|

市場調查報告書

商品編碼

1630189

Humanoid:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Humanoids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

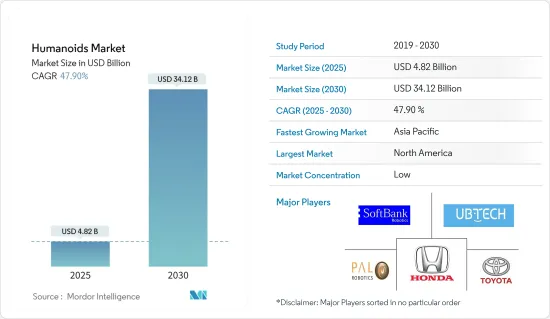

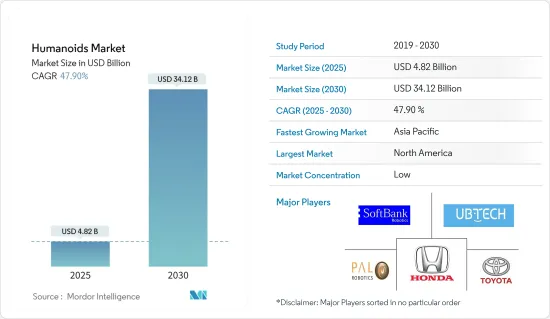

人形機器人市場規模預計到 2025 年為 48.2 億美元,預計到 2030 年將達到 341.2 億美元,預測期內(2025-2030 年)複合年成長率為 47.9%。

由於最近的趨勢,人們對人形機器人的興趣與日俱增,本田和現代正在推進實用化的開發,特斯拉於 2022 年 9 月發布了 Optimus 機器人的原型。此外,NASA也宣布將與Apptronik合作,將人形機器人「阿波羅」推向商業市場。

主要亮點

- 由於技術發展的快速進步和市場參與企業的崛起,機器人領域持續成長。例如,據 Addverb 高層聲稱,2022 年 1 月,Reliance Retail 以 1.32 億美元(98.3 億印度盧比)收購了國內機器人新興企業54% 的股份。該公司計劃在全球範圍內開展業務,並在諾伊達建造最大的機器人生產設施之一。機器人市場參與企業的此類舉措可能會進一步促進所研究市場的成長。

- 過去兩年,人形機器人市場迎來了重大推出。有幾個計劃正在開發其他旨在與人類密切合作的機器人。 2022年8月,特斯拉計畫在今年推出人形機器人原型機,旨在提升機器人智慧,為規模化生產提供解決方案。

- 世界各國政府也正在採取舉措,促進機器人市場先進技術的發展。例如,美國聯邦政府推出了一項名為「國家機器人舉措」的計劃,以加強該國的機器人製造能力並鼓勵該領域的研究。此外,美國政府2020年至2024年的計畫預算為350億美元。

- 此外,智慧人形機器人和人工智慧技術的設計者UBTECH Robotics最近發布了其人形機器人I的最新版本Walker X。沃克

- 引入人形機器人的一個主要障礙是其高成本,適當的資金籌措和租賃選擇與任何機器人一樣重要。隨著這些機器人投入運作和部署,實體部門被要求謹慎平衡對人們工作的擔憂。

人形機器人市場趨勢

人形技術進步預計將推動市場成長

- 隨著最近人工智慧趨勢帶來的新的臉部辨識、語音辨識和情緒辨識功能成為可能,人形機器人在客戶接觸點角色中的應用越來越多。隨著智慧型手機、網路和社群媒體正在成為關鍵的客戶參與管道,這項技術飛躍隨之而來。

- 隨著技術發展的加速,這些機器人正在被應用於從教育到娛樂的各個領域。根據NASSCOM人工智慧採用指數的最新研究,印度人工智慧(AI)能力的投資複合年成長率為31.8%。此外,預計到2023年將達到8.81億美元。

