|

市場調查報告書

商品編碼

1636461

英國電動車電池分離器:市場佔有率分析、產業趨勢、成長預測(2025-2030)United Kingdom Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

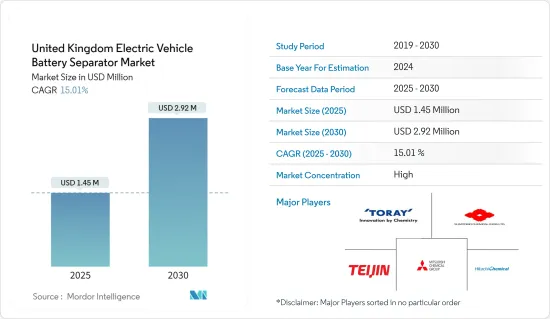

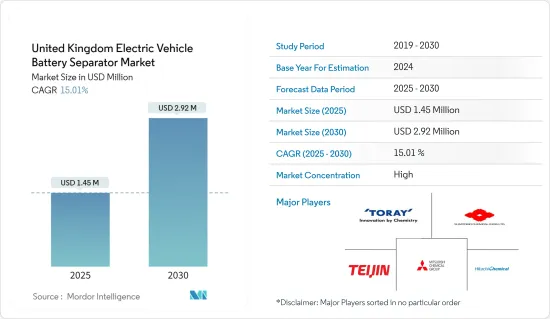

英國電動車電池隔膜市場規模預計到2025年為145萬美元,預計2030年將達到292萬美元,預測期內(2025-2030年)複合年成長率為15.01%。

主要亮點

- 從中期來看,電動車的普及和鋰離子電池價格的下降預計將在預測期內推動市場發展。

- 另一方面,一些國家的壟斷造成的電池材料供應鏈差異(例如原料短缺和分銷瓶頸)預計將抑制未來市場的成長。

- 然而,其他電池化學材料(例如固態電池、先進鋰離子化學材料和鈉離子電池)的持續研究和開發預計將在未來提供市場機會。

英國電動車電池隔膜市場趨勢

電動車的普及正在推動市場

- 在英國,電動車(EV)的需求快速成長,推動了電動車電池隔膜市場的成長。隨著國家轉向清潔能源,電動車成為人們關注的焦點,企業對其越來越感興趣。消費者興趣的增加是由環保意識的增強、電動車擁有的經濟效益以及電動車技術的突破性進步所推動的。

- 最近,該地區的電動車(EV)銷量大幅成長。國際能源總署(IEA)宣布,2023年電動車銷量將達45萬輛,較2022年成長21.62%。消費者日益成長的偏好不僅將加速電動車的普及,還將增加該地區對電池和電池隔膜的需求。

- 為了進一步鼓勵電動車的使用,政府推出了一系列獎勵和補貼。這包括稅收減免、電動車購買津貼以及增加充電基礎設施投資。這些舉措與歐盟 (EU) 為減少碳排放和實現氣候變遷目標而做出的更廣泛努力產生了共鳴。

- 例如,英國宣布將於 2023 年強制推行零排放汽車 (ZEV)。該指令規定,到2030年,80%的新車和70%的新車將是零排放車輛,目標是2035年實現100%的完全過渡。此外,政府也向購買電動貨車和卡車的企業和個人提供支持,涵蓋購買價格的35%。這相當於一輛小型貨車最多 2,500 英鎊(3,188 美元),一輛大型貨車最多 5,000 英鎊(6,377 美元)。這些激勵措施延伸到電動車購買的稅收優惠和補貼,將在未來一段時間內顯著增加對電動車電池的需求,進而帶動電池隔膜的需求。

- 此外,英國汽車產業旨在擴大電動車產量的投資激增。隨著英國公司進入電動車製造領域,對優質電池組件(尤其是隔膜)的需求大幅增加,凸顯了該行業對創新和永續性的承諾。

- 例如,2023年5月,捷豹路虎母公司塔塔汽車宣布建設計畫電動車電池工廠。位於英格蘭西南部的薩默塞特被選為電池工廠的廠址。這些努力對於加強電動車電池隔膜市場以及擴大該地區的電動車陣容至關重要。

