|

市場調查報告書

商品編碼

1636497

緊急發電機:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Emergency Power Generators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

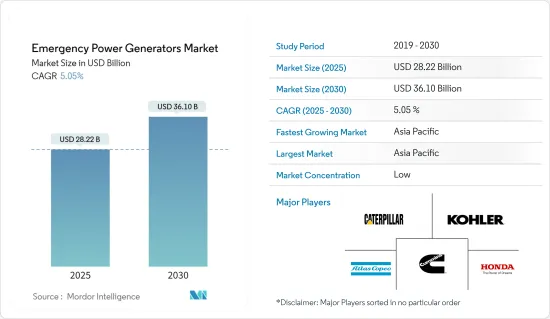

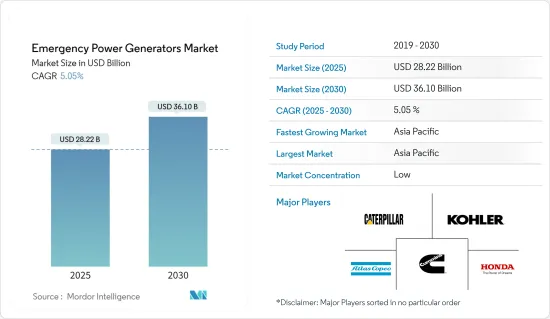

緊急發電機市場規模預計到2025年為282.2億美元,預計到2030年將達到361億美元,預測期間(2025-2030年)複合年成長率為5.05%。

主要亮點

- 從中期來看,醫療保健和建築業不斷成長的需求預計將推動市場向前發展。

- 然而,分散式可再生能源發電技術的投資增加預計將對市場研究產生負面影響。

- 發電機技術的最新進展集中在降低噪音、控制排放氣體以及提高功率輸出和效率。此外,人們對既可以使用天然氣也可以使用柴油的雙燃料發電機越來越感興趣。發電機的這些技術進步預計將在未來幾年推動市場成長。

- 在中國和印度等國家需求激增的推動下,亞太地區將在預測期內引領市場。

緊急發電機市場趨勢

75kVA 以下可能會顯著成長

- 小於 75kVA 的緊急發電機是緊湊型多功能機器,旨在為住宅、小型商業和輕工業應用提供可靠的備用電源。這些發電機非常適合電力需求適中的小規模業務,並為停電期間運作關鍵系統提供有效的解決方案。

- 老化的電力基礎設施、極端天氣事件和不斷成長的電力需求導致已開發地區和發展中地區頻繁停電。因此,住宅用戶和小型企業越來越依賴 75kVA 以下的發電機。這種轉變有助於在停電期間維持電力並保護冷氣、暖氣、照明和通訊等基本服務。

- 隨著世界人口的增加,對電力的需求也增加。 2021年至2023年間,全球電力消耗量將從28,169太瓦時增加到29,470太瓦時。亞太地區、非洲和拉丁美洲等快速都市化和電氣化的地區正在增加對備用電源解決方案的需求。這些地區的許多都市區和農村地區的電網不可靠,需要緊湊、經濟高效的發電機來確保家庭和小型企業的可靠電力。

- 2023年12月,東南部重要工業中心蔚山遭遇嚴重停電。由於變電站故障,約 155,000 個家庭陷入黑暗約兩個小時。這起事件是韓國自2017年以來最大規模的停電事件,當時大首爾地區約有20萬戶家庭受到停電影響。此類事件凸顯了對緊急備用發電機的需求不斷成長。

- 全球範圍內,住宅計劃大幅增加。這一趨勢可能會在不久的將來推動對備用發電機的需求。例如,土耳其建設公司Karmod 計劃於 2024 年 7 月在剛果、岡比亞和坦尚尼亞啟動新的住宅計劃。住宅計劃的加速預計將增加未來幾年對為施工機械供電的緊急備用發電機的需求。

