|

市場調查報告書

商品編碼

1636418

法國電動車電池隔膜:市場佔有率分析、產業趨勢與成長預測(2025-2030)France Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

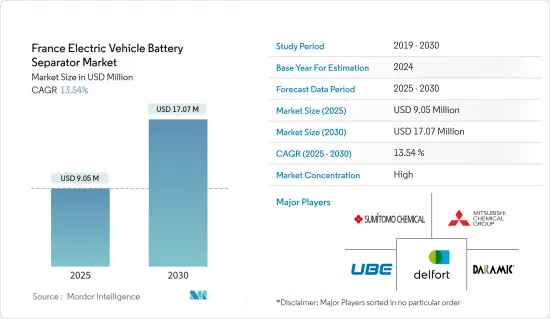

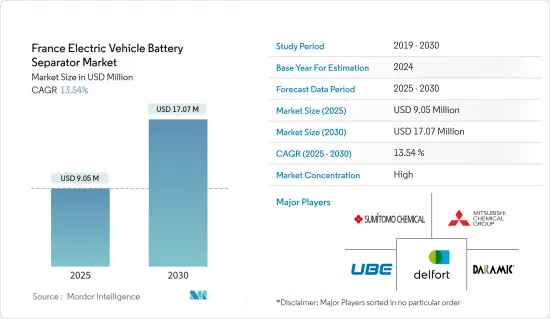

法國電動車電池隔膜市場規模預計到2025年為905萬美元,預計2030年將達到1,707萬美元,預測期內(2025-2030年)複合年成長率為13.54%。

主要亮點

- 從中期來看,電動車的普及和鋰離子電池價格的下降預計將在預測期內推動市場發展。

- 同時,原料的供需缺口預計將在預測期內抑制市場成長。

- 然而,先進電池技術的持續發展很可能為法國電動車電池隔膜市場創造商機。

法國電動車電池隔膜市場趨勢

鋰離子電池領域快速成長

- 在各種電池類型中,鋰離子電池(LIB)預計將在預測期內引領法國電動車(EV)電池隔離膜市場。鋰離子電池因其卓越的容量重量比而優於其他類型的電池。鋰離子電池越來越多的採用是由於其性能提高、維護量極小、保存期限長以及價格暴跌。

- 與鉛酸電池相比,鋰離子(Li-ion)電池表現出許多技術優勢。例如,鉛酸電池的使用壽命約為 400 至 500 次循環,而可充電鋰離子電池的平均使用壽命則令人難以置信,超過 5,000 次循環。此外,鋰離子電池在放電週期期間的維護頻率和電壓穩定性方面優於鉛酸電池,從而使電氣元件能夠隨著時間的推移保持高效。

- 近年來,產業龍頭企業紛紛加大投入,專注於規模經濟和研發,以提高電池性能。這種競爭的加劇大大降低了鋰離子電池的價格。由於技術進步、製造最佳化以及原料成本降低,鋰離子電池的體積加權平均價格已從2013年的780美元/kWh大幅下降至2023年的139美元/kWh。預測顯示,到 2025 年,電價將進一步下降至 113 美元/千瓦時左右,而雄心勃勃的目標是到 2030 年達到 80 美元/千瓦時。這種電池成本降低的趨勢使鋰離子電池成為越來越有吸引力的選擇。

- 從歷史上看,鋰離子電池主要用於行動電話和筆記型電腦等家用電子電器。然而,它的作用已經發生了變化,現在它是混合動力汽車、整體電池式電動車(BEV) 以及可再生能源領域電池儲能系統 (BESS) 的首選電源。

- 2024 年 5 月,Vercor 宣佈在 16 家商業銀行和 3 家公共銀行的支持下,已獲得超過 13 億歐元的綠色融資。這些資金將用於建造 Vercor 在敦克爾克的鋰離子超級工廠。這筆資金籌措使 Vercor 電池超級工廠和 Vercor 創新中心的融資總額超過 30 億歐元。這項重大支持證實了銀行合作夥伴對 Vercor 使命的信心,即向歐洲汽車產業提供低碳、高性能電池,並加強歐洲大陸在電動車和能源儲存的工業主權。

- 在法國,電動車鋰離子電池製造商汽車能源供應公司 (AESC) 正準備在 2025 年在上法蘭西省杜埃開設超級工廠。該工廠一期將容納雷諾ECHO 5和4Ever跨界多功能車,總合高達9吉瓦時,每年可為20萬輛電動車提供足夠的電力。

- 此外,到 2030 年,三項擴建計畫可能會將該設施的容量提高到 24 至 30 吉瓦時。歐洲投資銀行向商業銀行提供 3.372 億歐元的直接貸款和 1.128 億歐元的間接貸款來支持 AESC,該協議於 2023 年 9 月簽署。鋰離子電池產能的擴張表明,未來對電池組件,特別是鋰離子電池隔膜的需求將快速成長。