- 具有增強人工智慧和類人外觀的人形機器人可以輕鬆地向人們提供正確且一致的資訊。它可能在世界各地的疫苗接種中心有效。在每天接種數百種疫苗的疫苗接種中心,社交機器人可以成為一項資產,因為它可以提供重複訊息,以便工作人員可以專注於其他重要業務。

- 據 Spiceworks 稱,IT 自動化技術已成為北美和歐洲組織的首選,其中 45% 的組織已在使用該技術,另有 28% 的組織計劃在未來兩年內實施該技術。 5G 技術緊隨其後,42% 的受訪者目前使用中,25% 的受訪者考慮在未來兩年內部署該技術。

- 此外,2022年8月,小米宣布推出一款獨特的人形機器人「Cyber One」。公司在軟體、硬體、演算法創新等各環節投入巨資研發,開發技術先進的機器人。 CyberOne 可以感知 3D 空間,識別個人、手勢和臉部表情,並可以查看和處理其環境。

- 此外,CyberOne還配備了自製的MiAI環境辨識引擎和AI語音情緒偵測引擎,可辨識85種環境聲音和45種人類情緒,用於與世界溝通。

亞太地區將經歷最高的成長

- 亞太地區一直是整個市場的積極參與企業。中國、韓國、日本等國佔了很大的佔有率。由於該地區有公司參與人形機器人的開發,因此人們認為它們很快就會被採用。它也是世界上為數不多的日本軟銀、韓國機器人公司和印度 Invento Robotics 等主要國家參與企業推動人形機器人技術發展的地方之一。

- 在人口老化和工作人口減少的日本,機器人不僅被引入辦公室和學校,而且還被引入護理機構。根據世界經濟論壇 (WEF) 的數據,日本近三分之一的人口年齡超過 65 歲。此外,根據內務部的統計,預計到2025年,65歲以上的人口將達到約3,680萬人。

- 許多地區公司正在開發機器學習和人工智慧解決方案,為處於人工智慧和機器學習開發各個階段的公司提供支援。根據埃森哲的報告,到 2035 年,人工智慧可能佔印度目前總價值的 15%,即 9,570 億美元。此類技術的發展可能會進一步推動所研究市場的成長。

- 此外,據 IBEF 稱,政府最近在聯邦預算中向人工智慧投資了 700 億印度盧比(9.9305 億美元)。預計這將產生連鎖反應,使人工智慧的強度增加約1.3倍,並使印度的GDP增加3.2%。

- 此外,印度航太業對人形機器人的需求也很大。此外,ISRO(印度太空研究組織)最近推出了一款用於 Gaganyaan 任務的人形機器人。該機構正在製定一項太空計劃,計劃在 2022 年之前將人類送入太空。但在將人類送入太空之前,ISRO 計畫在年終發射一款名為 Vyom Mitra 的人形機器人。

- 同樣,區域性公司正在向新的國家擴張。例如,中國的優必選公司在韓國推出了一款攜帶式人形機器人,它可以說話、閱讀、唱歌和跳舞。

人形機器人產業概況

人形機器人市場競爭激烈,目前只有少數參與企業壟斷市場。市場正走向整合階段,只有少數活躍參與企業。主要參與企業包括豐田汽車公司、軟銀機器人公司和本田汽車公司。

- 2024 年3 月- NVIDIA 宣布推出用於人形機器人的GR00T 專案基礎模型以及Isaac 機器人平台的重大更新Isaac 機器人平台為開發人員提供了一個新的機器人訓練模擬器、Jetson Thor 機器人電腦和一個生成式AI 平台它描述了一個模型庫, CUDA 加速感知和操作。

- 2024 年 3 月 - 埃森哲透過埃森哲創投公司對 Sanctuary AI 進行了策略性投資,Sanctuary AI 是一家由人工智慧驅動的通用人形機器人開發商,可以快速、安全、高效地執行各種任務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 由於人口老化,對機器人的需求不斷增加

- 由於人形機器人技術的進步而帶來的功能成長

- 市場限制因素

- 研究、開發和部署相關的高成本

第 6 章 技術概覽

第7章 市場區隔

- 按用途

- 教育

- 研究/太空探勘

- 個人協助

- 娛樂與飯店

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- Honda Motor Co. Ltd.

