|

市場調查報告書

商品編碼

1636459

印度電動汽車電池製造設備:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)India Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

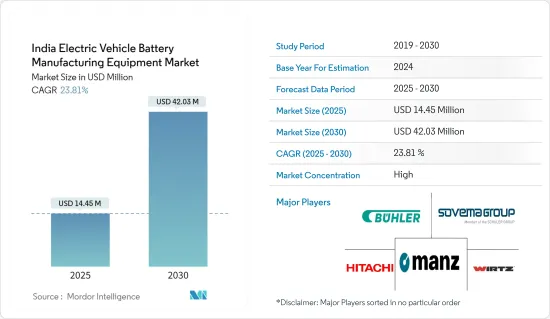

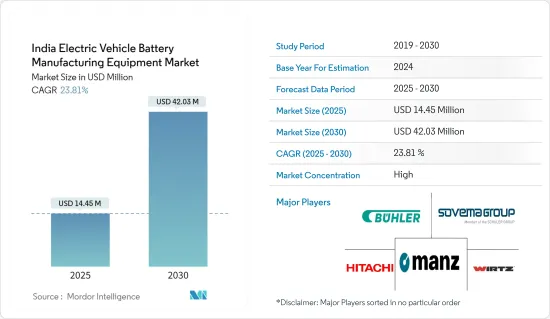

印度電動車電池製造設備市場規模預計到2025年為1,445萬美元,預計2030年將達到4,203萬美元,預測期內(2025-2030年)複合年成長率為23.81%。

主要亮點

- 從中期來看,政府對電池製造的政策和投資的增加以及電池原料成本的降低預計將在預測期內推動對電動車電池製造設備的需求。

- 另一方面,新興經濟體缺乏技術訣竅可能會嚴重限制電動車電池製造設備市場的成長。

- 然而,電動車的長期目標,如擴大產能、增強技術進步和降低成本,預計將在不久的將來為電動車電池製造設備市場的參與者創造重大機會。

印度電動車電池製造設備市場趨勢

電池原物料成本下降正在推動市場

- 由於原物料成本下降,印度電動車(EV)電池製造業正在經歷轉型。鋰、鈷、鎳、石墨等主要原物料價格下跌。價格下降不僅降低了整體生產成本,還使電動車電池變得更便宜,並推動了電動車市場的成長。

- 鋰離子 (Li-ion) 電池處於電動車 (EV) 市場革命的前沿,並刺激了電池製造的創新。近年來,全球鋰離子電池價格大幅下跌,且這一趨勢預計將持續下去。價格下降對於讓更多消費者負擔得起電動車發揮關鍵作用。

- 例如,彭博新能源財經強調 2023 年鋰離子電池價格將大幅下降。價格跌至 139 美元/kWh,下降 13%。這種下降趨勢預計將持續下去,到 2025 年降至 113 美元/千瓦時,到 2030 年降至 80 美元/千瓦時。

- 此外,印度正在共同努力確保鋰、鈷和鎳等關鍵材料的穩定和道德的供應。然而,這種追求充滿挑戰。為了應對原料挑戰,印度正在探索國內蘊藏量並建立國際合作。該國的重點是利用其礦產資源來滿足對電動車電池材料不斷成長的需求。

- 例如,2023年2月,印度地質調查局(GSI)在查謨和克什米爾Reshi地區的Salal-Haimana地區發現鋰蘊藏量估計為590萬噸。鋰是非鐵金屬,對於電池能源儲存系統和電動車 (EV) 電池至關重要。這項發現滿足了電動車對鋰不斷成長的需求,並增加了對電動車電池製造設備的需求。

- 此外,替代材料和電池化學物質的探索正在減少對昂貴原料的依賴。這種轉變不僅會降低成本,還會提高電池生產的永續性和效率。公司也投資研發,以發現可進一步提高電池性能和壽命的新材料。

- 例如,2023年11月,電動車電池領域知名企業SK On Co., Ltd.與電池材料領先製造商BASFSE公司合作。兩家公司的共同使命是開發用於鋰離子電池的先進材料,目標市場是北美和亞太地區,特別是印度。此次合作不僅增強了兩家公司的市場地位,而且正值綠色汽車產業放緩之際。這些進步可能會在短期內壓低電池價格並增加對電動車電池製造設備的需求。

- 此類計劃和創新可能會降低全部區域的原料成本,並在預測期內增加對電動車電池製造設備的需求。

鋰離子電池佔市場主導地位

- 在印度,鋰離子電池的興起正在顯著改變電動車(EV)電池製造設備產業。隨著電動車對鋰離子電池的需求增加,對專業製造設備的需求也增加。這包括製造電極、組裝電池、執行成型和老化過程以及組裝電池組的機器。印度電動車銷售的大幅成長和電池需求的並行激增凸顯了對先進製造設備的迫切需求,以確保高效和可擴展的生產。

