|

市場調查報告書

商品編碼

1630195

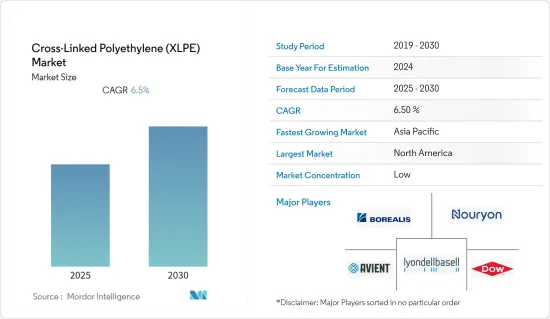

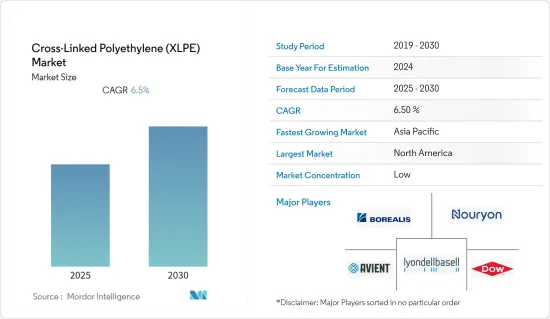

交聯聚乙烯(XLPE):市場佔有率分析、產業趨勢、成長預測(2025-2030)Cross-Linked Polyethylene (XLPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計交聯聚乙烯市場在預測期內的複合年成長率為 6.5%。

主要亮點

- 市場受到 COVID-19 的負面影響。受疫情影響,世界多個國家已進入封鎖狀態,以遏止病毒傳播。許多公司和工廠停止營運,擾亂了全球供應鏈,損害了全球生產、交貨時間和產品銷售。目前,市場已從 COVID-19 大流行中恢復過來,並正在以顯著的速度成長。

- 推動市場的關鍵因素是 XLPE 的低成本、靈活性、易於安裝以及管道應用的需求激增。

- 原料價格的波動以及低傳熱阻力和黏附力預計將阻礙所研究市場的成長。

- 都市化的快速發展和汽車行業不斷成長的需求預計將為預測期內交聯聚乙烯市場的主要企業提供重大成長機會。

- 北美是關鍵地區,亞太地區預計將成為預測期內交聯聚乙烯市場成長最快的地區。

交聯聚乙烯(XLPE)市場趨勢

建築和施工主導市場

- 建築業是使用交聯聚乙烯的主要最終用戶產業之一。交聯聚乙烯管用於住宅地板輻射供暖,因為輻射供暖可以為室內提供穩定的熱量供應。

- 此外,交聯聚乙烯 (XLPE) 管材和管道廣泛用於管道工程,取代銅、鍍鋅鋼和 PVC 管道。

- 基於 XLPE 的管材和管道耐腐蝕,在較寬的溫度範圍內表現良好,並且可以輸送熱水和冷水。因此廣泛用於冷、熱水管的保溫。

- XLPE 完全消除了安裝過程中的彎曲和管道等準備工作,可實現從配水點到出水口固定裝置的直接連接。這不僅降低了接頭安裝成本,而且還減少了接頭處湍流造成的壓力降。

- 根據美國人口普查局的數據,按季節已調整的後的年率計算,2023 年 4 月的建築支出估計為 19,084 億美元,比 3 月估計的約 18,850 億美元高出約 1.2%。 2023年1月至4月的整體建築支出為5,667億美元。

- 根據加拿大統計局數據,2022年第四季度,加拿大整體建築投資下降1.9%,至613億美元。住宅領域下降 3.4%,至 448 億美元,而非住宅領域成長 2.6%,至 165 億美元。

- 印度品牌股權基金會 (IBEF) 表示,印度需要發展基礎設施,以實現 2025 年 5 兆美元的經濟成長目標。在2023-24年預算中,基礎設施資本支出增加了33%,達到10兆盧比(1,220億美元)。因此,建設投資的增加將拉動交聯聚乙烯的需求。

