|

市場調查報告書

商品編碼

1630236

持續測試:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Continuous Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

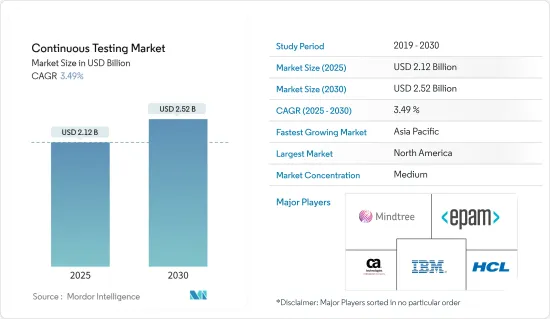

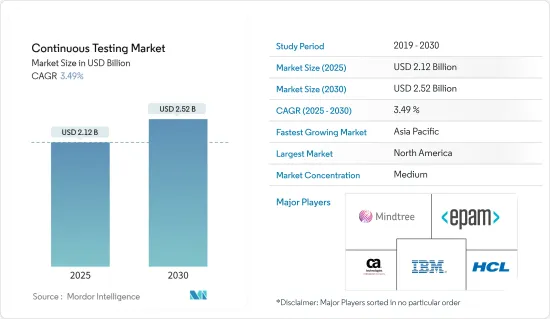

持續測試市場規模預計到 2025 年為 21.2 億美元,預計到 2030 年將達到 25.2 億美元,在市場估計和預測期間(2025-2030 年)複合年成長率為 3.49%。

複雜IT基礎設施的開發結合了實體系統和虛擬環境,需要持續測試以獲得正確的回饋和持續交付。持續整合(CI)在業界已經很普遍。相較之下,配置部分缺少一些環節,為持續測試和持續部署創造了機會。

主要亮點

- 全球業務的日益數位化正在增加對軟體開發的需求。開發公司也希望透過自動化測試流程來提高效率。因此,對持續及時交付的需求不斷成長正在推動市場成長。

- 採用敏捷和 DevOps 方法進行計劃管理也正在推動市場成長。例如,塔塔諮詢服務公司在業務中採用了敏捷和商業 4.0 概念。這些方法涉及持續測試,而不是在最後一刻發現問題並重複該過程。

- 對傳統方法的依賴以及缺乏熟練且經驗豐富的測試自動化人才正在阻礙持續測試市場的成長。

- 然而,在公司內不同團隊(例如業務分析師團隊、開發團隊和 QA 團隊)之間的正確整合方面,公司在持續測試的測試設計方面面臨一些挑戰。儘管企業都意識到持續測試的重要性,但採用持續測試顯然是一個開放的局面,有些企業尚未採用持續測試。儘管在軟體開發生命週期的各個領域中持續測試的採用有了顯著的改進,但企業仍然發現採用DevOps和持續交付很困難。

- 由於 COVID-19 的爆發,一些公司已經讓員工在家工作,這大大增加了開發人員實施 CT 工具的需求。企業擴大將其應用程式遷移到雲端和雲端基礎的平台。在這種情況下,有必要使用CT工具。

持續測試市場趨勢

雲端基礎的部署預計將顯著成長

- 雲端在持續測試部署中發揮重要作用。雲端基礎的測試由於易於部署、支援敏捷團隊與不同團隊協作、輕鬆的行動存取以及隨時隨地推動結果的能力而縮短了上市時間。所有這一切都是使用雲端處理完成的。

- 雲端基礎的配置可以為第三方工具和 API 提供 24x7 支持,無需停機。世界各地的組織正在轉向雲端基礎的服務,這使其成為現代商業趨勢。據 Flexera Software 稱,75% 的企業已採用 Microsoft Azure 來獲得公共雲端體驗。支援各種專業業務應用程式的雲端服務的廣泛可用性正在將企業轉變為數位企業。

- 雲端基礎的持續測試可以消除前期投資的需要並減少持續的維護成本,從而降低成本。

- 例如,Testsigma Technologies 提供人工智慧驅動的持續交付持續測試,作為其雲端基礎的敏捷和 DevOps 持續測試平台的一部分。這種整合的自動化測試工具可以自動執行 Web 和行動應用程式以及 API 的全面測試。雲端基礎的測試還允許測試人員透過客製化的資料庫庫支援實現資料檢驗和現場檢查,並執行安全的資料庫檢查。

