|

市場調查報告書

商品編碼

1637784

甲基異丁基甲醇 (MIBC):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Methyl Isobutyl Carbinol (MIBC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

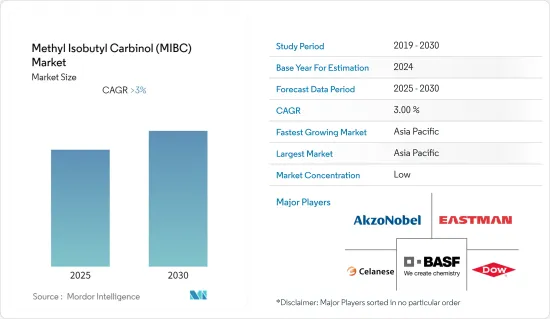

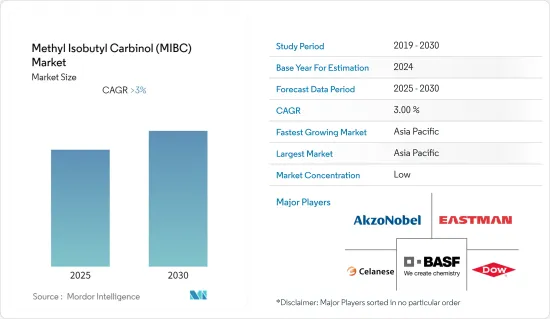

預測期內,甲基異丁基甲醇 (MIBC) 市場預計將以超過 3% 的複合年成長率成長。

主要亮點

- COVID-19 對甲基異丁基甲醇 (MIBC) 的需求產生了負面影響。疫情導致塑化劑、發泡、腐蝕抑制劑、潤滑劑和液壓油產量下降,進而導致甲基異丁基甲醇(MIBC)等化學物質市場萎縮。 MIBC 廣泛應用於多種終端使用者領域。

- 推動市場發展的主要因素之一是銅和鉬硫化礦中對硫化劑的需求激增。此外,表面塗層應用的需求不斷增加也有望推動市場發展。另一方面,MIBC 的毒性正在阻礙市場的成長。

- 未來的採礦項目計劃在拉丁美洲進行,預計將為市場成長提供機會。預計預測期內亞太地區將呈現最高成長率並主導全球市場。

甲基異丁基甲醇 (MIBC) 市場趨勢

採礦業主導市場

- 甲基異丁基甲醇 (MIBC) 是一種支鏈己醇,是一種有機化合物,在多種應用中用作塑化劑、液壓油、發泡和腐蝕抑制劑。甲基異丁基甲醇 (MIBC) 在開採銅和鉬硫化物以及煤等礦石的浮選過程中用作起泡劑。

- 泡沫浮選是一種重要的濃縮工藝,可用於選擇性地從親水性廢棄物中分離疏水性物質。礦用浮選是礦物選礦最常見的操作過程之一,有助於在進一步精製之前分離各種硫化物、碳酸鹽和氧化物。甲基異丁基甲醇 (MIBC) 吸附在水空氣界面上,有助於氣泡形成並穩定漂浮的泡沫。短鏈脂肪族醇和Polyglycolic是目前最常見的兩種牙線形式。

- 根據美國地質調查局的數據,澳洲是世界上最大的鐵礦石生產國,預計2022年總產量將達到約8.8億噸,其次是巴西(4.1億噸)和中國(3.8億噸)。 。

- 鐵礦石是世界上產量最大的礦產商品之一,預計 2022 年產量將達到近 26 億噸。鐵礦石、鉀肥和銅是世界產量最大的兩種礦產品,總產量分別為4000萬噸和2200萬噸。

- 根據美國經濟分析局(BEA)官方資料,2022年第三季美國採礦業(不包括石油和天然氣)的總貢獻約為697億美元,較上年同期成長12%。此外,今年前三個季度,該產業金額了約2,057億美元。

- 由於全球採礦業的發展及其對該行業的投資不斷增加,預計預測期內甲基異丁基甲醇 (MIBC) 市場將成長。

中國主導亞太市場

- 中國是多種金屬的最大生產國,包括煤炭、黃金和鋼鐵。亞洲(尤其是中國)的基礎建設主導了經濟成長,導致對鐵礦石、銅和煤炭等大宗商品的需求大幅增加。建設產業對這些商品的需求不斷增加,推動了中國採礦業的成長。

