|

市場調查報告書

商品編碼

1636621

熱電偶溫度感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Thermocouple Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

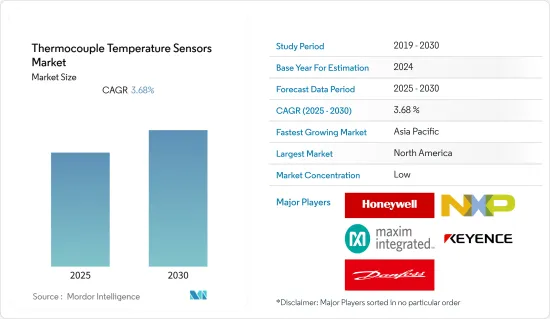

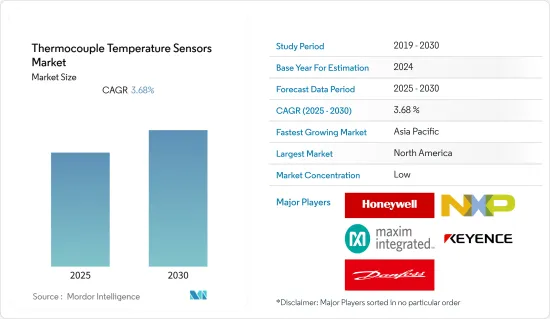

預計預測期內熱電偶溫度感測器市場複合年成長率為 3.68%。

主要亮點

- 此外,全球感測器市場先進技術的引入以及工業領域數位轉型的不斷成長的趨勢正在推動對感測器尤其是智慧感測器的需求。

- 熱電偶溫度感測器主要用於汽車工業的溫度控管和自動傳動系統。因此,嚴格的汽車排放法規、積極的自動駕駛汽車市場開發以及全球範圍內電動汽車(EV)的日益普及是推動市場成長的主要因素。例如,印度政府正致力於建造充電基礎設施和政策框架,以確保2030年有30%以上的車輛是電動車。

- 2019年2月,義法半導體與現代Autron夥伴關係推出了環保車用感測器解決方案開發實驗室。這項合作關係將使工程師們能夠共同開發環保汽車的先鋒解決方案,並專注於動力傳動系統控制器。

- 然而,對感測器的技術認知和極端條件下的加熱問題是阻礙市場成長的主要限制因素。

熱電偶溫度感測器的市場趨勢

汽車產業可望實現強勁成長

- 智慧感測器技術的小型化將增加對智慧汽車設備中安全和精確測量的溫度感測器的需求,以及及時的感測器資料的分析和產生。預計這將推動該應用中對熱電偶溫度感測器的需求。

- 此外,自動溫度控制(ATC)是大多數電動車和中階高階車型的共同功能。美國、德國和中國等可支配收入較高的地區電動車銷量不斷增加,為熱電偶溫度感測器市場創造了機會。

- 用於在汽車領域為多個設備充電,電池充電是許多自動駕駛汽車中使用的電池的常見問題,因此我們安裝了一個溫度感測元件,以定期檢查和監控加熱問題。這有助於延長設備的壽命並減少損壞。這將確保您的電池有足夠的電量。

- 電動車產量的增加預計將推動對熱電偶溫度感測器的需求。

北美佔有最大市場佔有率

- 預計美國將佔據熱電偶溫度感測器市場的突出佔有率。中國是世界上最大的汽車市場之一,擁有超過 13 家主要汽車製造商。電動車在美國的普及度正在迅速提升,據估計,電動車占美國市場所有汽車銷售量的1%。

- 加州在美國電動車(EV)銷售市場上佔據主導地位。加州的零排放汽車 (ZEV) 計劃要求該州的汽車製造商銷售一定比例的電動車,從而刺激了對電動車的需求。美國汽車市場可能會給汽車製造商帶來更大壓力,要求其擴大經濟型電動車的生產。因此,刺激了國內對熱電偶溫度感測器的需求。

- 此外,美國航太製造商也面臨激烈的國際競爭。 2017年,航太業為美國經濟貢獻了1,430億美元的出口銷售額。波音公司等航太公司於2018年獲得價值120億美元的契約,向美國航空公司供應47架新型787夢幻噴射機。同樣,2017年該公司與新加坡航空簽署了一份契約,交付39架新型寬體噴射機,價值138億美元。預計上述趨勢將推動該國對熱電偶溫度感測器的需求。

熱電偶溫度感測器產業概況

熱電偶溫度感測器市場競爭激烈,由幾家主要企業組成。主要參與者包括德州儀器公司、意法半導體公司、霍尼韋爾國際公司和丹佛斯集團。這些公司正在利用戰略合作舉措來增加市場佔有率和盈利。在市場上企業發展的公司也在收購從事熱電偶溫度感測器技術的新興企業,以增強其產品能力。

- 2019 年 1 月-Honeywell家居推出兩款新型 T 系列智慧恆溫器。新款恆溫器與先前的 T 系列型號最大的區別在於支援無線智慧房間感測器來平衡和優先調節家中的溫度。智慧房間感測器監測溫度、濕度和運動,並利用這些資訊對家庭的不同區域進行優先排序。設定優先順序可以讓您確定哪些房間最重要。整個加熱和冷卻系統的管理方式是,高優先房間和區域的溫度和濕度優先於低優先級位置。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 安全和監控趨勢不斷上升

- 科技快速發展

- 市場限制

- 傳統溫度感測器技術的優勢

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按應用

- 飲食

- 發電

- 車

- 石油化學和化學品

- 石油和天然氣

- 金屬與礦業

- 航太

- 其他應用(塑膠、用水和污水管理、電氣、生命科學)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Maxim Integrated Inc.