- 測試過程的部署比本地部署更快,從而節省時間和資源。此外,雲端可讓您隨時隨地存取您的測試環境。持續測試使用 Selenium 等平台執行定期自動化測試,以建立測試案例並快速提供結果。

北美佔最大市場佔有率

- 預計北美將成為持續測試市場的最大貢獻國家。該地區強大的金融基礎使其能夠對先進的解決方案和技術進行大量投資。

- 美國和加拿大的公司越來越需要減少開發軟體所花費的時間,這推動了持續測試的使用。

- 此外,網際網路基礎設施以及網路和行動應用程式的進步增加了對快速測試和配置的需求。敏捷和 DevOps 方法的日益普及對測試活動的組織產生了重大影響。

- 美國政府擴大採用持續測試來進行應用開發,而且眾多私人公司的需求也在不斷成長。例如,Google、Netflix、Amazon 和 Meta 等公司每天使用 DevOps 部署軟體升級數千次。

持續測試產業概述

持續測試市場由 Mindtree Limited、EPAM Systems Inc.、Broadcom Inc. (CA Technology Inc.)、IBM Corporation 和 HCL Technologies Ltd. 等參與者分割。

- 2024 年 4 月:HCL 宣佈在拉斯維加斯舉行的 Google Cloud Next'24 大會上榮獲三項年度合作夥伴獎。 HCLTech 因其提供有效且高效的應用程式到雲端遷移的能力而榮獲年度雲端遷移專業化合作夥伴獎。 HCLTech CloudSMART 工業化服務是 Google Cloud 和多重雲端環境的可擴展選擇。

- 2023 年 11 月 有效性測試平台 Cable 推出交易保證,這是業界首個解決方案,旨在增強金融犯罪合規性和交易測試。為銀行、金融科技和付款管道提供唯一針對金融交易的全自動持續有效性測試解決方案,確保嚴格遵守與交易監控和製裁可疑活動報告(SAR)相關的監管要求。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 採用敏捷和 DevOps

- 對持續、及時交付的需求不斷增加

- 市場限制因素

- 對傳統方法的依賴

- 缺乏熟練的測試自動化人才

第6章 市場細分

- 按服務

- 託管服務

- 專業服務

- 透過介面

- 網路

- 桌面

- 移動的

- 依部署類型

- 本地

- 雲端基礎

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Mindtree Limited

- EPAM Systems Inc.

- Broadcom Inc.(CA Technologies Inc.)

- IBM Corporation

- HCL Technologies Ltd

- Atos SE

- Sauce Labs Inc.

- Cigniti Technologies Limited

- Cognizant Technology Solutions Corp.

- Tech Mahindra Limited

- Hexaware Technologies Ltd

- Larsen & Toubro Infotech Ltd

第8章投資分析

第9章市場的未來

The Continuous Testing Market size is estimated at USD 2.12 billion in 2025, and is expected to reach USD 2.52 billion by 2030, at a CAGR of 3.49% during the forecast period (2025-2030).

The development of the complex IT infrastructure combines physical systems and a virtualized environment, which needs continuous testing for proper feedback and continuous delivery. Continuous integration (CI) is already widespread in the industry. In contrast, there was some missing link in the deployment part, creating an opportunity for continuous testing and continuous deployment.

Key Highlights

- The growing digitalization in businesses globally is creating the demand for software development. Also, developing companies are leaning toward increasing efficiency by automating their testing processes. Hence, the growing demand for continuous and timely delivery drives the market's growth.

- Adopting Agile and DevOps approaches for project management also boosts the market's growth. For instance, Tata Consultancy Services is adopting Agile and Business 4.0 concepts for their whole operations. These approaches include continuous testing rather than detecting a problem at the last stage and repeating the process.

- The dependency on traditional approaches and lack of skilled and experienced test automation workforce are hampering the growth of the continuous testing market.

- However, organizations face several challenges related to testing design for continuous testing in terms of proper integration between the different teams across the company, like business analyst teams, development, and QA teams. Although enterprises realize the importance of continuous testing, the deployment of CT has a vividly open landscape, and several companies have yet to adopt it. While there have been significant improvements in adopting continuous testing in each area of the software development lifecycle, enterprises still find it challenging to implement DevOps and continuous delivery.

- Due to the COVID-19 pandemic, several businesses had employees working from home, and the need to adopt CT tools for developers increased substantially. Companies have been increasingly moving their apps to the cloud or cloud-based platforms. Such instances necessitate the adoption of CT tools.

