。

中國主導亞太

- 中國在亞太市場佔據主導地位。中國是全球最大的化工市場之一,對區域市場影響重大。近年來,國營企業和民營企業跨國併購和對外待開發區投資快速成長。

- 正在實施的「十三五」規劃中,我國化工產業可望進入綠色發展、產業升級、結構發展的新階段。中國的醫療產業也在快速發展。作為北京「中國製造2025」工業計畫的一部分,習近平主席宣布計畫重點關注醫藥領域的創新和國內研發。

- 2021年,中國的醫療保健總支出超過7.7兆元(1.1兆美元)。整體醫療保健支出預計將增至 2.53 兆美元,複合年成長率為 8.4%。我國醫療支出佔GDP的比重將從2022年的6.6%提高到2035年的9.1%。

- 印度約佔全球塑膠消費量的6%,使其成為繼中國和美國之後的第三大消費國。經濟成長和人口成長預計將在未來幾十年推動塑膠消費,預計到 2060 年印度塑膠消費量將超過 1.6 億噸。預計這些因素將在預測期內推動中國氫氧化鋁市場。

氫氧化鋁產業概況

氫氧化鋁市場分散,全球有多家製造商。主要企業包括中國鋁業股份有限公司 (Chalco)、Nabaltec AG、TOR Minerals International Inc.、Huber Engineered Materials 和 LKAB Minerals AB。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 增加聚合物作為阻燃劑的使用

- 提高建築安全標準

- 抑制因素

- 接觸氫氧化鋁會增加健康風險

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 產品類型

- 工業級

- 醫藥級

- 其他

- 最終用戶產業

- 塑膠

- 藥品

- 塗料、黏合劑、密封劑、合成橡膠

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Almatis

- Alteo

- ALUMINA-CHEMICALS & CASTABLES

- Aluminum Corporation of China Ltd(Chalco)

- MAL-Magyar Alumnium

- Nabaltec AG

- Sumitomo Chemical Co. Ltd

- Huber Materials

- Sibelco

- LKAB Minerals AB

- TOR Minerals International, Inc.

- Akrochem Corporation

- Hindalco(Aditya Birla Management Corporation Pvt. Ltd)

第7章 市場機會及未來趨勢

- 擴大在電池和化學品領域的應用

簡介目錄

Product Code: 48013

The Aluminum Hydroxide Market is expected to register a CAGR of greater than 4.5% during the forecast period.

Key Highlights

- COVID-19 moderately impacted industry growth and temporarily halted production. However, post-pandemic, the consumption of aluminum hydroxide is increasing gradually in various industries.

- Major factors driving the market study include increasing usage in polymer applications, primarily as fire retardants, and a rise in safety standards in building construction. Increasing health risks, primarily due to exposure to aluminum hydroxide, are expected to hinder the market's growth.

- The rising usage of batteries and chemicals is expected to act as a growth opportunity for the market studied over the forecast period. Asia Pacific dominates the global aluminum hydroxide industry due to the surging plastic demand, especially in countries such as China and India.

Aluminum Hydroxide Market Trends

Plastics Segment to Dominate the Market

- Alumina trihydrate is majorly used in plastics as a flame retardant. Almost 40% of the alumina trihydrate produced is being used in the plastics industry. In thermoplastics, flame-retardant substances are added to the polymer matrix in a molten state during extrusion, while in thermosetting plastics, the flame-retardant materials are added to the polymer structure using polycondensation or grafting.

- Plastics are being used in different end-user industries owing to their advantages, such as low cost, less weight, durability, water-resistant, etc. Some of the major end-user industries include automotive and transportation, construction, and electrical and electronics, among others.

- Growing demand for lightweight and fire-resistant materials in the automotive industry to provide increased efficiency and design flexibility is primarily responsible for the growth of the plastics market. High-performance plastics offer manufacturers the advantages of design and comparable strength to steel. Thus, this helps in reducing the overall weight and controlling greenhouse gas emissions (GHG).

