|

市場調查報告書

商品編碼

1636166

變壓器監控系統 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Transformer Monitoring System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

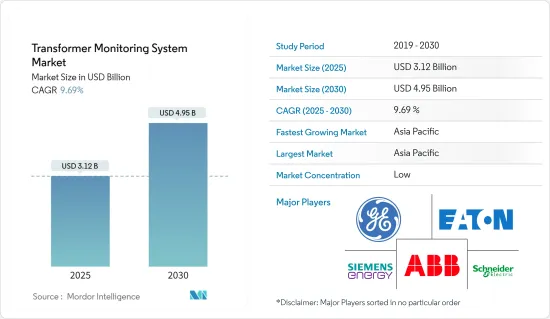

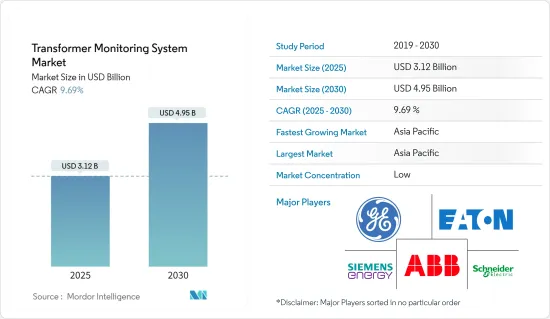

變壓器監控系統市場規模預計到 2025 年將達到 31.2 億美元,到 2030 年將達到 49.5 億美元,預測期內(2025-2030 年)複合年成長率為 9.69%。

主要亮點

- 隨著時間的推移,許多因素促進了全球變壓器監控系統市場的成長,例如更換現有電網和擴大配電網路以實現農村電氣化。監控系統主要用於使用變壓器的配電和發電網路。

- 另一方面,高昂的系統安裝成本是全球變壓器監控系統市場的主要市場限制,而感測器、監視器和資料儲存等技術進步正在增加其價值。然而,這些系統的維護成本較高,阻礙了變壓器監控系統市場的成長。

- 與自動化、巨量資料分析和物聯網 (IoT) 等新技術相關的變壓器監控系統的進步和發展對於當今高度工業化和不斷發展的工業環境至關重要。這些發展預計將為未來的變壓器監控系統市場創造一些機會。

- 亞太地區是兆瓦時發電量最高的主要市場之一。不斷成長的電力需求、跨境電力傳輸以及利用可再生資源的努力需要變壓器的使用,從而推動了變壓器監控系統市場的發展。

變壓器監控系統市場趨勢

軟體領域預計將出現顯著的市場成長

- 軟體元件通常是指整合到變壓器監控系統中的數位元件。這些組件包括控制演算法、人機介面 (HMI)、可程式邏輯控制器 (PLC)、監控和資料擷取 (SCADA)、資料登錄和分析工具、安全系統、通訊協定、診斷工具等。

- 變壓器部署的增加將導致對客製化軟體監控系統的需求增加。這包括人工智慧 (AI) 和機器學習演算法的整合,用於預測分析和變壓器運行最佳化。這些先進的功能可實現主動維護、故障偵測和效能最佳化,從而降低最終用戶的成本並提高可靠性。

- 由於世界多個地區的工人安全法更加嚴格,變壓器監控對於防止發電廠和各行業的損壞和事故變得越來越重要。增加對即時監控和物聯網(IoT)的投資以確保發電廠和工業設施的順利運作預計將提供新的機會。此外,物聯網(IoT)技術的累積導致了互聯變壓器監控系統的出現,實現了遠端監控和管理,提高了效率和便利性。

- 一個值得注意的趨勢是變壓器監控系統擴大採用數位化和物聯網技術。這種向智慧連網解決方案的轉變可以實現即時監控、預測性維護和變壓器效能最佳化,從而提高效率並減少停機時間。

- 預計對可無縫整合到支援物聯網的變壓器監控網路中的智慧感測器、致動器和控制閥的需求將顯著成長,這可能會推動市場成長。升級後的功能可降低營業成本、減少停機時間並提高效率。該技術為操作員提供了即時監控、預測性維護和遠端最佳化等先進功能。

- 根據國際能源總署(IEA)的數據,2022年全球電力網路總投資將達3,320億美元。此外,到 2050 年的十年間,年度投資預計將增加兩倍以上,達到 8,710 億美元,以支持淨零發展軌跡。因此,輸配電基礎設施的投資和升級預計將繼續,從而推動對變壓器監控系統的需求。

- 因此,該市場的製造商不斷創新,開發尖端的軟體解決方案,不僅提高業務效率和安全性,而且符合永續性目標。預計這些因素將在預測期內推動市場成長。

亞太地區預計將主導市場

- 亞太地區是全球最大的能源消費國。根據《世界能源統計評論》顯示,截至2022年,該地區發電量達14,546.4太瓦時,佔全球發電量的近49.8%。 2012年至2022年期間,發電量複合年成長率穩定在4.6%。此外,2022年發電量比與前一年同期比較增加4%。亞太地區不斷成長的電力需求預計將對該地區的變壓器使用產生重大影響,從而推動對變壓器監控系統的需求。

