|

市場調查報告書

商品編碼

1631582

綜合監控:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Unified Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

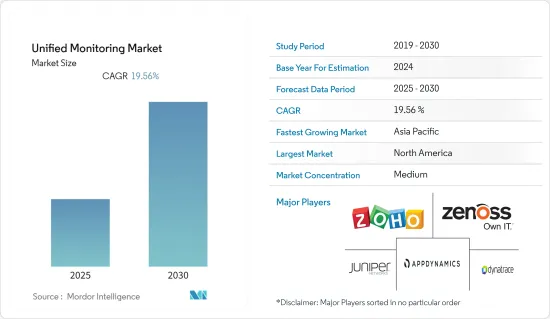

預計預測期內整合監控市場複合年成長率為19.56%

主要亮點

- 數位時代使企業能夠利用物聯網(IoT)、雲端和人工智慧(AI)等新的數位時代技術邁向數位轉型並產生新的業務成果,網路需求的不斷成長預計將推動市場發展。

- 報告顯示,70%的公司已經制定或正在製定數位轉型策略,21%的公司認為已經完成了數位轉型。預計到 2021 年,所有技術支出的約 40% 將用於數位轉型。

- 此外,市場也被公司越來越注重客戶體驗以發展業務所說服。統一監控工具透過監控所有服務、應用程式和技術的可用性和效能,幫助企業提供最佳的客戶體驗。我們也發現,年收益10 億美元的公司透過投資客戶體驗,三年內平均可增加 7 億美元的額外收益。此外,企業尤其是使用 SaaS 應用程式的企業預計收益將增加 10 億美元。

- 隨著 COVID-19 在全球蔓延,各行業及其IT基礎設施正在接受新挑戰的考驗。新的在家工作規範使最終用戶面臨新的挑戰,沒有單一的解決方案是有效的解決方案,因此,基於筒倉的監控方法不再是有效的解決方案,每個技術層獨立工作使用不同的工具對其進行監控,並且不再適合使用。市場預計將看到新功能整合到現有解決方案中以滿足新需求。這些表明供應商已準備好響應不斷變化的需求。

- 此外,在 COVID-19 冠狀病毒大流行期間,大多數消費者依賴數位銀行,針對金融服務業的網路攻擊急劇增加。根據 VMware Carbon Black 威脅分析部門的數據,從 2020 年 2 月到 3 月,網路攻擊增加了 38%。攻擊者利用 COVID-19 發動網路釣魚攻擊、木馬、後門、加密礦工、殭屍網路和勒索軟體。因此,提高對整個企業端點活動的警覺性和可見性比以往任何時候都更加重要。金融機構正在大力投資更新其網路解決方案,這正在推動市場發展。

綜合監控市場趨勢

BFSI 產業成長顯著並引領市場

- 銀行、金融服務和保險公司 (BFSI) 需要 24/7 可用並滿足嚴格的內部和外部服務水準要求的IT基礎設施。由於該部門以有助於公司收益的最終客戶交易為中心,因此公司可以透過強大的IT基礎設施管理工具來確保最終用戶應用程式和業務服務,這些工具支援需要監控且高度依賴的關鍵業務可用性和效能。

- 此外,BFSI 部門還面臨大規模網路攻擊。報告稱,金融機構遭受網路攻擊的可能性是其他機構的 300 倍,需要敏感的安全系統和持續監控。 2021 年,萬事達卡每天報告超過 38,000 次入侵試驗,與前一年同期比較增加 60%。

- 此外,在 COVID-19 冠狀病毒大流行期間,由於大多數用戶依賴數位銀行,針對金融服務業的網路攻擊激增。根據 VMware Carbon Black 威脅分析部門的數據,2021 年至 2022 年間,網路攻擊激增了 47%。隨著攻擊者使用網路釣魚攻擊、特洛伊木馬、後門、加密挖礦程式、殭屍網路和勒索軟體,提高對整個企業端點活動的警覺性和可見性變得比以往任何時候都更加重要。

- 此外,這些組織在地理位置上分散並使用各種技術,從遺留系統到雲端基礎的解決方案。這給這些金融機構帶來了巨大的壓力,要求它們透過即時資料監控所有組件並同時維護安全。

- 在關鍵企業中,不合規端點的自動修復涉及消費者的工作,例如修補系統、啟用防毒工具和檢查最新模式,以及向 IT 發送有關未授權存取的電子郵件。來滿足需求並增強公司的地位。 2022 年 8 月 Syxsense,整合安全和端點管理解決方案的全球領導者,今天宣布推出 Syxsense 零信任,這是 Syxsense Enterprise 中的一個新模組。零信任舉措應側重於端點保護,但傳統的身份驗證解決方案缺乏評估設備運作狀況、確保精細策略合規性和自動風險補救的能力。

