|

市場調查報告書

商品編碼

1632069

伺服驅動:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Servo Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

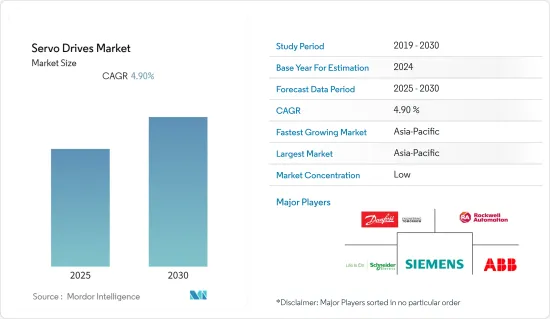

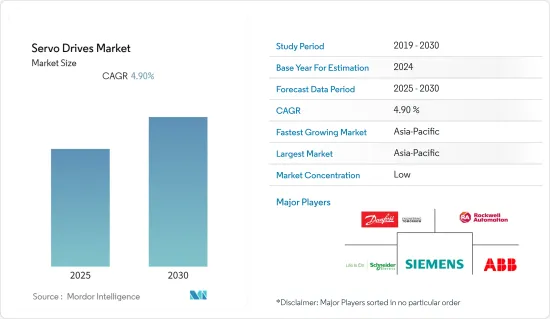

預計伺服驅動器市場在預測期內的複合年成長率為 4.9%。

主要亮點

- 自動導引運輸車(AGV)、自主移動機器人 (AMR) 和自動儲存和搜尋系統 (AS/RS) 等移動機器人正在推動對伺服驅動器的需求,並且這種需求預計將持續下去。這些移動機器人用於大型公司和市政倉庫。

- 例如,Advanced Motion Control 計劃於 2021 年開始將其 FlexPro 驅動器包裝為多軸產品,並將其作為標準產品提供。這些本質上是安裝在單一 PCB 上的多個單獨的 FlexPro 驅動器,具有通用電源和介面。

- 對於伺服電機以外的電機,必須以不同的扭矩和速度部署。然而,伺服馬達作為一個單元提供廣泛的扭矩和速度。此外,這些驅動器需要較少的維護,這是推動各種應用中對伺服驅動器需求的另一個因素。

- 世界各國政府都在工業和商業層面引進節能設備來降低能源消耗,其中伺服驅動器發揮重要作用。此外,由於工業自動化的擴展,未來幾年能源需求預計將增加,預計將擴大伺服驅動器的市場需求。然而,操作複雜性和高昂的初始設置成本正在阻礙市場成長。

- 由於石油和天然氣、採礦、食品加工和汽車等各行業對馬達的使用和需求減少,COVID-19 的爆發削弱了對伺服驅動器的需求。疫情法規導致的供應鏈中斷也影響了市場上伺服驅動器的需求和供應。

伺服驅動器市場趨勢

離散製造業預計將大幅成長

- 伺服驅動器在整個離散製造業中得到了廣泛的應用,這些行業處理汽車、飛機、國防設備、電子產品、半導體和紡織產品的大量生產。

- 英國政府於2019年通過立法,到2050年實現溫室氣體淨零排放,綠色工業革命舉措承諾在2030年結束石化燃料汽車的銷售。

- 過去幾年,各行業的大公司每年都在歐盟地區投資,製造和研發支出不斷增加。例如,2022年3月,英特爾宣布了第一階段計劃,未來10年在歐盟投資800億歐元,涵蓋從研發到製造和尖端封裝技術的半導體價值鏈。製造業務的成長預計將為市場創造巨大潛力。

- 此外,亞太地區開發中國家不斷發展的工業化、基礎設施活動以及石油和天然氣產業的成長可能會主導伺服驅動器的需求。此外,世界人口的快速成長導致過去十年都市化進程加快,各工業部門對產品和服務的需求不斷增加,進而導致工業化程度的提高。

- 此外,印度政府也核准了製藥業 16 家工廠的 PLI 計畫。這16家工廠的建設將需要總投資4,701萬美元。這些工廠的商業開發預計將於 2023 年 4 月開始。政府也宣布將向半導體公司提供10億美元在該國設立製造工廠。

