|

市場調查報告書

商品編碼

1636244

印度建築裝飾石材:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Construction Ornamental Stone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

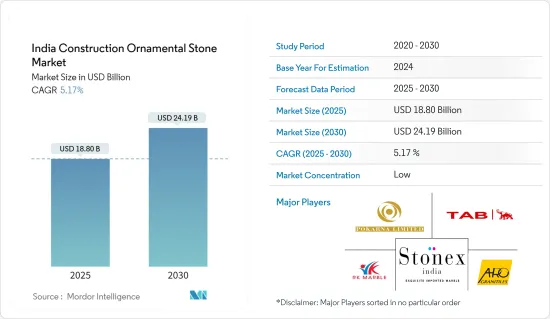

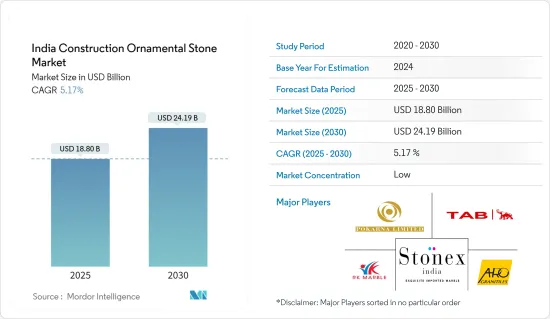

印度建築裝飾石材市場規模預計到2025年為188億美元,預計到2030年將達到241.9億美元,預測期內(2025-2030年)複合年成長率為5.17%。

印度的裝飾建築石材產業充滿活力且多樣化,天然石材種類繁多,如大理石、花崗岩、砂岩和石灰石。印度擁有數百年的石材工藝傳統,已成為該領域的全球重要參與者。該市場涵蓋廣泛的應用,包括住宅、商業和計劃,裝飾石材用於地板、覆層、檯面、雕塑、紀念碑等。

此外,印度房地產業的擴張以及人們可支配收入的增加正在推動市場的成長。該國憑藉豐富的天然石材資源、一流的工藝以及先進的採石和加工技術保持其全球競爭力。

然而,該行業面臨挑戰,包括與採石實踐相關的環境問題、監管複雜性以及合成替代品的競爭。我們繼續努力推廣永續採石方法並採用最尖端科技來解決這些問題。印度建築裝飾石材市場為國內外的擴張和創新提供了廣闊的前景,重點是永續性和技術進步。

印度建築裝飾石材市場趨勢

印度住宅房地產領先市場

在印度,建築市場仍深受住宅房地產產業繁榮的影響。這種活力很大程度上是由都市化、人口激增和可支配收入增加所推動的。在快速成長的中產階級和尋求優質且負擔得起的住宅的年輕人的推動下,住宅需求仍然強勁。 Pradhan Mantri Awas Yojana (PMAY) 等政府主導的舉措和其他經濟適用住宅計劃不僅推動了這一需求,而且也推動了該行業的發展。

COVID-19 大流行凸顯了擁有住房的重要性以及對寬敞、舒適的生活空間的需求,以適應遠距工作和社交距離。因此,開發商正在努力滿足這些不斷變化的需求,提供智慧家庭、綠色空間和綜合城鎮等功能。儘管市場偶爾波動,但印度的住宅房地產繼續吸引大量投資,引導建設產業的成長軌跡,並成為該國經濟格局的關鍵參與者。

石灰石領域推動市場

近年來,印度石灰石產值呈現明顯的產業波動趨勢。儘管具體數字尚未確定,但其軌跡反映出受多種因素影響的微妙局勢。與前一年同期比較變化顯示市場力量的動態相互作用,包括需求變化、供應鏈動態、監管因素和全球經濟狀況。

儘管缺乏確鑿的數據,這一趨勢凸顯了該行業的韌性和適應不斷變化的環境的能力。更觀點,這些波動可能反映了建築和建材行業的更廣泛趨勢,反映了國內需求和國際市場動態之間的複雜平衡。

