|

市場調查報告書

商品編碼

1636613

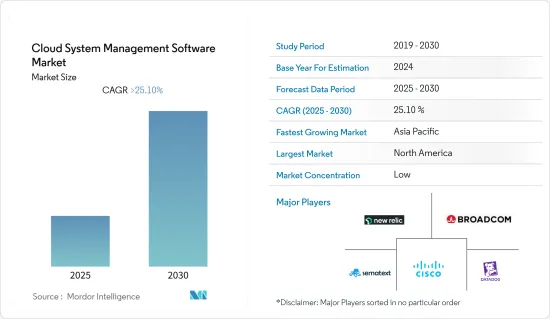

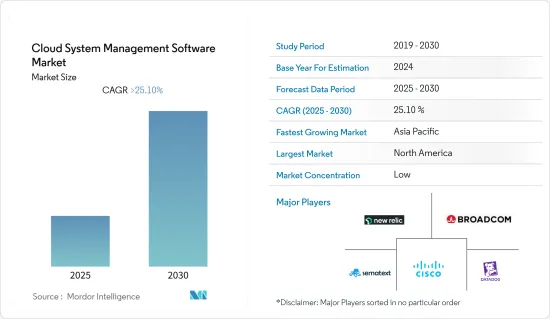

雲端系統管理軟體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Cloud System Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內雲端系統管理軟體市場將以超過 25.10% 的複合年成長率成長。

主要亮點

- 用於管理雲端系統的軟體稱為雲端系統管理軟體。此框架可協助您導航雲端自動化和操作。隨著對數位轉型、人工智慧和巨量資料分析的關注度不斷提高,許多企業開始轉向雲端服務。同時,隨著企業採用多重雲端策略並將更多工作負載和資料遷移到雲端,它們也在增加對雲端服務的支出。

- 混合雲端和多重雲端設計的日益普及推動了雲端系統管理市場的需求,這些設計支援在雲端、本地和邊緣環境中實現一致的部署和操作。數位轉型和最佳化工作從雲端運算中受益匪淺。企業正在投資系統創新計劃,以實現其業務目標、響應市場狀況並實施快速數位轉型計劃。例如,IBM開發了業界認可的混合雲容器技術Red Hat OpenShift。透過 Red Hat OpenShift,使用者可以從任何地方的任何雲端建立和存取雲端服務。

- 隨著雲端軟體成為每個企業 IT 環境中的必需品,它需要透過 SaaS 模型管理和運行應用程式,以及使用 IaaS 和 PaaS 平台管理雲端架構。基礎設施即服務(IaaS)一推出,企業就轉向在私有雲和公有雲、多個公有雲以及多個私有雲和公有雲之間進行配置。因此,雲端系統管理的採用已顯著轉向有利於效能、成本、配置監控和分析。同樣,所研究產業中的公司也透過策略聯盟和收購擴大了其投資組合。

- 多重雲端出現的兩個問題是擔心供應商鎖定以及需要對雲端支出進行更多控制。供應商鎖定是指更換供應商的成本過高,客戶因資金限制、勞動力短缺或需要避免業務中斷而無法離開原來的供應商的情況。資料外洩的風險也始終存在,阻礙了產業的發展。

- 越來越多的公司開始轉向針對利基市場並採用雲端基礎的應用程式的企業解決方案。這項舉措導致這些組織的優先事項發生了更實質的轉變。此外,隨著對數位技術的需求不斷成長,企業擴大使用雲端基礎的應用程式而不是本地應用程式來保持一致的業務運作。 COVID-19 對全球市場產生了重大影響,要求加強降低成本的力度,並要求 IT 系統和軟體產出更多產品。在雲端軟體領域,COVID-19 的影響導致人們對具有主動和預測最佳化功能、增強的應用程式效能和強大的成本控制的 SaaS 交付模式的興趣激增。

