|

市場調查報告書

商品編碼

1636602

資訊權管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Information Rights Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

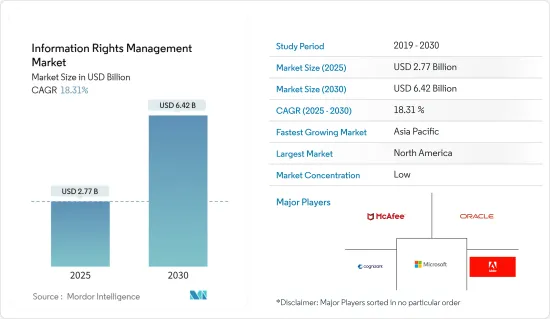

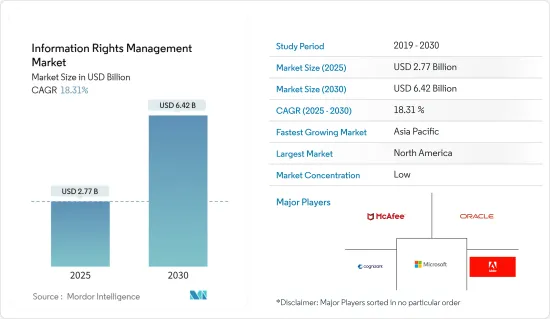

資訊版權管理市場在 2025 年的價值預估為 27.7 億美元,預計到 2030 年將達到 64.2 億美元,預測期內(2025-2030 年)的複合年成長率為 18.31%。

由於業務流程數位化,全球企業擴大使用線上平台來傳達業務訊息,因此出於文件安全目的,它們需要加密進入許可權,IRM 變得越來越重要。商機。

主要亮點

- IRM 通常涉及加密檔案以提供存取控制,並且可以使用附加 IRM 規則在文件加密後允許/拒絕特定操作。這使得用戶只能查看文件中的內容,但不能複製或貼上。此外,IRM 規則可能禁止列印、編輯或截取文件的螢幕截圖。這是 IRM 解決方案在市場上推出的驅動力,因為它們使公司能夠跨越複雜的證券共用資訊文件。

- IRM 是數位版權管理的子集,企業之所以採用 DRM 工具,是因為它透過使用加密程式來保護數位媒體資產,限制特定個人、時間或裝置的存取。 。企業通常使用 DRM 材料來保護敏感資料,尤其是在產品藍圖和 M&A(併購)過程中。高效的數位版權管理軟體使公司能夠在遵守監管義務的同時快速啟動新的宣傳活動和產品概念。

- 它還有助於防止競爭對手獲得您的商業機密和智慧財產權。考慮一家製藥公司。例如,這些 IRM 工具可能正在研究新藥的專利,但如果沒有 IRM 控制,競爭對手可能會竊取有用的資訊。此外,接受內部調查的銀行的個人資訊可能會被公開,從而損害銀行在市場上的地位。因此,各個終端用戶產業對 IRM 的利用正在創造市場成長的需求。

- 缺乏標準實務是組織在採用資訊完整性工具時面臨的主要問題之一。缺乏策略協調、文件數位化、流程自動化、管理不斷成長的資料量、確保資訊存取安全、減少資訊孤島、與舊有系統整合以及刪除低品質資料是資訊管理面臨的一些常見挑戰。

- 新冠疫情讓全球許多人轉移到了線上,並加速了長期的數位轉型。有些人開始在家工作,家裡有網路的孩子開始在線上上課,許多企業採用數位經營模式來繼續運作並確保穩定的收入來源。同時,研究人員正在利用人工智慧(AI)來了解病毒並加快疫苗的研發。已經創建了行動應用程式來「監視和追蹤」疫情的蔓延,並且線上內容的增加導致一系列最終用戶對 IRM 軟體的需求增加。

資訊權限管理市場趨勢

BFSI 產業預計將佔據主要佔有率

- 銀行、金融服務和保險 (BFSI) 行業是最容易受到資料遺失影響的行業之一,由於資訊的敏感性,BFSI 公司必須受到保護。銀行持有客戶的各種財務和資料,任何有進入許可權的人都可以存取所有這些資訊。金融科技的發展帶來了多項突破,包括電匯、信用卡/簽帳金融卡、網路銀行和行動付款。銀行必須使其系統適應這些變化並轉變業務,以確保在採用新技術的同時持續保持安全。

