|

市場調查報告書

商品編碼

1630388

美國商務用洗碗機:市場佔有率分析、行業趨勢和成長預測(2025-2030)United States Commercial Dishwasher - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

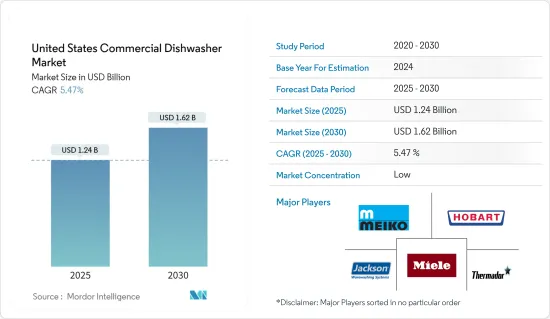

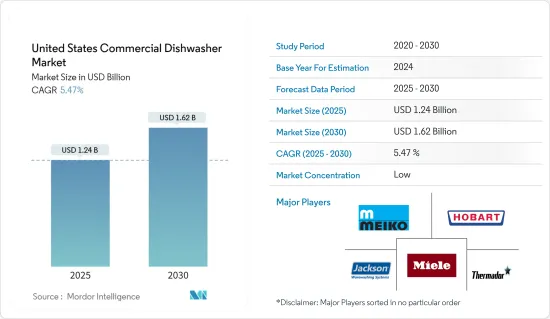

預計2025年美國商務用洗碗機市場規模為12.4億美元,2030年將達16.2億美元,預測期間(2025-2030年)複合年成長率為5.47%。

清洗廣泛應用於飯店、餐廳、商務用廚房進行高效清洗。與家用洗碗機不同,商務用洗碗機不僅可以清洗餐具,還可以消毒。美國是商務用洗碗機消費量全球領先的國家。一個顯著的市場趨勢是越來越重視永續清洗技術。商務用洗碗機通常消耗大量能源,尤其是用於加熱水。

許多商務用洗碗機現在都採用了在清洗過程中重複使用水和能源的技術。有些型號旨在最佳化節水和節能。一個主要的市場促進因素是人們對能源之星認證型號的日益偏好。現在大多數商務用洗碗機都具有節能功能,從而帶來諸如降低營業成本、降低消費量和減少化學清洗劑使用等優勢。

美國商務用洗碗機市場趨勢

餐廳的繁榮增加了對商務用洗碗機的需求

美國的餐飲業持續持續成長。全球有超過 100 萬家餐廳,這種快速成長正在推動商務用洗碗機市場的發展。由於商用洗碗機的效率和人事費用節省,大型連鎖餐廳和飯店正在推動對商務用洗碗機的需求。知名品牌,尤其是大型飯店和餐廳,由於其龐大的消費群而傾向於先進的商務用洗碗機。這些清洗可以同時清洗大量物品,提高業務效率。為此,領先的商務用洗碗機製造商正在創新以保持競爭力,並專注於先進、節能的型號。

罩式清洗廣泛應用於餐廳和餐飲設施。

餐廳和餐飲企業更喜歡商務用抽油煙機清洗來滿足其重型需求。在市場上的各種商務用洗碗機中,罩式洗碗機因其效率而脫穎而出,消除了檯面清洗通常需要的彎曲和提升。在罩式清洗中,髒盤子和乾淨盤子佔據不同的位置。即使機器正在運行,餐具也可以裝載到架子上,讓乾淨的餐具在髒餐具進入清洗室的同時退出清洗室。這種分離改善了衛生狀況。

與現有的標準機械相比,無縫操作不僅簡化了流程,而且還降低了運作成本和能源消耗。隨著旅遊業和餐旅服務業的蓬勃發展以及外出用餐趨勢的增加,罩式清洗的全球趨勢預計將擴大。此外,該地區先進技術的可用性也增強了對抽油煙機洗碗機的需求。

美國商務用洗碗機產業概況

美國商務用洗碗機市場較為分散,許多廠商爭奪市場佔有率。隨著技術不斷進步和產品創新不斷,中小企業正在透過贏得新契約和進入新市場來擴大其市場佔有率。市場主要參與者包括 MEIKO International、Hobart、Jackson WWS、Miele、Thermador 等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察與動態