雲端系統管理軟體市場趨勢

BFSI 預計將佔很大佔有率

- 隨著越來越多的銀行和金融服務機構希望透過預測客戶消費模式和從非結構化資料集中獲得洞察來實現資料收益,銀行和金融服務公司正在轉向人工智慧、分析和資料分析來增強其巨量資料經營模式。因此,基於雲端建置的多重雲端財務管理和FinOps正在成為系統和服務雲端管理的關鍵促進因素。資料科學和機器學習在業務和其他金融服務領域的普及正在推動雲端管理關鍵任務的發展。

- 此外,《一般資料保護規範》(GDPR)迫使基於 BFSI 的組織以不同的方式看待資料。習慣於嚴格監管的銀行、投資基金、保險公司和相關企業被迫更嚴格地控制資料,以避免因不合規而受到罰款和聲譽損害。

- 同樣,美國忠誠保險公司 (AF) 是一家補充保險產品和福利提供商,在 49 個州擁有超過 150 萬會員和超過 250 萬份保單。該公司需要協助來實現面向關鍵客戶訂閱系統的效能。這些參與系統進一步在使用內部部署系統、Azure 和 AWS 環境建置的混合多重雲端環境中運作。 Dynatrace 提供多種監控工具,以便從單一視圖了解您的領域並消除效能盲點,從而顯著提高 AF 的應用程式效能。

- 銀行和金融機構需要按需可擴展的基礎設施服務、適當的資料和儲存管理、具有 SDI 支援的計量收費模式的私有雲端基礎設施、AI主導的雲端管理和敏捷營運,以迎接雲端採用之旅。因此,採用混合雲將有助於 BFSI 最終用戶實現數位轉型。

- 根據Worldpay的全球支付報告,mPOS的銷售額預計將大幅成長,如圖所示。此外,許多已開發國家已經推出了先進的系統,允許客戶進行線上付款。智慧型手機的使用日益增加也促進了無現金交易的增加。預計這將在預測期內推動雲端基礎的系統管理軟體的採用。

亞太地區可望創下最高成長

- 由於IT基礎設施支出的增加、雲端基礎應用程式的採用不斷增加以及對流程自動化的需求不斷增加,亞太地區預計將實現成長。雲端管理平台正在成為多重雲端部署企業的基本需求,並且幾乎得到每個雲端供應商的支援。多重雲端已成為亞太地區大多數企業的常態。 84% 的亞太地區 CIO 認為未來三年多重雲端將佔其託管環境的 50%。

- 隨著越來越多的亞太企業轉向混合雲,許多創新解決方案應運而生,協助管理異質 IT 環境中雲端應用程式的生命週期。此外,雲端運算產業的發展和政府舉措可能會在預測期內積極推動市場成長。例如,根據國務院發展研究中心的數據,到 2023 年,中國雲端運算產業規模預計將超過 3,000 億元人民幣(423 億美元),而 2018 年的市場規模為 962.8 億元。 。在預測期內,全國超過60%的企業和政府機構將依賴雲端處理作為日常業務的關鍵部分。

- NASSCOM 也表示,印度的業務流程管理 (BPM) 和 IT 服務分別佔全球需求的 14% 和 10%,預計未來隨著全球雲端運算採用率的持續成長,這一趨勢還將持續。政府透過各種激勵計劃支持 IT 和基礎設施發展的需求。印度IT服務的發展可能會積極推動市場成長。

- 新冠疫情加速了客戶對數位技術的需求,以確保整個全部區域企業業務營運的彈性,從而採用雲端基礎的產品取代傳統產品。由於雲端解決方案具有遠端資料儲存功能和託管應用程式配置權限,BFSI、醫療保健和製造業等主要垂直行業對雲端基礎方案的需求激增。

- 根據印度國家軟體和服務公司協會(Nasscom)的報告,印度IT產業在22會計年度與前一年同期比較了2,270億美元的收入,年增15.5%。 IBEF表示,到2025年,印度軟體產品市場規模預計將達到1,000億美元。印度公司正在進行海外投資,以擴大其全球影響力並改善其全球交付中心。因此,對雲端基礎的軟體的投資正在以顯著的速度成長,預計這將在預測期內推動市場需求。