此外,這些波動可能促使行業相關人員重新思考策略、創新流程並探索永續成長路徑。產值的波動凸顯了敏捷性和遠見對於駕馭石灰石產業複雜格局的重要性。

最終,雖然由於缺乏數值資料,綜合分析受到限制,但印度石灰石產值背後的故事是該行業應對動態市場力量的彈性、適應性和持續發展的能力。

印度建築裝飾石材產業概況

印度建築裝飾石材市場本質上是分散的。市場上的一些主要企業包括 Pokarna Limited、Tab India Granite Pvt. Ltd、RK Marbles India、Stonex India Pvt. Ltd、Aro Granite Industries Ltd 等。

Pokarna Limited 因其創新實踐和對品質的承諾而脫穎而出。 Tab India Granite Pvt. Ltd 以其廣泛的永續花崗岩產品而脫穎而出。 RK Marbles India 展示了其在提供優質大理石和以客戶為中心的服務方面的專業知識。 Stonex India Pvt. Ltd 強調客製化和適應性,以滿足不同消費者的需求。 Aro Granite Industries Ltd 以獨特的產品和對卓越的關注服務市場。透過駕馭競爭格局,這些參與者塑造了產業發展軌跡,推動創新,並為品質和客戶滿意度設定了高標準。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察與動態

- 市場概況

- 市場促進因素

- 快速都市化導致需求增加

- 房地產業快速成長

- 市場限制因素/問題

- 增加環境法規

- 原物料價格波動

- 市場機會

- 增加客製化和創新

- 裝飾石材的需求不斷成長

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 對市場創新的見解

- COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 大理石

- 花崗岩

- 砂岩

- 砂岩

- 縞瑪瑙

- 石英岩

- 石板

- 按最終用戶

- 住宅

- 商業的

- 按用途

- 地板材料

- 覆層

- 按分銷管道

- 直銷

- 零售店

- 網路零售

第6章 競爭狀況

- 市場集中度概覽

- 公司簡介

- Pokarna Limited

- Tab India Granite Pvt. Ltd

- RK Marbles India

- Stonex India Pvt. Ltd

- Aro Granite Industries Ltd

- A-Class Marble India Pvt. Ltd

- Inani Marbles and Industries Ltd

- Asian Granito India Ltd

- Bhandari Marble Group

- Marble City Company*

第7章 市場趨勢

第 8 章 免責聲明/關於出版商

The India Construction Ornamental Stone Market size is estimated at USD 18.80 billion in 2025, and is expected to reach USD 24.19 billion by 2030, at a CAGR of 5.17% during the forecast period (2025-2030).

The Indian construction ornamental stone industry is dynamic and varied for its diverse selection of natural stones like marble, granite, sandstone, and limestone. With a heritage steeped in centuries of stone craftsmanship, India has established itself as a prominent global player in this field. This market addresses a broad spectrum of uses, spanning residential, commercial, and infrastructure projects, where ornamental stones are applied in flooring, cladding, countertops, sculptures, and monuments.

Furthermore, the expansion of India's real estate industry, alongside increasing disposable incomes among its people, has fueled the market's growth. The country maintains a competitive edge in the global arena by leveraging its abundant natural stone resources, top-notch craftsmanship, and advancements in quarrying and processing technologies.

Nevertheless, the industry faces challenges, including environmental concerns tied to quarrying practices, regulatory complexities, and competition from synthetic alternatives. In order to tackle these issues, there is a concerted effort toward promoting sustainable quarrying methods and embracing cutting-edge technologies. The Indian construction ornamental stone market offers promising prospects for expansion and innovation, both domestically and internationally, while emphasizing sustainability and technological progress.

