|

市場調查報告書

商品編碼

1630413

地質導向服務 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Geosteering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

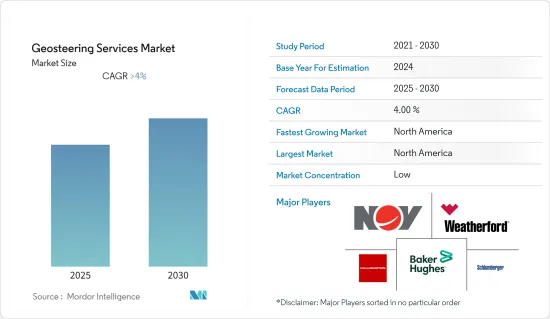

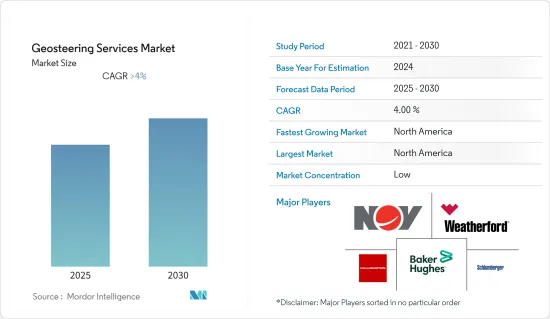

地質導向服務市場預計在預測期內複合年成長率將超過 4%

主要亮點

- 從長遠來看,石油和天然氣鑽井平台數量的增加以及對碳氫化合物的需求增加等因素預計將在預測期內推動市場。

- 另一方面,原油和天然氣價格飆升是阻礙市場成長的主要因素。

- 人們對商業性可行的氣體水合物生產技術越來越感興趣,以滿足日益成長的天然氣需求,預計這將為地質導向市場創造巨大的機會。

- 由於頁岩油氣產量高,預計北美將成為預測期內最大的市場,大部分需求來自美國和加拿大。

地質導向服務市場趨勢

旋轉導向系統不斷發展

- 旋轉導向系統(RSS)是一種用於定向鑽井的鑽井技術。 RSS 是一款專為從地面進行連續、旋轉、定向鑽孔而設計的工具,無需滑動轉向馬達。旋轉導引系統通常在鑽定向井、水平井或長偏置井時部署。

- 旋轉導向系統提供了更好的地面控制和可操作性,以最大限度地減少複雜地質和地震活動帶來的不確定性,並做出明智的導向決策,將油井放置在我將演示的特定區域。這為您提供即時控制和洞察力,以更好地了解您的區域並以最低的成本充分利用您的油井。促進石油和天然氣產量的成長提高了公司在地質導向服務市場的信譽

- 地質導向服務供應商不斷改進旋轉導向系統,以實現精確的井位定位、最佳化油井品質並最大限度地提高鑽井效率。去年,哈里伯頓推出了 iCruise X 智慧旋轉轉向系統 (RSS)。 iCruiseX 具有先進的轉向頭,可在可變流體條件和富含固態的流體中實現更高的耐用性。即使在高溫環境下也能表現良好,並且具有較大的轉向動力。預計工業進步的不斷進步將有助於市場成長。

- 全球天然氣產量從 2020 年的 3,725.9 億立方英尺增加到去年的 3,905.8 億立方英尺,成長了 4.8%。天然氣效用的增加要求增加天然氣產量以滿足全球消費量。

- 全球鑽機數量大幅增加29%,從2020年的16,333座增加到2022年11月的19,135座。鑽機數量的增加直接轉化為產業對地質導向服務的需求增加。在預測期內,鑽機數量可能會進一步增加,從而推動地質導向旋轉導向服務市場的成長。

- 因此,由於鑽機數量的增加、天然氣產量的增加以及地質導向技術領域的進步,預計地質導向旋轉導向服務在預測期內將會增加。

北美市場佔據主導地位

- 北美是最大的地質導向服務市場之一,預計其主導地位將持續下去。該地區是世界主要石油和天然氣生產盆地的所在地,為未來工業成長提供了肥沃的土壤。

- 美國是該地區最大的地質導向服務用戶,眾多陸上盆地尤其是二疊紀盆地的頁岩油氣繁榮帶動了地質導向服務市場的發展。國內頁岩油氣產量不斷擴大,頁岩盆地多邊水平鑽井嚴重依賴地質導向服務。

- 該地區的石油和天然氣產量正在顯著增加。 2021年原油產量從2020年的2,350萬桶/日成長1.9%至2,394.2萬桶/日。此外,該地區的天然氣產量將增加 2.4%,2021 年產量為 1,098.9 億立方英尺,而 2020 年為 1,073.1 億立方英尺。該地區碳氫化合物產量的增加預計將創造對更好的地質導向服務技術的需求。

- 根據能源資訊管理局的數據,與 2017 年相比,2021 年鑽探許可證核准增加了 34%。 2021 年,總合頒發了 3,557 張鑽探許可證,而 2017 年為 2,658 張。由於這些新的發展預計將刺激探勘和生產活動,未來對地質導向服務的需求可能會增加。

- 因此,由於北美地區龐大的上游石油和天然氣行業、近海工業的探勘不斷增加以及對石化燃料的需求不斷增加,預計北美地區將主導市場。

地質導向服務產業概況

地質導向服務市場適度細分。該市場的主要企業(排名不分先後)包括斯倫貝謝有限公司、哈里伯頓公司、貝克休斯公司、Weatherford International PLC 和 National-Oilwell Varco Inc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 至2027年原油產量預測(單位:千桶/日)

- 至2027年天然氣產量預測(單位:十億立方英尺/天)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 裝置

- 隨鑽測井工具與技術

- MWD 工具和技術

- 旋轉導向系統

- 驅動系統

- 3D地震探勘模型

- 其他

- 地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International PLC

- United Oil & Gas Consulting Ltd

- HMG Software LLC

- Maxwell Dynamics Inc.

