|

市場調查報告書

商品編碼

1630284

CaaS(容器即服務)-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Container as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

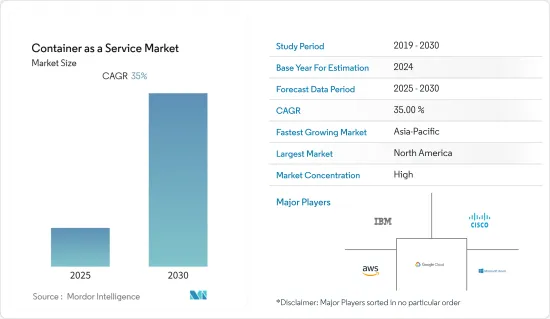

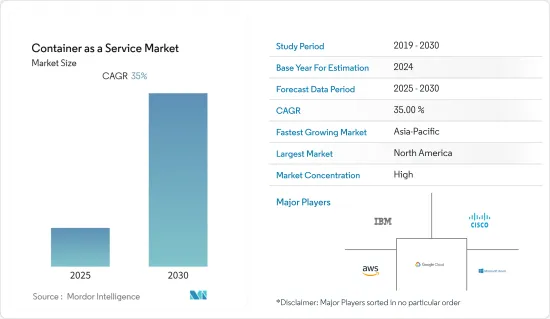

CaaS(容器即服務)市場預計在預測期內複合年成長率為 35%

主要亮點

- 該市場提供了廣泛的成長潛力,主要歸功於 CaaS(容器即服務)的快速採用,它可以幫助 IT 部門和開發人員創建、管理和運行隱藏的容器化應用程式。此外,由於託管應用程式,公司對減少運輸時間的服務的需求不斷成長,以及對成本效益和提高生產力的好處的認知不斷增強,正在推動整個市場的指數級成長。

- 此外,CaaS 模型為中小型企業 (SME) 提供了新的商機,因為它們使業務組織能夠承受更大的敏捷性(盡快創建新的生產工作負載的能力)。此外,該技術重量輕且非常易於管理,可快速交付和部署新的應用程式和容器。預計這將進一步加速市場成長。

- 此外,市場正在見證各種重大發展。例如,2022 年 10 月,專用安全測試解決方案供應商 Veracode 宣布增強其持續軟體安全平台,包括容器安全。 Veracode Container Security 的早期存取計畫主要面向現有客戶。新的 Veracode Container Security 主要是為了滿足雲端原生軟體工程團隊的整體需求,解決各種容器映像的漏洞掃描、安全配置和秘密管理需求。

- 然而,由於資料安全相關問題日益增多,CaaS 市場預計將面臨障礙。這是因為資料通常儲存在雲端伺服器上,這使其面臨各種駭客攻擊。雲端伺服器還需要持續的電力供應和網路連接才能有效運作。因此,在新興市場,CaaS(容器即服務)市場很可能進一步萎縮。

COVID-19 的爆發暴露了供應鏈的脆弱性。大多數 IT 公司都是提供關鍵 IT 服務的脆弱生態系統的一部分。鼓勵遠距工作的規定將確保服務供應商能夠獲得其關鍵任務業務客戶所需的工具和技術,以實現其提供的服務的速度、安全性、品質和整體有效性,從而帶來市場成長機會。著增加。

CaaS(容器即服務)市場趨勢

BFSI 產業預計將得到最大程度的採用

- 隨著越來越多的 BFSI 公司採用雲端並使其雲端供應商多元化,金融科技正在大幅改變銀行體系。此外,行動銀行和數位付款等技術正在徹底改變銀行業,特別是在印度和中國等新興經濟體。因此,CaaS 模型的使用和部署也在增加。容器應用程式平台旨在自動化任何雲端提供者的應用程式堆疊的託管、配置、部署和管理。

- 這些解決方案幫助銀行實現數位基礎現代化,提高競爭力,加速未來分店的服務交付,最佳化付款處理模型,並在不影響網路安全的情況下加深客戶參與。為應用程式開發人員提供自助服務訪問,可以輕鬆按需部署應用程式,幫助銀行在競爭日益激烈的金融服務環境中加快步伐並縮短上市時間。這些解決方案可協助金融機構開發和支援廣泛的應用程式,同時保持嚴格的安全性和合規性要求。您還可以提供新用途來吸引客戶和員工。

- 創建和提供按需金融服務需要使用尖端的數位工具。其中之一是 Kubernetes (K8s),它主要是一種開放原始碼容器編配和部署技術。該技術的虛擬作業系統允許應用程式跨平台、地理和雲端無縫運行。透過在 Kubernetes 上運行容器化,銀行組織可以為客戶提供無縫體驗、自動化儲蓄、參與創新並保護客戶資料。