亞太地區預計將佔據較大佔有率

- 隨著亞太地區繼續採用自動化技術,中國擴大採用機器人流程自動化。該地區是支持機器人採用和人工智慧開發的重要市場。此外,中國和印度等國家的幾家當地公司已經開始實施自動化之旅,以控制成本並提高商業價值。

- 此外,該地區的能源問題正在增加伺服驅動器和馬達的採用,並刺激許多行業開發技術先進的節能設備,從而進一步推動伺服驅動器的成長。例如,根據國際能源總署(IEA)報告(2022),2021年亞太地區電力需求將從2020年最低2%增加8%,其中中國和印度佔比10%左右正在增加。

- 該地區的控制系統在能源、石油和天然氣、交通、水利和市政等各個領域不斷湧現。隨著資訊科技與工業的深度融合,物聯網的快速發展,網路化控制系統正成為各國工業自動化的發展趨勢。

- 此外,印度是另一個為研究市場中的供應商提供巨大潛力的國家。該國是一個新興工業化國家,對先進技術的投資不斷增加,使其成為首選的製造地。例如,印度政府計劃增加國內化學品和石化產品的產量,減少進口,使印度成為製造中心。

伺服驅動器產業概況

全球伺服驅動器市場分為以下幾類:丹佛斯、ABB、施耐德電氣等提供技術先進的高品質設備,由於供應商為提高市場影響力而進行的併購和產品發布等活動不斷增加,競爭可能會加劇。

- 2022 年 3 月 - ADVANCED Motion Controls 宣布推出七款具有 60A 連續輸出的超緊湊型 FlexPro伺服驅動器。 60A 的連續額定電流比之前同尺寸型號高出 33%,使其成為該公司功率密度最高的伺服驅動器。該產品包括 PCB 安裝、機械整合和開發板外形尺寸。

- 2021年3月 - 安川電機株式會社推出交流伺服驅動器“Ho-X系列”,作為成熟的“Ho-7系列”的後繼數位資料,以業界最佳的運動性能為客戶增加附加值和數字數據解決方案的發布。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 工業自動化程度提高

- 加強有關能源效率的法規

- 市場挑戰

- 初始成本和安裝成本高

第 6 章 細分

- 按電壓

- 低電壓

- 中壓

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 飲食

- 用水和污水

- 發電

- 金屬/礦業

- 紙漿/造紙製造

- HVAC

- 離散製造

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東和非洲

- 北美洲

第7章供應商市場佔有率分析

第8章 競爭格局

- 公司簡介

- Danfoss

- Rockwell Automation

- Schneider Electric

- Siemens

- ABB Ltd

- Emerson Electric Co.

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- WEG

第9章投資分析

第10章市場的未來

簡介目錄

Product Code: 91170

The Servo Drives Market is expected to register a CAGR of 4.9% during the forecast period.

Key Highlights

- Mobile robotics such as Automated Guided Vehicles (AGV), Autonomous Mobile Robots (AMR), and Automated Storage and Retrieval Systems (AS/RS) have been driving demand for servo drives, and this is expected to continue in the future. These mobile robots are being used in warehouses by large companies and municipalities.

- For instance, in 2021, Advanced Motion Control will start packaging its FlexPro drives as multi-axis products and make them available as standards. They will essentially be several individual FlexPro drives mounted to a single PCB with a common power and interface.

- In the case of motors other than servo motors, they must be deployed with different torque and speeds. But the servo motors provide a diverse range of torque and speeds as a single unit. Further, these drives require less maintenance which are some factors adding demand for servo drives for different applications.

- Governments in various countries are installing energy-saving equipment to decrease energy consumption at industrial and commercial levels, where servo drives play an important role. Also, the demand for energy in coming years is anticipated to rise owing to the growing industrial automation, bolstering the market demand studied. However, the complexity of the operation and high initial setup cost are the factors hindering the market growth.

- The Covid-19 outbreak has weakened the demand for servo drives as the use of motors and its demand from various industries such as oil & gas, mining, food processing, automobile, and others has declined. Also, the disruption in the supply chain due to pandemic restrictions has affected the demand and supply of servo drives in the market.

Servo Drives Market Trends

Discrete Manufacturing is Expected to Grow Significantly

- Servo drives find robust applications across the discrete manufacturing industry, which deals with the mass production of automobiles, aircraft, defense equipment, electronic products, semiconductors, and textiles.