- The electrical industry is seeking alternatives to the use of halogens as flame retardants for health, safety, and recycling reasons. Created specifically to address these needs, the non-halogenated material will see widespread use in electrical applications such as insulating elements and housings for circuit breakers, contactors, transformers, and motors.

- Global plastics production was around 390.7 million metric tons in 2021, an annual increase of 4%. Plastic demand is set to continue growing for the foreseeable future, with production set to reach 589 million metric tons in 2050. The demand for eco-friendly solutions such as sustainable plastic packaging is also expected to experience growth.

- China is the leading producer of plastics, accounting for roughly 32% of global production. Despite the economic impacts of the pandemic, the production of plastic products in China increased in 2020. China currently produces 6-8 million metric tons of plastic products monthly.

- Furthermore, India's plastic industry has grown rapidly since its inception and is now a key player in global plastics production, comprising more than 20,000 processing units. It is a multi-billion dollar industry and a major contributor to India's economy, employing some four million people. It is also a global supplier, with India's polymer exports totaling some 1.5 million metric tons in 2021.

- The increase in polymer production activities in the Asia Pacific and European regions will likely drive the aluminum hydroxide market during the forecast period.

China to Dominate in Asia-Pacific

- China dominated the Asia-Pacific market. China has one of the world's largest chemical markets, significantly impacting the regional market. In recent years, there was a rapid growth in cross-border mergers and acquisitions by state-owned enterprises and private entities, as well as outbound greenfield investments.

- During the ongoing 13th five-year plan, China's chemical industry is expected to enter a new stage characterized by green development, industrial up-gradation, and structural developments. The Chinese healthcare sector is also growing at a rapid pace. As a part of Beijing's "Made in China 2025" industry plan, President Xi Jinping announced plans to focus on innovation and homegrown R&D concerning the pharmaceutical sector.

- In 2021, the total expenditure on health care in China reached over CNY 7.7 trillion (USD 1.1 trillion). Overall, healthcare spending is expected to increase to USD 2.53 trillion, representing a compound annual growth rate of 8.4%. The share of health spending in China's GDP will increase from 6.6%in 2022 to 9.1% in 2035.

- India accounts for approximately 6% of global plastics consumption, making it the third-largest consumer behind China and the United States. Economic growth and population growth are expected to drive plastics use in the coming decades, with projections showing that plastics consumption in India could rise to more than 160 million metric tons by 2060. Such factors are expected to drive the Chinese aluminum hydroxide market during the forecast period.

Aluminum Hydroxide Industry Overview

The aluminum hydroxide market is fragmented in nature, with several manufacturers across the world. The major companies include Aluminum Corporation of China Limited (Chalco), Nabaltec AG, TOR Minerals International Inc., Huber Engineered Materials, and LKAB Minerals AB, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use in Polymer Applications as Fire Retardants

- 4.1.2 Rise in Safety Standards in Building Construction

- 4.2 Restraints

- 4.2.1 Increasing Health Risks due to Exposure to Aluminum Hydroxide

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Industrial Grade

- 5.1.2 Pharmaceutical Grade

- 5.1.3 Other Product Types

- 5.2 End-User Industry

- 5.2.1 Plastics

- 5.2.2 Pharmaceuticals

- 5.2.3 Coatings, Adhesives, Sealants & Elastomers

- 5.2.4 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Almatis

- 6.4.2 Alteo

- 6.4.3 ALUMINA - CHEMICALS & CASTABLES

- 6.4.4 Aluminum Corporation of China Ltd (Chalco)

- 6.4.5 MAL - Magyar Alumnium

- 6.4.6 Nabaltec AG

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Huber Materials

- 6.4.9 Sibelco

- 6.4.10 LKAB Minerals AB

- 6.4.11 TOR Minerals International, Inc.

- 6.4.12 Akrochem Corporation

- 6.4.13 Hindalco (Aditya Birla Management Corporation Pvt. Ltd)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Usage in Batteries and Chemicals

02-2729-4219

+886-2-2729-4219