|

市場調查報告書

商品編碼

1851149

橡膠輸送帶:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Rubber Conveyor Belt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

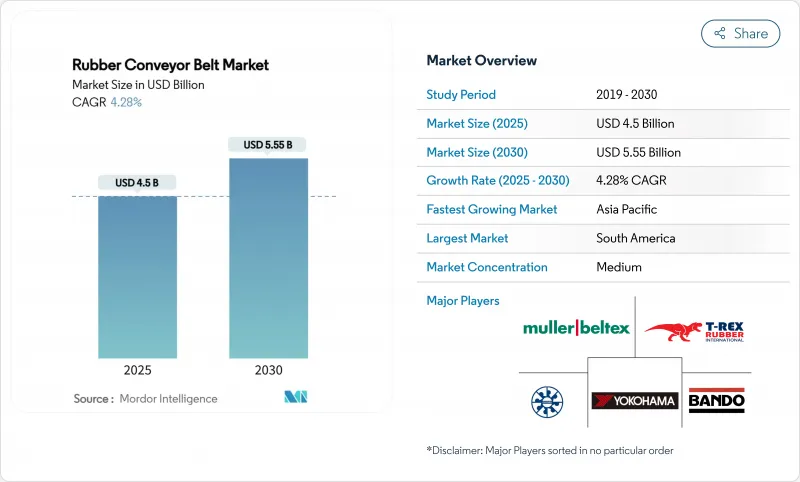

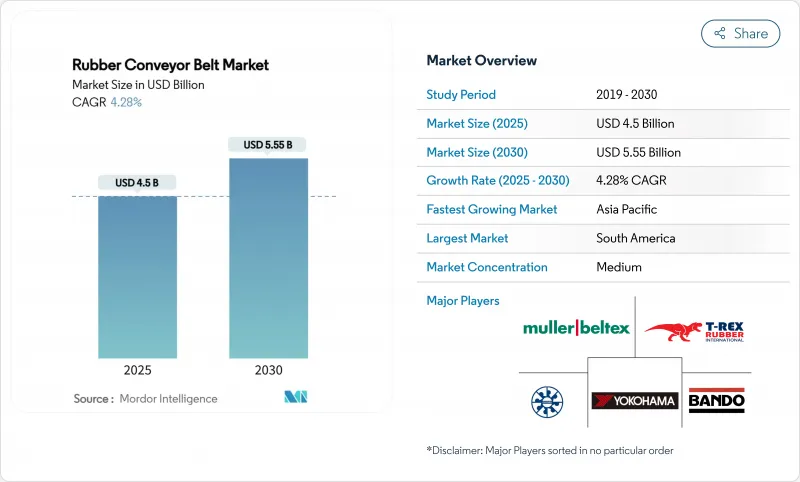

預計到 2025 年橡膠輸送帶市場規模將達到 45 億美元,到 2030 年將達到 55.5 億美元,年複合成長率為 4.28%。

隨著採礦、物流、回收和加工行業的營運商對其散裝物料輸送系統進行現代化改造,並指定使用耐熱、耐火、耐油、長壽命且高速的輸送帶,市場需求正在成長。三大結構性因素正在發揮作用:日益嚴格的安全法規、加速的自動化以及能源轉型礦物的快速成長。終端用戶現在將優質輸送帶視為提高生產力的槓桿,而非消耗品,這種認知促使他們簽訂更長的服務契約,並使供應商的收入更加穩定。同時,原料價格的長期波動,尤其是丁二烯和炭黑的價格波動,正促使製造商簽訂多年供應協議並試用生物基填料,這徵兆成本風險正在積極管控。

全球橡膠輸送帶市場趨勢與洞察

亞洲高溫電池金屬加工需求激增,推動耐熱傳送帶發展

中國、韓國和印尼的陰極和前驅體工廠擴大運作溫度超過200°C的反應堆,而兼具熱穩定性和靜電耗散能力的石墨烯奈米管增強傳送帶正迅速普及。這些傳送帶無需額外的冷卻能力即可提高處理量,由此帶來的生產效率提升促使垂直整合的礦業公司簽訂多年供應協議。目前普遍認為,高溫化合物的早期驗證已成為計劃進度可靠性的重要指標。