- 考慮到其輕量化、快速充電、延長充電週期、成本下降和行業進步,鋰離子電池預計將成為預測期內法國電動車電池隔膜市場成長最快的部分。

電動車的普及正在推動市場

- 法國電動車(EV)銷量快速成長,對電動車電池材料的需求不斷增加。隨著電動車銷量的飆升,這些材料的本地生產和投資正在增加,從而加強了法國的電池供應鏈。

- 法國專注於清潔能源和電動車,特別關注隔膜等電池組件。國際能源總署(IEA)強調了這一趨勢,指出2023年法國純電動車(BEV)銷量將達到約31萬輛,比2022年的21萬輛成長47%。電動車的快速普及表明對電池組件(包括隔膜)的需求正在迅速增加。

- 此外,2024 年 5 月,法國政府為其汽車製造商設定了一個雄心勃勃的目標,在未來 10 年內生產 200 萬輛電動或混合動力汽車。這是與擁有壓倒性市場佔有率的中國的激烈競爭。作為新中期規劃協議的一部分,汽車產業的中期目標是到 2027 年銷售 80 萬輛電動車,比 2022 年的 20 萬輛大幅成長。此外,汽車製造商的目標是將電動車 (EV) 銷量從 2022 年的 16,500 輛增加到每年 100,000 輛。

- 此外,補貼、稅收減免和更嚴格的排放法規等政府措施正在刺激電動車市場,並增加對電動車電池及其組件(如隔膜)的需求。例如,到 2024 年,政府已撥款 15 億歐元(16 億美元)用於各種計劃,以促進電動車的生產和購買。法國銷售的新車中有近20%是電動車,但其中只有12%是國產的。然而,透過這些支持措施,法國有望加強其電動車電池製造環境,為電池隔離膜市場的更大成長鋪平道路。

- 2023 年 5 月,Stellantis 與 Total Energy 和梅賽德斯-奔馳合作,慶祝汽車電池公司 (ACC) 位於法國比利-貝爾克洛-德韋蘭的超級電池工廠推出。該工廠是歐洲計劃建造的三座工廠中的第一座,一開始的生產線產能將為 13 吉瓦時 (GWh),目標是到 2030 年擴大到 40 GWh。超級工廠以減少二氧化碳排放的高性能鋰離子電池為目標,在 Stellantis 到 2030 年將歐洲電池產能擴大到 250GWh 的雄心壯誌中發揮著至關重要的作用。電池生產的飛躍將增強電池隔膜產業的實力。

- 此外,法國充滿活力的電動車市場正在推動電池技術的創新,特別是隔膜方面的創新。阿科瑪和 Prolodium 就下一代鋰陶瓷電池先進材料進行的合作研究證明了該地區需求不斷成長。

- 鑑於這些動態,法國正處於電動車需求大幅成長的邊緣,在可預見的未來,對電動車電池隔膜的需求必將增加。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車的擴張

- 鋰離子電池價格下降

- 抑制因素

- 原料供需缺口

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他電池類型

- 材料類型

- 聚丙烯

- 聚乙烯

- 其他材料類型

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Sumitomo Chemical Co. Ltd

- Delfortgroup AG

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Daramic SAS

- SK innovation Co., Ltd.

- Toray Industries, Inc.

- 其他知名企業名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電池技術的發展與進步

簡介目錄

Product Code: 50003593

The France Electric Vehicle Battery Separator Market size is estimated at USD 9.05 million in 2025, and is expected to reach USD 17.07 million by 2030, at a CAGR of 13.54% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the demand-supply gap of raw materials are expected to restrain market growth during the forecast period.

- Nevertheless, the growing progress in developing and advanced battery technologies are likely to create opportunities for the France electric vehicle battery separator market.

France Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment to be the Fastest Growing

- Among various battery types, lithium-ion batteries (LIBs) are set to lead the France electric vehicle (EV) battery separator market during the forecast period. LIBs are outpacing other battery types, thanks to their superior capacity-to-weight ratio. Their rising adoption is further fueled by advantages like extended performance with minimal maintenance, a longer shelf life, and plummeting prices.

- When compared to lead-acid batteries, lithium-ion (Li-ion) batteries showcase numerous technical benefits. For instance, while lead-acid batteries offer a lifespan of about 400-500 cycles, rechargeable Li-ion batteries boast an impressive average of over 5,000 cycles. Moreover, Li-ion batteries outshine lead-acid ones in terms of maintenance frequency and voltage consistency throughout the discharge cycle, ensuring prolonged efficiency of electrical components.

- In recent years, major industry players have ramped up investments, focusing on economies of scale and R&D to boost battery performance. This surge in competition has led to a notable drop in lithium-ion battery prices. Thanks to technological advancements, manufacturing optimizations, and falling raw material costs, the volume-weighted average price of lithium-ion batteries saw a significant decline from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further dip to around USD 113/kWh by 2025 and an ambitious target of USD 80/kWh by 2030. Such a downward trend in battery costs positions lithium-ion batteries as an increasingly attractive option.

- Historically, lithium-ion batteries found their primary application in consumer electronics like mobile phones and laptops. Yet, their role has evolved, and they are now the preferred power source for hybrids, the entire range of battery electric vehicles (BEVs), and battery energy storage systems (BESS) within the renewable energy sector.