- 例如,根據國際能源總署(IEA)的報告,2023年印度電動車銷量將達到8.2萬輛,比2022年成長驚人的70.8%,比2019年成長119倍。據預測,電動車銷量將繼續大幅成長,進一步增加該地區電池製造設備的需求。

- 此外,在當地投資和與全球技術提供者夥伴關係的推動下,我們共同努力建立最先進的製造設施。此舉將推動創新、提高產能並滿足對先進能源儲存解決方案不斷成長的需求。

- 例如,2024年7月,Ola Electric宣布計畫投資1億美元在泰米爾納德邦興建超級工廠,生產本土鋰離子電池。該公司計劃在明年初之前從韓國和中國進口電池轉向自己生產電池。此舉預計將提高國內電池產量,進而增加對製造設備的需求。

- 為了促進國內電動車電池產量,印度政府推出了一系列政策和獎勵。這包括對製造設備的補貼、稅收優惠以及對電池技術研發的支援。

- 例如,政府制定了雄心勃勃的2023年電動車銷售目標,並計劃在2030年實現30%的私家車、70%的商用車、80%的二輪車和三輪車的電動化。此外,還推出了每千瓦時 10,000 印度盧比(120 美元)至 15,000 印度盧比(180 美元)的補貼獎勵措施。這些努力不僅將促進電動車的生產和銷售,還將在未來幾年顯著增加對電池製造設備的需求。

- 總之,在政府的支持和產業動力的推動下,印度對電動車電池製造設備的需求預計在可預見的未來將大幅增加。

印度電動汽車電池製造設備產業概況

印度的電動車電池製造設備整合度中等。主要參與者(排名不分先後)包括 Manz AG、Wirtz Manufacturing、Buhler AG、Sovema Group SpA 和 Hitachi。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電池製造的政府政策和投資

- 電池原物料成本下降

- 抑制因素

- 新興經濟體缺乏技術訣竅

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 按流程

- 混合物

- 塗層

- 日曆

- 狹縫/電極加工

- 其他工藝

- 透過電池

- 鋰離子

- 鉛酸電池

- 鎳氫電池

- 其他電池

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Manz AG

- Hitachi Ltd.

- Wirtz Manufacturing India Pvt. Ltd.

- Buhler AG

- Sovema Group SpA

- Tata Chemicals

- Luminous Power Technologies

- kaya Power Group

- ACME Cleantech Solutions

- Inobat

- 其他知名企業名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車的長期目標

簡介目錄

Product Code: 50003726

The India Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 14.45 million in 2025, and is expected to reach USD 42.03 million by 2030, at a CAGR of 23.81% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising government policies and investments towards battery manufacturing and a decline in the cost of battery raw materials are expected to drive the demand for electric vehicle battery manufacturing equipment during the forecast period.

- On the other hand, the shortage of technological know-how in developing economies can significantly restrain the growth of the electric vehicle battery manufacturing equipment market.

- Nevertheless, the long-term ambitious targets for electric vehicles like scaling up production capacity, enhancing technological advancements, and reducing costs are expected to create significant opportunities for electric vehicle battery manufacturing equipment market players in the near future.

India Electric Vehicle Battery Manufacturing Equipment Market Trends

Decline in the Cost of Battery Raw Materials Drives the Market

- India's electric vehicle (EV) battery manufacturing industry is undergoing a transformation, driven by falling raw material costs. Key materials such as lithium, cobalt, nickel, and graphite have seen price reductions. This decline is not only lowering overall production costs but also making EV batteries more affordable, thus fueling the growth of the EV market.

- Lithium-ion (Li-ion) batteries have been at the forefront of the electric vehicle (EV) market revolution, spurring innovations in battery production. In recent years, global prices for lithium-ion batteries have dropped significantly, a trend that's set to continue. This price dip has played a crucial role in enhancing the affordability and accessibility of electric vehicles for a wider consumer base.

- For instance, Bloomberg NEF highlighted that, lithium-ion battery prices in 2023 marked a notable decline. Prices fell to USD 139/kWh, reflecting a 13% drop. Looking ahead, projections indicate this downward trend will continue, with prices expected to hit USD 113/kWh by 2025 and dive to USD 80/kWh by 2030, driven by relentless technological and manufacturing advancements.

