|

市場調查報告書

商品編碼

1630191

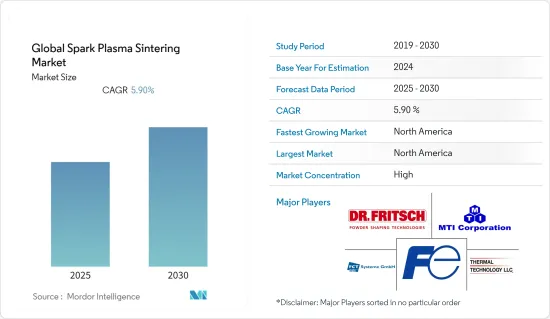

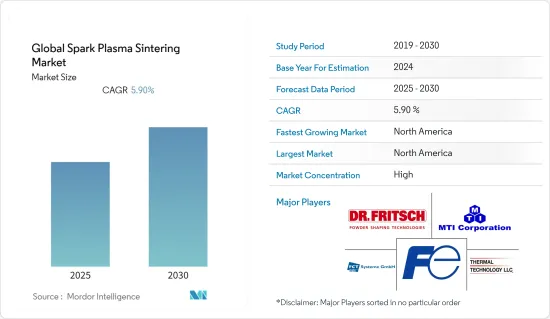

放電等離子燒結:全球市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Global Spark Plasma Sintering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計全球放電等離子燒結市場在預測期內的複合年成長率為 5.9%。

主要亮點

- 近幾十年來,基於高電流強度的精加工技術引起了工業領域的極大興趣。在這些技術中,放電等離子燒結已成為近年來最常使用的方法。近年來,SPS技術在材料科學和加工領域取得了巨大進步,因為它們能夠快速有效地緻密化各種材料,並且是適合固體合成和合成的裝置。

- SPS,也稱為 FAST,是一種高速粉末壓實技術,利用奈米材料開發以品質為中心的產品。這項技術引起了廣泛關注,因為它可以保留結晶微觀結構並創造具有有趣功能特性的材料。 SPS 系統的性能優於熱壓(HP) 燒結、熱等靜壓(HIP) 和常壓爐等傳統方法。微火花/等離子體是為 SPS 製程提案的各種物理機制中最常見的技術。

- 近年來,SPS 已成為生產高強度、超細結晶材料、彌散強化材料、熱電材料、金屬-鑽石(或一般的金屬-碳)複合材料和濺鍍靶材的合適選擇。此外,此製程有利於在成形過程中調節燒結體內的溫度梯度。這樣可以生產具有廣泛不同性能的梯度和層狀材料(例如 ZrO2/不銹鋼、Al2O3/鈦)。

- 近年來發表的許多論文也證明了 SPS 方法作為壓實粉末工具的日益普及。儘管SPS仍然是一項新技術,但最近的趨勢、研發和應用已經變得越來越明顯,並引起了研究和工業部門的極大關注。例如,SPS 最常見的應用之一是氮化鈦等高熔點材料的燒結。氮化鈦因其高耐腐蝕性、高強度和相對較輕的重量而廣泛應用於航太工業中的壓縮機、渦輪機和引擎的壓力管道。這些因素正在加速向汽車和國防領域的擴張。

- SPS的工業應用包括燃料電池材料、高強度耐磨工具、濺鍍靶材、磨料的鑽石成型、需要維護奈米級微結構的純金屬和混合金屬、陶瓷和金屬陶瓷開發等。由於其可用性的增加和製造成本的降低,預計在預測期內,工業和消費品中創新金屬、複合材料和陶瓷的採用將會增加。

- 此外,在 COVID-19 封鎖期間,SPS 進行了多種類型的研究,這對所研究市場的成長產生了積極影響。例如,2021 年 4 月,愛達荷州的研究人員將協助該產業製造更便宜、更耐用的高性能零件。愛達荷國家實驗室已開發出先進的功能,可協助業界設計高效的 SPS 製造流程。該研究所擁有最先進的設備,是世界上同類設備中最大的設備之一,使得在工業相關規模上生產新材料成為可能。 INL 設計和製造了四種自訂SPS 儀器,範圍從小型實驗室規模實驗支援到工業規模、大型高通量系統。

- 然而,SPS 需要大量的時間和金錢的前期投資。操作變數包括但不限於加熱燈速率、材料特性、晶粒設計和材料、保持溫度和時間、力策略、真空、大氣條件、功率設定、冷卻條件等。這可能成為市場成長的限制因素。

