|

市場調查報告書

商品編碼

1630265

Dark Analytics -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Dark Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

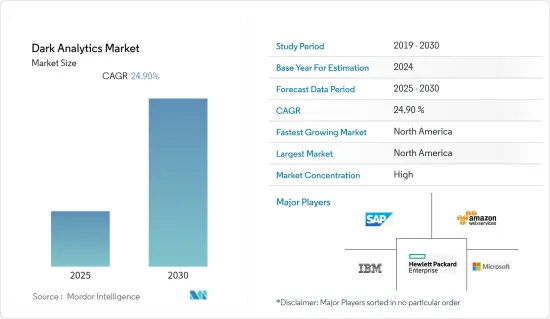

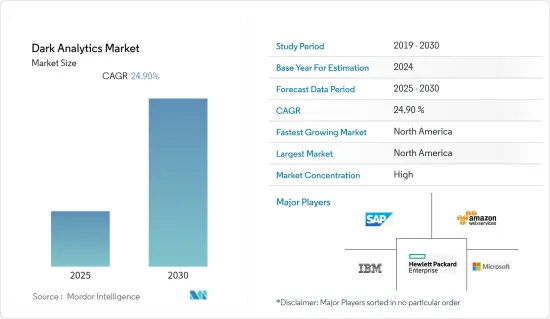

預計暗分析市場在預測期內複合年成長率為 24.9%

主要亮點

- 從網路、社群媒體和其他物聯網系統等各種來源收集大量資料。這些資料呈指數級成長,但並未針對潛在影響進行組織或檢查,而只是出於歷史目的進行管理。據 IBM 稱,收集到的資料中有 60% 很快就會失去效用。

- 推動暗分析市場成長的關鍵因素是透過分析銷售、生產和分銷趨勢等關鍵業務流程的即時資料來獲得決策見解。

- 如果使用得當,這些暗資料可以產生大量收益。例如,借助資料分析,行銷部門可以了解哪些產品最受特定目標群體的追捧,從而尋找促銷和優惠以提高業務績效。

- 2022 年,Ocient 調查了 500 位 IT 經理,以了解他們對資料分析的看法。其中,64% 已經在使用超大規模資料集來獲取見解並為決策提供資訊。該群體中 78% 的人認為更快的資料分析將產生更高的收益。為了保持競爭力並適應不斷變化的市場需求,您需要快速分析資料。

- COVID-19有利於暗網智慧的應用。這場大流行促使組織考慮各種商業性擴張方案。公司意識到他們可以從這些未充分利用的資料中提取有用的資訊,並將其用於收益開發。例如,在分析流量模式後,使用非結構化客戶地理位置和情緒資料來支援業務和行銷策略。

- 如果不加以管理,此類暗資料可能會對資料保護程式帶來重大風險,並導致意外成本。最近的一項研究顯示,近 50% 的企業資料是非結構化或從未結構化的,每年的儲存成本高達 2,600 萬美元。

暗分析市場趨勢

零售和電子商務保持強勁成長

- 在零售業,資料是透過多個客戶接觸點產生的。此外,隨著電子商務銷售透過數位化擴大,大量暗資料正在產生。對於零售公司來說,這些暗資料可能包含重要資訊。透過分析這些暗資料,零售公司可以提高和發展自己在競爭環境中的影響力。

- 幾乎每家零售公司都意識到數位轉型如何改變了消費者的購物和行為。零售公司開始考慮不同的策略來創造數位體驗。探索先前未開發的客戶數位生活資料,以深入了解如何在零售、行銷、客戶服務甚至產品開發策略中定位和個人化客戶體驗。

- Kroger 是美國最大的雜貨零售商,在 35 個州擁有 2,700 多家商店,利用先進的分析來了解客戶偏好和購買頻率。克羅格是唯一一家比其他連鎖超級市場更早採用電腦掃描器和結帳軟體的零售商。憑藉其資料分析能力,克羅格能夠確定通貨膨脹率上升導致大多數消費者選擇自有品牌而不是全國品牌。因此,我們在 2022 年第一季推出了 239 種新的自有品牌產品。

北美地區佔比最大

- 據估計,未來幾年北美將佔據暗分析市場的最大佔有率。該地區的國家是暗分析技術的早期採用者。分析提供者在該地區佔有重要地位,並為市場擴張做出了貢獻。範例包括 IBM Corporation、Microsoft Corporation 和 SAS Institute, Inc.。

