|

市場調查報告書

商品編碼

1635475

印度加油站 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)India Petrol Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

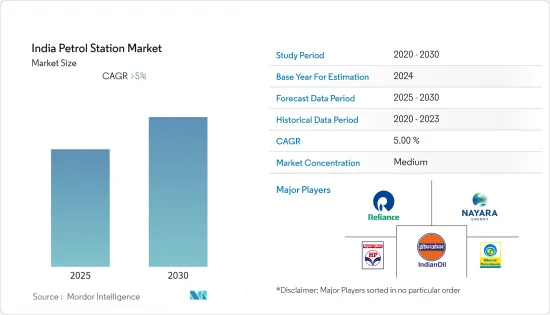

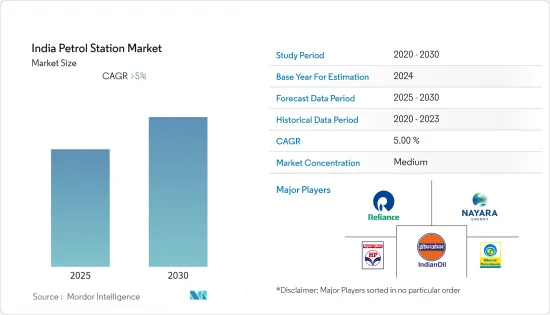

印度加油站市場預計在預測期內複合年成長率將超過 5%。

COVID-19 對 2020 年市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從長遠來看,印度石油產品需求增加和乘用車銷量增加等因素預計將在預測期內推動市場成長。

- 另一方面,汽油和柴油成本的上漲預計將限制未來幾年加油站燃料市場的成長。

- 印度加油站的改造除了電動車 (EV) 充電設施和壓縮天然氣之外還提供多種加油選項,例如汽油、柴油和靈活燃料,預計將在未來提供重大機會。

印度加油站市場趨勢

私營部門預計將成為成長最快的市場

- 由於印度燃料需求的增加和燃料零售的自由化,私營部門預計在預測期內將出現強勁成長。

- 考慮到未來的潛力,多家全球公司都有興趣進入印度的燃料零售領域。截至2022年5月1日,信實工業有限公司擁有1,459個加油站,Nayara Energy(原Essar Oil)擁有6,604個加油站,荷蘭皇家殼牌公司擁有324個加油站,其他公司擁有34個加油站。這與印度加油站市場的成長類似。

- 2022年6月,印度政府宣布對所有零售店實施普遍服務義務(USO)。該規則禁止加油站停止銷售汽油和柴油。這條規則也適用於偏遠地區的加油站。政府已明確表示,不遵守此規定的人將被吊銷執照。

- 另外,根據石油天然氣部的數據,印度2021-2022會計年度(截至2022年4月9日)汽油消費量將比上年度成長13%,達到3085萬噸,柴油消費量將成長5%達到7669萬噸。印度政府放寬了汽油和航空燃料銷售的規定,鼓勵英國石油公司、TotalEnergies和托克公司等私人公司進入該國。因此,我們認為私人公司將在預測期內主導市場。

- 因此,由於燃料需求的增加和私營企業對印度加油站行業興趣的成長,私營部門預計在預測期內將大幅成長。

乘用車滲透率的提高可能有助於市場成長

- 印度是世界領先的經濟強國之一。此外,由於人口成長、都市化和工業化,預計該國仍將是預測期內經濟成長率最高的國家。

- 近年來,該國經濟成長令人矚目,生活水準和平均收入不斷提高。近年來汽車銷量也穩定成長。

- 印度年汽車總銷量將從2008年的198萬輛增加到2021年的378萬輛,其中僅乘用車將占到306萬輛。此外,預計在預測期內汽車銷售將成長,這可能會增加該國對燃料和加油站的需求。

- 印度中階的崛起對汽車銷售至關重要。此外,到2030年,預計將有5億人進入中高所得階層。預計這將與汽車銷量的成長齊頭並進。

- 因此,所有這些因素預計將導致印度汽車銷量增加,並在預測期內推動零售加油站的需求。

印度加油站產業概況

印度加油站市場適度整合。主要企業(排名不分先後)包括印度石油有限公司、巴拉特石油有限公司、印度斯坦石油有限公司、納亞拉能源有限公司和信實工業有限公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 印度各公司零售加油站數(2013-2021)

- 印度各邦零售加油站數 (2021 年)

- 印度汽油和柴油消費趨勢(2021年)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 擁有者

- 公部門

- 私人公司

- 按最終用戶

- 公共部門

- 私部門

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Indian Oil Corporation Ltd

- Bharat Petroleum Corp. Ltd

- Hindustan Petroleum Corporation Limited

- Nayara Energy Limited

- Reliance Industries Limited

- Royal Dutch Shell PLC

- TotalEnergies SA

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92825

The India Petrol Station Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increasing demand for petroleum products and the rising sale of passenger vehicles in India are expected to help the market grow during the forecast period.