火花等離子燒結市場趨勢

汽車產業預計將推動市場成長

- 鎂基複合材料擴大應用於汽車和航太領域。鎂 (Mg) 及其合金是汽車應用中常用的金屬。這主要是由於鎂密度低(1.74g/cm3),有助於減少燃料消耗和溫室氣體排放。對重量敏感的應用的需求不斷成長,迫使這些材料的機械性能提高。實現這一目標的一種方法是將鎂的輕質性與陶瓷的卓越強度和剛性結合起來。

- 這種組合使得鎂基金屬基複合材料作為重要工程應用的先進材料越來越有吸引力。鎂基複合材料通常透過成型或粉末冶金方法生產,但一種有前景的方法是放電等離子燒結(SPS)。此方法需要在粉末材料的粒徑增加之前保護結晶,並且用於難以用常規燒結進行的粉末材料的早期銑床。

- 汽車產業,尤其是電動汽車產業,是研究市場供應商的巨大商機之一,SPS 用於熱電發電機的開發。這項正在發展的綠色技術將引擎廢氣和工業的廢熱轉化為電力。

- 例如,根據國際能源總署《2022年全球電動車展望》的資料,2021年電動車(EV)銷量較2020年加倍,達到660萬輛的新紀錄。 2012年,全球電動車銷量僅12萬輛。 2021年,全球汽車銷量的近10%將是電動車,是2019年市場佔有率的四倍。 2022年全球電動車銷量強勁成長,第一季銷量達200萬輛,較2021年同期成長75%。

- 此外,根據中國工業協會(CAAM)的數據,2021年中國純電動車銷量超過290萬輛,較2020年成長162%。此外,同年中國插電式混合動力汽車銷量約60.3萬輛,較2020年成長140%。電動車需求的激增預計將為研究市場提供利潤豐厚的機會。

亞太地區正在經歷顯著成長

- 亞太地區因其在全球製造業(特別是電子和半導體產業)中的主導地位而成為 SPS 系統的主要採用者之一。

- 例如,根據世界半導體貿易統計數據(WSTS),2022年4月中國半導體銷售額達到167.3億美元。 2022 年 4 月的數據顯示較 2021 年 4 月有所成長,當時銷售額達到 148 億美元。

- 隨著國際品質標準的遵守程度不斷提高,亞太地區的醫療旅遊業也不斷成長。客製化生物材料,例如人造骨替代品,需要高耐用性和強度。根據美國國家衛生統計中心(NCHS)的數據,印度髖置換術的費用至少是西方國家的五分之一。由於吸引了國外患者,SPS人工關節對生物材料的需求正在增加。

- 在所研究的市場中也可以看到數位化趨勢。市場供應商正在提供具有觸控螢幕控制包和 HTML-5 介面等新功能的產品,允許任何具有現代網頁瀏覽器的電腦連接到熔爐並安全地控制系統運作。供應商還提供自動攝取資料並提供無限虛擬儲存的技術。

- 該地區國家也是軍事和國防支出最高的國家之一。例如,2022年3月,中國將年度國防預算從2021年的2,090億美元增加到2,300億美元,成長7.1%。中國國防支出增加之際,中國人民解放軍在戰略印太地區炫耀武力的事件日益增加。此類案例為被調查市場的拓展提供了多種機會。

放電等離子燒結產業概述

全球放電等離子燒結市場由 Thermal Technology LLC 等主要企業佔據市場主導地位。由於高昂的資本成本和安裝所需的技術專業知識,服務供應商在進入市場時面臨挑戰。

- 2022 年 6 月 - 賽峰企業創投公司 (Safran Corporate Ventures) 將與合作夥伴合作,投資法國新興企業Sintermat,該公司在放電等離子燒結 (SPS) 方面擁有豐富的專業知識,作為資金籌措的一部分,該公司宣布已獲得超過600 萬歐元的融資。其他投資者包括UI Investissement、透過Carvest 基金設立的法國香檳勃根地農業信貸銀行(Credit Agricole de Champagne-Bourgogne) 以及由Bpifrance Investissement 代表法國國防採購機構DGA (Direction Generale de l'Armement) 管理的Definvest 基金。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 增加整個全部區域的國防預算

- 市場限制因素

- 高度一體化的市場

第6章市場演變

第7章 材料市場趨勢

第8章 各種先進燒結技術的發展趨勢

第9章市場區隔

- 按最終用戶使用情況

- 車

- 製造業

- 能源/電力

- 航太/國防

- 其他最終用戶應用程式

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第10章競爭格局

- 公司簡介

- Fuji Electronic Industrial Co. Ltd.