- 總之,電力需求增加導致停電,加上住宅計劃的增加,可能在未來幾年使發電機領域受益。

亞太地區主導市場

- 中國快速的工業化和城市發展給電網帶來了壓力,導致頻繁停電。這些停電造成了極大的不便和經濟影響。因此,備用發電機的需求猛增。

- 多種因素正在影響中國備用發電機市場。作為世界製造業中心,中國工業部門是消費大國。備用發電機對於商業建築、工廠、通訊塔和資料中心維持穩定的電力供應至關重要。

- 政府政策在中國備用發電機市場中發揮著至關重要的作用。中國快速的都市化和工業擴張正在推高電力需求。作為回應,各國政府大力投資基礎設施,特別是電網。然而,這些電網常常難以確保對備用發電機的持續需求,特別是在農村地區和高峰時段。

- 與此同時,印度蓬勃發展的經濟和基礎設施的成長正在超過其發電能力。這種不平衡導致頻繁停電,特別是在農村和郊區。

- 印度備用發電機市場的成長受到多種因素的推動。主要因素是由於需求超過供應導致停電增加。 2024年6月,北部和東部超負載電網崩壞,導致6.2億人13小時斷電。

- 2023 年 5 月的一項調查突顯了印度面臨的電力挑戰:57% 的家庭每天停電時間少於兩小時,37% 的家庭面臨兩到四小時停電。隨著全國氣溫上升,更多停電的風險變得更加明顯。因此,個人和企業越來越依賴備用發電機來保護自己免受這些潛在的干擾。

- 總之,隨著兩國各產業電力需求的激增,預計未來幾年對應急發電機的需求將會增加。

應急發電機產業概況

緊急發電機市場分散。市場上營運的主要企業(排名不分先後)包括Caterpillar公司、阿特拉斯·科普柯公司、康明斯公司、科勒公司和美國本田汽車公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 醫療保健和建築業的需求增加

- 停電問題增加

- 抑制因素

- 加大分散式可再生能源發電發電投資

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按容量

- 小於75KVA

- 75~350KVA

- 350KVA以上

- 按最終用戶

- 住宅

- 商業的

- 產業

- 按燃料類型

- 氣體

- 柴油引擎

- 其他燃料

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 北歐國家

- 義大利

- 土耳其

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 越南

- 馬來西亞

- 印尼

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 卡達

- 奈及利亞

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Atlas Copco AB

- Briggs & Stratton Corporation

- Caterpillar Inc.

- Wartsila Oyj Abp

- Cummins Inc.

- Doosan Corporation

- Generac Holdings Inc.

- American Honda Motor Co., Inc.

- Kohler Company

- Mitsubishi Heavy Industries Ltd

- 其他主要企業名單

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 可攜式發電機的技術進步

簡介目錄

Product Code: 50003776

The Emergency Power Generators Market size is estimated at USD 28.22 billion in 2025, and is expected to reach USD 36.10 billion by 2030, at a CAGR of 5.05% during the forecast period (2025-2030).

Key Highlights

- In the medium term, increasing demand from the healthcare and construction sectors is likely to drive the market in the upcoming years.

- However, increasing investment in distributed renewable energy generation technology is expected to negatively impact the market study.

- Recent advancements in generator technology have focused on reducing noise, controlling emissions, and boosting power output and efficiency. Furthermore, there's an increasing focus on dual-fuel gensets that can operate on both natural gas and diesel. These technological strides in generators are anticipated to bolster market growth in the coming years.

- Asia-Pacific is set to lead the market during the forecast period, fueled by surging demand in nations like China and India.

Emergency Power Generators Market Trends

Below 75 kVA is Likely to Witness Significant Growth

- Emergency power generators with a capacity below 75 kVA are compact, versatile machines designed to provide reliable backup power for residential, small commercial, and light industrial applications. These generators are ideal for smaller-scale operations where the power demand is moderate, offering an efficient solution for keeping essential systems running during power outages.

- Aging power infrastructure, extreme weather events, and escalating electricity demand are causing more frequent outages in both developed and developing regions. Consequently, both residential users and small businesses are increasingly relying on generators under 75 kVA. This shift ensures they can maintain power during disruptions, safeguarding essential services like refrigeration, heating, lighting, and communication.

