|

市場調查報告書

商品編碼

1630295

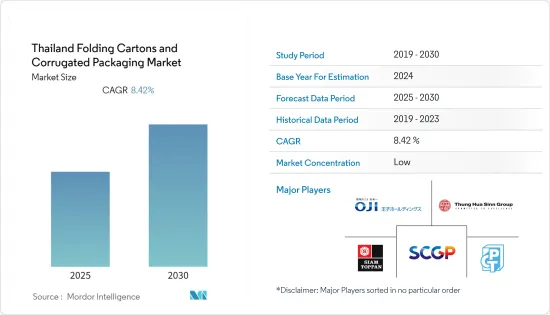

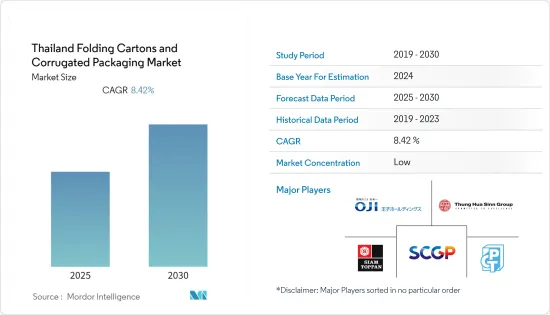

泰國折疊式紙盒和紙板包裝:市場佔有率分析、行業趨勢、成長預測(2025-2030)Thailand Folding Cartons and Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計泰國折疊式紙盒和瓦楞包裝市場在預測期內的複合年成長率為8.42%。

主要亮點

- 市場成長主要得益於包裝食品和飲料的持續需求。同樣,ThaiBev 的目標是增加再生紙的比例,並在瓦楞紙箱的生產中使用損壞的紙箱。

- 主要使用折疊式紙盒的行業包括食品和飲料行業、個人護理行業、醫療保健行業和家居用品行業。日本正在經歷從塑膠到紙質包裝的重大轉變,預計這將為紙箱包裝市場的製造商創造新的商機。隨著消費者越來越意識到塑膠對環境的負面影響,製造商正在利用這個機會創新環保解決方案。

- 隨著電子商務需求的增加,包裝挑戰也隨之增加。永續包裝從未像現在這樣成為品牌和消費者的首要任務。將生態包裝引入品牌營運不再是一種選擇,而是一種必然。

- 泰國的經濟發展導致紙箱及紙板製品的生產和消費增加。泰國的紙箱包裝產業正在蓬勃發展,並為國家經濟做出了寶貴貢獻。這是由於對合適的包裝材料的需求不斷增加,這些材料可用於包裝多個最終用戶垂直領域的任何物品。

- 網路購物在泰國逐漸成為主流,越來越多的消費者因為網購的便利性而選擇網路購物。隨著 COVID-19 大流行期間實施嚴格的限制和社交距離規則,這種轉變變得更加普遍。隨著該國電子商務的興起,即使在大流行之後,市場仍在擴大。

泰國折疊式紙盒和紙板包裝市場的趨勢

由於電子商務的增加而增加的包裝能力推動了市場的成長

- 由於COVID-19大流行,在線銷售的包裝紙板、薄紙和特殊紙的需求增加,推動了該國紙板包裝行業的成長。

- 自疫情爆發以來,電子商務銷售額已連續兩年多成長。同時,瓦楞紙業務需要支援才能繼續成長。造紙廠正在滿載運轉,一些生產商正在限制訂單並將委託給較小的公司。消費者擴大選擇電子商務而不是實體店。因此,預計未來需求將持續增加。

- 近年來,電子商務行業已成為重要參與者,亞馬遜使用瓦楞紙箱進行初級包裝,並依靠塑膠包裝來進行單一商品的包裝。泰國人對包裝廢棄物的日益擔憂促使政府頒布法規,鼓勵公眾採用折疊式紙盒和瓦楞紙箱等環保材料作為可行的包裝選擇,您很可能面臨壓力。

- 智慧型手機的普及與電子商務的價值直接相關。根據Tech Asia預測,未來兩年泰國電商市場規模預計將達到240億美元。

- 泰國國家統計局去年進行的一項調查顯示,約99.9%的15至24歲受訪者表示他們使用智慧型手機。這些數字正在推動電商購物的需求,並間接影響國內紙箱包裝的成長。

食品和飲料領域預計將佔據主要市場佔有率

- 由於該國中階人口不斷成長以及食品支出增加,收入增加正在推動食品和飲料行業的成長。隨著越來越多的人口居住在曼谷廣闊的郊區,對方便包裝食品的需求不斷增加。

- 此外,快速的都市化增加了該國對加工食品和已調理食品的需求。已調理食品是採用紙箱作為二次包裝的頂級公司之一,推動了市場成長。根據《全球有機貿易指南》,本會計年度泰國有機包裝食品和飲料的消費額預計約為 3,020 萬美元。