- 容器化程式的敏捷性、可擴展性和極大改善的使用者體驗對於滿足當今銀行的需求至關重要。無論是在私有雲端、公共雲端雲或混合雲端中,基於 Kubernetes 容器的編配都是金融服務公司的理想選擇。銀行可以使用 Kubernetes 在微服務、API 優先、雲端原生和無頭架構中部署容器化應用程式。

- 印度儲備銀行的聲明稱,2022會計年度印度各地記錄的數字付款總數約為710億筆。與前三年相比,這是一個顯著的成長。因此,隨著數位付款數量的增加,使用CaaS(容器即服務)的需求也將大幅增加,顯著推動市場成長。

預計北美將佔據最大的市場佔有率

- 預計北美地區將在整個預測期內佔據CaaS(容器即服務)市場的最大市場佔有率。成長的大部分歸功於美國和美國的經濟成長,這兩個國家的經濟由於工業產品產量的增加而強勁。

- 此外,對微服務的需求不斷成長、技術進步以及對微服務採用的需求不斷成長等因素正在推動該地區的市場。此外,該地區最大的CaaS解決方案提供商正在提出新的想法並擴大業務,以佔領該地區最大的市場佔有率並利用巨大的機會。

- 例如,2022 年 12 月,AWS 發布了 Finch,開放原始碼與雲端無關的開源命令列用戶端,專為運行、建置和發布 Linux 容器而設計。 Finch 主要捆綁開放原始碼元件,例如 nerdctl、lima、containerd 和 buildkit。在發布期間,Finch 主要是原生 macOS 用戶端,可在所有 Mac CPU 架構上運作。

- 同樣在 2022 年 3 月,Docker, Inc. 宣布獲得約 1.05 億美元的額外融資。這筆額外融資將用於將主要由開發人員使用的 Docker 容器應用開發工具的範圍擴展到無伺服器運算框架以及新興的 WebAssembly (Wasm) 和 Web3 平台領域。此外,據該公司稱,與傳統應用程式建置方法相比,主要使用Docker 容器的應用程式開發團隊發布程式碼的頻率提高了13 倍,採用新技術的工作效率提高了65%,並且遇到安全漏洞的可能性較小。

- 此外,到 2022 年 3 月,Oracle 雲端基礎架構 (OCI) 將擴展 11 項新的運算、網路和儲存服務和功能,以幫助客戶以更低的成本更快、更安全地運行工作負載。這項新服務為客戶提供了真正靈活的核心基礎設施服務,可自動最佳化專門針對應用程式需求量身定做的資源,從而顯著降低成本。該公司的新服務還包括直接管理託管虛擬機器、允許您使用容器而無需 Kubernetes編配的容器實例,以及連接 NVMe 驅動器以實現低延遲儲存的工作負載,其中包括 AMD E4-Dense Compute 實例、Oracle Cloud。 VMware 解決方案等等。

CaaS(容器即服務)產業概述

CaaS(容器即服務)市場相對集中,大型企業佔較大市場佔有率。然而,由於CaaS是一種新興的市場開發技術,因此存在巨大的商機,大量新參與企業將進入該市場,並尋求與主要參與企業合作,以獲取重要的市場佔有率。

2022 年 9 月,戴爾宣布擴大與紅帽公司的合作關係,提供新的解決方案,協助在多重雲端環境中管理和部署本地容器化基礎架構。戴爾和紅帽公司解決方案的結合可協助企業加速雲端原生應用程式的整體開發和營運 (DevOps),同時消除 IT 管理瓶頸和障礙。

2022 年 5 月,微軟宣布推出 Azure 容器應用程式的雲端原生產品,讓開發人員在預覽版中建立容器驅動的微服務架構。 Azure 容器應用程式是建立在主要由來自 CNCF計劃的開放原始碼技術(例如分散式應用程式執行階段(Dapr)、Kubernetes 事件驅動的自動縮放(KEDA) 和在Azure Kubernetes 服務(AKS) 上執行的Envoy)的基礎上建構的。 Azure 容器應用程式可以在從公用 API 端點到微服務的各種環境中成功利用。該服務允許執行包裝在任何容器中的使用程式碼,無論編程或運行時模型如何。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 利用市場促進因素和市場限制因素

- 市場促進因素

- 成本效益和生產力優勢

- 比本地容器更具彈性

- 微服務的普及

- 市場限制因素

- 安全性和合規性很難實現

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 透過提供的解決方案

- 儲存和網路

- 監測分析

- 管理和編配

- 安全

- 持續整合和持續部署

- 支援與維護

- 透過提供的解決方案

第5章市場區隔

- 按發展

- 本地

- 雲

- 按服務類型

- 專業服務

- 託管服務

- 按公司規模

- 小型企業

- 主要企業

- 按最終用戶使用情況

- BFSI

- 零售

- 資訊科技/通訊

- 製造業

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 澳洲

- 日本

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- Amazon Web Services, Inc.

