|

市場調查報告書

商品編碼

1635384

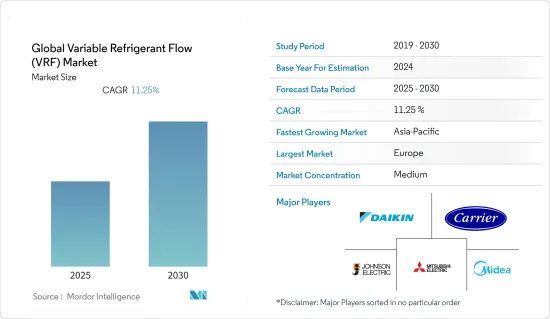

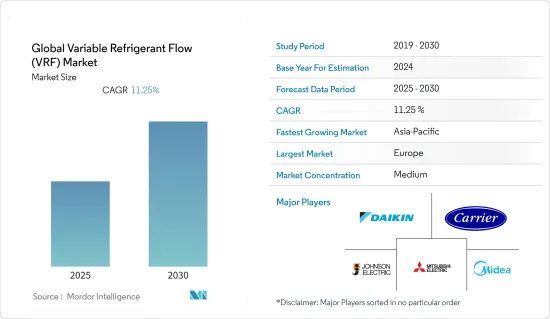

全球可變冷媒流量 (VRF) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Variable Refrigerant Flow (VRF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

全球可變冷媒流量 (VRF) 市場預計在預測期內複合年成長率為 11.25%

主要亮點

- VRF 系統具有同步加熱和冷卻服務、精確的溫度控制和高能源效率。與傳統方法相比,這些優勢提供了競爭優勢,並且是產業擴張的關鍵驅動力。建築業的擴張、房地產和建築業的放鬆管制、巨大的節能潛力、VRF 系統的低維護性和簡單性是推動 VRF 系統市場的主要因素。

- 例如,根據歐盟統計局的數據,2022 年 4 月歐盟建築業產出比去年同月增加了 3%。此外,2020年歐洲各國建設業產值各國差異較大。同年,德國產值最高,約3,790億歐元,其次是法國,為3,030億歐元。 2020年,歐盟27國年銷售額近1.7兆歐元。

- 對與全球暖化和臭氧層消耗相關的環境問題的擔憂導致了全球和區域法規的製定,這些法規對冷媒應用產生了重大影響。購買、設計、安裝和維修空調和冷凍設備的製造商和最終用戶應參考現行國家法規、規範和標準,以協助選擇適合其預期用途的冷媒。

- 聯合國環境規劃署技術、工業和經濟部 (UNEP DTIE) 臭氧行動司正在審查《關於蒙特婁議定書》下的承諾,特別是與逐步淘汰氟烴塑膠(HCFC) 相關的承諾。正在協助各國遵守規定。 HCFC 的替代品包括氨、碳氫化合物和二氧化碳等天然冷媒,以及全球暖化潛勢 (GWP) 較低的氣候和臭氧友善型 HFC,包括飽和和不飽和 HFC (HFO)。

- 由於 COVID-19 的爆發,各行業對他們購買的服務和產品對環境的影響表示擔憂,並願意為比其他產品更環保、更健康的產品支付更多費用。智慧暖通空調系統預計會有很高的需求。從自我控制到整合感測器、遠端溫度調節和能源控制,技術為最終用戶提供了更多控制權。 HVAC 系統根據不定期出勤導致的建築物運轉率情況來處理不同的負載條件。這需要合理化每位員工的佔地面積並持續發展辦公空間的使用模式。

VRF系統市場趨勢

市場區隔在市場成長中發揮重要作用

- 供氣 VRF 在亞洲和歐洲廣泛使用,並在全球範圍內受到青睞。我們正在迅速擴大在北美住宅和商業領域的佔有率。在被動式房屋計劃和其他旨在減少對石化燃料依賴的計劃中使用 VRF 的趨勢日益明顯。後者是目前特別熱門的話題,因為許多直轄市、城市甚至州都在推動全面電氣化。建築電氣化旨在將所有能源使用僅轉換為電力,因為電力系統變得更加環保並且減少對石化燃料的依賴。透過使用空氣源熱泵而不是燃氣爐或鍋爐,VRF 可以幫助實現這一目標。

