|

市場調查報告書

商品編碼

1636480

德國電動汽車電池製造:市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

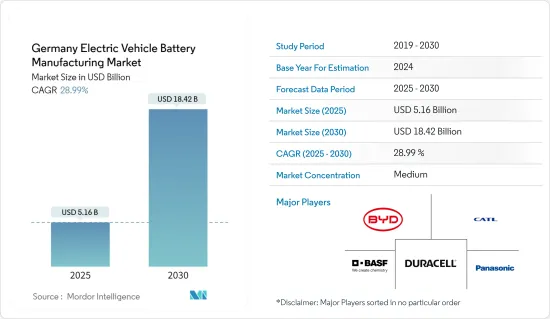

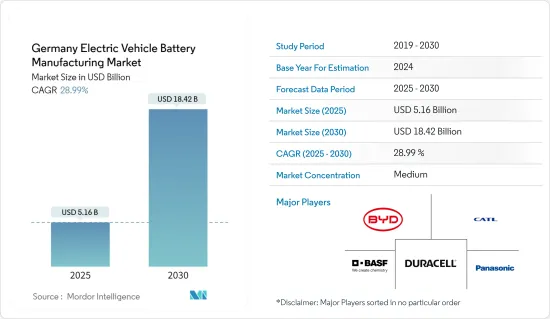

德國電動車電池製造市場規模預計到2025年為51.6億美元,預計到2030年將達到184.2億美元,預測期內(2025-2030年)複合年成長率為28.99%。

主要亮點

- 從中期來看,電動車需求的增加、增加電動車電池產能的投資以及電池原料(特別是鋰離子)成本的下降預計將在預測期內推動市場發展。

- 另一方面,電池原料成本下降預計將阻礙未來市場的發展。

- 德國電動車的長期雄心勃勃的目標預計將在預測期內創造重大機會。

德國電動車電池製造市場趨勢

鋰離子電池預計將佔較大佔有率

- 近年來,德國對電動車(EV)的需求顯著增加。這些電動車主要依賴電池能源儲存系統,這對於全電動、插電式混合動力汽車和混合動力汽車至關重要。

- 大多數插電式混合動力汽車和電動車都配備了鋰離子電池。由於鋰離子電池組價格的下降及其更高的能量密度、更長的循環壽命和整體效率等優點,插電式混合動力汽車對鋰電池材料的需求正在上升。

- 2023年,鋰離子電池組價格將比前一年下降14%,穩定在139美元/kWh。除了這些好處之外,正在進行的研究和開發旨在生產更有效、更有效率的電動車鋰電池材料。

- 此外,德國正在積極推動鋰電池的國內生產,以加強電動車的轉型。該策略旨在減少對進口鋰的依賴,並為快速成長的電動車市場建立永續的供應鏈。

- 例如,2023年6月,ivista Energy宣布計畫在德國精製鋰用於電動車電池。 ivista Energy 計劃於 2026 年開始生產,將與法國領先的石油和天然氣服務公司 Technip Energies 合作,主導工廠的設計。

- 此外,2024 年 5 月,Rock Tech Lithium Inc. 獲得在德國古本建造精製的批准。該工廠將生產約24,000噸氫氧化鋰,這對電動車電池和能源儲存系統至關重要。

- 鑑於這種氣候和鋰離子電池成本的下降,該細分市場有望獲得顯著的市場佔有率。

電動車電池產能投資可望帶動市場

- 近年來,德國大幅增加投資,加強電動車電池的國內生產,旨在解決供應鏈缺口。這些努力不僅增強了當地經濟,而且在幫助德國和歐盟整體實現淨零目標方面發揮了關鍵作用。

- 例如,2024年1月,歐盟決定德國向瑞典著名鋰離子電池製造商Northvolt提供9.02億歐元(9.8643億美元)的國家援助。這筆資金將支持在德國海德建立電動車 (EV) 電池生產設施。

- 德國政府提供各種激勵措施和補貼來吸引該領域的投資。此外,隨著該國電動車銷量的上升,政府可能會採取進一步措施以進一步促進國內電池製造。根據國際能源總署的資料,2023年德國純電動車(BEV)銷量將達到52萬輛,高於2022年的47萬輛。

- 此外,本土製造商與全球高科技公司之間的合作正在加速電池技術的進步,並鞏固德國在國際舞台上的地位。例如,優美科與大眾汽車計劃於2025年成立合資企業,在大眾汽車位於德國的薩爾茨吉特工廠生產電動車正極材料,目標年產能為20GWh。

- 鑑於這些新興市場的發展和資金支持,投資預計將增加電動車電池的產能,市場預計將向前發展。

德國電動車電池製造業概況

德國電動車電池製造市場規模中等。市場主要企業(排名不分先後)包括比亞迪有限公司、BASF股份公司、當代新能源科技有限公司、金霸王公司和松下控股公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 投資增加電池產能