- Google LLC(Google Cloud)

- Cisco Systems, Inc.

- IBM Corporation(Red Hat, Inc.)

- Microsoft Corporation(Microsoft Azure)

- Rancher Labs

- VMware, Inc.(Pivotal Software, Inc.)

- SUSE

- Rackspace Inc.

- TATA Communications

- Oracle Corporation

- Hewlett Packard Enterprise Development LP

第7章 投資分析

第8章市場機會及未來趨勢

The Container as a Service Market is expected to register a CAGR of 35% during the forecast period.

Key Highlights

- The market has a promising growth potential, mainly due to the surge in the adoption of containers as a service to assist IT departments and developers in creating, managing, and running containerized applications. Moreover, with the growing awareness of the benefits of cost-effectiveness and increased productivity, the rise in the need for services from businesses to reduce shipping times as a result of hosted applications facilitates the overall market's exponential growth.

- Furthermore, the CaaS model is expected to provide new business opportunities for small and medium-sized enterprises (SMEs) since it enables business organizations to endure a greater degree of agility, which is the ability to create a new production workload as quickly as possible. Additionally, the technique is quite easy to manage, as these are lightweight, enabling rapid delivery and deployment of new application containers. This is further expected to augment market growth.

- Moreover, the market is witnessing various significant developments. For instance, in October 2022, Veracode, a provider of application security testing solutions, announced the enhancement of its Continuous Software Security Platform to include container security. This early access program for Veracode Container Security is mostly underway for existing customers. The new Veracode Container Security offering, mainly built to meet the overall needs of cloud-native software engineering teams, addresses vulnerability scanning, secure configuration, and secret management requirements for various container images.

- However, the CaaS market is expected to face hindrances due to the rise in data security-related issues since usually the data is stored on cloud servers, exposing it to various hacking concerns. Also, cloud servers need a constant supply of electricity and internet connectivity to operate efficiently. This is likely to make the market for containers as a service even smaller in developing areas.

The COVID-19 outbreak made supply chains' vulnerabilities clear. Most IT firms were part of fragile ecosystems that provided critical IT services. Mandates encouraging remote work prompted service providers to guarantee that mission-critical enterprise clients had access to the tools and technologies required to enable the speed, security, quality, and general effectiveness of services offered, enhancing the market's growth opportunities vastly.

Container as a Service Market Trends

BFSI Sector Expected to Have Maximum Application

- Fintech has changed the banking system drastically, as more and more BFSI companies have embraced the cloud and diversified their cloud providers. Also, technologies like mobile banking, digital payments, etc., are revolutionizing the banking industry, especially in emerging countries like India and China. Hence, the use and deployment of CaaS models are also increasing. The container application platform is designed to automate the hosting, configuration, deployment, and administration of application stacks across any cloud provider.

- These solutions help the banks modernize their digital foundations for a competitive edge, speeding service delivery in branches of the future, optimizing payment processing models, and deepening customer engagement without compromising on cybersecurity. It gives application developers self-service access so they can easily deploy applications on demand that can help banks move more quickly and decrease time to market in the increasingly competitive environment of financial services. These solutions help financial institutions develop and support a broad range of applications while maintaining stringent security and compliance requirements. It also enables companies to deliver new applications to engage customers and associates.

- Creating and delivering on-demand financial services requires the use of cutting-edge digital tools. One of them is Kubernetes (K8s), which is mainly an open-source container orchestration and deployment technology. Applications can run seamlessly across platforms, regions, and clouds because of this technology's virtual operating systems. By operationalizing containerization with Kubernetes, banking organizations can thus offer a seamless experience to customers, automate savings, engage in innovation, and protect client data.

- In order to meet the needs of banks today, containerized programs' agility, scalability, and a quantum leap in user experience are essential. Whether in a private, public, or hybrid cloud, Kubernetes' container-based orchestration is the ideal option for financial services firms. So, banks can use Kubernetes to deploy containerized apps with an architecture that focuses on microservices, API-first, cloud-native, and headless, no matter what industry they work in-commercial, retail, or investing.

- As per the Reserve Bank of India, in the financial year 2022, the total count of digital payments that were recorded across India was around 71 billion. This was a drastic increase compared to the previous three years. Hence, with the rise in the number of digital payments, the need for using the container as a service will also increase considerably, facilitating the market's growth significantly.