北美自動化微型倉配倉庫推動了對輕型輸送帶的需求。

都市區微型倉配中心佔地不到10,000平方英尺,依靠緊湊輕巧的傳送帶,這些傳送帶可在毫米級精度內完成扭轉、提升和停止。業者從多層傳送帶改為單層層級構造後,報告指出節能超過20%,凸顯了傳送帶品質對總營業成本的影響。隨著勞動力短缺的持續,低彈性布料帶來的揀貨精度提升,將材料科學置於倉庫經濟的核心地位,從而直接提高了每平方英尺的收益。

印度太陽能製造群的擴張需要耐油傳送帶。

奧裡薩邦計劃興建一座6吉瓦的太陽能組件工廠,該工廠將採用耐油輸送帶處理會劣化傳統輸送帶的塑化劑和封裝。丁腈橡膠混合物與耐磨汽車胎體相結合,可防止分層並減少計劃外停機時間。特種化學品與可再生能源部署的這種結合,清楚地展現了國家產業政策如何推動橡膠輸送帶市場轉型為高級產品。

細分市場分析

到2024年,耐熱輸送帶將佔橡膠輸送帶市場佔有率的29%。富矽化合物技術的進步使這些輸送帶能夠在200 度C以上持續運行,使窯爐操作人員能夠提高爐膛設定溫度並提升生產效率。更少的熱裂紋意味著更少的停機維護,從而提高了工廠的運轉率。

預計從 2025 年到 2030 年,耐火輸送帶的複合年成長率將達到 5.9%。通過 CAN/CSA-M422 標準 A 型或 B 型認證的輸送帶價格較高,導致許多工地只指定使用這些等級的輸送帶,從而提高了未經認證的競爭對手的門檻。

到2024年,中型輸送帶將佔橡膠輸送帶市場規模的45%。聚酯尼龍汽車胎體兼具強度和柔韌性,而包裹樞紐設計無需升級驅動系統即可延長輸送帶壽命。這有助於節能並減少結構鋼材需求,從而加快投資回報,尤其是在電費高的地區。

隨著礦場採用更長的陸上輸送機,重型輸送帶預計將以 5.5% 的複合年成長率成長。固特異的超硬聚酯/尼龍設計最大限度地減少了數公里輸送距離內的拉伸,使下垂度保持在設計限值內。拉伸減少使得單段輸送佈局成為可能,從而減少了轉運點數量、粉塵排放和維護時間。

橡膠輸送帶市場細分:按輸送帶類型(耐熱、耐油、其他)、輸送帶重量、增強材料(編織/織物汽車胎體、鋼絲、編織)、終端用戶行業(物流倉儲、採礦採石、其他)和地區分類。市場預測以美元計價。

區域分析

到2024年,亞洲將佔全球銷售額的34%,這主要得益於中國龐大的製造地和印度不斷發展的基礎設施。泰國和馬來西亞天然橡膠原料的供應將有助於緩解成本衝擊,並為該地區的生產商帶來投入優勢。針對電池金屬精煉和太陽能組件製造的政策獎勵將推動對耐熱耐油型橡膠帶的需求,從而促進細分市場的成長。

預計到2030年,南美洲將以6.3%的複合年成長率達到最高成長。智利、秘魯和巴西的大型銅礦計劃正在用陸上輸送機取代運輸卡車,從而帶動了對重型鋼絲輸送帶的大宗訂單。安塔米納銅礦耗資20億美元的延壽項目已對新型輸送機進行了大量資本投資,提供側壁式和陡角式輸送機設計的供應商獲得了高額合約。該地區的礦場正日益轉向可再生能源,這進一步推動了對低延伸率輸送帶的需求,以降低能源消費量。

北美和歐洲佔據了較大的市場佔有率,但原因各不相同。北美倉庫優先考慮運作預測,因此採購配備感測器的傳送帶;而歐洲工廠則專注於低亞硝胺配方,以滿足健康標準。中東和非洲市場仍在發展中,但前景看好。鐵路計劃和鐵礦石需要能夠承受高溫和磨蝕性粉塵的傳送帶,因此買家傾向於選擇帶有抗紫外線塗層的合成橡膠和天然橡膠混合傳送帶。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲高溫電池和金屬加工產業推動耐熱皮帶發展