雲端系統管理軟體產業概況

雲端系統管理軟體市場參與企業很多,包括IBM Corporation、BMC Software Inc.、VMware Inc.、Cisco Systems Inc.、Microsoft Corporation和Oracle Corporation。領先的雲端系統管理供應商提供專業的運算解決方案,為最終用戶提供創造性且有效的解決方案,刺激市場擴張。

2022 年 12 月,為了確保整個業務基礎設施領域可靠的服務品質 (QoS),Dynatrace 與數位轉型領域的全球領導者 Microland 合作,以支援和增強 IT 營運。此次夥伴關係為全端企業數位應用和基礎設施環境帶來了無與倫比的可觀察性。

2022 年 11 月,雲端應用程式監控和安全平台 Datadog 收購了雲端和系統架構師的可視性服務 Cloucraft。將 Datadog 的即時可觀察性資料與 Cloudcraft 結合,可以幫助您進一步轉變監控,以確保工程師每天考慮的結構性變化的成功,例如雲端遷移和容器採用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

第 2 章 簡介

- 研究假設和市場定義

- 研究範圍

第3章調查方法

第4章執行摘要

第5章 市場動態

- 市場概況

- 市場促進因素

- 投資先進資料中心的新興技術

- IT 公司向 BYOD 和 CYOD 系統的轉變創造了對雲端管理服務的需求

- 採用多重雲端平台

- 市場限制

- 資料隱私和安全問題

- 網路攻擊增加

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對市場的影響

第6章 市場細分

- 按組件

- 雲端 IT 營運管理

- 雲端 IT 自動化和設定管理

- 雲端IT服務管理

- 按部署模型

- 民眾

- 私人的

- 混合

- 按組織規模

- 大型企業

- 中小型企業

- 按最終用戶產業

- 衛生保健

- 銀行和金融服務

- 零售和消費者服務

- 製造業

- 運輸和物流

- 媒體與娛樂

- 資訊科技/通訊

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Amazon Web Services

- Microsoft Corp.

- Cisco Systems Inc.

- Oracle

- Broadcom Inc.

- Sematext

- Dynatrace

- New Relic Inc.

- Splunk Inc.

- Data Dog

- Solarwinds

- 供應商市場佔有率

- 合併和收購

第8章投資分析

第9章 市場機會與未來趨勢

The Cloud System Management Software Market is expected to register a CAGR of greater than 25.10% during the forecast period.

Key Highlights

- Software used to administer a cloud system is referred to as cloud system management software. This framework helps to steer the cloud's automation and operations. With a stronger emphasis on digital transformation, AI, and big data analytics, many enterprises turned to cloud services. On the other side, corporations are spending more on cloud services as they implement multi-cloud strategies and move more workloads and data there.

- Demand for the cloud system management market is being driven by the rising popularity of hybrid and multi-cloud designs, which allow for consistent building and operation across cloud, on-premises, and edge environments. Initiatives for digital transformation and optimization have benefited greatly from the cloud. Companies invest in organized innovation programs to achieve business objectives, react to market circumstances, and implement expedited digital transformation projects. As an illustration, IBM created Red Hat OpenShift, the industry-recognized hybrid cloud container technology. Users can create and access cloud services from any cloud and from any location using Red Hat OpenShift.

- The requirement to manage and execute apps through a SaaS model or manage a cloud architecture with an IaaS or PaaS platform arose as cloud software became a staple of any business IT environment. Enterprises turned to deployments between private and public, multiple public, and numerous private and public clouds as soon as Infrastructure-as-a-Service (IaaS) was introduced. As a result, the adoption of cloud system management experienced a significant landscape shift in favor of performance, cost, configuration monitoring, and analytics. Similarly, companies in the industry under investigation used strategic alliances and acquisitions to broaden their portfolios.

- Two problems that arise with multi-cloud are vendor lock-in worries and a need for more cloud spend control. Vendor lock-in refers to a situation where the cost of switching vendors is so high that the customer is essentially stuck with the original vendor because of financial constraints, a lack of workforce, or the need to prevent business operations from being disrupted, which could impede the growth of cloud system management software. Also, there is a constant risk of data breaches, which impedes industry development.

