|

市場調查報告書

商品編碼

1630203

微型相機模組:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Compact Camera Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

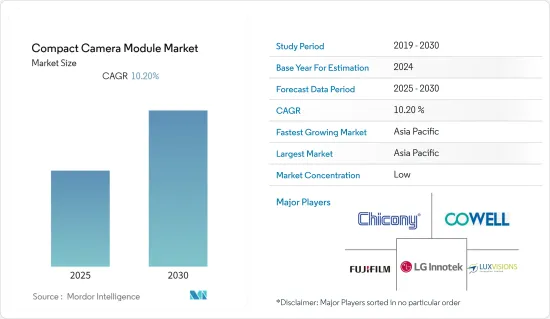

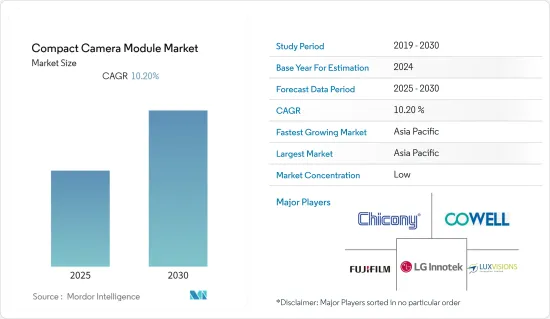

微型相機模組市場預計在預測期內複合年成長率為10.2%

主要亮點

- 在當前情況下,成為行動製造市場供應鏈的一部分是在CCM市場取得成功的關鍵因素。例如,韓國生態系統由於三星和LG的存在而獲得持續發展。

- 過去幾年,相機模組的平均售價持續下降。除此之外,對相機模組快速創新的需求正在幫助其保持相對於市場主要參與企業的優勢。

- CCM 在汽車中的高級駕駛輔助和汽車電子產品應用正在推動小型相機模組市場的發展。 CCM 設計的創新有助於其在汽車中的應用不斷增加。

- 該市場的一個關鍵驅動力是小型汽車相機模組的出現,作為自動駕駛、汽車電子產品和高級駕駛員輔助不可或缺的一部分。這也降低了這些小模組的平均售價。因此,對聯網汽車和自動駕駛汽車的需求不斷成長也為預測期內接受調查的市場供應商帶來了巨大的機會。

- 此外,CMOS相機模組的需求也在快速成長。與 CCD 感測器相比,CMOS 感測器具有多種優勢,包括功耗更低、影格速率更快、製造更容易以及成本更低。此外,CMOS 設計的進步(例如小型化)即使在低照度條件下也能實現卓越的效能和影像品質。

- 索尼表示,COVID-19大流行對影像感測器(特別是CMOS影像感測器)生產的影響很小,包括對材料採購的影響。然而,由於上述因素,該公司預計只會在智慧型手機製造商的供應鏈問題方面受到嚴重打擊。對於依賴SONY晶片的最終用戶來說,這是一個好消息,因為他們不再需要面臨為其最新產品購買影像感測器的問題。

小型相機模組市場趨勢

行動細分市場佔據最大市場佔有率

- 在微型相機模組市場中,由於消費者規格的不斷擴大和市場競爭的激烈,行動領域佔據了最大的市場佔有率。相機已成為行動裝置製造商的重要功能,因為消費者的購買意願很大程度上受到相機類型和像素大小的影響。

- 隨著行動裝置中高解析度攝影機和多個前置相機攝影機的採用,CCM 市場正在不斷擴大。後置和前置鏡頭的解析度需求不斷提高正在推動市場發展。

- 智慧型手機市場已達到成熟水平,感測器技術的不斷進步以及行動相機的深度效應趨勢增加了每個智慧型手機單元中多個小型相機模組的應用,從而增加了該細分市場對CCM的需求。

- 所有系列智慧型手機對提高相機解析度的需求不斷成長,導致多家製造商推出新產品。例如,2022 年 6 月,三星宣布推出一款至少 200 兆像素的智慧型手機感測器。三星的 ISOCELL HP3 影像感測器配備 0.56微米(μm) 像素,比傳統的 0.64μm 像素尺寸小 12%。