Continuous Testing Market Trends

Cloud-based Deployment is Expected to Grow Significantly

- The cloud plays a critical role in the deployment of continuous testing. Cloud-based testing helps reduce time-to-market, owing to the ease of deployment and collaboration assistance with the different teams in an Agile Team, easy mobile accessibility, and the ability to derive results on the go. All of these are executed with the use of cloud computing.

- Cloud-based deployment offers 24/7 support for third-party tools and APIs with zero downtime. Organizations across the world are moving to cloud-based services, which is a trend for modern businesses. According to Flexera Software, 75% of enterprises adopted Microsoft Azure for public cloud usage. The broad availability of cloud services to support various specialized business applications is helping companies transform into digital enterprises.

- Cloud-based continuous testing can save costs by eliminating the necessity for upfront hardware investments and decreasing ongoing maintenance costs.

- For instance, Testsigma Technologies offers AI-driven continuous testing for continuous delivery as part of its cloud-based continuous testing platform for Agile and DevOps. This unified automation testing tool can automate comprehensive testing for web and mobile apps and APIs. Cloud-based testing also enables testers to achieve data validation and field checks with the support of a customized database as an offering, thus leading to secure database checks.

- The deployment of the testing process is quick compared to on-premise deployment, thus saving time and resources. Additionally, the cloud allows access to the testing environment from anywhere, anytime. Continuous testing offers regular automated testing using platforms like Selenium to build test cases and deliver results faster.

North America Holds the Largest Market Share

- North America is projected to be the largest contributor to the continuous testing market. The region's strong financial position enables it to invest heavily in advanced solutions and technologies.

- The increasing need to reduce the time spent on software development in enterprises in the United States and Canada has boosted the use of continuous testing.

- Additionally, the advancements in internet infrastructure and web and mobile applications are increasing the demand for quick testing and deployment. The growing adoption of Agile and DevOps methodology has a significant impact on the organization of testing activities.

- The US government is increasingly adopting continuous testing for application development, leading to growing demand across various private companies. For instance, companies such as Google, Netflix, Amazon, and Meta are using DevOps to deploy software upgrades thousands of times each day, which is also expected to boost revenue growth in the region.

Continuous Testing Industry Overview

The continuous testing market is fragmented with the presence of players like Mindtree Limited, EPAM Systems Inc., Broadcom Inc. (CA Technology Inc.), IBM Corporation, and HCL Technologies Ltd.

- April 2024: HCL announced that it received three Partner of the Year awards at the Google Cloud Next '24, held in Las Vegas. HCLTech received the Cloud Migration Specialization Partner of the Year Award for its ability to provide effective and efficient migration of applications to the cloud. HCLTech CloudSMART Industrialized Services are scalable choices for Google Cloud and multi-cloud environments.

- November 2023: The effectiveness testing platform, Cable, launched its industry-first solution, Transaction Assurance, enhancing financial crime compliance and transaction testing. It offers banks, fintechs, and payment platforms the only fully automated and continuous effectiveness testing solution for financial transactions, ensuring strict adherence to regulatory requirements related to transaction monitoring as well as sanctions Suspicious Activity Reports (SARs).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Agile and DevOps

- 5.1.2 Increasing Need for Continuous and Timely Delivery

- 5.2 Market Restraints

- 5.2.1 Dependency on Traditional Approaches

- 5.2.2 Lack of a Skilled and Experienced Test Automation Workforce

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Managed Service

- 6.1.2 Professional Service

- 6.2 By Interface

- 6.2.1 Web

- 6.2.2 Desktop

- 6.2.3 Mobile

- 6.3 By Deployment Type

- 6.3.1 On-premise

- 6.3.2 Cloud-based

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mindtree Limited

- 7.1.2 EPAM Systems Inc.

- 7.1.3 Broadcom Inc. (CA Technologies Inc.)

- 7.1.4 IBM Corporation

- 7.1.5 HCL Technologies Ltd

- 7.1.6 Atos SE

- 7.1.7 Sauce Labs Inc.

- 7.1.8 Cigniti Technologies Limited

- 7.1.9 Cognizant Technology Solutions Corp.

- 7.1.10 Tech Mahindra Limited

- 7.1.11 Hexaware Technologies Ltd

- 7.1.12 Larsen & Toubro Infotech Ltd