|

市場調查報告書

商品編碼

1636442

美國電動車電池分離器:市場佔有率分析、產業趨勢、成長預測(2025-2030)United States Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

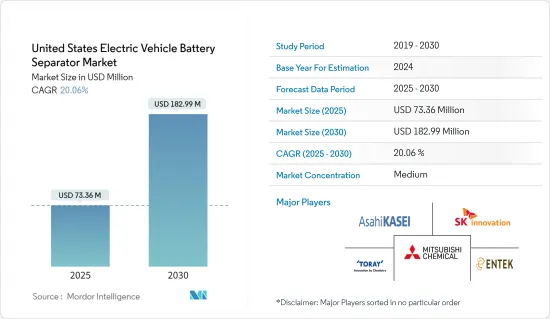

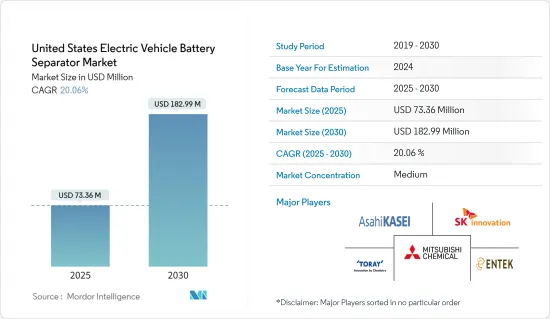

預計2025年美國電動車電池隔膜市場規模為7,336萬美元,預計2030年將達1.8299億美元,預測期內(2025-2030年)複合年成長率為20.06%。

主要亮點

- 從中期來看,電動車的廣泛使用和鋰離子電池價格的下降預計將推動美國電動車電池隔膜市場的發展。

- 另一方面,電池材料供應鏈缺口,如原料短缺和分銷瓶頸,預計將抑制美國電動車電池隔膜市場的未來成長。

- 然而,其他電池化學材料(例如固態電池、先進鋰離子化學材料和鈉離子電池)的持續研究和開發預計將在未來提供市場機會。

美國電動車電池隔膜市場趨勢

鋰離子電池領域可望主導市場

- 電池隔膜是一種多孔膜,對於鋰離子電池至關重要。透過將陰極和陽極分開並僅允許鋰離子通過,可以防止電短路。

- 最初,鋰離子電池主要應用於家用電子電器領域。然而,隨著時間的推移,電動車(EV)製造商在電動車(尤其是插電式混合動力電動車(PHEV))銷量增加的推動下成為主要消費者。這些電池具有能量密度高、循環壽命相對較長和效率高等優點。

- 根據國際能源總署(IEA)預測,2023年電動車電池需求量將超過750GWh,較2022年成長40%。美國佔這項需求的近100GWh。隨著電動車鋰離子電池用途的擴大,對隔膜的需求不斷增加。

- 此外,隨著鋰離子電池價格的下降,其在電動車中的應用不斷增加,對電池隔離膜的需求也隨之增加。 2023年,鋰離子電池組價格將與前一年同期比較%,達到139美元/kWh。

- 2023 年 7 月,佛羅裡達州勞德代爾堡的 Nuvola Technologies Inc. 推出了直接沉澱聚合物分離器技術。這項創新針對的是鋰離子電池的主要起火風險。這項專利技術是傳統薄膜分離器更好、更安全、更有效率的替代品。

- 2023年2月,美國著名鋰離子電池隔膜公司ENTEK與布魯克納集團加強夥伴關係,簽署了18條電池隔板生產線協議。為了滿足美國對電動車和能源儲存不斷成長的需求,ENTEK在領先目標為每年14億平方公尺的計劃基礎上宣布大幅擴大產能。

- 根據彭博新能源財經報道,自2016年以來,美國鋰離子電池產能激增,2023年將成長近兩倍。產能將從2022年的89GWh增加到2023年的114GWh,證實了美國電動車電池隔膜市場的穩健成長。