- 此外,2022年2月,OPPO宣布與哈蘇達成為期三年的策略夥伴關係,協助OPPO旗艦手機「Find」系列引進全新相機技術。這些案例正在推動預測期內對小型相機模組的需求。

- 愛立信預計,2021年全球智慧型手機用戶數將超過60億,預計未來幾年將增加數億。

亞太地區成長最快

- 中國和印度擁有最多的智慧型手機。此外,由於旨在使筆記型電腦和筆記型電腦更快、更薄的開發,相機模組製造商正在尋求進一步的品質創新。智慧型手機的快速普及和可支配收入的增加正在促使家用電子電器迅速轉向最新技術。

- 此外,智慧城市的採用是中國視訊監控的主要驅動力。先進的視訊監控技術正在融入城市政府以提高效率。

- 2021 年 10 月,聯邦政府選擇由霍尼韋爾自動化印度公司主導Nirbhaya 基金下的 496.57 億印度盧比的班加羅爾安全城市計劃。該計劃由內政部推出,旨在鼓勵婦女和女孩在公共領域尋求一切機會,免受基於性別的騷擾和暴力。這些發展正在推動小型相機模組在該地區的推出。

- 2022年7月,蘋果iPhone相機模組供應商LG Innotek宣布將投資10.7億美元擴大相機模組和其他電子元件的生產。一家韓國電子元件製造商與慶尚北道龜尾市簽署了一份合作備忘錄,將在 2023 年底年終擴大其龜尾製造園區的生產線。

- 此外,鍵盤和微型相機模組(CCM)製造商群光電子將於2021年5月在泰國的新工廠開始生產,到2021年終將產能從目前設計水準的60%提高到100%。

- 此外,汽車產業預計將成為該地區相機模組的最大消費者之一。日本是世界上最大的汽車市場之一。隨著產業動態的變化,汽車製造商正在轉向自動駕駛汽車來滿足消費者的需求。

小型相機模組產業概況

輕巧相機模組市場分散且競爭激烈。產品研究、研發費用上升、聯盟和收購等是市場參與者為維持激烈競爭所採取的主要成長策略。

- 2022 年 7 月 - LG Innotek 開發了一款超薄相機 Metalens,用於緊湊型、節儉型電動車自動駕駛套件。超透鏡具有散佈著奈米顆粒的平坦平面結構,可以像普通透鏡一樣以多種方式聚焦光波長,但它可以薄至微米。它還可用於行動電話和各種其他微型相機應用。

- 2021 年 10 月 - OmniVision Technologies Inc. 宣布推出適用於一次性內視鏡和導管的 OVMed、OCHSA 和 OCHTA 電纜模組。完全整合的醫療級成像子系統將直徑非常小的相機模組與升級的 OVMed 電纜和迷你 LED 照明相結合,這是一種經過全面醫療測試的組件,可提供卓越的圖像品質。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 汽車 ADAS(進階駕駛輔助系統)市場驅動力增加

- 家庭和商業設施中保全攝影機的使用增加

- 市場挑戰/限制

- 複雜的製造和供應鏈挑戰

- 科技演進趨勢

- 透過組件實現技術進步

- 每個最終產品的平均相機數量 - 智慧型手機相機與輕型汽車/行動電話的演變

第6章 市場細分

- 按成分

- 影像感測器

- 鏡片

- 相機模組組裝

- VCM 供應商(AF 和 OIS)

- 按用途

- 移動的

- 家用電子電器(不含手機)

- 車

- 醫療保健

- 安全

- 工業的

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 廠商市場佔有率/排名分析

- 相機模組廠商市場佔有率

- 影像感測器(CIS)供應商排名

- 鏡頭組廠商排名

第8章 競爭格局

- 公司簡介

- Chicony Electronics Co. Ltd

- Cowell E Holdings Inc.

- Fujifilm Corporation

- LG Innotek Co. Ltd

- LuxVisions Innovation Limited(Lite-On Technology Corporation)

- Primax Electronics Ltd

- Samsung Electro-Mechanics Co. Ltd

- Sharp Corporation

- Sony Corporation

- STMicroelectronics NV

- Sunny Optical Technology(Group)Company Limited

- ams AG

- Semiconductor Components Industries LLC(On Semiconductor)

- OFILM Group Co. Ltd

- OmniVision Technologies Inc.