North America is Expected to Account the Largest Market Share

- The North American region is expected to account for the largest market share in the Container as a Service market all throughout the forecast period. Most of the growth can be attributed to the growing economies of the U.S. and Canada, which are doing better because they are making more industrial goods.

- Also, factors such as increased demand for microservices, technological advancements, and the growing need for the adoption of microservices in this region are driving the market in the region. Also, the biggest CaaS solution providers in the region are coming up with new ideas and growing their businesses to get the most market share and take advantage of the huge opportunities in the region.

- For instance, in December 2022, AWS launched Finch, an open-source, cloud-agnostic command-line client designed especially for running, building, and publishing Linux containers. Finch primarily bundles together a number of open-source components such as nerdctl, lima, containerd, and buildkit. During the release, Finch was mostly a native macOS client that worked on all Mac CPU architectures.

- Also, in March 2022, Docker, Inc. revealed that it had picked up an additional sum of around USD 105 million in financing that, among other things, would be applied to extending the reach of the Docker container application development tools that developers mainly utilize into the realm of serverless computing frameworks and emerging WebAssembly (Wasm) and Web3 platforms. The company also says that application development teams that mainly use Docker containers release code 13 times more often, increase productivity with new technologies in 65% less time, and reduce the mean-time-to-remediate (MTTR) of security vulnerabilities by 62% compared to traditional ways of building applications.

- Moreover, in March 2022, Oracle Cloud Infrastructure (OCI) expanded with 11 new computing, networking, and storage services and capabilities that allow customers to run their workloads faster and more securely at a much lower cost. New offerings offer customers truly flexible core infrastructure services, automatically optimizing resources, especially to match application requirements, and significantly minimizing costs. Also, the company's new services include container instances that let customers use containers without directly managing the hosting VM or needing Kubernetes orchestration; AMD E4-Dense Compute instances that let customers use workloads that benefit from attached NVMe drives that offer low-latency storage; and an Oracle Cloud VMware Solution.

Container as a Service Industry Overview

The container market as a service is comparatively consolidated due to the existence of some leading players holding the majority share of the market. However, CaaS is a developing and demanding technology, and there are enormous business opportunities where a considerable number of new players are entering the market and are teaming up with significant players to capture a significant market share.

In September 2022, Dell declared that it is expanding its partnership with Red Hat to provide new solutions that will assist in managing and deploying on-premises, containerized infrastructure in multi-cloud environments. The combined Dell-Red Hat solutions would assist enterprises in speeding up the overall development and operations (DevOps) of cloud-native applications while removing IT management bottlenecks and barriers.

In May 2022, Microsoft declared a cloud-native product offering with Azure Container Apps, enabling developers to create microservice architectures utilizing containers in preview. Azure Container Apps is primarily built upon a foundation consisting of open-source technology with CNCF projects like Distributed Application Runtime (Dapr), Kubernetes Event-Driven Autoscaling (KEDA), and Envoy running on the Azure Kubernetes Service (AKS). Azure Container Apps can be well utilized in various contexts, from public API endpoints to microservices. The service enables the execution of application code wrapped in any container, regardless of programming or runtime model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Benefits of Cost Effectiveness and Increased Productivity

- 4.3.2 Greater Flexibility Than On-Premises Containers

- 4.3.3 Increasing Popularity of Microservices

- 4.4 Market Restraints

- 4.4.1 Difficulty in Achieving Security and Compliance

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 By Solutions Provided

- 4.6.1.1 Storage and Networking

- 4.6.1.2 Monitoring and Analytics

- 4.6.1.3 Management and Orchestration

- 4.6.1.4 Security

- 4.6.1.5 Continuous Integration and Continuous Deployment

- 4.6.1.6 Support and Maintenance

- 4.6.1 By Solutions Provided

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Service Type

- 5.2.1 Professional Services

- 5.2.2 Managed Services

- 5.3 By Size of the Enterprise

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Application

- 5.4.1 BFSI

- 5.4.2 Retail

- 5.4.3 IT & Telecommunications

- 5.4.4 Manufacturing

- 5.4.5 Other End-user Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Australia

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle-East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Web Services, Inc.

- 6.1.2 Google LLC (Google Cloud)

- 6.1.3 Cisco Systems, Inc.

- 6.1.4 IBM Corporation (Red Hat, Inc.)

- 6.1.5 Microsoft Corporation (Microsoft Azure)

- 6.1.6 Rancher Labs

- 6.1.7 VMware, Inc. (Pivotal Software, Inc.)

- 6.1.8 SUSE

- 6.1.9 Rackspace Inc.

- 6.1.10 TATA Communications

- 6.1.11 Oracle Corporation

- 6.1.12 Hewlett Packard Enterprise Development LP