- 根據美國人口普查局的數據,2002年至2021年間,美國公共住宅投資大幅增加。 2021年公共部門住宅建設計劃支出超過90億美元,較2020年略有下降。增幅最大的是2020年,公共住宅支出從68.9億美元增加到91.9億美元,增幅顯著。預計未來幾年美國住宅的總成本將會上升。

- 本公司開發新產品以滿足客戶的需求。例如,2022年2月,為了保持客戶關注並加快輕型商用暖通空調領域的步伐,開利中國發布了新的XCT8可變冷媒流量(VRF)系列。全新XCT8系列由開利佛山南海工廠製造,堅定不移地致力於品質、技術和能源效率,以滿足中國和海外客戶的需求。新型XCT8直流變頻多聯機系統填補了部分前代機型的空白,並超過中國GB 21454-2008多聯空調熱泵機組國家能源效率標準。

- 政府在住宅計劃開發方面的措施預計將為 VRF 市場創造重大成長機會。例如,2022 年 3 月,哈伊馬角開發人員Al Hamra 宣布了一項耗資 10 億迪拉姆(2.72 億美元)的住宅計劃,作為阿拉伯聯合大公國住宅市場更廣泛復甦的一部分。獵鷹島將建在哈姆拉村 (Al Hamra Village) 內,這是一個住宅,包括購物中心、遊艇俱樂部和酒店。該新計劃推出阿拉伯聯合大公國住宅市場繼續從冠狀病毒引發的低迷中復甦之際。為遠距工作者和退休金領取者提供居住以及擴大十年黃金簽證計劃等新的政府舉措正在提振市場。

- 此外,政府推出的智慧城市措施也為建築業提供了強勁的推動力。韓國基礎設施部先前宣布,韓國建設公司組成的財團將在科威特建造一座耗資 40 億美元的生態友善住宅城市。該財團主要由浦項製鐵 A&C 和現代建築與工程師協會主導,計劃建造一座環保、有組織、互聯的智慧城市。

歐洲市場佔有率突出

- 大多數商業機構都使用 VRF 系統,從小型商店和咖啡館到大型辦公大樓和公共區域。透過 VRF 分區,能源僅在辦公室運作中用於冷卻或加熱。 VRF 系統具有安靜的室內機和保持精確溫度控制的能力,可確保最舒適和高效的職場環境。

- 公司正在歐洲推出和銷售其產品,以擴大其影響力並佔領更廣泛的市場佔有率。例如,2021年2月,該航空公司向歐洲引進了XCT7 VRF空調系統。該系列包括單風扇和雙風扇、側面排放、頂部排放和全排放熱回收熱泵機組,功率範圍為 4 至 26 馬力。每個外部系統最多可將 4 個室外單元連結在一起,以實現 104 匹馬力的功率,同時最多可連接 64 個室內單元。室內機有環路、1路、2路、4路卡式等12種型。創新功能包括改善冷媒分佈平衡的離心式油分離器、增加耐腐蝕性的黑色塗層翅片技術、降低液體衝擊故障率的抗液衝擊壓縮機技術以及順暢供應潤滑油的十級回油技術. 它配備了功能。

- 此外,三星電子將於 2021 年 7 月在全球發表新款 VRF(可變冷媒流量)室外機「DVM S2」。當與室內機結合使用時,該公司的專利 WindFree Cooling 可以在任何地方實現,而無需忍受冷空氣直接流入房間的痛苦。三星第六代數位可變多聯空調(型號 DVM S2)的室外安裝技術實現了更大的多功能性和功能性。它允許連接 64 台三星室內空調,提供最大的舒適度,而不會產生令人討厭的冷風。 DVM S2 目前已在歐洲上市,可與三星的 1Way、4Way、4Way 600600 和壁掛式機型搭配使用。

- 為了滿足客戶需求,該地區的公司提供各種產品以增加市場佔有率。例如,博世的 VRF 空調系統不僅在一個中央系統中提供高達 270kW 的大容量,而且還採用了模組化設計,具有節省空間的室外單元、時尚的室內單元和複雜的控制設備方法。此高效產品系列適用於飯店、企業、醫院、餐廳、別墅、學校等空調設備。 VRF 系統的優點包括與建築管理系統的連接、每個房間的控制和集中控制。