- Shenzhen O-Film Tech Co. Ltd

- Fujikura Ltd

- Leopard Imaging Inc.

- Teledyne Lumenera

- CM Technology Company Ltd

第9章投資分析

第10章投資分析市場的未來

簡介目錄

Product Code: 62340

The Compact Camera Module Market is expected to register a CAGR of 10.2% during the forecast period.

Key Highlights

- In the current scenario, being a part of the mobile manufacturing market supply chain is a key factor for success in the CCM market. For instance, the Korean ecosystem has observed sustained development due to the presence of Samsung and LG.

- The average selling price of the camera modules has continuously declined over the past few years. Along with that, the need for rapid innovations in the camera module is assisting in retaining dominance with the critical players in the market.

- The application of CCM in the automotive for advanced driving assistance and automotive electronics is driving the market for a compact camera module. The innovation in the CCM design has benefited the rising application in automobiles.

- A significant driver for this market has been the emergence of the automotive compact camera module as an integral factor for automated driving, automotive electronics, and advanced driver assistance. This is also reducing the average selling price of these compact modules. Therefore, the increasing demand for connected and autonomous vehicles will also offer a massive opportunity to the studied market vendors during the forecast period.

- Additionally, the demand for CMOS camera modules is increasing rapidly. CMOS sensors offer various advantages over CCD sensors, such as low power consumption, faster frame rate, ease of manufacturing, and low cost. Moreover, the advancements in CMOS design, like miniaturization, make it possible to achieve better performance and quality of images even in low light conditions.

- According to Sony Corporation, the COVID-19 pandemic has had a minimal effect on the production of image sensors (particularly CMOS image sensors), including any impact on the procurement of materials. However, owing to the aforementioned factors, the company only expects to take a hit in terms of supply chain issues for smartphone manufacturers. This has been positive news for end users that rely on Sony chips, as they need not face any issues in procuring image sensors for their latest products.

Compact Camera Module Market Trends

Mobile Sector to Hold the Largest Market Share

- The mobile segment holds the largest market share of the compact camera module market, owing to the growing consumer specifications and the stiff competitive nature of the market. Cameras have become a critical feature for mobile device manufacturers as the consumer's purchasing decision is also greatly dependent on the type of camera and pixel size.

- The CCM market is aided by the adoption of high-resolution cameras in mobiles and increased by the adoption of multiple front and back cameras. The increasing resolution requirement for rear and front-facing mobile cameras drives the market.

- Even though the smartphone market has reached the maturity level, the continuous advancement in the sensors technology and the trend toward the depth effect of mobile cameras has raised the application of multiple compact camera modules for each smartphone unit, increasing the demand for CCM in the segment.

- The increasing demand to improve cameras' resolution across smartphones of all ranges has enabled several manufacturers to launch new products. For instance, in June 2022, Samsung announced the smallest 200 Mega Pixel smartphone sensor. Samsung's ISOCELL HP3 image sensor features 0.56-micrometer (μm)-pixels which are 12 percent smaller in pixel size than the predecessor's 0.64μm.

- Moreover, in February 2022, OPPO announced a three-year strategic partnership with Hasselblad to help introduce new camera technologies to OPPO's flagship Find series of mobiles. Such instances drive the demand for compact camera modules over the forecast period.

- According to Ericsson, the number of smartphone subscriptions globally surpassed six billion in 2021 and is forecast to grow further by several hundred million in the next few years.

Asia-Pacific Region to Witness the Fastest Growth

- China and India are the nations with the highest number of smartphones. Also, the development in the laptops and notebooks towards faster and thinner is advancing camera module companies for further improved quality innovations. The rapid increase in smartphone penetration and the growing disposable income is driving the population the quick switch to the latest technologies in consumer electronics.

- Moreover, the introduction of smart cities is acting as a significant driving force for video surveillance in China. Advanced video surveillance techniques have been integrated with the city administration to boost efficiency.

- In October 2021, the Union Government selected Honeywell Automation India to lead the INR 496.57-crore Bengaluru Safe City project under the Nirbhaya Fund. The project was launched by the Ministry of Home Affairs to encourage women and girls to pursue all opportunities in public spaces while being free from harassment or violence based on gender. Such developments are boosting the implementation of compact camera modules in the region.