北美地區預計將實現顯著成長

- 北美正在經歷快速的技術進步,滲透到教育、醫療保健和通訊等各個領域,資料中心的發展以滿足對伺服器和儲存空間不斷成長的需求,資源成本不斷增加,預計智慧城市計劃將佔據主導地位。由於北美投資增加,預計將推動北美市場的成長,因此整個預測期內市場的成長。

- 許多擁有IT 環境的公司都擁有來自多個供應商的眾多軟體層,這增加了對用戶支援的期望,包括最終用戶用戶端應用程式和具有業務邏輯的應用程式伺服器。功能來自動發現系統中的所有活動軟體資源。

一體化監控產業概況

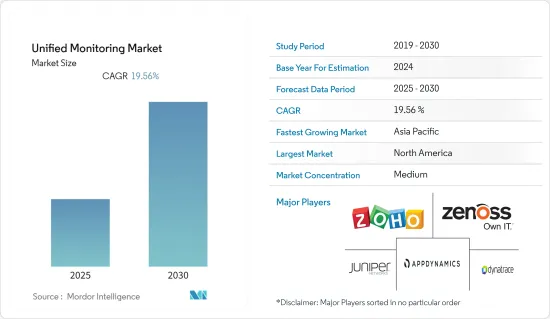

整合監控市場競爭激烈,由 Dynatrace LLC、Zoho Corporation、AppDynamics Inc.、Broadcom Inc. 和 Zenoss Inc. 等幾家大型企業主導。這些主要企業擁有壓倒性的市場佔有率,並致力於擴大海外基本客群。這些公司利用策略合作措施來擴大市場佔有率並提高盈利。然而,隨著技術和產品創新的進步,中小企業(SME)正在透過獲取新契約和開發新市場來增加其在市場上的影響力。

- 2022 年 8 月 - 全球網路安全領導者趨勢科技最近宣布推出趨勢科技 One,這是一款新的統一網路安全和攻擊面管理平台。此次發布是將眾多安全產品和功能整合到單一平台中的重要一步,使客戶能夠更好地了解、溝通和減輕其網路風險。

- 2022 年 7 月 - 全球技術服務和數位轉型公司 MindTree 今天宣布與零信任資料安全公司 Rubrik 合作推出統一網路復原平台 MIDTREE VAULT。 MINDTREE VAULT 使組織能夠快速轉向資料主導模型,確保資料不變性,並增強其保護網路攻擊並快速恢復的能力,從而解決全方位的恢復問題。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 企業快速採用網路解決方案

- 組織對網路安全和安保的興趣日益濃厚

- 市場限制因素

- 監管標準和框架不明確

- 市場機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 的影響

第5章市場區隔

- 按成分

- 解決方案

- 按服務

- 按發展

- 本地

- 雲

- 按行業分類

- BFSI

- 醫療保健/生命科學

- 製造業

- 資訊科技/通訊

- 零售

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Dynatrace LLC

- Zoho Corporation

- AppDynamics Inc.

- Broadcom Inc.

- Zenoss Inc.

- GroundWork Open Source, Inc.

- Acronis International GmbH

- Paessler AG

- Opsview Limited

- Juniper Networks Inc.

- Verizon Enterprise Solutions LLC

第7章 市場未來展望

第8章 市場機會及未來趨勢

The Unified Monitoring Market is expected to register a CAGR of 19.56% during the forecast period.

Key Highlights

- Growing demand for Digital Age Networking that enables enterprises to move toward digital transformation and generate new business outcomes by leveraging new digital age technologies such as the Internet of Things (IoT), cloud, and Artificial Intelligence (AI) is expected to drive the market.

- According to the report, 70% of companies either have a digital transformation strategy or are working on it, and 21% of companies perceive that they have already completed the digital transformation. Around 40% of all technology spending in 2021 is expected to go toward digital transformation.

- Moreover, increasing emphasis on customer experience by the enterprise to grow the business is also compelling the market. The unified monitoring tools help companies to deliver an optimal customer experience by monitoring the availability and performance of all their services, applications, and technologies. It was also found that companies that earn USD 1 billion annually can expect to earn, on average, an additional USD 700 million within three years of investing in customer experience. Additionally, companies using SaaS apps, in particular, can expect to increase revenue by USD 1 billion.

- With the spread of COVID-19 across the globe, industries and their IT infrastructure has been tested for new challenges. The new work-from-home norm has exposed the end-user to new challenges where a single solution is not the efficient solution and has resulted in a silo-based approach for monitoring being no longer sufficient to use, in which each technology tier was monitored independently by a different tool. The market is expected to experience new capabilities being integrated into existing solutions to address emerging needs. They indicate the preparedness of vendors to meet evolving needs.

- Furthermore, during the COVID-19 coronavirus pandemic, most consumers relied on digital banking, and cyberattacks targeting the financial services sector increased dramatically. According to the VMware Carbon Black Threat Analysis Unit, cyberattacks rose by 38% between February and March 2020. Attackers use COVID-19 to launch phishing attacks, trojans, backdoors, crypto miners, botnets, and ransomware. As a result, increased vigilance and visibility into enterprise-wide endpoint activity are more important than ever. Financial institutions are investing heavily to update their networking solutions, which will drive the market.