- 政府希望投資基礎設施來支持經濟成長,加速了中國建築業的發展。此外,中國不斷擴張的採礦業和即將訂定的政府舉措為未來的市場擴張創造了有利機會。

- 根據國家統計局統計,中國建築業規模大幅擴張。 2022年第四季,中國建築業產出估計達400億美元,較上一季(276億美元)成長近50%。

- 此外,根據美國地質調查局的數據,2022年鐵礦石總產量將達到3.8億噸,中國將成為繼澳洲和巴西之後的世界第三大生產國。

- 甲基異丁基甲醇(MIBC)在汽車工業中也發揮作用。 MIBC 用於生產主要用於汽車工業的潤滑油添加劑。因此,對潤滑油添加劑的需求不斷增加可能會對 MIBC 市場產生正面影響。

- 中國是世界上最大的汽車製造業國家。根據中國工業協會預測,2022年全國汽車產量將達2,702萬輛,較2021年的2,608萬輛成長約3.4%。

- 預計上述因素將在預測期內影響對甲基異丁基甲醇(MIBC)(MICB)的需求。

甲基異丁基甲醇 (MIBC) 產業概覽

甲基異丁基甲醇(MIBC)(MICB)市場比較分散。主要企業包括(不分先後順序):BASF公司、伊士曼化學公司、陶氏化學公司、阿克蘇諾貝爾公司和塞拉尼斯公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 硫化銅和硫化鉬礦石發泡需求激增

- 表面塗層應用需求不斷增加

- 限制因素

- 提高對 MIBC 毒性的認知

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 技術簡介

第 5 章 市場區隔(以金額為準的市場規模)

- 按應用

- 塑化劑

- 發泡

- 腐蝕抑制劑

- 潤滑劑和液壓油

- 其他用途

- 按最終用戶產業

- 建造

- 礦業

- 車

- 橡皮

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AkzoNobel NV

- Arkema Group

- BASF SE

- Celanese Corporation

- Cetex Petrochemicals

- Deepak Nitrite Ltd.

- Dow

- Eastman Chemical Company

- Evonik Industries AG

- Hubei Jusheng Technology Co. Ltd

- LG Chem

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Monument Chemical

- Sumitomo Chemical Co., Ltd.

- TORAY INDUSTRIES INC.

第7章 市場機會與未來趨勢

- 拉丁美洲未來的採礦項目

簡介目錄

Product Code: 47068

The Methyl Isobutyl Carbinol Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the demand for methyl isobutyl carbinol. The pandemic caused a decline in the manufacturing of plasticizers, frothers, corrosion inhibitors, lubrication oils, and hydraulic fluids, which in turn reduced the market for chemicals such as methyl isobutyl carbinol (MIBC). MIBC is used in a variety of end-user sectors.

- One of the major factors driving the market is the surging demand for frothers in copper and molybdenum sulfide ores. The increasing demand for surface coating applications will also likely drive the market forward. On the flip side, the toxic effects of MIBC are hindering the growth of the market studied.

- Upcoming mining operations in Latin America are expected to act as opportunities for market growth. The Asia-Pacific region is expected to witness the highest growth rate and is set to dominate the global market during the forecast period.

Methyl Isobutyl Carbinol Market Trends

Mining Industry to Dominate the Market

- Methyl isobutyl carbinol is branched hexyl alcohol, an organic chemical compound that is used as plasticizers, hydraulic fluids, frothers, and corrosion inhibitors in various applications. Methyl isobutyl carbinol is used as a frother in the flotation process in the mining of ores, such as copper and molybdenum sulfide, as well as coal.

- Froth flotation is an important concentration process that can be used to selectively separate hydrophobic materials from hydrophilic waste gangue. Froth flotation is one of the most popular operational processes for mineral beneficiation and is helpful for separating a wide range of sulfides, carbonates, and oxides before further refining. Methyl isobutyl carbinol absorbs at the water-air interface, assists in bubble formation, and stabilizes flotation froths. Short-chain aliphatic alcohols and polyglycols are the two most common forms of frothers today.

