|

市場調查報告書

商品編碼

1635373

建築 TIC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Construction TIC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

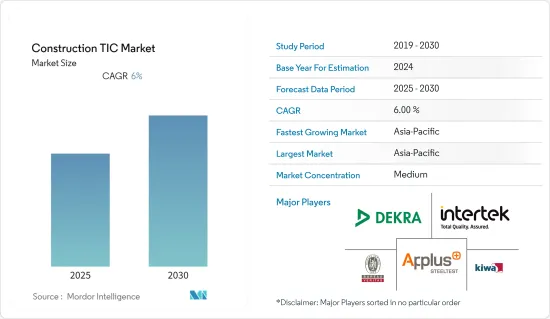

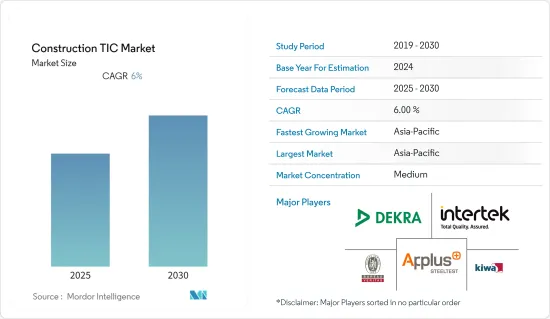

建築 TIC 市場預計在預測期內複合年成長率為 6%。

主要亮點

- 公共/政府當局必須提供以安全性和可靠性為核心的長期營運的基礎設施、房地產、零售、飯店、醫院和其他設施。鑑於該制度提出的各種法律要求、特定計劃的框架要求以及必須滿足的其他法規,商業房地產開發是一個合規雷區。

- 市場上的 TIC 服務涵蓋了從規劃到移交的業務待開發區計劃,包括測試、檢驗、認證和計劃管理。營運階段的資產管理(設施管理)也是業界關注 MEP 裝置永續性的問題,包括結構穩定性、暖通空調、消防系統和垂直運輸(電梯)。

- 在建築領域,無損檢測 (NDT) 服務可確保各個階段使用的所有材料和連接工藝都具有最高品質。無損檢測服務在建設產業的應用相當廣泛,從建築診斷到水泥建築物檢查。

- 為建設產業提供的各種 TIC 服務包括 QA/QC 現場檢查、建築材料測試、計劃管理、施工監督、LEED 等綠建築認證支援、設計審查、授權解決方案、能源績效評估和生命週期分析等。

- 每家公司提供的著名建築認證計劃包括 ISO 55001 資產管理、ISO 9001、ISO 14001,以滿足品質和環境管理法規,以及職業健康和安全管理體系,以防止職場相關的事故和疾病。 45001 和其他認證計劃。 SOCOTEC是英國最大的獨立建築材料測試實驗室,按照UKAS認可的程序和測試方法運作,所有採樣和測試方法均基於現行英國和歐洲標準。

- 建築領域正在進行多項夥伴關係活動。例如,2021 年 4 月,FDH 基礎設施服務有限責任公司與馬歇爾大學合作,與美國陸軍工兵團研究與開發中心簽訂了多年合約。合約範圍著重於無損檢測和結構健康監測(SHM)技術,以表徵通航河流沿岸大型水壩中嵌入的閘門錨的生命週期。

- 由於 COVID-19,印度、中國、義大利、西班牙和法國等多個國家的建築業活動受到嚴重影響。隨後,建設產業被允許逐步恢復生產。然而,由於限制措施和旅行禁令,出現了一些挑戰,包括勞動力短缺、供應鏈中斷導致建築材料短缺,以及因加強健康和安全措施而產生的額外成本。

建築TIC市場趨勢

測試檢驗領域佔有較大佔有率

- 全球化導致產品標準化程度提高,以及已開發技術滲透到建築和施工等各個行業,導致 TIC 市場在預測期內成長。

- 此外,中階人口的成長、快速都市化、網路化、通訊技術的進步以及對測試、檢驗和認證服務外包的偏好正在推動建設產業TIC 市場的成長。

- 此外,市場上的各個參與者都致力於開發和推出新產品和服務,以滿足各行業廣泛客戶的需求。例如,2021年2月,全球領先的測試、檢驗和認證公司Dekra擴展到能源產業和管線建設的無損材料測試(NDT)服務。這些服務有助於提高工作績效和工作效率。

- 隨著建築業結構安全需求的建設產業,建築業對 TIC 的需求也增加。許多建築商和承包商更喜歡 TIC,因為它可以幫助他們按時完成建造計劃。測試方法價格的某種程度的分散可以對市場產生約束。綠色和永續建築的出現可能為 TIC 服務提供者帶來市場機會。然而,缺乏測試設備和技術人員可能會帶來市場挑戰。

