|

市場調查報告書

商品編碼

1636451

法國電動車電池製造:市場佔有率分析、產業趨勢、成長預測(2025-2030)France Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

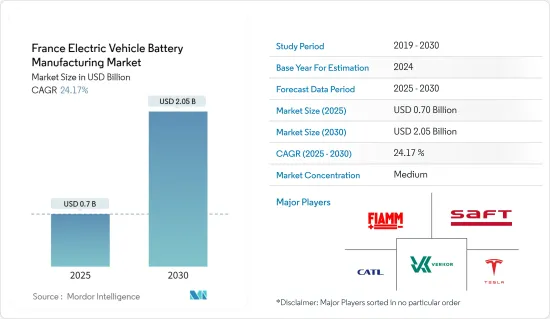

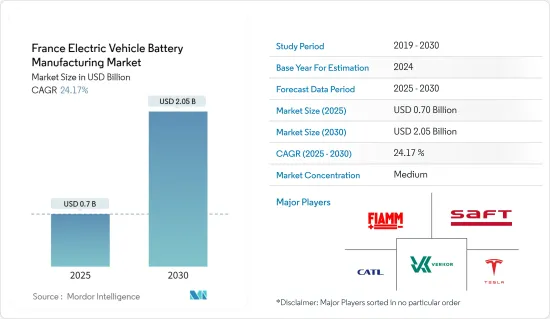

法國電動車電池製造市場規模預計2025年將達到7億美元,預計2030年將達20.5億美元,預測期內(2025-2030年)複合年成長率為24.17%。

主要亮點

- 從中期來看,市場預計將受到電動車激增以及與電動車電池製造設備相關投資的推動。

- 相反,原料蘊藏量短缺可能會阻礙預測期內的市場成長。

- 然而,電動車的擴張和政府遏制交通部門碳排放的雄心勃勃的目標可能會在預測期內為市場參與者創造市場機會。

法國電動車電池製造市場趨勢

鋰離子電池製造佔較大佔有率

- 鋰離子電池由正極、負極和分隔兩個電極的橫膈膜組成。電解潤濕的隔膜充當催化劑,在充電期間促進離子從正極移動到負極,並在放電期間反轉該過程。其合理的價格、高比能量以及承受多次充放電循環的能力使其成為電動車的理想材料。

- 隨著歐洲汽車產業脫碳,對超級工廠(大型二次電池製造設施)的投資變得極為重要。 2023年9月,麥格理資產管理公司成為法國電池製造商Vercor的主要投資者,投資近21.7億美元擴大鋰離子電池產量。

- 2024年2月,法國ACC獲得高達44億美元的資金,用於建立三個專門生產鋰離子電池的超級工廠。這些設施將建在法國,並將輔以研發投資。此債務計畫僅由知名商業銀行財團(法國巴黎銀行、德意志銀行、荷蘭國際集團和聯合聖保羅銀行)提供支持,並得到法國國家銀行、裕利安宜和 SACE 的支持。

- 同樣,總部位於法國盧瓦爾河地區、專門從事鋰電池再生的公司VoltR最近宣布了資金籌措。該公司在第一輪資金籌措中籌集了 430 萬美元,並得到了 C4 Ventures 和 Exergon 的大力支持。利用這筆資金籌措,VoltR 計劃在未來兩年內建立第一個鋰電池再製造工廠。這些投資預計在預測期內加強法國電動車電池製造市場。

- 目前,大多數電動車都配備了鋰離子電池。根據國際能源總署(IEA)的數據,近年來法國電動車銷量一直在成長。 2023年,電動車(包括插電式混合動力汽車和純電動車)銷量達47萬輛,與前一年同期比較增加38%。電動車銷量的成長趨勢預計將在預測期內加強法國電動車電池製造市場。

- 鑑於這些趨勢,法國電動車電池製造市場預計將在預測期內快速成長。

政府重視引進電動交通

- 在法國,由於環保意識的增強以及減少二氧化碳排放(特別是交通部門的二氧化碳排放)的努力,電池製造設備市場正在不斷成長。因此,政府舉措預計將在預測期內使電動車電池製造市場受益。

- 2024年5月,法國政府與汽車業簽署協議,制定了2027年電動車年銷量增加80萬輛的雄心勃勃的目標。該目標是 2024-2027 年行業協議的核心,強調在四年內將電動乘用車 (PC) 的銷量增加近兩倍,並顯著加強電池電動輕型車 (LDV)。這些發展可能會在未來幾年推動法國電動車製造市場的成長。

- 法國工業公司正在提高國內電動車產量。例如,雷諾集團透過其新合資企業雷諾電力整合了其在杜埃、莫伯日和萊茨的電動車生產。雷諾的雄心勃勃的目標是到 2025 年在法國每年生產 40 萬輛電動車,使法國成為歐洲領先的具有競爭力和高效的電動車生產中心。實現這些目標可以進一步刺激未來的電動車製造市場。

- 新的政府補貼將促進法國電動車的銷售。 2023 年 9 月,政府宣布了這些補貼計劃,作為加強「綠色產業」和加速「再工業化」的法律草案的一部分。其目的不僅是為了提高國內產量,也是為了減少對進口電動車的依賴,特別是來自中國的電動車。

- 此外,法國的這些措施有望促進整個歐洲的電動車銷售。根據國際能源總署(IEA)預測,2023年歐洲電動車銷量將達330萬輛,與前一年同期比較成長22%。預計這種成長趨勢將持續下去。

- 因此,法國電動車製造市場預計在預測期內將大幅成長。

法國電動車電池製造業概況

電動汽車電池製造設備市場發展緩慢。主要企業(排名不分先後)包括 Verkor、Contemporary Amperex Technology Co. Limited、Saft Groupe SA、Tesla Inc. 和 FIAMM SpA。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 投資增加電池產能

- 電池原物料成本下降

- 抑制因素

- 原料蘊藏量不足

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 透過電池

- 鋰離子

- 鉛酸電池

- 鎳氫電池

- 其他

- 依電池形狀分類

- 方形

- 袋型

- 圓柱形

- 搭車

- 客車

- 商用車

- 其他

- 透過促銷

- 電池電動車

- 油電混合車

- 插電式混合動力電動車

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc

- EnerSys

- Tesla Inc.