- According to the United States Geological Survey, Australia is by far the world's largest iron ore mining country, with a total production of approximately 880 million metric tons in 2022, followed by Brazil (410 million metric tons) and China (380 million metric tons).

- With a production volume of almost 2.6 billion metric tons in 2022, iron ore was one of the most produced mineral commodities worldwide. Iron ore, potash, and copper were the two mineral products that were produced the most globally, with total production amounts of 40 million metric tons and 22 million metric tons, respectively.

- According to the Bureau of Economic Analysis's (BEA) official data, the total value contributed by the mining sector in the United States (excluding oil and gas) in the third quarter of 2022 was approximately USD 69.7 billion, a 12% increase in value over the same period in the previous year. Also, the industry added nearly USD 205.7 billion in value throughout the first three quarters of the year.

- The market for methyl isobutyl carbinol is anticipated to grow during the projected period as a result of the development of mining industry operations around the world and the continuous increase in investment in the aforementioned industry.

China to Dominate the Asis-Pacific Market

- China is the largest producer of various metals, such as coal, gold, steel, etc. Infrastructure-driven growth in Asia, especially in China, resulted in a significant increase in demand for commodities like iron ore, copper, and coal. Increasing demand for such commodities from the construction industry has been driving the growth of the mining industry in China.

- The government's desire for infrastructure investment to support economic growth has accelerated the development of the construction sector in China. Also, China's expanding mining industry and impending government initiatives are creating a lucrative chance for the market to expand in the future.

- According to the National Bureau of Statistics, China's construction industry is expanding significantly. The fourth quarter of 2022 saw an increase in China's construction output of around 50% over the previous quarter (USD 27.6 billion), reaching an estimated USD 40 billion.

- Moreover, According to US Geological Survey, China will be the third largest country in the production of iron ore mines in 2022 globally, with a total production of 380 million metric tons, just after Australia and Brazil respectively.

- Methyl isobutyl carbinol also serves its purposes in the automobile industry. MIBC is used to produce lube oil additives, which are majorly used in the automobile industry. Thus, increased demand for lube oil additives would positively impact the MIBC market.

- The Chinese automotive manufacturing industry is the largest in the world. According to the China Association of Automobile Manufacturers, in 2022, automotive production in the country reached 27.02 million units, which increased by approximately 3.4%, compared to 26.08 million vehicles produced in 2021.

- The factors mentioned above are expected to impact the demand for Methyl Isobutyl Carbinol (MICB) in the forecast period.

Methyl Isobutyl Carbinol Industry Overview

The methyl isobutyl carbinol (MICB) market is fragmented. The major companies include (not in any particular order) BASF SE, Eastman Chemical Company, Dow, AkzoNobel N.V., and Celanese Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand for Frothers in Copper and Molybdenum Sulfide Ores

- 4.1.2 Increasing Demand for Surface Coating Applications

- 4.2 Restraints

- 4.2.1 Growing Awareness about the Toxic Effects of MIBC

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Plasticizers

- 5.1.2 Frothers

- 5.1.3 Corrosion Inhibitors

- 5.1.4 Lube oils and Hydraulic Fluids

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Mining

- 5.2.3 Automobile

- 5.2.4 Rubber

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel N.V.

- 6.4.2 Arkema Group

- 6.4.3 BASF SE

- 6.4.4 Celanese Corporation

- 6.4.5 Cetex Petrochemicals

- 6.4.6 Deepak Nitrite Ltd.

- 6.4.7 Dow

- 6.4.8 Eastman Chemical Company

- 6.4.9 Evonik Industries AG

- 6.4.10 Hubei Jusheng Technology Co. Ltd

- 6.4.11 LG Chem

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Mitsui Chemicals, Inc.

- 6.4.14 Monument Chemical

- 6.4.15 Sumitomo Chemical Co., Ltd.

- 6.4.16 TORAY INDUSTRIES INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Mining Operations in Latin America

02-2729-4219

+886-2-2729-4219