|

市場調查報告書

商品編碼

1630305

隧道自動化:市場佔有率分析、產業趨勢、成長預測(2025-2030)Tunnel Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

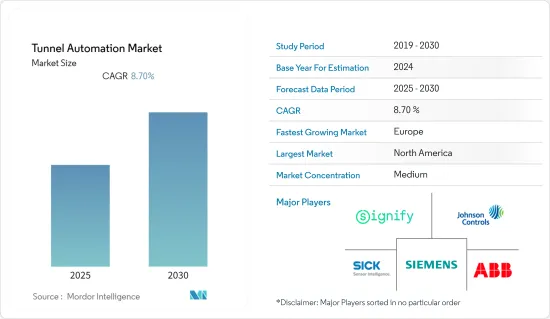

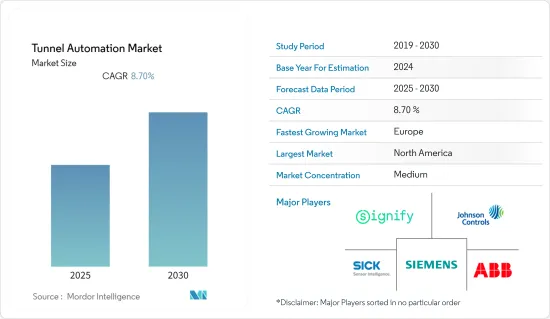

隧道自動化市場預計在預測期內複合年成長率為 8.7%。

主要亮點

- 車輛隧道事故發生率的增加促使隧道引入自動化技術。多年來,隧道火災事故年均發生次數呈現上升趨勢,其中夏季和冬季事故最多,秋季最少。

- 隧道自動化系統正在與物聯網 (IoT)、雲端處理和資料分析等先進技術連接,為消費者提供優於人工管理的顯著優勢。

- 使用這些技術,資料可以在通訊系統和其他設備(例如恆溫器、感測器和照明系統)之間共用和傳輸。從這些設備收集的資料將被分析並用於管理隧道內的自動化系統,從而提高效率。

- 然而,安裝隧道自動化和系統需要很高的初始成本。此外,與這些系統的維護相關的成本可能會增加整體成本壓力,從而限制市場成長。

- 由於 COVID-19 大流行,建築和汽車行業陷入停滯。儘管隧道計劃因施工量減少而受挫,但由於汽車銷量下降和交通流量減少,事故數量減少。結果,隧道自動化產業被迫陷入挫折,而相關系統的缺乏以及相當一部分人員在當地的重新安置更是雪上加霜。

隧道自動化市場趨勢

高速公路和公路佔很大佔有率

- 由於政府要求在既定目標內完成施工的壓力,並且需要滿足電力、水和氣流供應方面嚴格的安全標準,公路和公路隧道必須在規定的時間內完成。現代道路安全管理也關注隧道安全。此外,在道路和高速公路上建造的隧道的安全措施需要整合消防、通風、交通引導、通訊和照明。

- 由於從長遠來看,為了避免事故,對隧道安全措施的需求不斷增加,政府和建設機構正在整合隧道自動化系統。隨著道路安全監督和監控需求的不斷增加,對自動化系統的需求進一步增加。

- 在預測期內,隧道自動化系統中使用的感測器將與物聯網系統整合,以促進對道路和高速公路上建造的隧道中的照明、通風、電力、火災偵測和泵浦的順利監控。研究市場的技術進步預計將極大地幫助道路工人,減少他們的工作量並最佳化道路上建造的隧道的安全措施。

- 從地區來看,由於隧道建設的增加,對隧道自動化組件的需求正在增加。特別是已經證實,注重道路基礎設施發展的新興國家將投入大量資金進行隧道建設。

- 新興經濟體正在投資隧道建設計劃,以擴大現有計劃並促進道路和高速公路之間更好的溝通。在美國,漢普頓路大橋隧道擴建計劃就是一個很好的例子。該計劃總建設成本為38億美元,預計於2025年11月完工。該計劃旨在拓寬諾福克-漢普頓 I-64 走廊沿線約 10 英里的現有四車道路段,並建造橫跨港口的新雙隧道。

歐洲市場成長顯著

- 英國、德國和義大利等許多歐洲國家不斷增加的隧道建設正在促進該地區的市場成長。幾個重要的隧道計劃正處於開發階段或正在規劃中。

- 例如,2021年11月,連接德國和丹麥的海底隧道德國一側開始施工。這個耗資70億歐元的波羅的海計劃計劃於2029年完工。預計它將成為世界上最長的公路和鐵路隧道之一。