- 在北美,各種暗分析新興企業為多個行業提供服務。主要的分析雲端服務供應商也位於該地區。機器學習和人工智慧技術的出現、物聯網的普及以及業務應用程式的快速成長是推動全球暗分析市場的其他關鍵因素。

- 2022 年 7 月,Dataiku 與德勤美國數據和人工智慧聯盟生態系統聯手,協助企業建構可大規模交付價值的可重複使用的人工智慧計劃。兩家公司將共同幫助企業向數千名用戶部署人工智慧解決方案、簡化機器學習管道、處理風險和管治以及提高資料品質。

暗分析產業概述

近年來,暗分析市場受到關注。市場上的公司正在進行策略創新和合作,以提供對現有暗資料的洞察。市場上的供應商透過併購以及與價值鏈中的此類公司建立合作夥伴關係,增加了人工智慧和機器學習能力。這種策略方法預計將推動市場進行更密切的合作,以開發更好的解決方案,並可能影響市場結構。

2023 年 1 月,AWS 在印度啟動了數據實驗室計畫。該計劃透過培養內部資料分析技能、透過在職培訓和各種培訓課程來提高現有員工的技能以及與組織合作來使企業受益。 PayU Finance 利用 AWS 數據實驗室擺脫傳統基礎設施,建構適合其業務需求的可擴展資料平台。

2022 年 11 月,資料分析公司 KNIME推出了KNIME Hub。這加速了技能開發,並使資料主導的決策更容易在任何公司中採用。使用者可以透過 KNIME 資料 Hub 應用程式檢視、下載和共用解決方案。您也可以將工作流程部署為資料應用程式或服務,並將其提供給更多公司。

Amazon Web Services 宣佈於 2022 年 11 月推出HealthLake。 HealthLake 是一項使用新技術的醫學影像和分析服務。據該公司稱,HealthLake Imaging 可以將醫療系統的醫療影像儲存總成本降低高達 40%。例如,總部位於波士頓的 Radical Imaging 使用基於 HealthLake Imaging API 構建的 OHIF計劃,為其客戶提供零佔用空間、支援雲的醫療成像應用程式。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 機器學習和人工智慧的採用率提高

- 由於物聯網的引入,產生的資料量和類型迅速增加

- 市場限制因素

- 安全問題

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按分析類型

- 預測性

- 說明的

- 說明的

- 按行業分類

- BFSI

- 醫療保健

- 政府機構

- 通訊

- 零售/電子商務

- 其他行業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 其他

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- IBM Corporation

- SAP SE

- Amazon Web Services Inc.

- Micro Focus International PLC

- Microsoft Corporation

- SAS Institute

- Teradata Corporation

- Hewlett-Packard Enterprise Company

- Oracle Corporation

第7章 投資分析

第8章市場機會及未來趨勢

The Dark Analytics Market is expected to register a CAGR of 24.9% during the forecast period.

Key Highlights

- Vast amounts of data are collected from various sources, including the internet, social media, and other IoT systems. This data is expanding exponentially, but it is not organized or examined for potential consequences; instead, it is merely maintained for historical purposes. According to IBM, 60% of this gathered data loses its usefulness immediately.

- The main thing that is driving the growth of the dark analytics market is getting insights for making decisions by analyzing real-time data from key business processes like sales, production, and distribution trends.

- This dark data, if used appropriately, can generate a lot of revenue. For example, with the help of data analytics, the marketing division can understand which products are most demanded by particular target groups and thus look for promotions and offers to sell them to increase their performance.

- In 2022, Ocient polled 500 IT managers to find out what they thought about data analytics.62% agreed that data analysis is essential for business planning and company strategy. 64% of these already use hyperscale datasets to draw insights and use them in decision-making. 78% of this group realized faster data analytics generates higher revenue. The data should be analyzed quickly to stay ahead of the competition and adapt to changing market needs.

- The application of dark web intelligence benefited from COVID-19. The pandemic encouraged organizations to look into various commercial expansion options. Businesses believed they could extract useful information from this underutilized data to help with revenue development. For instance, unstructured customer geolocation and sentiment data were used to assist business and marketing strategy after it was analyzed for traffic patterns.

- This dark data can pose significant dangers to data protection procedures and accrue unanticipated expenditures if not managed. Recent studies show that almost 50% of a company's data is unstructured or never structured, which adds to an annual storage cost of $26 million.