- As the global population grows, so does the demand for electricity. Between 2021 and 2023, global electricity consumption rose from 28,169 TWh to 29,470 TWh. Regions like Asia-Pacific, Africa, and Latin America, witnessing rapid urbanization and electrification, are seeing a heightened demand for backup power solutions. Many urban and rural areas in these regions grapple with unreliable grid access, amplifying the need for compact, cost-effective generators to ensure consistent power for homes and small businesses.

- In December 2023, Ulsan, a key industrial hub in the southeast, suffered a notable power outage. Around 155,000 households were left in the dark for about two hours due to a malfunctioning substation. This incident stands out as South Korea's most significant power outage since 2017, when a blackout impacted roughly 200,000 households in the greater Seoul area. Such events underscore the growing need for emergency power backup generators.

- Globally, there's been a significant uptick in residential projects. This trend is set to drive the demand for backup generators in the near future. For example, in July 2024, Turkish construction firm Karmod plans to launch new housing projects in Congo, Gambia, and Tanzania. The acceleration of these housing projects is anticipated to heighten the demand for emergency backup generators to power construction equipment in the coming years.

- In summary, the increasing power demand leading to outages, coupled with a rise in residential construction projects, is poised to benefit the generator segment in the coming years.

Asia Pacific to Dominate the Market

- China's rapid industrialization and urban growth have strained its power grid, leading to more frequent power outages. These outages have caused significant inconvenience and economic repercussions. In response, the demand for backup power generators has surged.

- Various factors shape China's backup power generator market. As the world's manufacturing hub, China's industrial sector stands out as a primary consumer. Backup generators are essential for commercial buildings, factories, telecommunication towers, and data centers to maintain a consistent power supply.

- Government policies play a pivotal role in China's backup power generator market. China's swift urbanization and industrial expansion have driven up electricity demands. In response, the government has heavily invested in infrastructure, especially power grids. Yet, these grids, particularly in rural regions and during peak times, often struggle, ensuring a continuous demand for backup generators.

- Meanwhile, India's booming economy and infrastructure growth are outpacing its power generation capacity. This imbalance has led to frequent power outages, especially in rural and suburban regions.

- India's backup power generator market is witnessing growth, fueled by several factors. A primary driver is the increase in power cuts, stemming from demand outstripping supply. A significant incident occurred in June 2024, when an overload caused both the northern and eastern grids to collapse, leaving 620 million people in darkness for 13 hours.

- A survey from May 2023 highlighted the power challenges in India: 57% of households experienced daily outages of up to two hours, and 37% faced interruptions lasting two to four hours. With rising temperatures across the nation, the risk of intensified power outages becomes more pronounced. As a result, both individuals and businesses are increasingly relying on backup power generators to shield against these potential disruptions.

- In summary, as power demand surges across various sectors in both countries, the demand for emergency power generators is poised to rise in the coming years.

Emergency Power Generators Industry Overview

The emergency power generators market is fragmented. Some of the major players operating in the market (in no particular order) include Caterpillar Inc, Atlas Copco AB, Cummins Inc, Kohler Company, and American Honda Motor Co., Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand from the Healthcare and Construction Sectors

- 4.5.1.2 Increasing Power Cuts Issues

- 4.5.2 Restraints

- 4.5.2.1 Increased Investment In Distributed Renewable Energy Generation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Below 75 KVA

- 5.1.2 75-350 KVA

- 5.1.3 Above 350 KVA

- 5.2 End-user

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Fuel Type

- 5.3.1 Gas

- 5.3.2 Diesel

- 5.3.3 Other Fuel Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Russia

- 5.4.2.6 NORDIC Countries

- 5.4.2.7 Italy

- 5.4.2.8 Turkey

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Thailand

- 5.4.3.6 Vietnam

- 5.4.3.7 Malaysia

- 5.4.3.8 Indonesia

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco AB

- 6.3.2 Briggs & Stratton Corporation

- 6.3.3 Caterpillar Inc.

- 6.3.4 Wartsila Oyj Abp

- 6.3.5 Cummins Inc.

- 6.3.6 Doosan Corporation

- 6.3.7 Generac Holdings Inc.

- 6.3.8 American Honda Motor Co., Inc.

- 6.3.9 Kohler Company

- 6.3.10 Mitsubishi Heavy Industries Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement in Portable Generators

02-2729-4219

+886-2-2729-4219