- 因此,由於 IRM 使銀行和金融機構能夠降低安全風險並與外部相關人員合作,因此對 IRM 的需求預計會增加。像 Seclore 的企業數位版權管理 (EDRM) 這樣的參與者確保對企業內部和跨企業共用的資訊提供端到端的保護。手機銀行客戶數量正在成長。線上媒體使服務提供者能夠透過向需要敏感的客戶特定資料(必須防止未授權存取)的使用者提供服務來推動全球市場。

- 尋求大額貸款的公司必須向銀行發送個人訊息,包括財務資訊、商業策略和收益預測,以便銀行分析其信用風險。信貸分析師仔細篩選這些資料以確定最佳貸款利率和其他貸款條款。這些資料包含有關貴公司的高度敏感資訊。這意味著銀行內部管理該業務的多個團隊都面臨安全漏洞的威脅,因此需要內部 IRM 工具。

- 此外,在外包、雲端處理、自帶設備 (BYOD)、文件共用和外部協作成為常見商業運作方式的時代,機密資訊經常與第三方共享。公司內部外部互動的程度越高,資料外洩的風險就越大。

- 由於數位轉型,BFSI 行業的多家市場參與者正在創新新技術,為資料提供高安全性平台,從而為 IRM 市場創造機會。例如,2023 年 1 月,HDFC 銀行宣布進入數位轉型的下一階段,目標是透過現代化資料環境、轉換應用程式組合和使用 Microsoft 雲端確保安全性來最大化業務價值。

北美可望主導市場

- 由於北美(尤其是美國)快速採用技術進步,該地區的數位媒體內容消費和企業數位化一直在大幅成長。

- 更快的網路速度和越來越多的支援存取數位媒體的設備使消費者可以隨時隨地更自由地存取媒體內容。這些趨勢有望增強該地區採用 IRM 解決方案的優勢。

- 該國的行動網際網路使用量大幅成長,已成為全球行動無線連線數量最多的國家。隨著平板電腦、智慧型手機和用戶端對網路的依賴越來越大,使用數位版權管理解決方案變得至關重要。企業對無線技術的投資不斷增加,推動了對 IRM 解決方案的需求,這些解決方案由在美國和加拿大營運的 IRM 市場參與者提供可靠的 IRM 解決方案。

- 為了因應該地區的資料駭客趨勢,已經出現了更嚴格的法律規範,要求公司對如何處理客戶資料承擔更多責任。目前已有多項隱私和資料保護法正在實施,例如醫療保健行業的 HIPAA 和金融業的 PCI DSS。 IRM 可以追蹤文件存取和分發等操作,自動提供全面的審核追蹤並協助確保法規遵循。

- 研發知識、商業機密和智慧財產權資料容易受到內部威脅,包括來自員工的威脅。例如,部門之間的資料可能是機密的,並且可以透過在電子郵件中包含受密碼保護的文件,使用 IRM 工具將與公司財務相關的資料傳輸限制給組織的特定成員。

資訊權限管理行業概覽

資訊權管理市場的競爭格局較為分散,存在多家 IRM 解決方案供應商。市場參與者正在與各種最終用戶公司建立夥伴關係關係,以增加其在市場上的佔有率。這些公司也致力於在市場上提供創新的解決方案和服務。

2023 年 9 月, Oracle宣布了一項加入網路和資料安全新開放標準的計畫。

2022 年 9 月,微軟開發了 Microsoft 365 應用程式和服務的資訊權限管理 (IRM) 元素。公司可以開始使用 Azure RMS 來保護他們的敏感電子郵件和文件。此資訊安全系統還可以連接到Microsoft Exchange和SharePoint等伺服器以及Excel和Microsoft Word等用戶端程序,並可保護任何文件格式。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- BYOD 趨勢和企業移動性的日益普及、嚴格的法規和合規性

- 採用各種行業特定的數位版權管理解決方案

- 業務流程快速數位化和網際網路使用率不斷提高

- 市場限制

- 數位內容安全缺乏標準化

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場區隔

- 按組織規模

- 中小型企業

- 大型企業

- 按部署形式

- 在雲端

- 本地

- 按最終用戶產業

- BFSI

- 衛生保健

- 媒體與娛樂

- 教育與研究

- 政府及公共機構

- 資訊科技和電訊

- 其他最終用戶產業(法律與政府、製造業)

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Microsoft Corporation

- McAfee, LLC

- Cognizant Technology Solutions Corporation(assetServ)

- Adobe Inc.