- 北美自動化微型倉配倉庫推動了對輕型輸送帶的需求。

- 南美洲某銅礦礦坑至選礦廠輸送機改裝及更換週期最佳化

- 歐盟2023/1115號條例強制要求回收廠使用阻燃輸送帶

- 印度太陽能製造群的擴張需要耐油傳送帶。

- 物聯網驅動的狀態監測催生了按噸付費的服務協議

- 市場限制

- 丁二烯和炭黑價格波動對利潤率造成壓力。

- 歐洲食品加工中PVC和模組化輸送帶的替代

- 北美地區 UL/CSA 阻燃性測試認證前置作業時間

- 歐盟對硫化過程中亞硝胺暴露情況的審查

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析(資本投資、曼德勒、創投資金籌措)

第5章 市場規模與成長預測

- 按皮帶類型

- 耐熱性

- 耐油性

- 耐火性能

- 化學耐受性

- 一般

- 按皮帶重量

- 輕的

- 中型重量

- 重量級

- 透過增強材料

- 紡織品/織品汽車胎體

- 鋼絲

- 織物

- 按最終用戶行業分類

- 物流/倉儲

- 採礦和採石

- 製造業(離散型和流程型)

- 金屬加工和鋼鐵廠

- 發電(火力發電和生質能發電)

- 飲食

- 建築和骨材

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 策略性舉措(夥伴關係、業務擴張、併購)

- 市佔率分析

- 公司簡介

- Bridgestone Corporation

- Continental AG(ContiTech and Phoenix)

- The Yokohama Rubber Co. Ltd.

- Fenner Dunlop Holdings Ltd.(Michelin Conveyor Solutions)

- Bando Chemical Industries Ltd.

- Sempertrans(Semperit AG)

- Dunlop Conveyor Belting

- Qingdao Rubber Six Conveyor Belt Co.

- Zhejiang Double Arrow Rubber Co.

- Oriental Rubber Industries Pvt. Ltd.

- Oxford Rubbers Pvt. Ltd.

- Muller Beltex BV

- T-Rex Rubber International BV

- Mitsuboshi Belting Ltd.

- Wuxi Boton Belt Co. Ltd.

- Truco Group

- Smiley Monroe Ltd.

- GRT Rubber Technologies

- Continental Belting Pvt. Ltd.

- Probelt Global Ltd.

第7章 市場機會與未來展望

The rubber conveyor belt market size is estimated at USD4.5 billion in 2025 and is forecast to reach USD5.55 billion by 2030, advancing at a 4.28% CAGR.

Demand is expanding because operators in mining, logistics, recycling, and process industries are modernizing bulk-material-handling systems and specifying heat-, fire-, and oil-resistant belts that last longer and run at higher speeds. Three structural forces are at work: stricter safety rules, accelerating automation, and rapid growth in energy-transition minerals. End-users now treat premium belts as productivity levers rather than consumables, a perception that is lengthening service contracts and smoothing revenue for suppliers. Concurrently, lingering raw-material volatility-especially in butadiene and carbon black-has pushed manufacturers to secure multi-year supply agreements and trial bio-based fillers, an early sign that cost risk is being actively managed.

Global Rubber Conveyor Belt Market Trends and Insights

Surge in High-Temperature Battery-Metals Processing in Asia Boosting Heat-Resistant Belts

Cathode and precursor plants across China, Korea, and Indonesia increasingly operate reactors above 200°C, driving rapid uptake of graphene-nanotube-enhanced belts that combine thermal stability with static dissipation. These belts allow processors to raise throughput without adding cooling capacity, and the resulting productivity gain is convincing vertically integrated miners to lock in multi-year supply agreements. A fresh inference is that early certification of high-heat compounds now serves as a proxy for project schedule reliability.