- Toyota Motor Corporation

- SoftBank Robotics

- Ubtech Robotics Inc.

- Pal Robotics

- Hanson Robotics

- Kawada Robotics Corporation

- Promobot

- Invento Robotics

- Robotis Co. Ltd.

第9章投資分析

第10章市場的未來

The Humanoids Market size is estimated at USD 4.82 billion in 2025, and is expected to reach USD 34.12 billion by 2030, at a CAGR of 47.9% during the forecast period (2025-2030).

Humanoid robots have gained increased interest in recent years, with Honda and Hyundai developing iterations for commercialization, and Tesla unveiled the prototype of its Optimus robot in September 2022. NASA has also announced its hat into the ring with its collaboration with Apptronik to launch the humanoid robot Apollo into commercial markets.

Key Highlights

- With the rapid rate of technological developments and the rise of the emergence of players in the market, there has been growth in the field of Robotics. For instance, in January 2022, according to a top official of Addverb, Reliance Retail purchased a 54 percent share in the domestic robotics startup for USD 132 million (INR 983 crore). The company planned to develop its business worldwide and build one of Noida's most extensive robotic production facilities. Such initiatives by the market players in robotics may further drive the studied market growth.

- Over the past two years, the market for humanoids has witnessed significant launches. Several projects have been developing other robots designed to work closely with people. In August 2022, Tesla planned to disclose the humanoid robot prototype this year, aiming to improve the robot's intelligence and provide a solution for large-scale production.

- Governments worldwide have also taken initiatives to foster the development of advanced technologies in robotics markets, with a view to promoting its adoption. For example, in order to strengthen the ability of the country to build its own robots and to encourage research in this area, the US Federal Government has launched a program called the National Robotics Initiative. Further, the US government plans a budget of 35 billion USD from 2020 to 2024.

- Furthermore, UBTECH Robotics, a designer of intelligent humanoid robotics and AI technologies, has recently announced Walker X, the latest version of humanoid robot I. Walker X has been updated to perform a broader range of household tasks, including serving tea, pouring liquids, watering flowers, wiping surfaces, and operating the vacuum cleaner.

- A major impediment to the adoption of humanoid robots has been their expensive cost, with suitable financing and leasing options being as essential for them as they are for a robot. As these robots are driven and deployed, the brick-and-mortar sector calls for a careful balancing of concerns about people's jobs.

Humanoids Market Trends

Technological Advancements in Humanoids is Expected to Drive the Market Growth

- With new facial recognition, speech, and emotion recognition capabilities enabled by the recent advances in AI, humanoid robots have seen an increase in applications of customer contact roles resulting from these developments. This technological leap is occurring against the backdrop of the smartphone, web, and social media becoming primary customer engagement channels.

- With a faster rate of technological development, these robots have been witnessing adoption in many fields, varying from education to entertainment. According to NASSCOM's most recent study on the AI Adoption Index, investments in India's artificial intelligence (AI) capabilities are registering a CAGR of 31.8%. Further, they are expected to reach USD 881 million by 2023.

- A humanoid robot with its enhanced AI & human-like exterior makes it simple to educate people with correct and consistent information. It is likely effective for vaccination centers worldwide. With several hundred vaccines daily, a social robot is an asset in giving out repetitive information so the staff can focus on other essential tasks.

- According to Spiceworks, in North American and European organizations, IT automation technology emerged as the top choice, with 45% already utilizing it and an additional 28% planning adoption within the next 2 years. Following closely, 5G technology stood as the second most favored, with 42% currently employing it and 25% eyeing adoption in the coming 2 years.