- Moreover, India is making concerted efforts to ensure a stable and ethical supply of vital materials like lithium, cobalt, and nickel. However, this pursuit is fraught with challenges. To address the raw material conundrum, India is exploring its domestic reserves and establishing international collaborations. The country's focus is on harnessing its mineral wealth to meet the burgeoning demand for EV battery materials.

- For instance, in February 2023, the Geological Survey of India (GSI) discovered lithium reserves estimated at 5.9 million tonnes in the Salal-Haimana region of Jammu and Kashmir's Reasi district. Lithium, a non-ferrous metal, is crucial for battery energy storage systems and electric vehicle (EV) batteries. This find is set to cater to the rising lithium demand for EVs, subsequently amplifying the need for equipment in electric vehicle battery manufacturing.

- Additionally, the exploration of alternative materials and battery chemistries is diminishing the dependence on costly raw materials. This shift not only curtails expenses but also enhances the sustainability and efficiency of battery production. Companies are also investing in research and development to discover new materials that can further boost battery performance and longevity.

- For instance, in November 2023, SK On Co., a prominent player in the electric vehicle battery arena, teamed up with BASF SE, a leading battery materials producer. Their joint mission is to pioneer advanced materials for lithium-ion batteries, targeting markets in North America and the Asia-Pacific, with a keen focus on India. This partnership not only strengthens their market position but also comes at a time when the green automobile sector is witnessing a slowdown. Such advancements are poised to drive down battery prices and elevate the demand for EV battery manufacturing equipment in the foreseeable future.

- Such type of projects and inovations are likely to decline the cost of raw materials across the region and rising demand of EV battery manufacturing equipment during the forecast period.

Lithium-Ion Battery Type Dominate the Market

- In India, the rise of lithium-ion batteries has significantly shaped the electric vehicle (EV) battery manufacturing equipment industry. As the demand for lithium-ion batteries in EVs grows, so does the need for specialized manufacturing equipment. This includes machinery for producing electrodes, assembling cells, conducting formation and aging processes, and putting together battery packs. With a notable increase in EV sales in India, the parallel surge in battery demand highlights the urgent need for advanced manufacturing equipment to ensure efficient and scalable production.

- For instance, in 2023, the International Energy Agency (IEA) reported electric vehicle sales in India reached 82,000 units, marking a 70.8% increase from 2022 and an astonishing 119-fold jump from 2019. Projections indicate a continued surge in EV sales, further driving the demand for battery manufacturing equipment in the region.

- Moreover, there's a concerted effort to establish cutting-edge manufacturing facilities, backed by both local investments and partnerships with global technology providers. The focus is on producing high-quality lithium-ion batteries, a move set to drive innovation, enhance production capacity, and meet the growing appetite for advanced energy storage solutions.

- For instance, in July 2024, Ola Electric unveiled plans to invest USD 100 million in its Tamil Nadu gigafactory, aiming to produce indigenous lithium-ion batteries. The company intends to transition to its battery cells by early next year, moving away from current imports from Korea and China. Such strides are anticipated to boost the country's battery production and, in turn, elevate the demand for manufacturing equipment.

- In a bid to strengthen domestic EV battery production, the Indian government has introduced a suite of policies and incentives. These include subsidies for manufacturing equipment, tax incentives, and support for battery technology research and development.

- For instance, in 2023, the government set ambitious EV sales targets: by 2030, they aim for 30% of private cars, 70% of commercial vehicles, and a remarkable 80% of two and three-wheelers to be electric. Additionally, subsidy incentives have been introduced, ranging from INR 10,000 per kWh (USD 120) to INR 15,000 per kWh (USD 180). These initiatives are poised to not only boost EV production and sales but also significantly heighten the demand for battery manufacturing equipment in the coming years.

- In conclusion, with the government's backing and the industry's momentum, the demand for EV battery manufacturing equipment in India is set to witness a substantial rise in the foreseeable future.

India Electric Vehicle Battery Manufacturing Equipment Industry Overview

India's electric vehicle battery manufacturing equipment is moderately consolidated. Some key players (not in particular order) are Manz AG, Wirtz Manufacturing, Buhler AG, Sovema Group S.p.A, Hitachi Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Dearth of technological know-how in developing economies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Manz AG

- 6.3.2 Hitachi Ltd.

- 6.3.3 Wirtz Manufacturing India Pvt. Ltd.

- 6.3.4 Buhler AG

- 6.3.5 Sovema Group S.p.A

- 6.3.6 Tata Chemicals

- 6.3.7 Luminous Power Technologies

- 6.3.8 kaya Power Group

- 6.3.9 ACME Cleantech Solutions

- 6.3.10 Inobat

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219