- 電池原物料成本下降

- 抑制因素

- 原料蘊藏量不足

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池

- 鋰離子

- 鉛酸電池

- 鎳氫電池

- 其他

- 電池形式

- 方形

- 袋型

- 圓柱形

- 車輛

- 客車

- 商用車

- 其他

- 晉升

- 電池電動車

- 油電混合車

- 插電式混合動力電動車

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc

- EnerSys

- GS Yuasa Corporation

- SK On Co, Ltd

- Hyundai Motor Group

- LG Chem Ltd

- BASF SE

- Panasonic Corporation

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車的長期目標

簡介目錄

Product Code: 50003748

The Germany Electric Vehicle Battery Manufacturing Market size is estimated at USD 5.16 billion in 2025, and is expected to reach USD 18.42 billion by 2030, at a CAGR of 28.99% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising demand for electric vehicles, investments to enhance electric vehicle battery production capacity, and a decline in the cost of battery raw materials, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, the decline in the cost of battery raw materials is expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in Germany are expected to create a significant opportunity in the forecast period.

Germany Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- In recent years, Germany has witnessed a significant surge in the demand for electric vehicles (EVs). These EVs rely on energy storage systems, predominantly batteries, which are crucial for all-electric, plug-in hybrid, and hybrid vehicles.

- Most plug-in hybrids and all-electric vehicles are powered by lithium-ion batteries. The demand for lithium battery materials in plug-in hybrids is on the rise, driven by the declining prices of lithium-ion battery packs and their advantages, including high energy density, extended cycle life, and overall efficiency.

- In 2023, the price of lithium-ion battery packs dropped by 14% from the previous year, settling at USD139/kWh. Beyond these benefits, ongoing research and development efforts aim to produce even more effective and efficient lithium battery materials for electric vehicles.

- Moreover, Germany is actively championing its domestic lithium battery manufacturing, reinforcing its transition to electric vehicles. This strategy seeks to diminish dependence on imported lithium and establish a sustainable supply chain for the burgeoning EV market.

- For example, in June 2023, Livista Energy unveiled plans for a lithium refinery in Germany, targeting electric vehicle batteries. Set to begin production in 2026, Livista Energy has partnered with Technip Energies, a leading French oil and gas services firm, to lead the plant's design.

- Additionally, in May 2024, Rock Tech Lithium Inc. secured approval for a lithium refinery in Guben, Germany. This facility is projected to produce approximately 24,000 tonnes of lithium-hydroxide, essential for electric car batteries and energy storage systems.

- Given this landscape and the declining costs of lithium-ion batteries, the segment is poised to capture a substantial market share.

Investments to Enhance the EV Battery Production Capacity is Expected to Drive the Market

- In recent years, Germany has significantly increased its investments to enhance domestic production of electric vehicle batteries, aiming to address supply chain gaps. These efforts are set to not only strengthen the local economy but also play a crucial role in assisting Germany and the wider EU in achieving their net-zero targets.

- For instance, in January 2024, the European Union greenlit a substantial EUR 902 million (USD 986.43 million) state aid package from Germany to Northvolt, a prominent Swedish lithium-ion battery manufacturer. This financial backing is designated for establishing an electric vehicle (EV) battery production facility in Heide, Germany.

- The German government has rolled out a range of incentives and subsidies to lure investments into this sector. Moreover, with electric vehicle sales on the rise in the country, the government is likely to introduce more policies to further boost domestic battery manufacturing. Data from the International Energy Agency indicates that in 2023, battery electric vehicle (BEV) sales in Germany reached 0.52 million units, a rise from 0.47 million units in 2022.

- Furthermore, partnerships between local manufacturers and global tech firms have sped up advancements in battery technology, solidifying Germany's stature in the international arena. For example, in 2025, Umicore and Volkswagen AG are set to launch a joint venture to produce cathode materials for electric vehicles, targeting an annual capacity of 20 GWh at Volkswagen AG's Salzgitter plant in Germany.

- Given these developments and financial backing, anticipated investments to boost EV battery production capacity are likely to propel the market forward.

Germany Electric Vehicle Battery Manufacturing Industry Overview

The Germany electric vehicle battery manufacturing market is moderate. Some of the major players in the market (in no particular order) include BYD Company Ltd, BASF SE, Contemporary Amperex Technology Co. Limited, Duracell Inc., and Panasonic Holdings Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 SK On Co, Ltd

- 6.3.7 Hyundai Motor Group

- 6.3.8 LG Chem Ltd

- 6.3.9 BASF SE

- 6.3.10 Panasonic Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219