- National-Oilwell Varco Inc.

- Geo-Steering Solutions Inc.

- Geonaft Company

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 71221

The Geosteering Services Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- Over the long term, factors like increasing numbers of oil and gas rigs and increased demand for hydrocarbons are expected to drive the market during the forecasted period.

- On the other hand, high volatility in the prices of crude oil and natural gas is the main factor hindering the growth of the market.

- Nevertheless, the increasing interest in commercially viable production techniques for producing gas hydrates to meet the increasing natural gas demands is expected to create enormous opportunities for the geosteering market.

- Due to the high output of shale oil and gas, North America is expected to be the largest market during the forecast period, with the majority of demand coming from the United States and Canada.

Geosteering Services Market Trends

Rotary Steerable System to Witness Growth

- A rotary steerable system (RSS) is a form of drilling technology used in directional drilling. It is a tool designed to drill directionally with continuous rotation from the surface, eliminating the need to slide a steerable motor. Rotary steerable systems are typically deployed when drilling directional, horizontal, or extended-reach wells.

- They have better surface control and allow more maneuverability to geosteer through complex geology, minimize seismic uncertainty, and make informed geosteering decisions to place your wells in specific zones. This provides real-time control and insight to help enhance zonal understanding and get the most out of the well at the lowest cost. Aiding the growth of oil and gas production increase the company's reliability in the geosteering services market.

- Geosteering service providers continue to advance rotary steerable systems to deliver accurate wellbore placement, optimize borehole quality, and enable maximum drilling efficiency. Halliburton released the iCruise X intelligent rotary steerable system (RSS) last year. It is equipped with an advanced steering head fit for greater durability in operations with variable fluid conditions and in fluids with high solids content. It delivers in high-temperature environments and provides more power for steering. The increase in the advancements in the industry is expected to aid the growth of the market.

- Natural gas produced in the world increased by 4.8% to 390.58 billion cubic feet last year from 372.59 billion cubic feet in 2020. The increased utility of natural gas has ordained an increase in natural gas production to meet the world's consumption.

- The number of rigs globally increased significantly by 29% to 19,135 units by November 2022 from 16,333 units in 2020. An increasing number of rigs directly corresponds to the increase in the demand for geosteering services in the industry. The number of rigs may increase further in the forecast period, thereby boosting the geosteering rotary steerable services market's growth.

- Therefore, geosteering rotary steerable services are expected to increase in the forecast period due to an increase in the number of rigs, rising production of natural gas, and advancements in the realm of geosteering technology.

North America to Dominate the Market

- North America is one of the largest geosteering services markets, and its dominance is expected to continue in the coming years. The region contains major oil and gas oil production basins in the world, which provide fertile ground for future industry growth.

- The United States is the region's largest user of geosteering services, notably with the boom in shale oil and gas in numerous onshore basins, such as the Permian basin, which has led to the advancement of the geosteering services market. Shale oil and gas production in the country has continuously expanded, and multilateral horizontal drillings in shale basins rely heavily on geosteering services.

- The production of oil and gas has increased significantly in the region. In 2021, crude oil production increased by 1.9% producing 23,942 thousand barrels of oil per day as compared to 23,500 thousand barrels of oil per day in 2020. Moreover, gas production in the region increased by 2.4%, producing 109.89 billion cubic feet in 2021 as compared to 107.31 billion cubic feet in 2020. Increasing production of hydrocarbons in the region is expected to create demand for better geosteering services techniques.

- According to the Energy Information Administration, drilling permit approval increased by 34% in 2021 as compared to 2017. In 2021, a total of 3,557 drilling permits were issued, as compared to 2,658 in 2017. This new development is expected to drive exploration and production activity, and hence, the demand for geosteering services is likely to increase in the future.

- Hence, the North American region is expected to dominate the market due to its vast crude oil and natural gas upstream sector, rising exploration in the offshore industry, and increasing demand for fossil fuel.

Geosteering Services Industry Overview

The geosteering services market is moderately fragmented. Some of the key players in this market (in no particular order) include Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International PLC, and National-Oilwell Varco Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Billion, till 2027

- 4.3 Crude Oil Production Forecast, in thousands barrels per day, till 2027

- 4.4 Natural Gas Production Forecast, in billion cubic feet per day, till 2027

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment

- 5.1.1 LWD Tools and Technologies

- 5.1.2 MWD Tools and Technologies

- 5.1.3 Rotary Steerable Systems

- 5.1.4 Drive Systems

- 5.1.5 3D Seismic Model

- 5.1.6 Other Equipment

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Halliburton Company

- 6.3.3 Baker Hughes Company

- 6.3.4 Weatherford International PLC

- 6.3.5 United Oil & Gas Consulting Ltd

- 6.3.6 HMG Software LLC

- 6.3.7 Maxwell Dynamics Inc.

- 6.3.8 National-Oilwell Varco Inc.

- 6.3.9 Geo-Steering Solutions Inc.

- 6.3.10 Geonaft Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219