Automated Micro-Fulfilment Warehouses in North America Driving Lightweight Belt Demand

Urban micro-fulfilment centers occupy footprints under 10,000 sq ft and rely on compact lightweight belts that twist, climb, and stop within millimetres. Operators switching from multi-ply to single-ply constructions report energy savings exceeding 20%, highlighting how belt mass influences total operating cost. Because labour shortages persist, gains in picking accuracy linked to low-stretch fabrics directly elevate revenue per square foot, placing materials science at the heart of warehouse economics.

Expansion of Solar-PV Manufacturing Clusters in India Requiring Oil-Resistant Belts

A planned 6 GW solar-module plant in Odisha will employ oil-resistant belts to handle plasticisers and encapsulants that degrade conventional covers. Pairing nitrile blends with abrasion-resistant carcasses prevents delamination, cutting unplanned downtime. This linkage between specialty chemistry and renewable-energy rollout underscores how national industrial policy can redirect rubber conveyor belt market size toward premium variants.

Other drivers and restraints analyzed in the detailed report include:

- "Pit-to-Plant" Conveyor Retrofits in South American Copper Mines Elevating Replacement Cycle

- EU 2023/1115 Mandating Flame-Retardant Belts in Recycling Plants

- IoT-Enabled Condition-Monitoring Unlocking Pay-Per-Ton Service Contracts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heat-resistant belts held 29% of the rubber conveyor belt market share in 2024. Advances in silica-rich compounds let these belts run continuously above 200 °C, enabling kiln operators to raise furnace set-points and unlock throughput gains. Fewer thermal cracks mean shorter maintenance shutdowns, an outcome that expands effective plant availability.

Fire-resistant variants are forecast to grow at a 5.9% CAGR between 2025-2030, fuelled by underground-mine safety codes and EU recycling mandates. Belts achieving Type A or B certification under CAN/CSA-M422 command premiums, and many sites now specify only these grades, elevating barriers for non-certified competitors.

Medium-weight belts provided 45% of the rubber conveyor belt market size in 2024. Polyester-nylon carcasses balance strength and flexibility, letting parcel hubs extend belt life without upgrading drives. The resulting energy savings and lower structural-steel requirements reinforce payback, especially where electricity tariffs are high.

Heavy-weight belts are projected to post a 5.5% CAGR as mines adopt longer overland conveyors. Goodyear's extra-stiff polyester/nylon designs minimise stretch on multi-kilometre flights, keeping sag within design limits. Lower elongation allows single-flight layouts that reduce the number of transfer points, cutting dust emissions and maintenance hours.

Rubber Conveyor Belt Market Segmented by Belt Type (Heat-Resistant, Oil-Resistant and More), Belt Weight, Reinforcement Material (Textile / Fabric Carcass, Steel Cord and Solid-Woven), End-User Industry (Logistics & Warehousing, Mining & Quarrying and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia dominated with 34% of 2024 revenue, propelled by China's large manufacturing base and India's infrastructure push. Access to natural rubber feedstock from Thailand and Malaysia buffers cost shocks, giving regional producers an input advantage. Policy incentives for battery-metal refining and solar-module manufacturing channel belt demand toward heat- and oil-resistant variants, effectively concentrating growth in specialised niches.

South America is forecast to record the highest 6.3% CAGR to 2030. Major copper projects in Chile, Peru, and Brazil are replacing haul trucks with overland conveyors, driving large orders for heavy-duty steel-cord belts. Antamina's USD 2 billion life-extension dedicates substantial capital to new conveyors, and suppliers that offer sidewall or steep-angle designs are capturing premium contracts. The region's commitment to renewable power for mines further raises interest in low-stretch belts that cut energy draw.

North America and Europe retain significant shares, but for different reasons. North American warehouses prioritise predictive uptime and thus purchase sensor-equipped belts, while European factories focus on low-nitrosamine formulations to meet health standards. The Middle East and Africa remain nascent yet promising: rail projects and iron-ore mines require belts that withstand high heat and abrasive dust, pushing buyers toward blended synthetic-natural rubbers with UV-stable covers.

- Bridgestone Corporation

- Continental AG (ContiTech and Phoenix)

- The Yokohama Rubber Co. Ltd.