India Construction Ornamental Stone Market Trends

Indian Residential Real Estate is Driving the Market Studied

In India, the construction market remains heavily influenced by the buoyancy of the residential real estate industry. This vigor is primarily fueled by urbanization, a burgeoning population, and rising disposable incomes. With a burgeoning middle class and a youthful demographic seeking quality yet affordable housing, the demand for residential properties remains robust. Government-led initiatives like the Pradhan Mantri Awas Yojana (PMAY) and other affordable housing schemes have not only bolstered this demand but also added impetus to the industry.

The onset of the COVID-19 pandemic underscored the importance of homeownership, emphasizing the need for spacious and comfortable living spaces that accommodate remote work and social distancing. Consequently, developers are pivoting to meet these evolving demands, offering features like smart homes, green spaces, and integrated townships. Despite occasional market fluctuations, residential real estate in India remains a magnet for substantial investments, steering the growth trajectory of the construction industry and emerging as a pivotal player in the nation's economic landscape.

The Limestone Segment is Driving the Market Studied

In recent years, the production value of Indian limestone has shown a discernible trend, indicative of fluctuations within the industry. While specific figures remain unspecified, the trajectory reflects a nuanced landscape influenced by various factors. The year-on-year variations suggest a dynamic interplay of market forces, including shifts in demand, supply chain dynamics, regulatory factors, and global economic conditions.

Despite the absence of numerical specifics, the trend underscores the industry's resilience and adaptability to changing circumstances. From a broader perspective, these fluctuations may mirror broader trends within the construction and building materials industry, reflecting the intricate balance between domestic demand and international market dynamics.

Furthermore, such fluctuations may prompt industry stakeholders to reassess strategies, innovate processes, and explore avenues for sustainable growth. The volatility in production value underscores the importance of agility and foresight in navigating the intricacies of the limestone industry.

Ultimately, while the absence of numerical data limits a comprehensive analysis, the narrative surrounding the production value of Indian limestone highlights the industry's capacity for resilience, adaptability, and continuous evolution in response to dynamic market forces.

India Construction Ornamental Stone Industry Overview

The Indian construction ornamental stone market is fragmented in nature. The key players in the market include Pokarna Limited, Tab India Granite Pvt. Ltd, RK Marbles India, Stonex India Pvt. Ltd, and Aro Granite Industries Ltd.

Pokarna Limited stands out for its innovative practices and commitment to quality. Tab India Granite Pvt. Ltd distinguishes itself with an extensive range of sustainable granite products. RK Marbles India showcases its expertise in premium marble offerings and customer-centric service. Stonex India Pvt. Ltd emphasizes customization and adaptability to meet diverse consumer needs. Aro Granite Industries Ltd contributes to the market with unique offerings and a focus on excellence. As these players navigate the competitive landscape, they collectively shape the trajectory of the industry, driving innovation and setting high standards for quality and customer satisfaction.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Urbanization Leads to Increased Demand

- 4.2.2 Rapid Growth in the Real Estate Industry

- 4.3 Market Restraints/ Challenges

- 4.3.1 Increase in Environmental Regulations

- 4.3.2 Volatility in Raw Material Prices

- 4.4 Market Opportunities

- 4.4.1 Increase in Customization and Innovation

- 4.4.2 Growing Demand for Ornamental Stones

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/ Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Marble

- 5.1.2 Granite

- 5.1.3 Sandstone

- 5.1.4 Sandstone

- 5.1.5 Onyx

- 5.1.6 Quartzite

- 5.1.7 Slate

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Application

- 5.3.1 Flooring

- 5.3.2 Cladding

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Retail Stores

- 5.4.3 Online Retail

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Pokarna Limited

- 6.2.2 Tab India Granite Pvt. Ltd

- 6.2.3 RK Marbles India

- 6.2.4 Stonex India Pvt. Ltd

- 6.2.5 Aro Granite Industries Ltd

- 6.2.6 A-Class Marble India Pvt. Ltd

- 6.2.7 Inani Marbles and Industries Ltd

- 6.2.8 Asian Granito India Ltd

- 6.2.9 Bhandari Marble Group

- 6.2.10 Marble City Company*