- COVID-19 的疫情對 VRF 系統業務以及其他行業產生了重大負面影響。一方面,VRF 系統製造商必須處理所有問題,例如採購生產 VRF 系統所需的原料和組件、交付成品以及吸引偏遠地區的工人。然而,各種製造組織自動化程度的提高以及用於調度和警報的建築自動化系統(BAS)的整合對市場成長產生了積極影響。

- 此外,歐盟擁有英國、法國、德國、丹麥、瑞士、盧森堡、比利時和其他斯堪地那維亞國家等富裕國家,是世界上人均收入和GDP最高的國家之一。根據國際貨幣基金組織的數據,2020年歐盟國內生產總值151,670億美元,預計2026年將達到211,830億美元。該地區的人均收入也很高,有七個歐洲國家位居世界前七名。因此,歐洲公民能夠在建築自動化和生活空間智慧整合上花費大量資金,這推動了所研究的市場。

VRF系統產業概況

全球可變冷媒流量 (VRF) 市場由於少數主要參與者的存在而適度整合。公司不斷投資於策略聯盟和產品開發,以佔領更多的市場佔有率。我們將介紹一些最近的市場趨勢。

- 2022 年 4 月 - 三星推出全新 DVM S2 可變冷媒流量 (VRF) 室外空調機組,擴大了空調產品線。除了室內空調機組外,VRF 機組也被列為用於冷凍的設備。該公司表示,WindFree 技術「消除了嚴重的冷風,並透過 23,000 個微孔以 0.15 m/s 的速度分散空氣,有助於創造一個靜止的空氣環境」。全新 DVM S2 系列提供多種容量,包括熱泵和純冷卻版本,功率範圍從 8 HP 到 34 HP。

- 2022 年 2 月 - 可變冷媒流量 (VRF) 和輕型商用 HVAC 合資企業開利 (Carrier) 與東芝開利公司 (TCC) 簽訂了具有法律約束力的協議,收購東芝公司的所有權。 Carrier Global Corporation 提供健康、安全、永續、智慧的建築和低溫運輸解決方案。此次收購以尖端和獨特的技術擴展了全球 VRF 產品平台,為產品組合增添了一個知名品牌,並鞏固了該營運商在成長最快的 HVAC 類別之一的地位。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- HVAC VRF 系統具有有吸引力的經濟和環境效益,可推動成長

- VRF 系統具有很高的節能潛力,幾乎不需要維護。

- 市場限制因素

- 初始成本高

- 競爭加劇限制了淨利率

第6章 市場細分

- 按成分

- 室外機

- 室內機

- 按最終用戶

- 工業的

- 商業的

- 住宅

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Daikin

- Carrier

- Mitsubishi Electric

- Midea Group

- Johnson Electric

- LG Electronics

- Fujitsu

- Lennox

- Panasonic

- Samsung Electronics

第8章供應商定位分析

第9章投資分析

第10章投資分析市場的未來

簡介目錄

Product Code: 91613

The Global Variable Refrigerant Flow Market is expected to register a CAGR of 11.25% during the forecast period.

Key Highlights

- VRF systems offer simultaneous heating and cooling services, accurate temperature control, and high energy efficiency. These benefits give these systems a competitive edge over conventional methods and are the main drivers of industry expansion. The expanding construction industry, loosening regulations in the real estate and construction sectors, significant potential for energy savings, and low and simple maintenance needs of VRF systems are all major factors propelling the market for VRF systems.

- For instance, According to Eurostat, Construction output in European Union increased 3%, in April of 2022 over the same month in the previous year. Furthermore, The production value of the construction industry in European countries in 2020 varied drastically per country. That year, Germany had recorded the largest production value at roughly EUR 379 billion, followed by France at EUR 303 billion. In 2020, the annual turnover of the EU-27 countries amounted to almost EUR 1.7 trillion.

- Environmental concerns regarding global warming and ozone depletion have led over time to the development of evolving global and regional regulations, which have had significant implications for refrigerants across applications. Manufacturers and end-users who purchase, design, install, and service equipment air conditioning and refrigeration equipment should consult their specific country's current regulations, codes, and standards to aid with refrigerant selection for each intended use.