- 來自大型公用事業規模可再生能源農場的可再生可再生能源的日益整合、工業和建築的電氣化以及中國和印度等國家資料中心的成長都導致了電力消耗的顯著增加。隨著該地區人口和都市化的成長,電力需求預計將增加,從而增加對具有更高電壓和功率水平的變壓器的需求。此外,將風能和太陽能等可再生能源併入電網需要新的變壓器來控制它們產生的可變和分散式能源。

- 隨著中國電力需求穩定成長,國家大力投資輸配電基礎設施,以滿足不斷成長的能源需求。例如,2023年1月,中國消費電子網路公司宣布計畫在2023年投資約770億美元用於輸電基礎設施和能源儲存系統。

- 印度也是世界上最大的電力消耗國之一。印度正在能源、交通和房地產領域進行大規模基礎建設。這些計劃需要強大的電網系統,包括電力變壓器,以支援不斷成長的能源需求,並確保各種基礎設施的可靠供電。此外,國家電網老化,急需現代化改造。隨著電力負載的增加以及太陽能電池板和風力發電機等可變發電資產的整合,電網穩定性已成為關鍵問題。因此,包括州和聯邦公用事業在內的政府正在大力投資升級和現代化其電網。

- 例如,據該國最大的輸電營運商印度電網公司(PGCIL)稱,該國正在投資342億美元建設州際輸電系統(ISTS),主要是為了適應可再生能源和電力傳輸的計劃而建設。據國有電力公司稱,該計劃預計到 2026 年至 2027 年投資額將高達 17.1 兆美元。據電力部稱,2022會計年度已核准23個綠色能源交通ISTS計劃,總成本達19億美元。截至 2022 年 11 月,已核准價值約 72 億美元的輸電計劃。

- 預計此類發展將增加變壓器的使用,並在預測期內推動變壓器監控系統市場的發展。

變壓器監控系統產業概況

變壓器監控系統市場分散。該市場的主要企業(排名不分先後)包括通用電氣公司、ABB 有限公司、西門子能源公司、施耐德電氣公司和伊頓公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029 年之前的市場規模與需求預測

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 現有電網更新及配電網擴建

- 抑制因素

- 安裝成本高

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按成分

- 軟體

- 硬體

- 按服務

- 油品監測

- 繞組監控

- 氣體監測

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- General Electric Company

- ABB Ltd.

- Siemens Energy AG

- Schneider Electric SE

- Eaton Corporation plc

- MISTRAS Group

- Vaisala Oyj

- Hitachi Ltd

- KJ Dynatech Inc.

- Gasera Ltd

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 變壓器監控系統的技術進步與發展

簡介目錄

Product Code: 50002228

The Transformer Monitoring System Market size is estimated at USD 3.12 billion in 2025, and is expected to reach USD 4.95 billion by 2030, at a CAGR of 9.69% during the forecast period (2025-2030).

Key Highlights

- Over the long term, a number of factors have contributed to the growth of the global transformer monitoring system market, including the replacement of existing grids and the expansion of distribution networks in order to achieve rural electrification. Monitoring systems are primarily utilized in distribution and power generation networks where transformers are utilized.

- On the other hand, the system's high installation costs are the primary market restraint for the global transformer monitoring system market, and the technological advancements that include sensors, monitors, and data storage enhance its value as well. However, these systems are expensive to maintain, hampering the growth of the transformer monitoring system market.

- Nevertheless, advancements and developments in transformer monitoring systems associated with new technologies such as automation, big data analytics, and the Internet of Things (IoT) are crucial in today's highly industrialized and evolving industrial environment. These developments are expected to create several opportunities for the transformer monitoring systems market in the future.

- Asia-Pacific is one of the significant markets with the highest terawatt-hour capacity of electricity generation. With an increase in the demand for power and cross-border transmission and initiatives to utilize renewable resources, transformer usage is in demand, thus driving the transformer monitoring system market.

Transformer Monitoring System Market Trends

Software Segment Expected to Experience Significant Market Growth

- Software components typically refer to the digital elements integrated into the transformer monitoring system. These components could include control algorithms, human-machine interfaces (HMI), programmable logic controllers (PLC), supervisory control and data acquisition (SCADA), data logging and analysis tools, safety systems, communication protocols, and diagnostic tools, which are used for predictive maintenance techniques to anticipate issues before they occur.

- This increased adoption of transformers will consequently lead to a higher demand for tailored software monitoring systems. This includes the integration of artificial intelligence (AI) and machine learning algorithms for predictive analytics and optimization of transformers operations. These advanced capabilities enable proactive maintenance, fault detection, and performance optimization, leading to cost savings and improved reliability for end-users.