- In May 2024, Verkor announced securing over EUR 1.3 billion in green financing, backed by 16 commercial banks and 3 public banks. These funds are earmarked for constructing Verkor's inaugural lithium-ion Gigafactory in Dunkirk, boasting an initial production capacity of 16 GWh/year. With this latest financing, Verkor's total secured funding for its battery gigafactory and the Verkor Innovation Centre surpasses EUR 3 billion. This substantial backing underscores banking partners' confidence in Verkor's mission to deliver low-carbon, high-performance batteries to Europe's automotive sector, bolstering the continent's industrial sovereignty in electric mobility and energy storage.

- In France, Automotive Energy Supply Corporation (AESC), a lithium-ion battery manufacturer for electric vehicles, is gearing up to launch a gigafactory in Douai, Hauts-de-France, by 2025. The factory's inaugural phase will cater to Renault's ECHO 5 and the 4Ever crossover utility vehicle, with a combined capacity of up to 9 Gigawatt-hours, sufficient to power 200,000 electric cars annually.

- Additionally, the plans for three expansions could see the facility's capacity soar to between 24 to 30 gigawatt-hours by 2030. The European Investment Bank is backing AESC with a direct loan of EUR 337.2 million and an additional EUR 112.8 million in indirect loans to commercial banks, a deal inked in September 2023. Such expansive lithium-ion battery manufacturing capabilities signal a burgeoning demand for battery components, notably lithium-ion battery separators, in the coming years.

- Given their lightweight nature, rapid charging, extended charging cycles, decreasing costs, and advancements in the industry, lithium-ion batteries are poised to be the fastest-growing segment in the France electric vehicle battery separator market during the forecast period.

Growing Adoption of Electric Vehicles to Drive the Market

- France's surging electric vehicle (EV) sales are propelling a heightened demand for EV battery materials, with separators taking center stage. As EV sales soar, local production and investments in these materials are on the rise, fortifying France's battery supply chain.

- France's dedication to clean energy and electric vehicles is intensifying its emphasis on battery components, notably separators. The International Energy Agency (IEA) highlighted this trend, noting that battery electric vehicle (BEV) sales in France reached around 310,000 units in 2023, a 47% leap from 210,000 units in 2022. This rapid surge in EV adoption signals a burgeoning demand for battery components, including separators.

- Moreover, in May 2024, the French government set an ambitious target for its carmakers: produce two million electric or hybrid vehicles by the decade's end. This comes amid stiff competition from China's dominant market. As part of a new medium-term planning agreement, the industry aims for an interim target of 800,000 electric vehicle sales by 2027, a significant leap from 200,000 in 2022. Furthermore, carmakers are setting their sights on boosting sales of electric light utility vehicles to 100,000 annually, up from just 16,500 in 2022.

- Additionally, government measures like subsidies, tax breaks, and stringent emissions regulations are energizing the EV market, subsequently heightening the demand for EV batteries and their components, such as separators. For instance, in 2024, the government allocated EUR 1.5 billion (USD 1.6 billion) across various programs to spur EV production and purchases. While nearly 20% of new cars sold in France are electric, only 12% of those are domestically produced. However, with these supportive measures, France is poised to bolster its EV battery manufacturing landscape, paving the way for heightened growth in the battery separator market.

- In May 2023, Stellantis, in partnership with TotalEnergies and Mercedes-Benz, celebrated the launch of the Automotive Cells Company's (ACC) battery gigafactory in Billy-Berclau Douvrin, France. This facility, the first of three planned in Europe, commenced with a production line capacity of 13 gigawatt-hours (GWh) and aims to scale up to 40 GWh by 2030. Targeting high-performance lithium-ion batteries with a reduced CO2 footprint, the gigafactory plays a pivotal role in Stellantis' ambition to escalate battery manufacturing capacity to 250 GWh in Europe by 2030. Such strides in battery production are set to bolster the battery separator sector.

- Moreover, France's dynamic EV market is catalyzing innovations in battery technology, especially in separators. Collaborations, like those between Arkema and ProLogium on advanced materials for next-gen lithium ceramic batteries, underscore the region's growing demand.

- Considering these dynamics, France is on the brink of a significant EV demand surge, which will inevitably amplify the need for EV battery separators in the foreseeable future.

France Electric Vehicle Battery Separator Industry Overview

The France rechargeable battery market is semi-consolidated. Some of the key players in the market (not in any particular order) include Sumitomo Chemical Co. Ltd, Mitsubishi Chemical Group Corporation, UBE Corporation, Daramic SAS and Delfortgroup AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Gap of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Battery Types

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co. Ltd

- 6.3.2 Delfortgroup AG

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 UBE Corporation

- 6.3.5 Daramic SAS

- 6.3.6 SK innovation Co., Ltd.

- 6.3.7 Toray Industries, Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Progress in Developing and Advanced Battery Technologies

02-2729-4219

+886-2-2729-4219