- The United Nations Environment Program - Division of Technology, Industry, and Economics (UNEP DTIE) OzonAction Branch assists countries in complying with their commitments under the Montreal Protocol on Substances that Deplete the Ozone Layer, especially those related to the phase-out of hydrochlorofluorocarbons (HCFCs). The substitutes to HCFCs include the climate and ozone-friendly alternatives such as natural refrigerants - ammonia, hydrocarbons, and carbon dioxide; and lower global warming potential (GWP) HFCs, both saturated HFCs and unsaturated HFCs (HFOs).

- With the outbreak of COVID-19, industrial companies are expressing concerns about the environmental impact of the services and products they buy and are willing to pay more for more environmentally and health-friendly options than others. Smart HVAC systems are expected to have significant demand. Technology gives end-users more control, from self-regulation to sensors to remote temperature adjustment to integrating energy controls. The HVAC systems deal with varied load conditions depending on the occupancy rate in the buildings due to irregular attendance. Rationalizing square foot occupancy per employee and evolving office space usage patterns will be necessary.

VRF Systems Market Trends

Residential Segments Plays a Prominent role in Market Growth

- Air supply VRF is widely used in Asia and Europe and is well-liked worldwide. It is quickly gaining market share in North America's residential and commercial sectors. The use of VRF in Passive House projects or other projects looking to reduce their site's reliance on fossil fuels is a growing trend. Due to the current push for complete electrification by numerous municipalities, cities, and even states, the latter is a particularly hot topic. Building electrification aims to convert all energy uses to electricity alone as the power system becomes more environmentally friendly and less dependent on fossil fuels. By using an air source heat pump rather than a gas-driven furnace or boiler, VRF can help achieve this goal.

- According to US census Bureau, Between 2002 and 2021, public residential building investment in the US increased dramatically in value. Over USD 9 billion were spent on residential construction projects by the public sector in 2021, a minor decline from 2020. The highest rise occurred in 2020, when public residential spending increased to USD 9.19 billion from USD 6.89 billion, representing a significant increase. Over the next few years, it's anticipated that the total cost of newly built homes in the US will rise.

- To meet the demands of the customer, the firms are developing new products. For Instance,in February 2022, In order to maintain its pace and sharpen its emphasis on clients in the light commercial HVAC segment, Carrier China has introduced the new XCT8 variable refrigerant flow (VRF) series. The new XCT8 series is produced in Carrier's Nanhai, Foshan factory with an unwavering dedication to quality, technology, and energy efficiency in order to satisfy the needs of Chinese and international customers. The new XCT8 direct current frequency conversion VRF systems close gaps in some earlier generation models and surpass China's GB 21454-2008 national energy efficiency standard for multi-connected air conditioner heat pump units.

- The government policies in the developments of the housing projects will significantly create opportunity for the VRF Market to grow. For instance, in March 2022, Al Hamra, a developer in Ras Al Khaimah, announced an AED1 billion (UDS 272 million) residential project as part of a broader recovery in the UAE's housing market. Falcon Island will be created within Al Hamra Village, a residential neighborhood with a mall, a yacht club, and hotels. The new project is being launched as the UAE's housing market continues to recover from the coronavirus-induced slump. New government efforts such as residency for distant workers and pensioners and the expansion of the 10-year golden visa program have boosted the market.

- Moreover, the Smart City initiative that the government launched has been pushing the construction sector strongly. The South Korean infrastructure ministry has previously announced a consortium of South Korean construction companies to build an eco-friendly USD 4 billion residential city in Kuwait. Primarily led by Posco A&C and Hyundai Architects and Engineers Associates Co., the consortium would be building a smart city that is environment-friendly, well-organized, and connected.

Europe Holds the Prominent Share of the Market

- Most commercial structures, from little stores and cafes to big office complexes and public areas, use VRF systems. VRF zoning ensures that energy is only used to cool, or heat occupied offices. Due to their quiet indoor units and ability to maintain precise temperature control, VRF systems guarantee the most comfortable and productive work environment.

- To expand their presence and capture a wide market share, the companies are launching and making available in Europe. For instance, in February 2021, Carrier introduced its XCT7 VRF air conditioning system in Europe. The range includes sizes from 4 to 26hp in single- and dual-fan, side discharge, top discharge, and full discharge heat recovery heat pump units. To achieve 104 horsepower with up to 64 indoor units per outside system, up to four outdoor units can be coupled. Twelve indoor units are offered, including round-way, 1-, 2-, and 4-way cassettes. Innovative features include a centrifugal oil separator that improves refrigerant distribution balance, a black-coated fin technology that increases corrosion resistance, anti-liquid shock compressor technology that lowers the failure rate from liquid shock, and a 10-stage oil return technology that ensures a smooth supply of lubricant.