- 此外,乳製品包裝產業對紙盒包裝的需求不斷增加。液體包裝是乳製品最常見的紙板包裝類型。隨著消費者積極從軟性飲料轉向健康的乳製品替代品,國內牛奶消費量預計將增加。

- 最近,食品加工和包裝解決方案公司利樂和mmilk在泰國推出了首款利樂頂紙瓶。 A2+和綠色牛奶等mmilk產品現在將在泰國以四頂紙盒和瓶子形式出售。

- 食品加工和包裝服務公司利樂泰國公司與森林管理委員會 (FSC) 和世界自然基金會泰國分會合作,鼓勵泰國消費者在飲料紙盒上尋找利樂標誌。該公司表示,消費者將獲得由環保材料(來自負責任管理的森林的紙張)製成的紙箱產品,並且還將支持當地農業。

泰國折疊式紙盒及紙板包裝產業概況

泰國的折疊式紙盒和瓦楞包裝市場高度分散,主要參與者包括 Siam Toppan Packaging、Thai Containers Group (SCG Packaging)、Thung Hua Sinn Group、Continental Packaging (Thailand) 和 Oji Holdings Corporation。市場參與者正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2022年5月,泰國貨櫃集團宣布將把其在泰國的纖維包裝產能每年擴大7.5萬噸,並於2023年中期開始商業生產,以滿足隨著經濟復甦而增加的需求。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 由於電子商務的增加而增加包裝能力

- 由於美國貿易戰,主要生產轉移至泰國

- 政府促進永續包裝環境的舉措

- 擴大輕質材料的採用以及最終用戶領域印刷技術的創新空間

- 市場挑戰

- 對各種應用中瓦楞紙產品的材料可得性和耐用性的擔憂

- 市場機會

- 最終用戶群參與永續性

- 政府舉措

- COVID-19 對產業的影響

第6章 市場細分

- 按最終用戶

- 飲食

- 醫療保健和製藥

- 家庭和個人護理

- 其他最終用戶產業(製造、汽車等)

第7章 競爭格局

- 公司簡介

- Siam Toppan Packaging Co. Ltd

- Thai Containers Group(SCG Packaging)

- Thung Hua Sinn Group

- Continental Packaging(Thailand)Co. Ltd

- Oji Holdings Corporation

- ASA Group Company Limited

- Sarnti Packaging Co. Ltd

- Balance Packing Co. Ltd

- BG Packaging Company Limited

- Tri-Wall Ltd

- C&H Paperbox(Thailand)Co. Ltd

- Hong Thai Packaging Company Limited

第8章市場的未來

The Thailand Folding Cartons and Corrugated Packaging Market is expected to register a CAGR of 8.42% during the forecast period.

Key Highlights

- Growth in the market studied is mainly due to the continued demand for packaged food and beverages. Likewise, ThaiBev aimed to increase the recycled paper proportion and use damaged cartons to produce corrugated cartons.

- The industries where folding cartons are mainly used include the food and beverage industry, personal care industry, healthcare industry, household care industry, and others. The country is experiencing a significant shift from plastic to paper-based packaging adoption, expected to generate incremental opportunities for manufacturers in the folding carton packaging market. Since consumers are becoming increasingly aware of plastic adverse effects on the environment, manufacturers are capitalizing on this opportunity to innovate in eco-friendly solutions.

- As the e-commerce demand grows, so does the packaging challenge. Sustainable packaging is an unprecedented priority for both brands and consumers. Implementing eco-packages in brand operations is no longer an option but a necessity.

- The economic development in Thailand resulted in the increased production and consumption of folding cartons and corrugated packaging products. The Thai folding carton packaging industry is witnessing growth and contributing noteworthily to the country'scountry's economy. It is because of the increasing demand for suitable packaging materials that can be used to pack anything across several end-user verticals.

- Online shopping is gradually becoming a significant mainstream in Thailand, with more consumers preferring it due to its convenience. This shift became even more prevalent during the COVID-19 pandemic, with the strict lockdown and social distancing rules being in place. With the Rising E-commerce in the country, the market is increasing after the pandemic.

Thailand Folding Cartons & Corrugated Packaging Market Trends

Increasing Packaging Capacity Due to Rising E-commerce Drives the Market Growth

- Increased demand for packing boards for online sales, tissue papers, and specialty papers, as a result of the COVID-19 pandemic, promoted the paperboard packaging industry growth in the country.