- 由於這些發展,電動車電池隔膜的需求預計在預測期內將大幅增加。

鋰離子電池類型主導市場

- 鋰離子電池在電動車電池隔膜市場的成長中發揮關鍵作用,並正在塑造電動車(EV)產業的發展軌跡。高能量密度、長循環壽命和極低的自放電率使鋰離子電池成為電動車的首選。鋰離子電池在電動車領域的普及增加了對這些電池量身定做的特殊隔膜的需求。

- 主要市場參與者正在活性化研發投資和生產活動,加劇競爭並壓低價格。根據彭博社 NEF 報導,電動汽車和電池能源儲存系統(BESS) 的平均電池組價格整體上漲,但 2023 年下降 13%,收於 139 美元/kWh。這一趨勢可能會持續下去,預計 2025 年價格將降至 113 美元/千瓦時,並在 2030 年進一步降至 80 美元/千瓦時。

- 此外,隨著永續性變得更加重要,國家回收鋰離子電池的努力正在重塑隔膜市場。由永續材料製成且更容易回收的分離器越來越受歡迎。這一趨勢符合歐洲減少廢棄物和加強循環經濟的更廣泛目標,並正在推動分離器技術的創新。

- 例如,2024年2月,英國大眾集團與著名電池回收公司Ecoba建立夥伴關係,從電動車(EV)電池中回收鋰離子材料。這項合作不僅推進了大眾汽車集團英國公司邁向循環能源模式的道路,也突顯了這家汽車巨頭對加強英國永續性的承諾。

- 此外,英國蓬勃發展的超級工廠支撐了其主導歐洲電池產業的雄心壯志。這些主要用於生產鋰離子電池的大型設施正在增加對專用隔膜的需求。

- 2023 年 11 月,英國政府宣布投資 5,000 萬英鎊(6,300 萬美元)來加強電池供應鏈,重點關注鋰離子電池,以加強該國未來的電動車生產目標。電池策略承諾在 2030 年之前為零排放汽車、電池及其供應鏈提供有針對性的支持,包括新資本和研發資金。這些策略性投資預計將提高英國的鋰離子電池產量,並推動未來幾年對電池隔離膜的需求。

- 因此,這些努力將在預測期內提高鋰離子電池產量並顯著提高電動車電池隔膜產能。

英國電動汽車電池隔膜產業概況

英國電動車電池隔膜市場正在變得半固體。主要參與者(排名不分先後)是三菱化學集團、工業、東麗、住友化學和帝人。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車的擴張

- 降低電池原物料成本

- 抑制因素

- 供應鏈缺口

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 透過電池

- 鋰離子

- 鉛酸電池

- 其他

- 依材料類型

- 聚丙烯

- 聚乙烯

- 其他材料類型

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Mitsubishi Chemical Group Corporation

- Hitachi Chemical Company Ltd

- Toray Industries Inc.

- Sumitomo Chemical Co. Ltd

- Teijin Ltd

- Entek International

- EniChem

- SK Innovation Co. Ltd

- 其他知名企業名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 增加其他電池化學物質的研究和開發

簡介目錄

Product Code: 50003728

The United Kingdom Electric Vehicle Battery Separator Market size is estimated at USD 1.45 million in 2025, and is expected to reach USD 2.92 million by 2030, at a CAGR of 15.01% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopolies of some countries, such as ingredient shortages or distribution bottlenecks, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

United Kingdom Electric Vehicle Battery Separator Market Trends

Growing Adoption of Electric Vehicles Drives the Market

- In the United Kingdom, the surging demand for electric vehicles (EVs) is propelling the growth of the EV battery separator market. As the nation pivots towards clean energy, the spotlight is firmly on electric vehicles, a segment garnering heightened attention from companies. This burgeoning interest among consumers is fueled by heightened environmental consciousness, the economic benefits of owning an EV, and strides in EV technology.

- Recently, the region has seen a notable uptick in electric vehicle (EV) sales. The International Energy Agency (IEA) highlighted that in 2023, EV sales reached 450,000 units, marking a 21.62% rise from 2022. This escalating consumer inclination not only accelerates EV adoption but also amplifies the demand for batteries and battery separators in the region.

- To further bolster EV adoption, the government has introduced a suite of incentives and subsidies. These encompass tax breaks, grants for electric car purchases, and bolstered investments in charging infrastructure. Such initiatives resonate with broader European Union endeavors to mitigate carbon emissions and achieve climate goals.