- Transformer monitoring is becoming more and more essential to prevent damage or accidents in power plants and various industries due to strict legislation pertaining to worker safety in several regions of the world. Increasing investments in real-time monitoring and the Internet of Things (IoT) to ensure the smooth functioning of power plants and industrial facilities are predicted to provide fresh opportunities. Additionally, the accumulation of Internet of Things (IoT) technology has led to the emergence of interconnected transformer monitoring systems, enabling remote monitoring and management for improved efficiency and convenience.

- One prominent trend is the increasing adoption of digitalization and IoT technologies in transformer monitoring systems. This shift toward smart and connected solutions allows for real-time monitoring, predictive maintenance, and optimization of transformer performance, thereby enhancing efficiency and reducing downtime.

- The projected significant growth in demand for smart sensors, actuators, and control valves capable of integrating seamlessly into IoT-enabled transformer monitoring networks is likely to propel market growth. The upgraded features have resulted in lower operating costs, less downtime, and more efficiency. The technologies have given operators advanced functionality, including real-time monitoring, predictive maintenance, and remote optimization.

- According to the International Energy Agency (IEA), the total global investment spending in electricity networks stood at USD 332 billion in 2022. Furthermore, to support the net-zero trajectory, the annual investment is expected to more than triple to USD 871 billion annually in the decade preceding 2050. Thus, investments and upgradation of the T&D infrastructure are expected to continue in the coming years, thereby aiding the demand for transformer monitoring systems.

- As a result, manufacturers in this market are continuously innovating to develop cutting-edge software solutions that not only enhance operational efficiency and safety but also align with sustainability goals. Such factors are expected to aid market growth during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is the largest energy consumer globally. As of 2022, according to the Statistical Review of World Energy, the region generated nearly 14,546.4 TWh of electricity, accounting for nearly 49.8% of the global generation. During 2012-2022, electricity generation registered a steady CAGR of 4.6%. Additionally, in 2022, electricity generation increased by 4% Y-o-Y. The rising electricity demand in Asia-Pacific is expected to impact the usage of transformers in the region significantly, thus driving the demand for transformer monitoring systems.

- The rising integration of renewable energy from massive utility-scale renewable energy farms in countries such as China and India, the electrification of industries and buildings, and the growth of data centers all contribute to a significant increase in electricity consumption. As the population and urbanization in the region grow, the demand for electricity is also expected to increase, driving the need for transformers to handle higher voltages, and power levels will also increase. Additionally, integrating renewable energy sources like wind and solar into the grid will require new transformers to control the variable and decentralized energy they produce.

- As electricity demand across China has grown steadily, the country has invested heavily in its T&D infrastructure to satiate the burgeoning energy demand. For instance, in January 2023, the State Grid Corporation of China announced plans to invest nearly USD 77 billion in transmission infrastructure and energy storage systems during 2023, up by nearly 4.0% Y-o-Y.

- India is also one of the largest electricity consumers globally. India is witnessing massive infrastructure development in the energy, transportation, and real estate sectors. These projects require a robust electrical grid system, including power transformers, to support the growing energy demand and ensure reliable power supply to various infrastructural facilities. In addition, the country's power grid has become older and is in dire need of modernization. With the increasing power load and rising integration of variable generation assets such as solar panels and wind turbines, grid stability has become a significant issue. Hence, the government, including state and federal electric utilities, has been investing heavily in the upgrade and modernization of the grid.

- For instance, according to the Powergrid Corporation of India (PGCIL), the country's largest transmission utility, the country plans to invest USD 34.2 billion to set up an interstate transmission network (ISTS), primarily to accommodate and transmit renewable energy. According to the state utility, the plan envisions investments of up to USD 17.1 trillion from 2026 to 2027. According to the Power Ministry, the country has already approved 23 ISTS projects for green energy evacuation at a total cost of USD 1.9 billion during FY 2022. As of November 2022, transmission projects worth nearly USD 7.2 billion were approved.

- Such developments are expected to increase the usage of transformers, thus driving the transformer monitoring system market during the forecast period.

Transformer Monitoring System Industry Overview

The transformer monitoring system market is fragmented. Some of the key players in this market (in no particular order) include General Electric Company, ABB Ltd, Siemens Energy AG, Schneider Electric SE, and Eaton Corporation PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Replacement of Existing Grids and the Expansion of Distribution Networks

- 4.5.2 Restraints

- 4.5.2.1 High Installation Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Hardware

- 5.2 By Service

- 5.2.1 Oil Monitoring

- 5.2.2 Winding Monitoring

- 5.2.3 Gas Monitoring

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Colombia

- 5.3.4.5 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 General Electric Company

- 6.3.2 ABB Ltd.

- 6.3.3 Siemens Energy AG

- 6.3.4 Schneider Electric SE

- 6.3.5 Eaton Corporation plc

- 6.3.6 MISTRAS Group

- 6.3.7 Vaisala Oyj

- 6.3.8 Hitachi Ltd

- 6.3.9 KJ Dynatech Inc.

- 6.3.10 Gasera Ltd

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement and Developments in Transformer Monitoring Systems

02-2729-4219

+886-2-2729-4219