- 上述因素預計將在預測期內推動交聯聚乙烯市場。

亞太地區是成長最快的市場

- 在亞太地區,中國僅花費全球約3%的醫療保健支出,就能滿足全球22%人口的醫療保健需求。為了縮小這一差距,中國正在大力投資國內醫療保健產業。

- 此外,建築業的成長、工業和公共基礎設施投資的增加以及由於快速都市化發展的天然氣管道、輸水和污水處理系統是預測期內推動該國探勘市場的關鍵因素。交聯聚乙烯廣泛應用於建築、汽車、醫療、電氣和電子等多個行業。

- 根據國際貿易局統計,中國是全球最大的建築市場。獎勵策略的基礎設施投資預計將推動行業成長。例如,中國的「十四五」計畫強調交通、能源、水系統、新型都市化等新型基礎建設計劃。據計算,「十四五」期間(2021-2025年)新基礎建設投資總額將達到約4.2兆美元。

- 中國政府頒布了《「健康中國2030」》藍圖,顯示中國繼續以健康作為社會經濟永續發展的先決條件。此外,該國的藥物研究正變得更加活躍,預計對 XLPE 的需求在預測期內將會成長。

- 據印度投資局稱,印度有望成為世界第三大建築業。根據2020-2025年國家基礎設施管道(NIP),印度基礎設施投資預算為1.4兆美元,其中24%用於可再生能源,18%用於道路和高速公路,17%用於城市基礎設施,鐵路佔17%。該預算約佔印度基礎設施開發總資本支出的70%。

- 這些因素正在推動預測期內受調查市場的需求。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進要素

- XLPE 成本低、靈活性強且易於安裝

- 管材應用需求快速成長

- 其他司機

- 抑制因素

- 原物料價格波動

- 傳熱阻力低、附著力低

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 製作方法

- 過氧化物法

- 四郎嫁接法

- 電子束加工方法

第5章市場區隔(以金額為準的市場規模)

- 按類型

- 高密度聚苯乙烯(HDPE)

- 低密度聚乙烯(LDPE)

- 其他類型

- 按最終用戶產業

- 建築/施工

- 電力/電子

- 車

- 醫療保健

- 化工

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema

- Armacell

- Avient Corporation

- Borealis AG

- Dow

- Exxon Mobil Corporation.

- Hanwha Chemical

- Lyondelbasell Industries NV

- Nouryon

- Solvay SA

第7章 市場機會及未來趨勢

- 都市化快速推進

- 汽車產業需求增加

簡介目錄

Product Code: 61958

The Cross-Linked Polyethylene Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- The market was negatively impacted due to COVID-19. Owing to the pandemic scenario, several countries around the world went into lockdown to curb the spread of the virus. The shutdown of numerous companies and factories has disrupted worldwide supply networks and harmed global production, delivery schedules, and product sales. Currently, the market has recovered from the COVID-19 pandemic and is increasing at a significant rate.

- Major factors driving the market studied are low-cost, flexibility, and easy installation of XLPE and the surge in demand from the pipes and tubing applications.

- Fluctuations in raw material prices and low heat transfer resistance and adhesion are expected to hinder the growth of the market studied.

- Rapid growth in urbanization and increase in demand from automotive industry are expected to provide substantial growth opportunities to the key players present in the cross-linked polyethylene market during the forecast period.

- North America is the leading region and Asia-Pacific is expected to be the fastest-growing region for cross-linked polyethylene market during the forecast period.

Cross-Linked Polyethylene (XLPE) Market Trends

Building and construction to Dominate the Market

- Building and construction are one of the major end-user industries in which cross-linked polyethylene is used. Cross-linked polyethylene tubing is used for radiant floor heating in residential housings as radiant heating provides a consistent heat to a room.

- Besides, cross-linked polyethylene (XLPE) tubing and piping are being widely used in plumbing operations, replacing copper and galvanized steel, and PVC pipingas the latter are subjected to rusting, cost, and circulation.

- XLPE-based tubing and piping resist corrosions and perform well under a wide range of temperatures, allowing transportation of both heated water and cold water. Hence, this is being widely used in chilled and hot water pipe insulation.

- XLPE can run straight from a distribution point to an outlet fixture by totally eliminating the preparation such as bending and tubing operations during installation. This reduces costs in installing joints, as well as the drop in pressure, due to turbulence induced at the transitions.