- Fenner Dunlop Holdings Ltd. (Michelin Conveyor Solutions)

- Bando Chemical Industries Ltd.

- Sempertrans (Semperit AG)

- Dunlop Conveyor Belting

- Qingdao Rubber Six Conveyor Belt Co.

- Zhejiang Double Arrow Rubber Co.

- Oriental Rubber Industries Pvt. Ltd.

- Oxford Rubbers Pvt. Ltd.

- Muller Beltex B.V.

- T-Rex Rubber International B.V.

- Mitsuboshi Belting Ltd.

- Wuxi Boton Belt Co. Ltd.

- Truco Group

- Smiley Monroe Ltd.

- GRT Rubber Technologies

- Continental Belting Pvt. Ltd.

- Probelt Global Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in High-Temperature Battery-Metals Processing in Asia Boosting Heat-Resistant Belts

- 4.2.2 Automated Micro-Fulfillment Warehouses in North America Driving Lightweight Belt Demand

- 4.2.3 Pit-to-Plant Conveyor Retrofits in South American Copper Mines Elevating Replacement Cycle

- 4.2.4 EU 2023/1115 Mandating Flame-Retardant Belts in Recycling Plants

- 4.2.5 Expansion of Solar-PV Manufacturing Clusters in India Requiring Oil-Resistant Belts

- 4.2.6 IoT-Enabled Condition-Monitoring Unlocking Pay-Per-Ton Service Contracts

- 4.3 Market Restraints

- 4.3.1 Volatility in Butadiene and Carbon Black Prices Compressing Margins

- 4.3.2 PVC and Modular Belt Substitution in European Food Processing

- 4.3.3 Certification Lead-Times for UL/CSA Flame Tests in North America

- 4.3.4 EU Scrutiny of Nitrosamine Exposure During Vulcanization

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis (Capex, MandA, VC Funding)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Belt Type

- 5.1.1 Heat-Resistant

- 5.1.2 Oil-Resistant

- 5.1.3 Fire-Resistant

- 5.1.4 Chemical-Resistant

- 5.1.5 General-Purpose

- 5.2 By Belt Weight

- 5.2.1 Lightweight

- 5.2.2 Medium-Weight

- 5.2.3 Heavy-Weight

- 5.3 By Reinforcement Material

- 5.3.1 Textile / Fabric Carcass

- 5.3.2 Steel Cord

- 5.3.3 Solid-Woven

- 5.4 By End-user Industry

- 5.4.1 Logistics and Warehousing

- 5.4.2 Mining and Quarrying

- 5.4.3 Manufacturing (Discrete and Process)

- 5.4.4 Metal Processing and Steel Mills

- 5.4.5 Power Generation (Thermal and Biomass)

- 5.4.6 Food and Beverage

- 5.4.7 Construction and Aggregates

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves (Partnerships, Expansions, M&A)

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Bridgestone Corporation

- 6.3.2 Continental AG (ContiTech and Phoenix)

- 6.3.3 The Yokohama Rubber Co. Ltd.

- 6.3.4 Fenner Dunlop Holdings Ltd. (Michelin Conveyor Solutions)

- 6.3.5 Bando Chemical Industries Ltd.

- 6.3.6 Sempertrans (Semperit AG)

- 6.3.7 Dunlop Conveyor Belting

- 6.3.8 Qingdao Rubber Six Conveyor Belt Co.

- 6.3.9 Zhejiang Double Arrow Rubber Co.

- 6.3.10 Oriental Rubber Industries Pvt. Ltd.

- 6.3.11 Oxford Rubbers Pvt. Ltd.

- 6.3.12 Muller Beltex B.V.

- 6.3.13 T-Rex Rubber International B.V.

- 6.3.14 Mitsuboshi Belting Ltd.

- 6.3.15 Wuxi Boton Belt Co. Ltd.

- 6.3.16 Truco Group

- 6.3.17 Smiley Monroe Ltd.

- 6.3.18 GRT Rubber Technologies

- 6.3.19 Continental Belting Pvt. Ltd.

- 6.3.20 Probelt Global Ltd.