- Businesses increasingly use enterprise solutions to employ cloud-based apps to target a niche market. This adoption brought about much more substantial changes in these organizations' priorities. In addition, as the need for digital technologies increases, cloud-based apps rather than on-premise ones are more frequently used to maintain consistent enterprise business operations. Because of rising cost-cutting initiatives and pressure to produce more from IT systems and software, COVID-19 had a considerable impact on the global market. The cloud software segments were consequently looking toward SaaS delivery models with proactive and predictive optimization capabilities, enhanced application performance, and robust cost control due to COVID-19.

Cloud System Management Software Market Trends

BFSI Expected to Hold Significant Share

- As more banks and financial services organizations look to monetize data by predicting customer spending patterns and insights driven by unstructured datasets, the demand for AI, predictive analytics, and big data continues to grow in Banking and Financial services firms to strengthen the business model. As a result, multi-cloud financial management and FinOps built on the cloud are becoming significant drivers of cloud management for systems and services. The present state of data science and machine learning pervasiveness in banking and other financial service offerings attracts the mission-critical development of cloud management.

- Moreover, the General Data Protection Regulation (GDPR) led BFSI-based organizations to change how they think about data. Being accustomed to stringent regulations, banks, investment funds, insurance companies, and allied businesses have been tasked with managing their data even more closely to avoid fines and reputational loss from failing to comply with the regulations.

- Likewise, American Fidelity (AF), supplemental insurance products and enrollment benefits provider, has over 1.5 million policyholders across 49 states of America, with more than 2.5 million policies. The company needed help to realize the performance of its critical customer-facing enrollment systems. These enrollments further operate across a hybrid, multi-cloud environment built on a mix of on-premise systems, Azure, and AWS environments. Dynatrace offers multiple monitoring tools to obtain single view-based visibility into its territory and eliminate performance blind spots, significantly improving AF's application performance.

- The banking and financial organizations can significantly leverage the benefits of on-demand scalable infrastructure services, adequate data and storage management, SDI-enabled private cloud infrastructure in pay-per-use models, AI-driven cloud management, and agile operations solutions that embrace their cloud adoption journey. This way, hybrid cloud adoption can help BFSI end users achieve digital transformation.

- According to Worldpay's global payment report, mPOS sales are analyzed to grow significantly, as indicated in the graph. Additionally, many developed countries are implementing advanced systems to allow customers to make online payments. The expanding use of smartphones has also contributed to increased cashless transactions. This is expected to boost the adoption of cloud-based system management software during the forecast period.

Asia-Pacific Expected to Witness Highest Growth Rate

- Asia-Pacific is expected to witness growth owing to the growing spending on IT infrastructure, the rise in adoption of cloud-based applications, and the increasing demand for the automation of processes. A cloud management platform is becoming a basic need for enterprises with multi-cloud deployments, addressed by almost all cloud providers. Multi-cloud has become the norm for most enterprises across the Asia Pacific region. It is expected that 84% of CIOs in Asia-Pacific believe multi-cloud would constitute up to 50% of their hosting environment in the next three years.

- As more Asia-Pacific enterprises move to the hybrid cloud, many innovative solutions have emerged to help organizations manage cloud applications' lifecycles in a heterogeneous IT environment. Moreover, growing development in the cloud computing industry and government initiatives would positively drive the market's growth over the forecast period. For instance, according to the Development Research Center (DRC) of the State Council, China's Cabinet, the cloud computing industry in the country is expected to exceed CNY 300 billion (USD 42.3 billion) by 2023, over a threefold increase from its 2018 market value of CNY 96.28 billion. During this forecast period, over 60% of the country's businesses and government agencies depend on cloud computing as an integral part of their daily operations.