- Dr Fritsch GmbH & Co KG

- Thermal Technology LLC

- FCT Systeme GmbH

- MTI Corporation

- Shanghai HaoYue Furnace Technology Co.,Ltd.

- Elenix Inc.

- Toshniwal Instruments Madras Pvt. Ltd.

- SinterLand Inc.

第11章投資分析

第12章 未來趨勢

簡介目錄

Product Code: 61430

The Global Spark Plasma Sintering Market is expected to register a CAGR of 5.9% during the forecast period.

Key Highlights

- In the last couple of decades, elaboration techniques based on high current intensities have attracted substantial interest from industrial sectors. Among these techniques, spark plasma sintering has emerged as the most adopted method in the last few years. The SPS technique has recently made significant advancements in materials science and materials processing due to the capability of fast and efficient densification of various materials and the suitability of the equipment for conducting solid-state syntheses and syntheses.

- SPS, also known as FAST, is a high-speed powder consolidation technology that develops quality-centered products from nanomaterials. The technology has gained significant attention for its ability to retain nanocrystalline microstructures and create materials with interesting functional properties. SPS systems have surpassed conventional methods, like hot press (HP) sintering, hot isostatic pressing (HIP), or atmospheric furnaces. Micro-spark/plasma is the most common technique among various proposed physical mechanisms for the SPS process.

- In recent years, SPS has emerged as the preferred option for producing high-strength, ultra-fine crystalline materials; dispersion strengthened materials, thermoelectric or metal-diamond (or generally metal-carbon) composite materials, and sputter targets. Besides, the process facilitates the adjustment of temperature gradients within the sintering body during compaction. It enables the production of gradient and layered materials with widely differing properties (e.g., ZrO2/stainless steel, Al2O3/titanium).

- The increasing adoption of the SPS method as a tool for consolidating powders is also demonstrated by a large number of papers published in recent years. Although SPS is still an emerging technology, slow developments, research, and applications have been increasingly witnessed in recent years, attracting great attention from the research and industrial sectors. For instance, one of the most common applications of SPS is the sintering of high melting point materials, such as titanium nitride. They have been extensively used in the aerospace industry for compressor, turbine, and pressure piping in an engine, owing to their high corrosion resistance, high strength, and relatively lightweight. These factors are fuelling their deployment in the automotive and defense sector.

- Some of the industrial applications of SPS include fuel cell materials, high strength and wear-resistant tooling, sputter targets, diamond compaction for abrasives, and the development of pure or mixed metallics, ceramics, or cermets, where maintaining nanometric and fine microstructure is required. The increasing adoption of innovative metals, composite materials in industrial and consumer products, and ceramics is anticipated to grow during the forecast period, owing to their increasing availability and decreasing manufacturing costs.

- Moreover, during the COVID-19 lockdown, many types of research were carried out in the SPS, which had a positive influence on the studied market growth. For instance, in April 2021, IDAHO researchers will help the industry make high-performance parts inexpensive and durable. Idaho National Laboratory developed advanced capabilities to help the industry design efficient SPS manufacturing processes. The lab's latest addition, one of the largest machines of its kind worldwide, makes it possible to manufacture new materials at industrially relevant scales. INL designed and built four custom SPS machines that range from supporting small experiments on the bench scale to industrial-scale, large-format, and high-throughput systems.

- However, SPS requires a significant up-front investment in time and expense. The operational variables include but are not limited to heat ramp rates, material properties, die design and material, hold temperatures and times, force strategies, vacuum, atmospheric conditions, power settings, and cooling conditions. This can act as a restraining factor to the growth of the market.

Spark Plasma Sintering Market Trends

The Automotive Segment is Expected to Drive the Market's Growth

- Mg-matrix composites are increasingly used in automotive and aerospace applications. Magnesium (Mg) and its alloys are popular metals in automotive applications. It results mainly from the low density (1.74 g/cm3) of Mg, which aids in reducing fuel consumption and greenhouse gas emissions. The increasing demand for weight-critical applications enforces the enhancement of the mechanical properties of these materials. One of the ways is to combine the light weight of Mg with the superior strength and stiffness of a ceramic.

- Resulting from this mix, metal-matrix composites based on Mg are increasingly more appealing as advanced materials for important engineering applications. Mg-matrix composites are generally fabricated by molding and powder metallurgy methods; one of the promising ones is spark plasma sintering (SPS). This method is desired for earlier cryomilling of powder materials to protect grains before they increase in size and for powder materials that are difficult to sinter by conventional sintering.