- 此外,印度中央政府已於2021年12月進行100%資本投資,用於測試中心的建築施工、公共事業安裝和測試車道設施。預計這將在預測期內進一步推動市場成長。

亞太地區佔主要市場佔有率

- 亞太地區正在經歷研發投入的增加、都市化和工業化的快速發展、大規模的製造能力和出口、中等收入群體人均收入的提高、生活方式的改善以及品質認證、測試和檢驗的重要性不斷上升。預計消費者對市場的認知在預測期內將出現較高的複合年成長率。此外,已開發國家在該地區設有製造地,特別是在中國和印度。

- 例如,印度政府計劃在2022年3月在該國建造8500公里的道路和11,000公里的國家公路走廊。出版商預計這項建設活動將為 2022 年產業成長做出貢獻。印度政府和杜拜政府簽署了一項協議,將在查謨和克什米爾建造工業、IT塔、物流中心、醫學院、多功能塔和專科醫院。

- 網路和通訊技術的進步,以及對外包測試、檢驗和認證服務的偏好,正在促進建設產業TIC 市場的成長。此外,2021 年 11 月,印度政府核准在 Pradhan Mantri Awas Yojana(都市區)下建造 361 萬套住宅。此外,透過支持新建住宅,該計劃下批准的住宅總數已達到1.14兆套,這正在推動市場成長。

- 近年來,世界各國都市區大幅增加。因此,人們對安全、永續建築和健康城市環境的期望不斷提高。 TIC 服務可協助建築業的參與者開發高品質、盈利且符合環境和安全法規的設施和基礎設施。此外,2021年8月,印度宣布計劃透過資產租賃計畫籌集6兆印度盧比,以確保基礎設施計劃的政府預算資金。

建築TIC行業概況

全球建築 TIC 市場競爭激烈,眾多參與者包括 Intertek Group PLC、Bureau Veritas SA、Kiwa NV 和 Applus Services SA。市場參與者正致力於擴大其國內和國際基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。然而,隨著技術和產品發明的改進,中小企業(SME)正在透過贏得新契約和進入新市場來擴大其市場佔有率。

- 2022 年 1 月 - 建築和基礎設施風險管理領域的領先供應商 SOCOTEC Group 宣布收購荷蘭岩土勘察和岩土市場的領導者 Inpijn Blokpoel。透過收購 Inpijn Blokpoel Engineers,SOCOTEC 鞏固了其作為荷蘭建築和基礎設施 TIC 市場主要企業的地位,並擴大了其服務組合,以更好地為客戶服務。 SOCOTEC 集團的目標是成為建築和基礎設施領域以及整個建築環境生命週期的測試、檢驗和認證服務的領先提供者。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 增加建設活動投資

- 市場挑戰

- 供應鏈複雜性

第 6 章 細分

- 按服務類型

- 測試和檢驗服務

- 認證服務

- 依採購類型

- 外包

- 在內部

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Intertek Group PLC

- Bureau Veritas SA

- Kiwa NV

- Applus+Services SA

- Dekra certification Gmbh(DEKRA SE)

- TUV SUD

- Vincotte International SA

- HQTS Group

- SGS SA

- MISTRAS Group Inc.

- Atlas

第8章投資分析

第9章市場的未來

The Construction TIC Market is expected to register a CAGR of 6% during the forecast period.

Key Highlights

- Public/government authorities need to deliver infrastructure, real estate, retail, hotels, and hospitals that operate with safety and reliability as a core over the long term of its existence. safety and compliance are key to any major construction project. Considering the variable legislative requirements introduced by institutions, project-specific framework demands, and a host of other regulations to meet, commercial property development is a compliance minefield.

- TIC services in the marketplace cover a wide range of operations from planning to handover in greenfield projects, including testing, inspection and certification, and project management. Managing assets during the operational phase (facility management) with respect to structural stability, sustainability of MEP installation, including HVAC, fire system, and vertical transportation (lift), have also become a concern for the industry

- In the construction sector, non-destructive testing (NDT) services ensure that all materials and joining processes utilized during the various phases are of the highest quality. The applications of NDT services within the construction industry are considerably vast, ranging from building diagnoses to testing concrete structures.

- Various TIC services that cater to the construction industry include QA/QC site inspections, building materials testing, project management, and construction supervision, assistance with green building certifications like LEED, design reviews, permitting solutions, energy performance assessments, and lifecycle analysis.

- Some prominent construction certification programs offered by companies include ISO 55001 Asset Management, ISO 9001, and ISO 14001, to meet quality and environmental management regulations, and ISO 45001, which assesses occupational safety and health management systems to prevent workplace-related accidents and illness. SOCOTEC is the UK's largest independent construction materials testing laboratory that operates according to UKAS accredited procedures and test methods, whose sampling and testing methods are based entirely on the current British and European Standards.

- The construction sector is witnessing multiple partnership activities. For instance, in April 2021, FDH Infrastructure Services LLC collaborated with Marshall University on a multi-year agreement with the United States Army Corps of Engineers, Engineer Research and Development Center. The contract scope centers on non-destructive testing and structural health monitoring (SHM) technologies to characterize the lifecycle of embedded gate anchorages in big dams along navigable rivers.