- NASSCOM also stated that Business Process Management (BPM) and IT services in India contribute to over 14% and 10% of the global demand and is expected to continue with consistent growth in the worldwide cloud adoption rate. The government supported the need for growing IT and Infrastructure through various incentive programs. The development of IT services in India will positively drive the market's growth.

- COVID-19 accelerated customer demand for digital technologies to ensure resilient enterprise business operations across the region, resulting in cloud-based offerings replacing traditional products. Key verticals such as BFSI, healthcare, and manufacturing sectors are witnessing a surge in demand for cloud-based solutions, owing to remote data storage capabilities and provisioning privileges for hosted applications.

- The National Association of Software and Service Companies (Nasscom) reported that the Indian IT sector generated USD 227 billion in sales in FY22, representing a 15.5% Y-o-Y growth. As stated by IBEF, by 2025, it is anticipated that the Indian software products market will be worth USD 100 billion. Indian enterprises are investing overseas to expand their global footprint and improve their global delivery centers. Therefore, the significant growth in the investments in cloud-based software is analyzed to bolster the demand for the market during the forecast period.

Cloud System Management Software Industry Overview

There are numerous participants in the Cloud System Management Software market, including IBM Corporation, BMC Software Inc., VMware Inc., Cisco Systems Inc., Microsoft Corporation, and Oracle Corporation. Leading cloud systems management suppliers deliver specialized computing solutions and give end-customers creative, effective solutions, spurring market expansion.

In December 2022, to ensure dependable Quality of Service (QoS) throughout the business infrastructure estate, Dynatrace, and Microland, a global leader in digital transformation, teamed to support and enhance IT operations. This partnership will provide unparalleled observability across full-stack enterprise digital application and infrastructure environments.

In November 2022, Datadog, the cloud applications monitoring and security platform, acquired Cloucraft, a visualization service for cloud and system architects. Combining Datadog's real-time observability data with Cloudcraft will shift monitoring further and support the customer's success with cloud migrations, container adoptions, or other structural changes engineers consider every day.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 TOC

2 INTRODUCTION

- 2.1 Study Assumption and Market Definition

- 2.2 Scope of the Study

3 RESEARCH METHODOLOGY

4 EXECUTIVE SUMMARY

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Emerging Technologies Investing into Advanced Data Centers

- 5.2.2 IT Companies Turning to BYOD and CYOD Systems Create Demand for Cloud Management Services

- 5.2.3 Adoption of Multi-cloud Platform

- 5.3 Market Restraints

- 5.3.1 Data Privacy and Security Concers

- 5.3.2 Increased Cyber Attacks

- 5.4 Industry Value Chain Analysis

- 5.5 Industry Attractiveness - Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

- 5.6 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Cloud IT Operations Management

- 6.1.2 Cloud IT Automation and Configuration Management

- 6.1.3 Cloud IT Service Management

- 6.2 By Deployment Model

- 6.2.1 Public

- 6.2.2 Private

- 6.2.3 Hybrid

- 6.3 By Organisation Size

- 6.3.1 Large Enterprises

- 6.3.2 Small-Medium Enterprises

- 6.4 By End-user Industry

- 6.4.1 Healthcare

- 6.4.2 Banking and Financial Services

- 6.4.3 Retail and Consumer Services

- 6.4.4 Manufacturing

- 6.4.5 Transport and Logistics

- 6.4.6 Media and Entertainment

- 6.4.7 IT and Telecommunication

- 6.4.8 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.2.4 Russia

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.5.1 Brazil

- 6.5.5.2 Mexico

- 6.5.6 Middle East and Africa

- 6.5.6.1 United Arab Emirates

- 6.5.6.2 Saudi Arabia

- 6.5.6.3 South Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services

- 7.1.2 Microsoft Corp.

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Oracle

- 7.1.5 Broadcom Inc.

- 7.1.6 Sematext

- 7.1.7 Dynatrace

- 7.1.8 New Relic Inc.

- 7.1.9 Splunk Inc.

- 7.1.10 Data Dog

- 7.1.11 Solarwinds

- 7.2 Vendor Market Share

- 7.3 Mergers and Acquisitions