- On the other note, the increasing cost of petrol & diesel fuels is anticipated to restrain the growth of the fuel station fuel market in the coming years.

- Nevertheless, converting the fuel stations in India to provide multiple fueling options such as petrol, diesel, and flex fuels, besides electric vehicle (EV) charging facilities, compressed natural gas is expected to offer vast opportunities in the future.

India Petrol Station Market Trends

The Private Owned Segment is Expected to be the Fastest-Growing Market

- The private-owned segment is expected to witness significant growth during the forecast period due to rising fuel demand and the liberalization of fuel retailing in India.

- Looking at the future potential, various global players are interested in entering the Indian fuel retail segment. As of 1st May 2022, Reliance Industries Limited has 1,459 fuel stations, Nayara Energy (formerly Essar Oil) has 6,604, Royal Dutch Shell has 324 outlets, and other companies have 34 outlets. This, in turn, replicates the growth in the Indian fuel station market.

- In June 2022, The government of India announced the implementation of Universal Service Obligation (USO) for all retail outlets. As per the rule, petrol pumps cannot stop selling petrol and diesel. This rule is also applicable to petrol pumps in remote areas. The government has made it clear that whoever does not follow these rules will get their license canceled.

- Moreover, according to the Ministry of Petroleum and Natural Gas, during the FY2021-2022 (as of 9th April 2022), Indian gasoline consumption rose to 30.85 million metric tonnes (MMT), showing a growth of 13% compared to the previous year, and the diesel has reached 76.69 MMT with a 5% rise from FY2020-21. The Government of India is relaxing restrictions on the sale of gasoline and aviation fuel and encouraging private players like British Petroleum, TotalEnergies, and Trafigura in India. This is likely to make the companies in the private-owned segment dominate the market during the forecast period.

- Hence, with the increase in demand for fuel and the growing interest of the private players in the Indian fuel station sector, the private-owned segment is expected to grow significantly during the forecast period.

Rising Passenger Vehicles Penetration May Help the Market Grow

- India is one of the largest economies in the world. Further, the country is expected to remain the fastest-growing economy during the forecast period due to the rising population, urbanization, and industrialization.

- The country has seen remarkable economic growth in recent years, with rising living standards and average income. A steady rise in vehicle sales has also been witnessed in recent years.

- India has seen a total annual vehicle sales rise from 1.98 million in 2008 to 3.78 million in 2021, of which the passenger vehicles alone accounted for 3.06 million. Further, vehicle sales are expected to grow during the forecast period, which may increase the demand for fuel and fuel stations in the country.

- The rise of the Indian middle class is essential in vehicle sales. Moreover, an estimated 500 million people will likely move into the middle-and high-income brackets by 2030. This is expected to go together with the rise in vehicle sales.

- Hence, all these factors are expected to cause a rise in vehicle sales in India, likely to propel the demand for retail fuel stations during the forecast period.

India Petrol Station Industry Overview

The Indian fuel station market is moderately consolidated. Some of the key players (in no particular order) include Indian Oil Corporation Ltd, Bharat Petroleum Corp. Ltd, Hindustan Petroleum Corporation Limited, Nayara Energy Limited, and Reliance Industries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Company-Wise Retail Fuel Stations in India, 2013-2021

- 4.4 State-Wise Retail Fuel Stations in India, 2021

- 4.5 India Gasoline and Diesel Consumption Trends, till 2021

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.2 Restraints

- 4.9 Supply Chain Analysis

- 4.10 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Ownership

- 5.1.1 Public Sector Undertakings

- 5.1.2 Private Owned

- 5.2 By End-User

- 5.2.1 Public-Sector

- 5.2.2 Private-Sector

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Indian Oil Corporation Ltd

- 6.3.2 Bharat Petroleum Corp. Ltd

- 6.3.3 Hindustan Petroleum Corporation Limited

- 6.3.4 Nayara Energy Limited

- 6.3.5 Reliance Industries Limited

- 6.3.6 Royal Dutch Shell PLC

- 6.3.7 TotalEnergies SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219