- Furthermore, In July 2021, The new DVM S2 Variable Refrigerant Flow (VRF) outdoor air conditioning unit from Samsung Electronics will be released globally. It combines with interior units to deliver the company's patented WindFree Cooling anywhere without the pain of direct cold air flow indoors. The outdoor-installed technology of Samsung's sixth-generation Digital Variable Multi air conditioner, model number DVM S2, allows for greater versatility and functionality. It allows connection with 64 Samsung interior air conditioning units to provide the best comfort possible without unwelcome cold breezes. In Europe, DVM S2 is now offered and works with Samsung's 1Way, 4Way, 4Way 600600, and wall-mounted variants.

- To meet the demands of the customers the firms in the region are providing different products so that they can enhance their market share. For example, In addition to providing a large capacity range of up to 270 kW in a single central system, Bosch VRF Air Conditioning Systems also employs a modular design approach with space-saving outside units, fashionable indoor units, and sophisticated controls. This high-efficiency product line is appropriate for air-conditioning facilities, including hotels, businesses, hospitals, restaurants, villas, and schools. The advantages of a VRF system include connecting to building management systems and providing individual room control and centralized control.

- The COVID-19 epidemic significantly negatively impacted the VRF systems business, just like it did in any other industry. On the one hand, procuring the raw materials and components needed to produce VRF Systems, delivering finished goods, and luring workers out of quarantines were all issues that VRF system makers had to deal with. However, the market growth has been positively impacted by increasing automation in various manufacturing organizations and integrating the Building Automation System (BAS) for schedules and alarms.

- Moreover, With affluent countries like the United Kingdom, France, Germany, Denmark, Switzerland, Luxembourg, Belgium, and other Scandinavian countries EU has one of the highest per capita income and GDP in the world. According to IMF, the European Union Gross Domestic Product in 2020 was USD 15,167 billion and is expected to reach USD 21,183 billion by 2026. The region's per capita income is also high, with seven European countries being in the top seven in the world. This allows the European citizens to spend higher on building automation and smart integration of the living space which will drive the studied market

VRF Systems Industry Overview

The Global Variable Refrigerant Flow (VRF) market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- April 2022 - With the introduction of its brand-new DVM S2 Variable Refrigerant Flow (VRF) outdoor air conditioning unit, Samsung has expanded its AC product line. Together with the interior AC units, the VRF unit provides cooling. WindFree technology, according to the business, "eliminates severe cold draughts and disperses air through 23,000 micro holes at a speed of 0.15 m/s that aids in producing a still air environment." Between 8HP and 34HP in heat pump and cooling-only variants, the new DVM S2 lineup will be offered in a variety of capacities.

- February 2022 - The variable refrigerant flow (VRF) and light commercial HVAC joint venture between Carrier and Toshiba Carrier Corporation (TCC) have signed a legally binding agreement to buy out Toshiba Corporation's ownership stake. Carrier Global Corporation provides healthy, safe, sustainable, and intelligent building and cold chain solutions. As well as expanding its global VRF product platform with cutting-edge and distinctive technology and the inclusion of a known brand to its portfolio, the anticipated purchase will boost Carrier's position in one of the fastest-growing HVAC categories.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Attractive Economic & Environmental Benefits of HVAC VRF Systems to Foster Growth

- 5.1.2 VRF systems have a high potential for energy savings and need little to no maintenance

- 5.2 Market Restraints

- 5.2.1 High Initial Costs

- 5.2.2 Growing Competition to Limit Margin

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Outdoor Units

- 6.1.2 Indoor Units

- 6.2 By End User

- 6.2.1 Industrial

- 6.2.2 Commercial

- 6.2.3 Residential

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin

- 7.1.2 Carrier

- 7.1.3 Mitsubishi Electric

- 7.1.4 Midea Group

- 7.1.5 Johnson Electric

- 7.1.6 LG Electronics

- 7.1.7 Fujitsu

- 7.1.8 Lennox

- 7.1.9 Panasonic

- 7.1.10 Samsung Electronics

8 VENDOR POSITIONING ANALYSIS

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219