- 隨著鋰離子電池隔膜產能的擴大和電動車技術的進步,鋰離子產業預計將主導美國電動車電池隔離膜市場。

電動車的普及正在推動電動車電池隔膜市場

- 近年來,美國電動車(EV)電池市場經歷了顯著的快速成長。這種勢頭得益於多種因素,包括政府獎勵、更嚴格的排放法規、消費者環保意識的提高、國內外公司建立的眾多電動汽車電池製造廠以及電動汽車充電基礎設施的進步。這些因素共同增強了美國電動車電池隔膜市場。

- 政府正在透過一系列政策和獎勵促進電動車的採用。這包括稅額扣抵、補貼、回扣以及對充電基礎設施的重大投資。這些措施提高了消費者對電動車的興趣,並增加了對電池組的需求。為此,主要汽車製造商和電池製造商正在增加該地區電動車電池組的產能。

- 國際能源總署(IEA)的資料顯示,美國電池式電動車銷量呈現穩定成長,從2022年的80萬輛躍升至2023年的110萬輛,成長37.5%,成長顯著。

- 2023年1月,特斯拉宣布對其位於內華達州的鋰離子電池組裝廠進行重大擴建。特斯拉斥資 36 億美元巨額投資,旨在提高尖端電池的產量,並為 Cybertruck BEV 建立專門的工廠。該投資包括一座創新的 4680 鋰離子電池工廠和一座專門的 Cybertruck 工廠。

- 2023年11月,豐田宣布將投資80億美元興建位於北卡羅萊納州的豐田電池製造工廠(TBNMA)。這使得該工廠的總投資達到139億美元。此外,除了先前宣布的兩條電池生產線外,豐田還將建立八條專門生產電動車鋰離子電池的新電池生產線,以擴大產能。

- 鑑於對新興電動車電池工廠的投資不斷增加、政府支持政策以及電動車的快速普及,美國電動車電池隔膜市場前景看好。

美國電動汽車電池隔膜產業概況

美國電動車電池隔膜市場正在變得半固體。該市場的主要企業包括(排名不分先後)Entek International、SK Innovation、旭化成、住友化學、東麗、Nuvola Technology、Celgard LLC、SEMCORP Advanced Materials Group 和 Sepion Technologies。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車的擴張

- 鋰離子電池價格下降

- 抑制因素

- 供應鏈缺口

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 依電池類型

- 鋰離子

- 鉛酸電池

- 其他電池類型

- 依材料類型

- 聚丙烯

- 聚乙烯

- 其他材料類型

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Entek International,

- SK Innovation Co. Ltd.

- Asahi Kasei Corporation

- Hitachi Chemical Company Ltd

- Sumitomo Chemical Co., Ltd.

- Toray Industries Inc

- Nuvola Technology

- SEMCORP Advanced Materials Group

- Celgard LLC

- Sepion Technologies

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第7章 市場機會及未來趨勢

- 鋰離子電池隔膜材料的持續研究與進步

The United States Electric Vehicle Battery Separator Market size is estimated at USD 73.36 million in 2025, and is expected to reach USD 182.99 million by 2030, at a CAGR of 20.06% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the United States Electric Vehicle Battery Separator Market.

- On the other hand, the supply chain gap in battery materials, such as ingredient shortages or distribution bottlenecks, is expected to restrain the United States Electric Vehicle Battery Separator Market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

United States Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- A battery separator, a porous membrane, is vital in lithium-ion batteries. It prevents electrical short circuits by isolating the cathode and anode, allowing only lithium ions to pass through.

- Initially, lithium-ion batteries primarily served the consumer electronics sector. However, over time, electric vehicle (EV) manufacturers became the leading consumers, driven by rising EV sales, especially in plug-in hybrid electric vehicles (PHEVs). These batteries offer advantages like high energy density, a relatively long cycle life, and efficiency.

- As per the International Energy Agency, the demand for EV batteries surpassed 750 GWh in 2023, marking a 40% increase from 2022. The United States accounted for nearly 100 GWh of this demand. With the rising application of lithium-ion batteries in EVs, the demand for their separators is poised to grow in tandem.

- Moreover, as lithium-ion battery prices decline, their adoption in electric vehicles is set to rise, subsequently boosting the demand for battery separators. In 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD 139/kWh.