- As a case in point, in 2023, the UK rolled out a Zero-Emission Vehicle (ZEV) mandate. This directive stipulates that by 2030, 80% of new cars and 70% of new vans should be zero-emission, aiming for a complete 100% transition by 2035. Additionally, the government extends support to businesses and individuals acquiring electric vans and trucks, covering 35% of the purchase price. This translates to a maximum of GBP 2,500 (USD 3,188) for small vans and GBP 5,000 (USD 6,377) for larger ones. Such incentives, spanning tax rebates and subsidies for EV purchases, are poised to significantly elevate the demand for EV batteries and, consequently, battery separators in the foreseeable future.

- Furthermore, the UK's automotive landscape is witnessing a surge in investments, all aimed at amplifying EV production. As UK firms delve into EV manufacturing, there's a pronounced uptick in the demand for premium battery components, especially separators, underscoring the industry's commitment to innovation and sustainability.

- For instance, in May 2023, Tata Motors, the parent company of Jaguar Land Rover, announced plans for a multi-billion dollar electric car battery plant, set to commence in the following year. The chosen site for this battery facility is Somerset, nestled in southwest England. Such endeavors, alongside the expansion of electric vehicle lineups in the region, are pivotal in bolstering the EV battery separator market.

- Given these developments, it's anticipated that the demand for EV battery separators will see a significant uptick during the forecast period.

Lithium-Ion Battery Type to Dominate the Market

- Li-ion batteries play a pivotal role in the growth of the EV battery separator market, shaping the trajectory of the electric vehicle (EV) industry. Celebrated for their high energy density, extended cycle life, and minimal self-discharge rate, Li-ion batteries have become the top choice for electric vehicles. This prevalent adoption of Li-ion batteries in the EV sector amplifies the demand for specialized separators tailored for these batteries.

- Key market players are ramping up their R&D investments and production activities, intensifying competition and driving prices down. Bloomberg NEF reports that while average battery pack prices for EVs and battery energy storage systems (BESS) saw a general rise, 2023 stood out with a notable 13% drop, settling at USD 139/kWh. The trend appears set to continue, with forecasts predicting a dip to USD 113/kWh by 2025 and a further slide to USD 80/kWh by 2030, all thanks to relentless technological and manufacturing advancements.

- Additionally, as sustainability takes center stage, the nation's commitment to recycling lithium-ion batteries is reshaping the separator market. Separators made from sustainable materials and designed for easier recycling are becoming increasingly popular. This trend aligns with Europe's broader goals of waste reduction and strengthening the circular economy, propelling innovations in separator technology.

- For example, in February 2024, Volkswagen Group United Kingdom Ltd. forged a partnership with Ecoba, a prominent battery recycling firm, to reclaim lithium-ion materials from electric vehicle (EV) batteries. This collaboration not only advances VWG UK's journey towards a circular energy model but also underscores the automotive titan's commitment to bolstering sustainability in the UK.

- Furthermore, the nation's burgeoning gigafactories underscore its ambition to dominate Europe's battery landscape. These expansive facilities, predominantly centered on Li-ion battery production, are amplifying the demand for specialized separators.

- In November 2023, the United Kingdon (UK) government unveiled a GBP 50 million (USD 63 million) investment aimed at fortifying the battery supply chain, with a focus on lithium-ion batteries, to bolster the country's future EV production goals. The Battery Strategy promises targeted backing for zero-emission vehicles, batteries, and their supply chains, including fresh capital and R&D funding extending to 2030. Such strategic investments are poised to boost lithium-ion battery production in the UK and elevate the demand for battery separators in the years ahead.

- Consequently, these initiatives are set to bolster lithium-ion battery output and substantially amplify the capacity for EV battery separators during the forecast period.

United Kingdom Electric Vehicle Battery Separator Industry Overview

The United Kingdom's electric vehicle battery separator market is semi-consolidated. Some key players (not in particular order) are Mitsubishi Chemical Group Corporation, Hitachi Chemical Company Ltd, Toray Industries Inc., Sumitomo Chemical Co. Ltd, Teijin Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group Corporation

- 6.3.2 Hitachi Chemical Company Ltd

- 6.3.3 Toray Industries Inc.

- 6.3.4 Sumitomo Chemical Co. Ltd

- 6.3.5 Teijin Ltd

- 6.3.6 Entek International

- 6.3.7 EniChem

- 6.3.8 SK Innovation Co. Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research and Development of Other Battery Chemistries

02-2729-4219

+886-2-2729-4219