- Oracle Corporation

- Bynder BV

- Nextlabs, Inc.

- Intralinks, Inc.

- Citrix Systems, Inc.

- Seclore Technology Private Limited

- Locklizard Limited

- Vaultize Technologies

第7章投資分析

第8章 市場機會與未來趨勢

The Information Rights Management Market size is estimated at USD 2.77 billion in 2025, and is expected to reach USD 6.42 billion by 2030, at a CAGR of 18.31% during the forecast period (2025-2030).

Enterprises worldwide are increasingly using online platforms to communicate their business information due to the digitalization of business processes, which need encrypted access rights for security purposes of the document, creating an opportunity for the IRM software market vendors.

Key Highlights

- IRM frequently encrypts files to impose access controls, and extra IRM rules can be used to allow/deny specific actions after a document has been encrypted. This can result in a user only being able to view material from a document, not copy or paste it. In other circumstances, users may be prohibited by the IRM rule from printing, editing, or taking screenshots of the document. This drives the market adoption of IRM solutions because it enables a company to share information files with advanced securities.

- IRM is a subset of Digital Right Management, and companies are adopting DRM tools because, through this, digital media assets are protected by the use of an encryption program, which limits access to particular individuals, times, or devices and imposes a limit on the number of times the content can be installed or opened. DRM material is typically used by corporations to protect confidential data, especially during product design papers and M&A (merger and acquisition) processes. With efficient digital rights management software, a firm may quickly launch new campaigns and product concepts while keeping in compliance with regulatory obligations.

- It can stop competitors from obtaining trade secrets or intellectual property. Consider a pharmaceutical organization. For instance, these IRM tools may be working on a patent for a new medicine, but the absence of IRM controls may allow a rival to steal useful informations. Additionally, private information about a bank under investigation internally might be made public, harming the bank's standing in the market. This road application of IRM across various end-user industries creates a demand for market growth.

- The absence of standard practices is one of the main issues organizations face with adopting information-proper management tools. Lack of uniformity in strategy, digitization documents, automating procedures, managing the growing volume, safeguarding information access, reducing information silos, integrating with legacy systems, and removing low-quality data are common information management difficulties.

- The COVID-19 pandemic caused many worldwide to move online, accelerating a long-term digital transformation. Several people began working from home, children with at-home Internet connections started attending classes online, and numerous businesses adapted digital business models to continue operating and keep certain revenue streams. In the meantime, researchers used artificial intelligence (AI) to underastand the virus and hasten the search for a vaccine. Mobile applications were created to help "monitor and trace" the growth of the pandemic, which has increased the demand for IRM software across various end users due to an increase in the volume of online content.

Information Rights Management Market Trends

BFSI Industry is Expected to Hold Significant Share

- The banking, financial services, and insurance (BFSI) industry is most vulnerable to data loss, and due to the sensitive nature of the information, BFSI firms must be protected. Banks have various financial and personal data about their clients; anyone with access rights can access all that information. Financial technology development has produced several breakthroughs and advancements, including wire transfers, credit/debit cards, online banking, and mobile payments. Banks have had to modify their systems to suit these changes and transform their operations to ensure sustained security while introducing new technologies.

- Hence, the demand for IRM is expected to increase as it will enable banking and financial institutions to mitigate security risks and collaborate with external parties. Players such as Seclore's enterprise digital rights management (EDRM) ensure end-to-end protection of information shared within and outside the enterprise. The number of mobile banking customers is increasing. Service providers use the online medium to enable users to have services requiring confidential data specific to the customers, which need to be secured from unauthorized access, driving the market worldwide.

- Businesses seeking large loans must send the bank their private information, including financial information, business strategies, and revenue projections, for the bank to analyze credit risk. Credit analysts examine the data to calculate the optimal lending rate of interest and other loan terms. It contains extremely sensitive information about a company. Thus, any of the multiple teams managing it within the bank have the threat of a security breach, which requires IRM tools in the organization.

