|

市場調查報告書

商品編碼

1630241

軟性管道:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Flexible Pipe - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

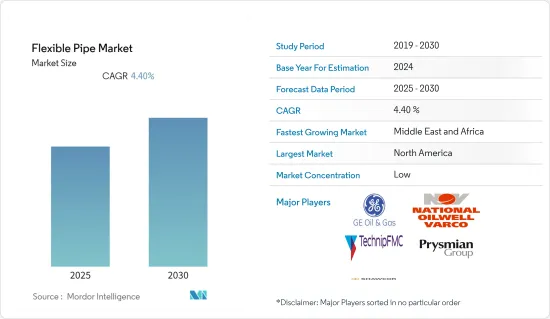

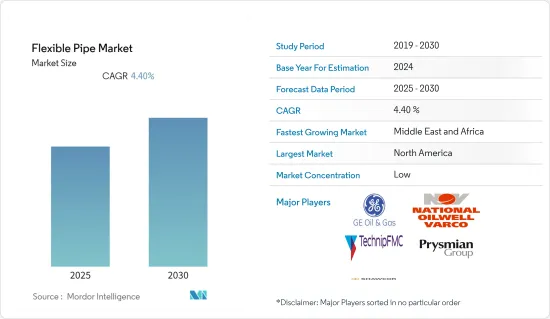

預計軟管市場在預測期內的複合年成長率為 4.4%。

主要亮點

- 軟性管道廣泛用於將石油和其他液體從一處輸送到另一處,特別是在海底、建築工地和礦石中。軟性管道因其具有壓力控制高、重量輕、防漏、成本低等優點而被跨行業使用。由於這些管道提供的技術和成本優勢,預計在預測期內,新探勘活動中鋼製設備的使用將被更快取代。

- 除了石油和天然氣公司繼續關注非傳統石油和天然氣來源外,海上和海底開發正在轉向更深的水深和更惡劣的環境,並進行檢查以將成本保持在最低限度。此外,維護和修理成本很高。因此,軟性管道被認為是最佳選擇,因為它們在提高陸上和海上油井的生產率、壽命和盈利方面發揮關鍵作用。

- 然而,另一方面,對石油和天然氣鑽探活動的嚴格監管以及為遏制對環境的負面影響而實施的嚴格限制正在限制軟管市場的成長。

軟性管市場趨勢

石油和天然氣產業引領市場

- 石油是石油和天然氣的下游產品,廣泛應用於化妝品。隨著可支配收入的增加和職業婦女數量的增加,對化妝品的需求逐年增加。

- 石油和天然氣需求的增加需要石油和天然氣的高效運輸,這給石油和天然氣帶來了巨大的物理和化學壓力。此外,不僅在已開發地區,而且在新興市場,由於航空公司數量的增加而導致運輸業的擴張,以及乘用車和汽車數量的增加,正在推動石油工業市場的發展。

- 對石油和天然氣的需求不僅限於汽車,還廣泛用於工業中為機械提供動力。

- 交通運輸業可能會推動軟管市場的需求,因為它是石油和天然氣的最大消費量。

北美佔最大市場佔有率

- 美國是北美最大的軟管市場。新發現的頁岩資源和旨在未來幾年成為最大石油和天然氣生產國的政府政策預計將推動該國對軟性管道的需求。

- 例如,美國內政部 (DoI) 將根據國家外大陸棚石油和天然氣租賃計劃(國家 OCS 計劃),從 2019 年至 2024 年允許在約 90% 的外大陸棚(OCS) 英畝土地上進行海上探勘鑽探該地區的石油和天然氣產業預計將開啟新的市場機會。

- 此外,根據美國能源情報署的數據,由於原油、天然氣和天然氣工廠液體(NGPL)產量大幅增加,加上美國能源成長乏力,2020年美國將成為能源淨出口國消費量情況在預測期內仍將持續。

- 在預測期內,石油和天然氣需求的成長可能會提振北美軟管市場。

軟性管行業概況

主要軟管製造商包括 National Oilwell Varco Inc.、GE Oil & Gas Corporation、TechnipFMC PLCI Inc.、Shawcor Ltd 和 Prysmian Group。先進的產品開發和併購是主要企業保持競爭力和快速獲得市場佔有率的關鍵策略。

- 2019 年1 月:GE 旗下貝克休斯(BHGE) 推出了新技術和水下開發方法,旨在降低海上石油和天然氣項目的成本並提高生產率,這些機器將石油和天然氣轉移到稱為管匯的管道中。這些技術是模組化、結構化、緊湊的,旨在響應現場生命週期中不斷變化的條件,將總擁有成本降低高達 50%。

- 2018 年 8 月:NOV 完成了一個協作行業計劃,以在真實的海底環境中檢驗和演示全尺寸 Seabox 海底水處理模組的安裝和性能。這使得營運商能夠最佳化水驅並提高石油採收率。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 石油和天然氣行業對非腐蝕性管道的需求增加

- 鑽井過程中的技術進步

- 市場限制因素

- 石油價格波動

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

第5章市場區隔

- 按原料分

- 高密度聚苯乙烯

- 聚醯胺

- 聚二氟亞乙烯

- 其他原料

- 按用途

- 離岸

- 深海

- 超深海

- 陸上

- 離岸

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 俄羅斯

- 挪威

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 馬來西亞

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- National Oilwell Varco(NOV)

- TechnipFMC PLC

- The Prysmian Group

- GE Oil & Gas Corporation

- Shawcor Ltd

- SoulForce(Pipelife Nederland BV)

- Airborne Oil & Gas BV

- Magma Global Ltd

- ContiTech AG

- Chevron Phillips Chemical Company LLC

- Flexsteel Pipeline Technologies Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 65697

The Flexible Pipe Market is expected to register a CAGR of 4.4% during the forecast period.