- In July 2023, Fort Lauderdale, Florida's Nuvola Technologies Inc. unveiled a direct deposition polymer separator technology. This innovation targets the primary fire risk in lithium-ion batteries. The patented technology is touted as a superior, safer, and more efficient alternative to conventional film separators.

- In February 2023, ENTEK, a prominent United States lithium-ion battery separator firm, and Bruckner Group strengthened their partnership by signing agreements for 18 battery separator film production lines. Responding to the rising demand for electric vehicles and energy storage in the United States, ENTEK announced a significant production capacity expansion, building on a prior project aiming for 1.4 billion square meters annually.

- BloombergNEF reports that the United States lithium-ion battery manufacturing capacity surged from 2016, nearly tripling by 2023. In 2023, the capacity reached 114 GWh, up from 89 GWh in 2022, underscoring robust growth for the U.S. electric vehicle battery separator market.

- Given the expanding capacities for lithium-ion battery separators and advancements in their technology for electric vehicles, the lithium-ion segment is poised to dominate the U.S. electric vehicle battery separator market.

Growing Adoption of Electric Vehicles Driving the EV Battery Separator Market

- In recent years, the United States has witnessed a significant surge in its electric vehicle (EV) batteries market, primarily fueled by the growing adoption of electric vehicles. This momentum can be attributed to a confluence of factors: government incentives, stringent emission regulations, heightened environmental consciousness among consumers, the establishment of numerous EV battery manufacturing plants by both domestic and foreign entities, and advancements in EV charging infrastructure. These elements collectively bolster the United States Electric Vehicle Battery Separator Market.

- The government is championing EV adoption through a suite of policies and incentives. These encompass tax credits, grants, rebates, and substantial investments in charging infrastructure. Such initiatives have amplified consumer interest in EVs, subsequently driving up the demand for battery packs. In response, leading automakers and battery manufacturers are ramping up their production capacities for EV battery packs within the region.

- Data from the International Energy Agency (IEA) highlights a robust growth in battery electric vehicle sales in the U.S., with figures jumping from 800,000 vehicles in 2022 to 1,100,000 in 2023, marking a remarkable 37.5% increase.

- In January 2023, Tesla announced a major enhancement to its Li-ion battery assembly plant in Nevada. With a substantial investment of USD 3.6 billion, Tesla aims to boost production of a cutting-edge battery cell and set up a dedicated factory for its Cybertruck BEV. This investment includes a plant for the innovative 4680 lithium-ion cells and a specialized facility for the Cybertruck.

- In November 2023, Toyota revealed an ambitious investment of USD 8 billion in its North Carolina-based Toyota Battery Manufacturing facility (TBNMA), which is still under construction. This move elevates the plant's total investment to a staggering USD 13.9 billion. Furthermore, Toyota is expanding its production capabilities by adding eight new battery lines, complementing the two previously announced, all dedicated to producing lithium-ion batteries for electric vehicles.

- Given the escalating investments in emerging EV battery plants, supportive government policies, and the surging adoption of electric vehicles, the trajectory for the U.S. Electric Vehicle Battery Separator Market looks promising.

United States Electric Vehicle Battery Separator Industry Overview

The United States Electric Vehicle Battery Separator Market is semi-consolidated. Some of the major players in the market (in no particular order) include Entek International, SK Innovation Co. Ltd., Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., Toray Industries Inc, Nuvola Technology, Celgard LLC, SEMCORP Advanced Materials Group, Sepion Technologies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Other Battery Type

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Entek International,

- 6.3.2 SK Innovation Co. Ltd.

- 6.3.3 Asahi Kasei Corporation

- 6.3.4 Hitachi Chemical Company Ltd

- 6.3.5 Sumitomo Chemical Co., Ltd.

- 6.3.6 Toray Industries Inc

- 6.3.7 Nuvola Technology

- 6.3.8 SEMCORP Advanced Materials Group

- 6.3.9 Celgard LLC

- 6.3.10 Sepion Technologies

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Advancement in Li-ion Battery Separator Material