- Keyence Corporation

- NXP Semiconductors NV

- Honeywell International Inc.

- Danfoss Group

- Texas Instruments Inc.

- Microchip Technology

- STMicroelectronics

第7章投資分析

第8章 市場機會與未來趨勢

The Thermocouple Temperature Sensors Market is expected to register a CAGR of 3.68% during the forecast period.

Key Highlights

- Further, the introduction of advanced technologies in the global sensors market, along with the constantly growing trend of digital transformation in the industrial world, has resulted in the rising demand for sensors, especially for smart sensors.

- Thermocouple temperature sensors are mainly used for thermal management and automatic transmissions systems in the automotive industry. Therefore, the stringent emission norms for automobiles, aggressive development in an autonomous vehicle, and increasing penetration of electric vehicle (EV), globally, are some of the major factors driving the market growth. For instance, the Indian government is focusing on creating charging infrastructure and policy framework, so that by 2030, more than 30% of vehicles are electric vehicles.

- In February 2019, STMicroelectronics' entered into a partnership with Hyundai Autron, to launch a development lab for eco-friendly automotive sensor solutions. The collaboration will provide the environment for engineers to collaborate on pioneering solutions for eco-friendly vehicles, with a focus on powertrain controllers.

- However, technical awareness about sensor and heating issues in the extreme condition is the key restraints which hamper the market growth.

Thermocouple Temperature Sensors Market Trends

Automotive Industry is Expected to Register a Significant Growth

- The need for temperature sensors for safety and precision measurements of the smart automotive equipment, to analyze and produce timely sensor data, is likely to increase because of the miniaturization of the intelligent sensor technology. This is expected to fuel the demand for thermocouple temperature sensors in this application.

- Further, Automatic Temperature Control (ATC) is a common feature in most of the electric vehicles and high-end models in the mid-range segment. The increased sales of electric vehicles among high disposable income regions, such as the United States, Germany, and China, provides an opportunity for the growth of the thermocouple temperature sensors market.

- The battery charges used for charging multiple devices in the automotive segment are equipped with temperature-sensing elements that regularly check and monitor heating issues, as this is a common problem with batteries mostly used in automated vehicles. This helps in increasing the life of devices and decreases damage. Thereby, ensuring that the batteries are sufficiently charged.

- The increasing production of electric vehicles is expected to drive the demand for thermocouple temperature sensors.

North America Holds the Largest Market Share

- The United States is expected to have a prominent share in the thermocouple temperature sensor market. The country is one of the largest automotive markets in the world and is home to over 13 major auto manufacturers. Electric vehicle use in the United States has risen rapidly, with an estimated 1% of automotive sales in the US market for electric vehicles.

- California dominates the US market in terms of sales of electric vehicles (EVs). It's Zero Emission Vehicle (ZEV) program is driving the demand for EVs, by requiring automakers in the states to sell a certain percentage of electric cars. The US auto market is likely to further pressurize automakers to expand their affordable EV offerings. Hence, fueling the demand for thermocouple temperature sensors in the country.

- Further, US aerospace manufacturers are very competitive internationally. In 2017, the aerospace industry contributed USD 143 billion in export sales to the US economy. Companies in the aerospace sector, such as Boeing, won contracts worth USD 12 billion in 2018, to supply 47 new 787 Dreamliner jets to American Airlines. Similarly, the company signed a deal with Singapore Airlines for the delivery of 39 new wide-body jets, worth USD 13.8 billion, in 2017. The above-mentioned trends are expected to drive the demand for thermocouple temperature sensors in the country.

Thermocouple Temperature Sensors Industry Overview

The thermocouple temperature sensors market is highly competitive and consists of several major players. Some of the key players areTexas InstrumentsInc.,STMicroelectronics,Honeywell InternationalInc.,Danfoss Group, among others.These companies are leveraging their strategic collaborative initiatives to increase their market share and profitability.The companies operating in the market are also acquiring start-ups working on thermocouple temperature sensortechnologies to strengthen their product capabilities.

- January 2019 - Honeywell Home introduced two new T-Series smart thermostats. The greatest difference between the new thermostats and earlier T-Series models is support for wireless Smart Room Sensors to balance and prioritize temperature in the home. Smart Room Sensors monitor temperature, humidity, and motion and use that information to prioritize different areas in a home. Prioritizing lets you configure which room or rooms are most important. The entire heating and cooling system will be managed, so the temperature and humidity in the higher priority rooms and areas take precedence over lower priority locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Trends of Security and Surveillance

- 4.3.2 Rapid Technological Developments

- 4.4 Market Restraints

- 4.4.1 Dominance of Legacy Temperature Sensor Technologies

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Food and Beverage

- 5.1.2 Power Generation

- 5.1.3 Automotive

- 5.1.4 Petrochemicals and Chemicals

- 5.1.5 Oil and Gas

- 5.1.6 Metals and Mining

- 5.1.7 Aerospace

- 5.1.8 Other Applications (Plastics, Water and Wastewater Management, Electrical, Life sciences)

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Maxim Integrated Inc.

- 6.1.2 Keyence Corporation

- 6.1.3 NXP Semiconductors NV

- 6.1.4 Honeywell International Inc.

- 6.1.5 Danfoss Group

- 6.1.6 Texas Instruments Inc.

- 6.1.7 Microchip Technology

- 6.1.8 STMicroelectronics