- 此外,2022年4月,Webild及其瑞士子公司CSC Costruzioni將成功開發一款基於前衛技術的原型車AXEL(自動探勘電動車),以提高都靈和里昂之間隧道挖掘工人的安全。一個名為的機器人的測試運行這種創新的遠端操作機器人可以檢查潛在風險未知的隧道內的大氣狀況。這也是義大利首次使用機器人在規劃的鐵路建設工地測量隧道。

- 公路隧道是道路交通中最容易發生事故的區域之一,尤其是在車輛高速行駛的高速公路上。保持隧道內良好的照明條件對於確保交通暢通至關重要,以便車輛駕駛人能夠識別障礙物並在不減速的情況下通過隧道。因此,該地區對隧道照明系統的需求很大。

- 例如,Signify 正在與安裝商 Bravida 合作,為一條 21 公里的高速公路旁路提供照明,旨在緩解斯德哥爾摩的交通堵塞。這條道路總長超過18公里位於隧道內,隧道將由該公司提供的專門設計的隧道照明燈具進行照明。

隧道自動化行業概況

隧道自動化市場競爭適度,有多家實力雄厚的參與者。這些參與者專注於擴大海外基本客群。我們也致力於透過策略合作來增加市場佔有率並增強盈利。

- 2021 年 10 月 - Signify 宣佈在 Ahmed Hamdi 2 隧道安裝 LED 照明。該公司在蘇伊士運河下方 4,250 公尺長的隧道的兩個方向上安裝了所有照明裝置和控制設備,並提供全方位的供電、監控、操作、編程和推出服務。

- 2021 年 7 月 - 西門子智慧交通系統 (ITS)推出新品牌“UNEX TRAFFIC”,並作為西門子移動的新公司開始運作。該公司將繼續提供自適應交通控制和管理、高速公路和隧道自動化領域的解決方案,以及V2X和道路用戶收費(收費)的智慧解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 爆發對產業的影響

第5章市場動態

- 市場促進因素

- 政府法規推動隧道自動化解決方案的採用

- 擴展隧道自動化解決方案以及物聯網和雲端整合

- 市場挑戰

- 隧道自動化解決方案實施成本高

第6章 市場細分

- 透過提供

- 硬體

- 軟體

- 服務

- 按成分

- 照明/電源

- 訊號處理

- 空調

- 其他組件

- 依隧道類型

- 鐵路

- 公路

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Siemens AG

- Johnson Controls Inc.

- ABB Limited

- SICK AG

- Signify Holding BV

- Agidens International NV

- SICE

- Indra Sistemas SA

- Advantech Co., Ltd.

- CODEL International Ltd

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 67213

The Tunnel Automation Market is expected to register a CAGR of 8.7% during the forecast period.

Key Highlights

- The introduction of automated technology in tunnels has been prompted by an increase in the incidence of vehicle tunnel accidents. Over the years, the average annual occurrence of tunnel fire accidents has grown, with the bulk of incidents happening in the summer and winter seasons and the least in the autumn.

- Tunnel automation systems are being connected with sophisticated technologies, including the internet of things (IoT), cloud computing, and data analytics, giving consumers a significant advantage over human management.

- With the use of these technologies, data may be shared and transported between communication systems and other devices like thermostats, sensors, and lighting systems. The data collected from these units are analyzed and used to manage the automation systems in the tunnels to improve their efficiency.

- However, the installation of tunnel automation systems involves high upfront costs. Additionally, the costs associated with the maintenance of these systems can increase the overall cost pressure, thereby restricting market growth.

- The building and automotive sectors came to a halt as a result of the COVID-19 pandemic. While reduced construction operations pushed tunnel projects back, fewer accidents occurred as a result of lower automobile sales and light traffic. As a result, the tunnel automation industry suffered a setback, exacerbated by a shortage of associated systems and the relocation of a substantial portion of the personnel to their hometowns.

Tunnel Automation Market Trends

Highways and Roadways to Hold a Significant Share

- Tunnels in highways and roadways are required to be built within a stipulated amount of time due to government pressure to complete construction within set goals and need to meet strict safety standards in terms of power, water, and airflow supply. Modern road safety management is also focused on safety in tunnels. Furthermore, the safety measures of tunnels built on roadways or highways need the integration of fire protection, ventilation, traffic guidance, communications, and lighting.