- In July 2022, the camera module supplier for Apple iPhone, LG Innotek, announced an investment of USD 1.07 billion to expand the production of camera modules and other electronic parts. The South Korean electronics parts maker signed a memorandum of understanding with the city of Gumi, North Gyeongsang Province, to add production lines to its Gumi manufacturing campus by the end of 2023.

- Moreover, in May 2021, Chicony Electronics Co. Ltd, a manufacturer of Keyboard and compact camera modules (CCM), started production at its new plant in Thailand, with the capacity to increase from 60% of the designed level currently to 100% by year-end 2021.

- Further, the automotive sector is expected to be one of the region's largest consumers of camera modules. Japan is one of the largest automotive markets in the world. With changing dynamics in the industry, automotive manufacturers are moving toward autonomous vehicles to meet the needs of consumers.

Compact Camera Module Industry Overview

The compact camera module market is fragmented and highly competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the market to sustain the intense competition.

- July 2022 - LG Innotek is developing an ultrathin camera metalens for compact and frugal electric vehicle self-driving kits. Metalenses have a flat, planar structure peppered with nanoparticles that can focus the light wavelengths in various ways, just like regular lenses, but can be as thin as a micron. They can also be used in phones and various other micro-camera applications.

- October 2021 - OmniVision Technologies Inc. announced the launch of OVMed, OCHSA, and OCHTA cable modules for single-use endoscopes and catheters. The fully-integrated medical-grade imaging subsystems combine an exceptionally small diameter camera module with upgraded OVMed cables and mini-LED illumination for a fully medically-tested assembly that provides excellent image quality.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact Of Covid-19 On The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Market of Advanced Driver Assistance System in Vehicles

- 5.1.2 Increased Use of Security Cameras in Households and Commercial Establishments

- 5.2 Market Challenges/Restraints

- 5.2.1 Complicated Manufacturing and Supply Chain Challenges

- 5.3 Technology Evolution Trends

- 5.3.1 Component-wise Technological Advancements

- 5.3.2 Average Number of Cameras per End-product - Smartphones Vs. Light Vehicles/Camera Evolution in a Mobile Phone

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Image Sensor

- 6.1.2 Lens

- 6.1.3 Camera Module Assembly

- 6.1.4 VCM Suppliers (AF and OIS)

- 6.2 By Application

- 6.2.1 Mobile

- 6.2.2 Consumer Electronics (Excl. Mobile)

- 6.2.3 Automotive

- 6.2.4 Healthcare

- 6.2.5 Security

- 6.2.6 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 VENDOR MARKET SHARE/RANKING ANALYSIS

- 7.1 Camera Module Vendor Market Share

- 7.2 Image Sensor (CIS) Vendor Ranking

- 7.3 Lens Set Vendor Ranking

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Chicony Electronics Co. Ltd

- 8.1.2 Cowell E Holdings Inc.

- 8.1.3 Fujifilm Corporation

- 8.1.4 LG Innotek Co. Ltd

- 8.1.5 LuxVisions Innovation Limited (Lite-On Technology Corporation)

- 8.1.6 Primax Electronics Ltd

- 8.1.7 Samsung Electro-Mechanics Co. Ltd

- 8.1.8 Sharp Corporation

- 8.1.9 Sony Corporation

- 8.1.10 STMicroelectronics NV

- 8.1.11 Sunny Optical Technology (Group) Company Limited

- 8.1.12 ams AG

- 8.1.13 Semiconductor Components Industries LLC (On Semiconductor)

- 8.1.14 OFILM Group Co. Ltd

- 8.1.15 OmniVision Technologies Inc.

- 8.1.16 Shenzhen O-Film Tech Co. Ltd

- 8.1.17 Fujikura Ltd

- 8.1.18 Leopard Imaging Inc.

- 8.1.19 Teledyne Lumenera

- 8.1.20 CM Technology Company Ltd

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219

![輕便相機模組市場[鏡頭類型:自動對焦與定焦;最終用途:移動、汽車、安全、工業、醫療保健、計算等] - 2023-2031 年全球產業分析、規模、佔有率、成長、趨勢和預測](/sample/img/cover/42/default_cover_6.png)