Key Highlights

- Flexible pipes and tubes are widely used to transport oils or other liquids from one location to the other, especially through the seabed, or at construction sites and ores. Due to benefits like high-pressure control, lightweight, leak resistance, and lower price, flexible pipes are being used across industry verticals. The technical and cost advantages these pipes offer, are expected to replace the usage of steel equipment for new exploration activities at a greater pace over the forecast period.

- With the ongoing focus of the oil and gas companies on unconventional sources for oil and gas, along with the offshore and subsea developments, which are moving into deeper waters and more challenging environments, there is a need to minimize inspection to reduce cost. Further, the maintenance and repair costs are high. And thus, flexible pipes are found to be the best fit, as they play a key role in increasing the productivity, life-expectancy, and profitability of onshore and offshore wells.

- However, on the flip side, strict restrictions that are imposed to curb the adverse effects on the environment, along with the rigid regulations imposed on oil and gas drilling activities, restrict the growth of the flexible pipe market.

Flexible Pipes Market Trends

Oil and Gas Industry to Drive the Market

- The downstream product of oil and gas, i.e., petroleum, is widely used in cosmetic products. With the growth of disposable income and the increasing number of working women, the demand for cosmetics is increasing year-on-year.

- This increasing demand for oil and gas requires effective transportation of oil and gas are under enormous physical and chemical stress. Further, the expansion of the transport sector by increasing the number of aviation carriers in the developed region as well as developing regions, along with the increase in the number of owners of passenger cars and vehicles will be driving the market for the oil industry.

- The need for oil and gas does not only restrict to vehicles but it is also widely used in industries for running machines as well.

- The transport sectors are the highest consumption oil and gas and thus, it will fuel the demand for flexible pipe market.

North America Holds the Largest Market Share

- The United States is the largest market for flexible pipes in North America. The country's newfound shale resources and government policies, which aim at making the country the top oil and gas producer in the next few years, are expected to drive the demand for flexible pipes in the country.

- For instance, with the US Department of Interior (DoI) planning to allow offshore exploratory drilling in about 90% of the outer continental shelf (OCS) acreage, under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open up new opportunities to the market.

- Further, according to the US Energy Information Administration, the United States will become a net energy exporter in 2020 and will remain so throughout the forecast period, as a result of large increases in crude oil, natural gas, and natural gas plant liquids (NGPL) production, coupled with slow growth in the US energy consumption.

- The increase in demand for oil and gas will, in turn, boost the flexible pipe market during the forecast period in North America.

Flexible Pipes Industry Overview

The flexible pipe market is competitive and fragmented.Some of the key flexible pipe manufacturers are National Oilwell VarcoInc., GE Oil & Gas Corporation, TechnipFMC PLCInc., Shawcor Ltd, and Prysmian Group, among others. The development of advanced products andmergers andacquisitions are the keystrategies adopted by the major players to remain competitive and to quickly gain market share.

- January 2019:Baker Hughes, a GE company (BHGE),rolled out new technology and underwater development approach, which is set to reduce costs and improve the productivity of offshore oil and natural gas projects. The system includes pumps, flexible pipes, machines to divert oil and gas to pipelines known as manifolds, etc., to control the production. These technologies are modular, structured, compact, and designed to be more responsive to changing conditions across the life of the field, cutting the total cost of ownership by up to 50%.

- August 2018:NOVcompleted a joint industry project to verify and demonstrate installationand performance aspects of a full-scale Seabox subsea water treatment module in a realistic subsea environment.The Seabox system enables water treatment to be done directly at the seabed and water to be pumped straight into the injection well. This will allow the operator to optimize waterflooding and improve oil recovery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Demand for Non-corrosive Pipes in Oil and Gas Industry

- 4.3.2 Technological Advances in Drilling Process

- 4.4 Market Restraints

- 4.4.1 Fluctuating Oil Prices

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 TECHNOLOGY SNAPSHOT

5 MARKET SEGMENTATION

- 5.1 By Raw Material

- 5.1.1 High-density Polyethylene

- 5.1.2 Polyamides

- 5.1.3 Polyvinylidene Fluoride

- 5.1.4 Other Raw Materials

- 5.2 By Application

- 5.2.1 Offshore

- 5.2.1.1 Deepwater

- 5.2.1.2 Ultra-deepwater

- 5.2.2 On shore

- 5.2.1 Offshore

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Russia

- 5.3.2.3 Norway

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 National Oilwell Varco (NOV)

- 6.1.2 TechnipFMC PLC

- 6.1.3 The Prysmian Group

- 6.1.4 GE Oil & Gas Corporation

- 6.1.5 Shawcor Ltd

- 6.1.6 SoulForce (Pipelife Nederland B.V.)

- 6.1.7 Airborne Oil & Gas BV

- 6.1.8 Magma Global Ltd

- 6.1.9 ContiTech AG

- 6.1.10 Chevron Phillips Chemical Company LLC

- 6.1.11 Flexsteel Pipeline Technologies Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219