- The automotive industry, especially the Electric Vehicle sector, is one of the significant opportunities for studied market vendors, where SPS is used in the development of thermoelectric generators. This developing green technology converts waste heat from engine exhaust and industrial plants into electricity.

- For instance, according to the International Energy Agency's Global EV Outlook 2022 data, sales of electric vehicles (EVs) doubled in 2021 from 2020 to a new record of 6.6 million. In 2012, just 120 000 electric cars were sold worldwide. Nearly 10% of global car sales were electric in 2021, four times the market share in 2019. The global sales of electric cars are rising strongly in 2022, with 2 million sold in the first quarter, up 75% from the same period in 2021.

- Further, according to the China Association of Automobile Manufacturers (CAAM), in 2021, over 2.9 million battery electric vehicles were sold in China, growing 162% compared to 2020. Moreover, about 603,000 plug-in hybrid cars were sold in China during the same year, an increase of 140% compared to 2020. The upsurge in demand for Evs is expected to offer lucrative opportunities for the studied market.

Asia Pacific Region to Witness Significant Growth

- Asia-Pacific is one of the major adopters of the SPS systems, owing to its dominance in the global manufacturing sector, especially in the electronic and semiconductor industries.

- For instance, according to World Semiconductor Trade Statistics (WSTS), semiconductor sales in China reached USD 16.73 billion in April 2022. The April 2022 figure marks an increase from April 2021, when the sales reached USD 14.8 billion.

- With the growing compliance with international quality standards, the medical tourism industry is also growing in the Asia Pacific region. Customized bio-materials, such as artificial replacements for bones, require high durability and strength. According to the National Centre for Health Statistics (NCHS), the cost of hip replacement surgery in India is lower by at least a fifth of the cost in western countries. Attracting foreign patients, the need for SPS joint replacement biomaterials is growing.

- The growing trend of digitization is also witnessed in the studied market. Market vendors are offering products with new features, such as an integrated touch screen control package and full HTML-5 interface, that enables any computer with a modern web browser to connect to the furnace and control the system securely. Vendors are also offering techniques through which data is automatically captured and provides unlimited virtual storage.

- The countries in the region are also in the top listings of the highest spenders on military and defense. For instance, in March 2022, China hiked its annual defense budget by 7.1% to USD 230 billion from USD 209 billion in 2021, three times that of India's military spending. China's hike in defense spending comes amid the People's Liberation Army's growing incidents of muscle-flexing in the strategic Indo-Pacific region. Such instances offer several opportunities for the expansion of the studied market.

Spark Plasma Sintering Industry Overview

The Global Spark Plasma Sintering Market is consolidated with the presence of key players like Thermal Technology LLC dominating the market. The service provider requires high capital cost and expertise with the technology for the installation, which is challenging the entry of new players in the market.

- June 2022 - Safran Corporate Ventures announced that it had made a joint investment with partners in the company Sintermat, a French startup that has developed expertise in spark plasma sintering (SPS), as part of a funding round exceeding EUR 6 million. The other investors comprised UI Investissement, Credit Agricole de Champagne-Bourgogne via its Carvest fund, and the Definvest fund managed by Bpifrance Investissement on behalf of the French defense procurement agency DGA (Direction Generale de l'Armement).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Defense Budgets Across Geographies

- 5.2 Market Restraints

- 5.2.1 Highly Consolidated Market

6 MARKET EVOLUTION

7 MARKET TRENDS REGRDING DIFFERENT MATERIALS

8 TRENDS REGARDING DIFFERENT TYPES OF ADVANCED SINTERING TECHNOLOGIES

9 MARKET SEGMENTATION

- 9.1 By End-user Application

- 9.1.1 Automotive

- 9.1.2 Manufacturing

- 9.1.3 Energy & Power

- 9.1.4 Aerospace & Defense

- 9.1.5 Other End-user Applications

- 9.2 By Geography

- 9.2.1 North America

- 9.2.2 Europe

- 9.2.3 Asia Pacific

- 9.2.4 Latin America

- 9.2.5 Middle East and Africa

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Fuji Electronic Industrial Co. Ltd.

- 10.1.2 Dr Fritsch GmbH & Co KG

- 10.1.3 Thermal Technology LLC

- 10.1.4 FCT Systeme GmbH

- 10.1.5 MTI Corporation

- 10.1.6 Shanghai HaoYue Furnace Technology Co.,Ltd.

- 10.1.7 Elenix Inc.

- 10.1.8 Toshniwal Instruments Madras Pvt. Ltd.

- 10.1.9 SinterLand Inc.

11 INVESTMENT ANALYSIS

12 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219