Dark Analytics Market Trends

Retail and E-commerce to Hold Significant Growth

- During the time frame of the forecast, the retail and e-commerce vertical is expected to grow quickly.In retail industries, data is generated through multiple customer touchpoints. Also, as e-commerce sales have grown due to digitalization, a significant amount of dark data has been produced. For retailers, this dark data may hold crucial information. Retailers may develop and improve their presence in the competitive environment by analyzing this dark data, which also offers growth potential.

- Nearly all retailers acknowledge how the digital shift has changed consumer shopping and behavior. Retailers have started investigating various strategies for creating digital experiences. Some companies are even examining hitherto unexplored customer digital life data to gain insights into how to target better and personalize customer experiences in retailing, marketing, customer service, and even product development strategies.

- To keep track of their customers' preferences and purchases based on their regularity, Kroger Co., the largest grocery operator in the US with over 2700 shops throughout 35 states, uses advanced analytics. The only retailer to embrace computerized scanners and checkout software more quickly than any other supermarket chain was Kroger. Kroger was able to determine that rising inflation has caused most consumers to choose private labels over national brands thanks to its data analytics capabilities. It consequently introduced 239 new private-label goods in Q1 2022.

North America to Hold Largest Share

- North America is estimated to account for the largest share of the dark analytics market in the forthcoming years. Countries in the region are early adopters of dark analytics technology. Analytics providers have a significant presence in the area, which contributes to the market's expansion. IBM Corporation, Microsoft Corporation, and SAS Institute, Inc. are a few examples.

- In North America, various dark analytics startups provide services to multiple industries. In addition, leading analytics and cloud service providers are based in this region. The emergence of machine learning and AI technology, widespread adoption of IoT, and rapid growth in business applications are other vital factors fueling the global dark analytics market.

- In July 2022, Dataiku tied up with and joined the Deloitte US Data and AI Alliance Ecosystem to help enterprises build reusable AI projects that deliver value at scale. Together, the companies will help businesses deploy AI solutions to thousands of users, make ML pipelines more efficient, handle risk and governance, and improve the quality of data.

Dark Analytics Industry Overview

The dark analytics market has been gaining traction in recent years. The companies in the market have been strategically innovating and partnering to provide insights into the dark data present. The vendors in the market have added AI and machine learning capabilities through mergers and acquisitions or by partnering with such companies in the value chain. Such strategic approaches are expected to drive the market towards closer collaboration to develop a better solution and may impact the market structure.

In January 2023, AWS launched the Data Lab Program in India. The program will benefit enterprises by building internal data analytics skills, upskilling current staff through on-the-job training and different training courses, and partnering with organizations. PayU Finance uses AWS Data Lab to move away from legacy infrastructure and build a scalable data platform suited to its business requirements.

In November 2022, the data analytics company KNIME launched the KNIME hub. This will hasten skill development and make data-driven decisions simple to adopt throughout any firm. Users can view, download, and share their solutions via the KNIME data hub application. They can also deploy their workflows as data apps and services that can be made available to more significant businesses.

Amazon Web Services announced the launch of HealthLake in November 2022. HealthLake is a service for medical imaging and analytics that uses new technologies. The company says that HealthLake Imaging can help health systems save up to 40% on the total cost of storing medical images. For instance, Radical Imaging, a Boston-based company, is providing customers with zero-footprint, cloud-capable medical imaging applications using an OHIF project that is built on HealthLake Imaging APIs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption Rates of Machine Learning and Artificial Intelligence

- 4.2.2 Rapid Growth in Generated Data Volume and Variety Owing to Adoption of IoT

- 4.3 Market Restraints

- 4.3.1 Security Concerns

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type of Analytics

- 5.1.1 Predictive

- 5.1.2 Prescriptive

- 5.1.3 Descriptive

- 5.2 By End-user Vertical

- 5.2.1 BFSI

- 5.2.2 Healthcare

- 5.2.3 Government

- 5.2.4 Telecommunications

- 5.2.5 Retail & E-commerce

- 5.2.6 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Australia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middl-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 SAP SE

- 6.1.3 Amazon Web Services Inc.

- 6.1.4 Micro Focus International PLC

- 6.1.5 Microsoft Corporation

- 6.1.6 SAS Institute

- 6.1.7 Teradata Corporation

- 6.1.8 Hewlett-Packard Enterprise Company

- 6.1.9 Oracle Corporation