- Additionally, sensitive information is regularly provided to third parties, frequently without protection, in an age where outsourcing, cloud computing, bring-your-own-device (BYOD), file-sharing, and collaboration with external parties are common in conducting business. The risk of data leaking increases with the level of external engagement within the company, which creates a demand for IRM tools in the BFSIs because it would be helpful

- Due to digital transformation, several BFSI industry market players are innovating new technology to provide a high-security platform for Data, which is creating an opportunity for the IRM market. For instance, in January 2023, HDFC Bank collaborated with Microsoft on the next stage of its digital transformation journey with the goal of maximizing business value through modernizing the data landscape, transforming the application portfolio, and securing the company with Microsoft Cloud.

North America is Expected to Dominate the Market

- The consumption of digital media content and the digitization of enterprises in North America, especially in the United States, is increasing tremendously, owing to the rapid adoption of technological advancements in the region.

- The increasing speed of internet speeds, coupled with the increase in the number of devices supporting access to digital media, has increased the freedom of consumers to access media content anywhere and anytime. Such trends are expected to boost the region's dominance in adopting IRM solutions.

- Mobile internet usage in the country has grown tremendously, with the greatest number of mobile wireless connections. The use of digital rights management solutions is now essential due to the increase of tablets, smartphones, and client internet dependence. Due to the increase in wireless technology investments by businesses, there would be a greater need for IRM solutions supported by IRM market players working to present trustworthy IRM solutions in the US and Canada.

- A more stringent regulatory framework has emerged in response to the region's current trend of data hacks, and businesses are more accountable for how client data is handled. Several privacy and data protection legislation have been introduced, including HIPAA in the healthcare business and PCI DSS in the finance industry. Because IRM can track actions such as file access and distribution, it can automatically provide a thorough audit trail, enabling it to offer regulatory compliance.

- Research and development knowledge, trade secrets, and intellectual property data are vulnerable to insider threats, which include employees and other internal staff. For instance, inter-department data are confidential, and data transfer related to the financials of the company can be restricted to certain members of the organization through the IRM tool by including password protection files in e-mails, which is driving the market in the United States because many large corporates have their head offices in the region.

Information Rights Management Industry Overview

The competitive landscape of the information rights management market is fragmented owing to the presence of several IRM solution providers. The market players are extending partnerships and collaborating with several companies in different end-users to boost their market presence. The companies are also making efforts to provide innovative solutions and offerings in the market.

In September 2023 - Oracle announced its participation initiative to a new open standard on network and data security, which will help organizations to better secure their data in distributed IT environments by providing them with collective enforcement of shared security policies, enabling networks to reinforce the security architecture organizations have been using without changing existing applications and networks.

In September 2022, Microsoft developed the information rights management (IRM) elements of Microsoft 365 applications and services, which could be used after the rights management service (RMS) has been activated. The user company may begin utilizing Azure RMS to protect crucial emails and documents. This information security system could protect all file formats, which also connects with servers like Microsoft Exchange and SharePoint and client programs like Excel, Microsoft Word, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of BYOD Trends and Enterprise Mobility, and Stringent Regulations and Compliance

- 4.2.2 Adoption of Digital Rights Management Solutions Across Various End-user Verticals

- 4.2.3 Rapid Digitization of Business Process Coupled With Increase in Internet Usage

- 4.3 Market Restraints

- 4.3.1 Lack of Standardization for Security of Digital Content

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Size of the Organization

- 5.1.1 Small and Medium Enterprises

- 5.1.2 Large Enterprises

- 5.2 By Deployment Mode

- 5.2.1 On-Cloud

- 5.2.2 On-Premise

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Media and Entertainment

- 5.3.4 Education and Research

- 5.3.5 Government and Public Institutions

- 5.3.6 IT & Telecom

- 5.3.7 Other End-user Industries (Law and Order Agencies, Manufacturing)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Microsoft Corporation

- 6.1.2 McAfee, LLC

- 6.1.3 Cognizant Technology Solutions Corporation (assetServ)

- 6.1.4 Adobe Inc.

- 6.1.5 Oracle Corporation

- 6.1.6 Bynder B.V.

- 6.1.7 Nextlabs, Inc.

- 6.1.8 Intralinks, Inc.

- 6.1.9 Citrix Systems, Inc.

- 6.1.10 Seclore Technology Private Limited

- 6.1.11 Locklizard Limited

- 6.1.12 Vaultize Technologies