- FIAMM SpA

- Verkor

- LG Chem Ltd

- Saft Groupe SA

- Panasonic Corporation

- List of Other Prominent Companies

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車的長期目標

簡介目錄

Product Code: 50003718

The France Electric Vehicle Battery Manufacturing Market size is estimated at USD 0.70 billion in 2025, and is expected to reach USD 2.05 billion by 2030, at a CAGR of 24.17% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles and related investments in electric vehicle battery manufacturing units are likely going to drive the market.

- Conversely, the lack of raw material reserves might hinder the market's growth during the forecasted period.

- Nevertheless, the government's ambitious targets for the expansion of e-mobility and curbing carbon emissions from the transportation sector are likely to present market opportunities for the market players during the forecasted period.

France Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery Manufacturing to Hold Significant Share

- The lithium-ion battery comprises a cathode, an anode, and a separator that isolates the two electrodes. The separator, moistened with electrolyte, acts as a catalyst, facilitating the movement of ions from the cathode to the anode during charging and reversing the process during discharging. Its reasonable cost, high specific energy, and ability to endure numerous charge-discharge cycles render it ideal for electric vehicles.

- As Europe's automotive sector pushes towards decarbonization, investing in gigafactories-large-scale rechargeable battery manufacturing facilities-becomes crucial. In September 2023, Macquarie Asset Management, the primary investor in Verkor, a French battery manufacturer, is amplifying Lithium-ion battery production with an investment close to USD 2.17 billion.

- In February 2024, ACC, a French firm, clinched a significant USD 4.4 billion for establishing three gigafactories focused on lithium-ion battery cell production. These facilities will be constructed in France, complemented by investments in research and development. The debt package, solely supported by a consortium of prominent commercial banks-BNP Paribas, Deutsche Bank, ING, and Intesa Sanpaolo-also garners backing from Bpifrance, Euler Hermes, and SACE.

- Similarly, VoltR, a company based in Pays de la Loire, France, specializing in rejuvenating lithium batteries, recently announced a funding achievement. The firm raised USD 4.3 million in its inaugural fundraising round, with significant backing from C4 Ventures and Exergon. With this funding, VoltR aims to set up its first lithium battery reconditioning facility within the next two years. Such investments are poised to bolster France's electric vehicle battery manufacturing market during the forecast period.

- Most electric vehicles are now integrating lithium-ion batteries. According to the International Energy Agency, electric vehicle sales in France have been on the rise in recent years. In 2023, sales of electric cars, encompassing both plug-in hybrids and battery electric vehicles, reached 470,000 units, marking a 38% increase from the prior year. This upward trajectory in electric car sales is anticipated to bolster France's electric vehicle battery manufacturing market in the forecast period.

- Given these trends, France's electric vehicle battery manufacturing market is set for rapid growth in the forecast period.

Government Emphasis to Introduce E-Mobility

- In France, the market for battery manufacturing equipment is on the rise, driven by heightened awareness of environmental concerns and efforts to curb carbon dioxide emissions, especially from the transportation sector. Consequently, government initiatives are poised to benefit the electric vehicle battery manufacturing market during the forecast period.

- In May 2024, the French government sealed a deal with the automotive sector, ambitiously targeting 800,000 annual electric vehicle (EV) sales by 2027. This target, a centerpiece of the 2024-2027 sectoral agreement, emphasizes nearly tripling sales of electric passenger cars (PCs) in four years and significantly boosting battery electric light-duty vehicles (LDVs). Such moves are set to drive the growth of France's electric vehicle manufacturing market in the coming years.

- Industry players in France are ramping up the nation's electric vehicle production. For example, the Renault Group, through its new venture Renault ElectriCity, has centralized its electric vehicle manufacturing in Douai, Maubeuge, and Ruitz. Renault's ambitious goal is to produce 400,000 electric vehicles annually in France by 2025, aiming to establish the nation as Europe's leading hub for competitive and efficient electric vehicle production. Achieving such targets could further invigorate the electric vehicle manufacturing market in the years ahead.

- New government subsidies are set to boost electric vehicle sales in France. In September 2023, the government announced plans for these subsidies, part of a draft law to strengthen the "green industry" and accelerate "reindustrialization." The intent is not just to enhance domestic production but also to reduce dependence on imported electric vehicles, especially from China.

- Moreover, these initiatives in France are poised to elevate electric vehicle sales across Europe. According to the International Energy Agency, Europe recorded sales of 3.3 million electric cars in 2023, marking a 22% increase from the previous year. This upward trend is expected to persist.

- As a result, France's electric vehicle manufacturing market is projected to experience significant growth during the forecast period.

France Electric Vehicle Battery Manufacturing Industry Overview

The electric vehicle battery manufacturing equipment market is moderate. Some of the major players (not in particular order) include Verkor, Contemporary Amperex Technology Co. Limited, Saft Groupe S.A., Tesla Inc., and FIAMM SpA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc

- 6.3.4 EnerSys

- 6.3.5 Tesla Inc.

- 6.3.6 FIAMM SpA

- 6.3.7 Verkor

- 6.3.8 LG Chem Ltd

- 6.3.9 Saft Groupe S.A

- 6.3.10 Panasonic Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219