- Since the pandemic began, e-commerce sales have grown by more than two years. Meanwhile, the corrugated business needs help to keep up. Paper mills operate at total capacity; some producers limit orders and outsource to smaller firms. Consumers are increasingly choosing e-commerce over brick-and-mortar establishments. Thus, the demand is expected to continue to rise.

- The e-commerce industry emerged as a significant player in recent years, with Amazon using corrugated board boxes for the principal packaging and relying on plastic packaging for individual items. The increasing concerns of Thai people associated with packaging waste are likely to compel the government to ring regulations that prompt the citizens to adopt environment-friendly options, such as folding cartons or corrugated boxes, as a viable choice for packaging.

- The growing smartphone adoption in the country directly correlates with the e-commerce value since most citizens prefer online shopping through mobile phones rather than laptops or PCs. According to Tech Asia, the e-commerce market's estimated size in Thailand would amount to USD 24 billion in the next two years.

- According to a survey conducted by the National Statistical Office (Thailand) in the previous year, around 99.9% of respondents aged between 15 to 24 stated that they are using smartphones. Such figures drive the demand for e-commerce shopping, indirectly influencing the folding carton packaging growth in the country.

Food and Beverage Segment is Expected to Hold Major Market Share

- The increase in incomes and increased spending on food by the growing middle-class population in the country is driving the food and beverage industry growth. As a more significant share of the population lives in Bangkok's sprawling suburbs, the demand for convenient packaged food options is growing.

- Moreover, rapid urbanization increased the demand for processed foods and ready-to-eat meals in the country. Ready-to-eat meal products are among the top adopters of cartons as the secondary form of packaging, fueling the market's growth. According to Global Organic Trade Guide, the consumption value of organic packaged food and beverages in Thailand is estimated to be approximately USD 30.2 million in the current year.

- Additionally, there is an increasing demand for folding carton packaging from the dairy packaging sector. Liquid cartons are the most common type of paperboard packaging used for dairy products. Milk consumption in the country is likely to increase as consumers actively switch from soft drinks to healthy dairy alternatives.

- In recent years, Tetra Pak, a food processing and packaging solutions company, and mMilk, launched a tetra top carton bottle for the first time in Thailand. mMilk is well known in the country for its lactose-free milk. The mMilk products, such as A2+ and Green Milk, were to be sold in Thailand in tetra-top carton bottles.

- TETRA PAK Thailand, a food processing and packaging services company, in collaboration with the Forest Stewardship Council (FSC) and WWF Thailand, is encouraging Thai consumers to look for the Tetra Pak logo on beverage cartons. The company stated that the consumers would get carton products made from environmentally sound materials - paper sourced from responsibly managed forests that would also support local farming.

Thailand Folding Cartons & Corrugated Packaging Industry Overview

The Thailand Folding Cartons and Corrugated Packaging Market is highly fragmented, with significant players like Siam Toppan Packaging Co. Ltd, Thai Containers Group (SCG Packaging), Thung Hua Sinn Group, Continental Packaging (Thailand) Co. Ltd, and Oji Holdings Corporation among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In May 2022, the Thai Containers Group announced that it would be expanding its fiber packaging capacity by 75,000 metric tons per year in Thailand to fulfill the growing demand as the economy recovered with a commercial start-up in mid-2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Packaging Capacity due to Rising E-commerce

- 5.1.2 Shift of Major Production to Thailand in lieu of US-China Trade War

- 5.1.3 Government Initiatives on Promoting Sustainable Packaging environment

- 5.1.4 Growing adoption of light weighing materials and scope for printing innovations across end user segments

- 5.2 Market Challenges

- 5.2.1 Concerns over Material Availability and Durability of Corrugated Board-based Products Across Applications

- 5.3 Market Opportunities

- 5.3.1 End User Segment Participation toward Sustainability

- 5.3.2 Governmental Initiatives

- 5.4 Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Food and Beverage

- 6.1.2 Healthcare and Pharmaceutical

- 6.1.3 Household and Personal Care

- 6.1.4 Other End-user Industries (Manufacturing, Automotive, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Siam Toppan Packaging Co. Ltd

- 7.1.2 Thai Containers Group (SCG Packaging)

- 7.1.3 Thung Hua Sinn Group

- 7.1.4 Continental Packaging (Thailand) Co. Ltd

- 7.1.5 Oji Holdings Corporation

- 7.1.6 ASA Group Company Limited

- 7.1.7 Sarnti Packaging Co. Ltd

- 7.1.8 Balance Packing Co. Ltd

- 7.1.9 BG Packaging Company Limited

- 7.1.10 Tri-Wall Ltd

- 7.1.11 C&H Paperbox (Thailand) Co. Ltd

- 7.1.12 Hong Thai Packaging Company Limited