- Furthermore, in August 2022, Xiaomi launched a unique humanoid robot called CyberOne. The company invested heavily in R&D in various areas, including software, hardware, and algorithm innovation, to make the technologically advanced robot. CyberOne is capable of perceiving 3D space and recognizing individuals, gestures, and expressions, allowing it to see and process its environment.

- In addition, CyberOne is equipped with a self-made MiAI environment recognition engine and an AI vocal emotion detection engine that allows it to recognize 85 types of environmental sounds and 45 categories of human emotions for its communication with the world.

Asia-Pacific to Witness the Highest Growth

- Asia-Pacific has been an active player across the market. Countries such as China, South Korea, Japan, and contribute significantly to its large share. The presence of companies that are involved in developing humanoids in this region would make it one of the first to be adopted. It's also one of the few places in the world where players from major countries such as Softbank Japan, Robotics Korea, and Invento Robotics India have come up with advances in humanoid technology.

- When Japan's population grows older, and its workforce shrinks, it is installing robots in both offices and schools as well as nursing homes. According to the World Economic Forum (WEF), nearly one-third of Japan's population is over 65. Also, according to the Statistics Bureau Japan, it was estimated that the number of people aged 65 years or older would reach around 36.8 million people by 2025.

- Various regional companies have developed machine learning and AI solutions that help companies at every stage of their AI and machine learning development. According to a report by Accenture, it's expected that AI has the potential in order to make up 15% of India's current gross value in 2035, or USD 957 billion. Such developments in technology may further drive the studied market growth.

- Moreover, according to IBEF, the Government recently invested INR 7,000 crore (USD 993.05 million) in the Union Budget for Artificial Intelligence. It is expected to increase the AI intensity by approximately 1.3 times, translating into spillover benefits of a 3.2% increase in India's GDP.

- Furthermore, India has been witnessing a demand for humanoids in the aerospace industry. Further, ISRO (Indian Space Research Organization) recently revealed a humanoid robot for its Gaganyaan mission. The organization worked on a space program to launch humans into space by 2022. However, before sending humans into space, ISRO planned to launch a humanoid robot named Vyom Mitra by the end of this year.

- Likewise, regional companies have been expanding their reach to new countries. For instance, Chinese company Ubtech has released a portable humanoid robot in South Korea that can talk, read, sing, and dance.

Humanoids Industry Overview

The humanoid market is competitive, with few players currently dominating the market. The market is moving toward a consolidated stage with few active players. The major players are Toyota Motor Corporation, Softbank Robotics, and Honda Motor Co. Ltd.

- March 2024 - NVIDIA Announces Project GR00T Foundation Model for Humanoid Robots and Major Isaac Robotics Platform Update Isaac Robotics Platform Provides Developers New Robot Training Simulator, Jetson Thor Robot Computer, Generative AI Foundation Models, and CUDA-Accelerated Perception and Manipulation Libraries.

- March 2024 - Accenture has made a strategic investment through Accenture Ventures in Sanctuary AI, a developer of humanoid general-purpose robots powered by AI that can perform a wide variety of work tasks quickly, safely, and effectively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Robotics due to Aging Population

- 5.1.2 Technological Advancements in Humanoids Leading to Growth in Features

- 5.2 Market Restraints

- 5.2.1 High Expenses associated with Research and Development and Deployment

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Application

- 7.1.1 Education

- 7.1.2 Research and Space Exploration

- 7.1.3 Personal Assistance

- 7.1.4 Entertainment & Hospitality

- 7.1.5 Other Applications

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Honda Motor Co. Ltd.

- 8.1.2 Toyota Motor Corporation

- 8.1.3 SoftBank Robotics

- 8.1.4 Ubtech Robotics Inc.

- 8.1.5 Pal Robotics

- 8.1.6 Hanson Robotics

- 8.1.7 Kawada Robotics Corporation

- 8.1.8 Promobot

- 8.1.9 Invento Robotics

- 8.1.10 Robotis Co. Ltd.