- 市場概況

- 市場促進因素

- 餐飲業的成長

- 市場限制因素

- 空間限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 洞察市場趨勢與創新

- COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 罩型

- 櫃檯下式

- 機架式

- 按最終用戶

- 飯店

- 餐廳

- 餐飲單位

- 咖啡廳和麵包店

第6章 競爭狀況

- 市場集中度概覽

- 公司簡介

- Thermador

- MEIKO International

- Fagor America

- Electrolux AB

- Hobart

- Miele

- Whirlpool Professional Appliances

- Jackson WWS

- Insinger Machine Company

- CMA Dishmachines*

第7章 市場機會及未來趨勢

第 8 章 免責聲明與出版商訊息

The United States Commercial Dishwasher Market size is estimated at USD 1.24 billion in 2025, and is expected to reach USD 1.62 billion by 2030, at a CAGR of 5.47% during the forecast period (2025-2030).

Hotels, restaurants, and commercial kitchens extensively rely on dishwashers for efficient cleaning. Unlike their household counterparts, commercial dishwashers not only clean but also sterilize wares. The United States is the global leader in terms of commercial dishwasher consumption. A notable trend in the market is the heightened emphasis on sustainable cleaning technologies. Commercial dishwashers typically consume substantial energy, especially for heating water.

Presently, many commercial dishwashers are integrating technologies that recycle water and energy during the cleaning process. Some models are designed to optimize both water and energy savings. A significant market driver is the rising preference for ENERGY STAR-certified models. Most commercial dishwashers now boast energy-saving features, translating to benefits like reduced operating costs, lower energy consumption, and diminished use of chemical cleaning agents.

United States Commercial Dishwasher Market Trends

Restaurant Boom Fuels the Surge in Commercial Dishwasher Demand

The US restaurant industry is on a consistent growth trajectory. With over 1 million restaurants and counting, this surge is set to boost the commercial dishwasher market. Major restaurant and hotel chains are driving up the demand for commercial dishwashers owing to their efficiency and labor cost savings. Established brands, especially in big hotels and restaurants, lean toward advanced commercial dishwashers due to their vast consumer base. These dishwashers can clean numerous items simultaneously, enhancing business efficiency. In response, leading commercial dishwasher manufacturers are innovating, focusing on advanced and energy-efficient models to stay competitive.

Hood Type Dishwashers Are Extensively Used in Restaurants and Catering Facilities

Restaurants and catering businesses favor commercial hood-type dishwashers for their heavy-duty needs. Among the various commercial dishwashers on the market, hood types stand out for their efficiency, eliminating the need for bending or lifting, a common requirement with counter machines. In hood-type dishwashers, soiled and clean dishes occupy distinct areas. Racks can be loaded even while the machine operates, allowing a clean rack to exit as a soiled one enters the wash chamber. This separation enhances hygiene.

The seamless operation not only streamlines processes but also cuts down on running costs and energy consumption compared to standard machines available today. With the tourism and hospitality sectors booming and a rising trend of dining out, the global market for hood-type dishwashers is set to expand. Furthermore, the demand for hood-type dishwashers is bolstered by the availability of advanced technology in the region.

United States Commercial Dishwasher Industry Overview

The US commercial dishwasher market is fragmented, with numerous players competing for market share. As technological advancements and product innovations continue, mid-sized and smaller companies are expanding their market presence by securing new contracts and entering new markets. Some of the major players in the market include MEIKO International, Hobart, Jackson WWS, Miele, and Thermador.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in the Food Service Industry

- 4.3 Market Restraints

- 4.3.1 Space Constraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Insights on Current Trends and Innovations in the Market

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hood Type

- 5.1.2 Under Counter

- 5.1.3 Rack Type

- 5.2 End User

- 5.2.1 Hotels

- 5.2.2 Restaurants

- 5.2.3 Catering Units

- 5.2.4 Cafes & Bakeries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Thermador

- 6.2.2 MEIKO International

- 6.2.3 Fagor America

- 6.2.4 Electrolux AB

- 6.2.5 Hobart

- 6.2.6 Miele

- 6.2.7 Whirlpool Professional Appliances

- 6.2.8 Jackson WWS

- 6.2.9 Insinger Machine Company

- 6.2.10 CMA Dishmachines*