- The UK government passed the law in 2019 to reduce greenhouse gas emissions to net-zero by 2050, and the green industrial revolution initiative pledges to stop the sale of fossil fuel vehicles by 2030, which could boost the adoption of electric cars creating the demand for servo motors and hence for the servo drives.

- The spending on manufacturing and R&D has increased, with the annual investments in the EU region in the past few years by the major players of different industries. For instance, in March 2022, Intel announced the first phase of its plan to invest EUR 80 billion in the EU over the next decade along the entire semiconductor value chain from research and development (R&D) to manufacturing to state-of-the-art packaging technologies. The growth in the manufacturing operations is expected to create a wide scope for the market.

- Furthermore, the rising industrialization, infrastructure activities, and oil & gas industry growth in developing countries of the Asia Pacific region is likely to dominate the demand for servo drives. In addition, the worldwide population is growing at an exponential rate, has led to urbanization over the last decade, and raised the demand for products and services across various industry verticals; as a result, industrialization is rising.

- Moreover, the government of India approved the PLI scheme for 16 plants in the pharmaceutical industry. Establishing these 16 plants would result in a total investment of USD 47.01 million. The commercial development of these plants is expected to begin by April 2023. Also, the government announced USD 1 billion to each semiconductor company to establish manufacturing units in the country.

Asia Pacific is Anticipated to Hold Significant Share

- China is witnessing growth in the adoption of robotic process automation, owing to the growing adoption of automation technologies in Asia-Pacific. The region is an essential market for boosting robotic adoption and AI development. Also, several local businesses in the countries like China and India have started implementing automation journeys to manage costs and improve business value.

- The energy concern in the region is also increasing the adoption of servo drives & motors and stimulating many industries to develop technologically advanced energy-efficient devices, hence further driving the servo drives growth. For instance, according to the International Energy Agency (IEA) report 2022, the electricity demand in 2021 is increased by 8% from a low of 2% in 2020 in the Asia Pacific region and mostly driven by China and India up by around 10%.

- The control systems in the region have emerged across various fields, like the energy, oil and gas, transportation, water, and municipal sectors. Due to the deep integration of information technology and industry and the rapid development of the Internet of Things, the networked control system is becoming the development trend of industrial automation in countries.

- Furthermore, India is another country that offers vast potential for the studied market vendors. The country is a newly industrialized landscape due to increasing investment in advanced technologies, becoming a preferred manufacturing hub. For instance, the Indian government plans to boost domestic production of chemicals and petrochemicals to cut down imports and make India a manufacturing hub for the sector, expected to create the demand for servo forgives in the forecast period.

Servo Drives Industry Overview

The global servo drives market is fragmented owing to players such as Danfoss, ABB, Schneider Electric, etc., that offer high-quality devices with technological advancement. The competition will likely intensify due to rising activities such as mergers and acquisitions and product launches by vendors to enhance their presence in the market.

- March 2022 - ADVANCED Motion Controls has released seven new micro-sized FlexPro servo drives rated to output 60A continuous. The 60A continuous current rating is 33% higher than previous models for the same size making these their highest power-density servo drives. This offering includes PCB Mount, Machine Embedded, and Development Board form factors.

- March 2021 - Yaskawa Electric Corporation announced the launch of the AC servo drives 'Σ-X Series,' the successor to the reputed 'Σ-7 Series,' to enhance customer added value with the industry's best motion performance and digital data solution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Industrial Automation

- 5.1.2 Growing Regulations Regarding Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 High Initial and Installation Cost

6 SEGMENTATION

- 6.1 By Voltage

- 6.1.1 Low

- 6.1.2 Medium

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Food & Beverage

- 6.2.4 Water & Wastewater

- 6.2.5 Power Generation

- 6.2.6 Metal & Mining

- 6.2.7 Pulp & Paper

- 6.2.8 HVAC

- 6.2.9 Discrete Manufacturing

- 6.2.10 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Russia

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia & New Zealand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Chile

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Turkey

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Danfoss

- 8.1.2 Rockwell Automation

- 8.1.3 Schneider Electric

- 8.1.4 Siemens

- 8.1.5 ABB Ltd

- 8.1.6 Emerson Electric Co.

- 8.1.7 Hitachi Ltd.

- 8.1.8 Mitsubishi Electric Corporation

- 8.1.9 Yaskawa Electric Corporation

- 8.1.10 WEG

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219