- According to U.S. Census Bureau, in April 2023, the estimated construction spending was USD 1,908.4 billion at a seasonally adjusted annual rate which was around 1.2% above the March estimate of around USD 1,885.0 billion. During the 1st four months of 2023, the overall construction spending amounted to USD 566.7 billion.

- According to Statistics Canada, during the fourth quarter of 2022, overall investment in building and construction in Canada has reduced by 1.9% which was valued at USD 61.3 billion. Residential sector has reduced to USD 44.8 billion by 3.4%, whereas, non-residential sector grown by 2.6% to USD 16.5 billion.

- According to India Brand Equity Foundation (IBEF) has stated that India has to develop the infrastructure in order to reach the economic growth target of USD 5 trillion by 2025. Capital investment for infrastructure has been increased by 33% to Rs. 10 lakh crore (USD 122 billion) under Budgest 2023-24. Thus, increase in construction investment in turn boost the demand for cross-linked polyethylene.

- The above memtioned factors are expected to drive the market for cross-linked polyethylene during the forecast period.

Asia-Pacific is the fastest growing Market

- In the Asia-Pacific region, China has spent only about 3% of the global healthcare spending, to address the healthcare needs of 22% of the world's total population. To reduce this gap, China is investing heavily in its domestic healthcare sector.

- Additionally, growth in the construction sector, increased investments in industrial and public infrastructure, and development of gas pipelines, water transmission, and sewer systems fueled by rapid urbanization, are the key factors that will drive the studied market, in the country, during the forecast period. Cross-linked polyethylene is extensively used in wide range of industries such as building and construction, automotive, medical, and electrical and electronics including others.

- According to International Trade Administration, China is the world's largest construction market. There is a stimulus-induced infrastructure investment is expected to increase the industry's growth. For exmaple, China's 14th Five-Year Plan emphasizes new infrastructure projects in transportation, energy, water systems, and new urbanization. According to estimates, overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will reach roughly USD 4.2 trillion.

- Chinese government promulgated Healthy China 2030, a blueprint that outlines its ongoing intent to prioritize health as a precondition for sustained social and economic development. Additionally, growing research on pharmaceuticals, in the country, will also augment the demand for XLPE, during the forecast period.

- According to Invest India, India is expected to become the third largest construction industry in the world. As under National Infrastructure Pipeline (NIP) for FY 2020-2025, India has an investment budget of USD 1.4 trillion on infrastructure, 24% on renewable energy, 18% on roads & highways, 17% on urban infrastructure, and 12% on railways. This budgest is accounted to around 70% of the total capital expsnditure of Indian infrastructure development.

- Such factors are boosting the demand for the market studied during the forecast period.

Cross-Linked Polyethylene (XLPE) Industry Overview

The cross-linked polyethylene (XLPE) market is fragmented in nature. Some of the major players include Dow, Nouryon, Borealis AG, LyondellBasell Industries Holdings B.V., and Avient Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Low-cost, Flexibility, and Easy Installation Of XLPE

- 4.1.2 Surge in Demand from Pipe and Tubing Applications

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuation in Raw Material Prices

- 4.2.2 Low Heat Transfer Resistance and Adhesion

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Methods

- 4.5.1 Peroxide Method

- 4.5.2 Silane Grafting Method

- 4.5.3 Electron Beam Processing

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 High-density Polyethylene (HDPE)

- 5.1.2 Low-density Polyethylene (LDPE)

- 5.1.3 Other Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Electrical and Electronics

- 5.2.3 Automotive

- 5.2.4 Medical

- 5.2.5 Chemical Industry

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Armacell

- 6.4.3 Avient Corporation

- 6.4.4 Borealis AG

- 6.4.5 Dow

- 6.4.6 Exxon Mobil Corporation.

- 6.4.7 Hanwha Chemical

- 6.4.8 Lyondelbasell Industries NV

- 6.4.9 Nouryon

- 6.4.10 Solvay SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Growth in Urbanization

- 7.2 Increase in Demand from Automotive Industry

02-2729-4219

+886-2-2729-4219