Unified Monitoring Market Trends

BFSI Sector Will Experience Significant Growth and Drive the Market

- The banking, financial services, and insurance companies (BFSI) demand an IT infrastructure that is available 24X7x365 days and meets rigorous internal and external service level requirements. As the segment majorly deals with end customers, who contribute to companies' revenue, an enterprise needs to ensure that the end-user applications and business services are monitored with a robust IT infrastructure management tool that supports business-critical availability and performance, thus posing a huge dependency on unified monitoring tools.

- Additionally, the BFSI sector faces major cyberattacks. According to the report, financial firms are 300 times more likely than other institutions to experience cyberattacks and thus require a hypervigilant security system and continuous monitoring. In 2021, Mastercard reported over 38,000 intrusion attempts each day, which increased by 60% compared to the previous year.

- Further, during the Covid-19 coronavirus pandemic, most users rely on digital banking, and there has been a sudden increase in cyberattacks targeting the financial services sector. According to the VMware Carbon Black Threat Analysis Unit, cyberattacks spiked by 47% between 2021-2022. Attackers are using phishing attacks, trojans, backdoors, crypto miners, botnets, and ransomware, so increased vigilance and visibility into enterprise-wide endpoint activity are more paramount than ever; financial institutions are investing heavily to update their networking solutions which are expected to drive the market.

- Moreover, these organizations are geographically distributed and deal with different technologies, from legacy systems to hybrid cloud-based solutions. Hence, there is tremendous pressure on such financial organizations to monitor all the components with real-time data, simultaneously maintaining security.

- In significant companies, automated remediation of non-compliant endpoints could include patching the system, enabling an antivirus tool and making sure it is up to date on patterns, emailing IT about unauthorized access, and much more solutions to meet consumer demand and reinforcing their position. In August 2022, Syxsense, a global leader in Unified Security and Endpoint Management solutions, today announced Syxsense Zero Trust, a new module within Syxsense Enterprise that enables endpoint compliance with Zero Trust Network Access policies (ZTNA). Zero Trust initiatives require a hyper-focus on endpoint protection, but traditional authentication solutions lack the ability to evaluate device health, ensure granular policy compliance, and automate risk remediation.

North America is Expected to Experience Significant Growth

- North America is expected to dominate the market throughout the forecast period due to rapid technological advancements and its penetration in various sectors such as education, healthcare, telecom, etc., development of data centers to meet the growing demand for servers and storage space, increasing cost of resources and rising investment in smart cities projects which are expected to drive the growth in North America.

- Most of enterprises with IT landscapes are featuring numerous software layers from multiple vendors, and thus there are rising support expectations from the users' side which is fueling the dependency on unified monitoring capabilities for automatically discovering all of the active software resources in the environment including end-user client applications, and application servers with business logic.

Unified Monitoring Industry Overview

The unified monitoring market is competitive and is dominated by a few major players like Dynatrace LLC, Zoho Corporation, AppDynamics Inc., Broadcom Inc., and Zenoss Inc. These major players, with a prominent share in the market, is focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

- August 2022 - Trend Micro the global leader in cybersecurity, recently announced the launch of Trend Micro One, a new unified cybersecurity and attack surface management platform. This launch is a major step towards consolidating a multitude of security products and features in a single platform, enabling customers to understand better, communicate, and mitigate cyber risks.

- July 2022 - Mindtree, global technology services and digital transformation company, today announced that it has partnered with Rubrik, the Zero Trust Data Securit Company, to launch a unified cyber-recovery platform named MINDTREE VAULT. It enables organizations to work through the full scope of recovery by empowering them to quickly shift to data-driven models, ensure data is immutable, and enhance their ability to guard against cyberattacks and swiftly recover from them.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption for Networking Solutions by Enterprises

- 4.2.2 Increasing Cyber Safety and Security Concerns Among Organisations

- 4.3 Market Restraints

- 4.3.1 Uncertain Regulatory Standards and Frameworks

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-user Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare and Life Sciences

- 5.3.3 Manufacturing

- 5.3.4 IT & Telecommunication

- 5.3.5 Retail

- 5.3.6 Other End-user Vertical

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dynatrace LLC

- 6.1.2 Zoho Corporation

- 6.1.3 AppDynamics Inc.

- 6.1.4 Broadcom Inc.

- 6.1.5 Zenoss Inc.

- 6.1.6 GroundWork Open Source, Inc.

- 6.1.7 Acronis International GmbH

- 6.1.8 Paessler AG

- 6.1.9 Opsview Limited

- 6.1.10 Juniper Networks Inc.

- 6.1.11 Verizon Enterprise Solutions LLC