- Owing to the heightened demand for safety measures in tunnels to avoid accidents in the long run, governments and construction bodies are integrating tunnel automation systems. The demand for automation systems is further driven by the increasing necessity of the supervision and monitoring of traffic safety.

- Over the forecast period, the sensors used in tunnel automation systems are anticipated to be integrated with IoT systems to facilitate smooth monitoring and controlling of lighting, ventilation, power supply, fire detection, and pumps in the tunnel that are built on roadways and highways. Technological advancements in the studied market are expected to help road workers immensely, reducing workload and optimizing the safety measures in the tunnels built in roadways.

- Across geographies, the market is witnessing demand for tunnel automated components owing to the increase in tunnel constructions. Especially in emerging economies that are highly focused on advancing their road infrastructural portfolio can be identified to invest heavily in tunnel construction.

- In developed economies, investments are flowing into tunnel construction projects to expand existing projects and facilitate better communication of roadways and connections between highways. The Hampton Roads Bridge-Tunnel Expansion Project makes for a good example in the United States. The project slated at USD 3.8 billion is anticipated to be completed by November 2025. The project is aimed at widening the current four-lane segments along nearly ten miles of the I-64 corridor in Norfolk and Hampton, with new twin tunnels across the harbor.

Europe Market to Grow Significantly

- The rise in tunnel construction in many European countries, such as the United Kingdom, Germany, and Italy, among others, can be ascribed to the market's growth in this region. Several significant tunnel projects are either in the development stage or in the pipeline.

- For instance, in November 2021, construction work started on the German side of an underwater tunnel connecting Germany and Denmark. The EUR 7 billion projects under the Baltic Sea are set to be completed by 2029. It is expected to be one of the world's longest road and rail tunnels.

- Further, in April 2022, Webuild and its Swiss subsidiary CSC Costruzioni successfully completed the test run of a robot called AXEL (Autonomous Exploration Electrified Vehicle), a prototype based on avantgarde technology to improve the safety of workers involved in the excavation of the Turin-Lyon base tunnel. The innovative, remote-controlled robot is able to inspect the atmospheric conditions of a tunnel where potential risks are unknown. It also marks the first example in Italy of the use of robotics to explore a tunnel at the site of a planned railway.

- Roadway tunnels are among the most accident-prone zones when it comes to road transport, especially highways, as the vehicles travel at high speed. It is crucial to maintain sufficient lighting conditions inside the tunnel to ensure a smooth flow of traffic as vehicle drivers can identify obstacles and navigate through the tunnel without reducing speed. As such, there is a significant demand for tunnel lighting systems in the region.

- For instance, Signify is working with installer Bravida to illuminate a 21-km expressway bypass designed to relieve traffic congestion in Stockholm. Of the road's' total distance, more than 18 kilometers will be in a tunnel, which will be illuminated by the specially designed tunnel luminaires provided by the company.

Tunnel Automation Industry Overview

The Tunnel Automation Market is moderately competitive and consists of some influential players. These players are concentrating on expanding their customer base across foreign countries. They are also leveraging strategic collaborative actions to improve their market percentage and enhance their profitability.

- October 2021 - Signify announced the installation of LED lighting in the Ahmed Hamdy 2 Tunnel. The company installed all lighting units and control devices, along with a full range of supply, monitoring, operation, programming, and start-up services in both directions of the 4,250-meter-long tunnel, which runs underneath the Suez Canal.

- July 2021 - Siemens Intelligent Traffic Systems (ITS) launched its new brand Yunex Traffic and started operating as a new company of Siemens Mobility. The company will continue to provide solutions in the field of adaptive traffic control and management, highway, and tunnel automation as well as smart solutions for V2X and road user charging (tolling).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulations Favoring Adoption of Tunnel Automation Solutions

- 5.1.2 Growing Integration of IoT and Cloud With Tunnel Automation Solutions

- 5.2 Market Challenges

- 5.2.1 High Deployment Costs of Tunnel Automation Solutions

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Component

- 6.2.1 Lighting and Power Supply

- 6.2.2 Signalization

- 6.2.3 HVAC

- 6.2.4 Other Components

- 6.3 By Tunnel Type

- 6.3.1 Railways

- 6.3.2 Highways and Roadways

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Johnson Controls Inc.

- 7.1.3 ABB Limited

- 7.1.4 SICK AG

- 7.1.5 Signify Holding BV

- 7.1.6 Agidens International NV

- 7.1.7 SICE

- 7.1.8 Indra Sistemas SA

- 7.1.9 Advantech Co., Ltd.

- 7.1.10 CODEL International Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219