- Due to Covid-19, construction sector activities were severely affected in some countries (such as India, China, Italy, Spain, and France, among others). Then, the construction industries were gradually allowed to take up production again. However, several difficulties arose due to the confinement measures and travel bans, such as labor shortages, supply chain disruptions leading to scarcity of construction material, and additional costs due to intensified health and security measures.

Construction TIC Market Trends

Testing and Inspection Segment to Hold a Significant Share

- Globalization has resulted in product standardization norms and penetration of developed technologies across various industries such as building and construction, among others, resulting in the growth of the TIC market during the forecast period.

- Furthermore, the growing middle-class population, rapid urbanization, networking, and communication technology advancement, and a preference to outsource testing, inspection, and certification services have fueled the growth of the TIC market in the building and construction industry.

- Various players in the market are also focusing on developing and launching new products and services to cater to the needs of a wide range of customers across industries. For instance, in February 2021, Dekra, one of the world's leading testing, inspection, and certification, expanded into non-destructive material testing (NDT) services for the energy industry and pipeline construction. These services help to improve work performance and worker efficiency.

- The demand for TIC for building and construction is increasing as the industry's structural safety needs grow. Many builders and contractors prefer TIC because it helps to ensure that construction projects are completed on time. Constant variation in the prices of testing methods can be a market restraint. The emergence of green and sustainable construction may present a market opportunity for TIC service providers. However, lacking testing facilities and skilled resources may pose a market challenge.

- Furthermore, the Central Government of India provided a 100% capital investment in December 2021 for the construction of a building, the establishment of utilities, and the test lane equipment for the test center. It will further drive the market growth over the forecast period.

Asia Pacific to Hold Significant Market Share

- Asia-Pacific is expected to have a high CAGR during the forecast period due to rising R&D investment, rapid urbanization and industrialization, massive manufacturing capabilities and exports, rising per capita income among the middle-class population, improved lifestyles, and increasing consumer awareness about the importance of quality certification, testing, and inspection. Furthermore, the developed countries have manufacturing units in the region, particularly in China and India.

- For instance, by March 2022, the Government of India intends to build 8,500 kilometers of roads and 11,000 kilometers of National Highway corridors in the country. The publisher anticipates that these construction activities will help the industry grow in 2022. The Indian government and the government of Dubai signed an agreement to construct industrial parks, IT towers, logistics centers, a medical college, multipurpose towers, and a specialized hospital in Jammu and Kashmir.

- The advancements in networking and communication technology, and the preference for outsourcing testing, inspection, and certification services have all contributed to the growth of the TIC market in the building and construction industry. Additionally, in November 2021, the Indian Administration approved the construction of 3.61 lakh homes under the Pradhan Mantri Awas Yojana (Urban). Moreover, supporting the new housing units takes the total number of sanctioned places under the scheme to 1.14 crore which has driven the market growth.

- During the last few years, countries worldwide have noticed significant urban population growth. Hence, the expectation for safe, sustainable buildings and a healthy urban environment is increasing. TIC services are helping players in the construction sector develop facilities and infrastructure that are high quality, profitable, and compliant with environmental and safety regulations. Furthermore, in August 2021, India announced its plans to raise INR 6 trillion through an asset-leasing program to free up government budget funds for infrastructure projects.

Construction TIC Industry Overview

Global Construction TIC Market is competitive with the presence of various players such as Intertek Group PLC, Bureau Veritas SA, Kiwa NV, Applus Services SA, among others. The market players are concentrating on expanding their national and international customer base. These firms leverage strategic collaborative initiatives to improve their market share and profitability. However, with technological betterment and product inventions, mid-size to smaller businesses expand their market presence by securing new contracts and entering new markets.

- January 2022 - The SOCOTEC Group, a key vendor in building and infrastructure risk management, has announced the acquisition of Inpijn Blokpoel, a major player in the Dutch ground investigation and geotechnical market. SOCOTEC strengthens its position as a key player in the Dutch construction and infrastructure TIC market by acquiring Inpijn Blokpoel Engineers and expanding its service portfolio to serve its customers better. The group's goal is to become the leading provider of testing, inspection, and certification services in the construction and infrastructure sectors and throughout the lifecycle of any built environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments in Construction Activities

- 5.2 Market Challenges

- 5.2.1 Growing Complexity in Supply Chains

6 SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Testing and Inspection Service

- 6.1.2 Certification Service

- 6.2 By Sourcing Type

- 6.2.1 Outsourced

- 6.2.2 In-house

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intertek Group PLC

- 7.1.2 Bureau Veritas SA

- 7.1.3 Kiwa NV

- 7.1.4 Applus+ Services SA

- 7.1.5 Dekra certification Gmbh (DEKRA SE)

- 7.1.6 TUV SUD

- 7.1.7 Vincotte International SA

- 7.1.8 HQTS Group

- 7.1.9 SGS SA

- 7.1.10 MISTRAS Group Inc.

- 7.1.11 Atlas