|

市場調查報告書

商品編碼

1630185

金屬塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Metal Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

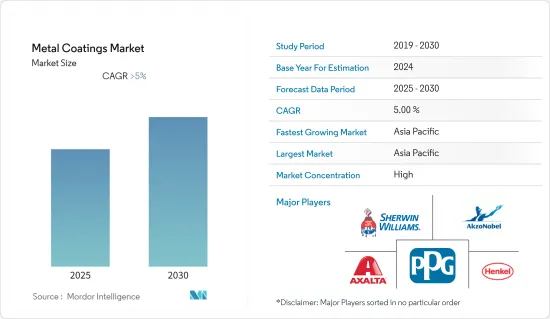

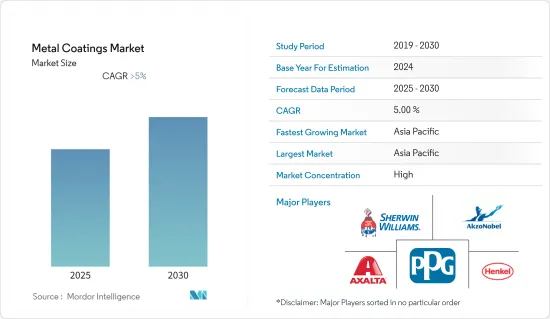

預計金屬塗料市場在預測期內複合年成長率將超過 5%。

COVID-19 的爆發導致全球範圍內的國家封鎖、製造活動和供應鏈中斷以及生產停頓,對 2020 年的市場產生了負面影響。然而,到了2021年,情況開始好轉,市場恢復了成長軌跡。

主要亮點

- 推動市場的主要因素是嚴格的 VOC 法規推動了對水性 DTM 塗料的需求。

- 另一方面,金屬塗層不適合惡劣環境,很可能阻礙市場發展。

- 亞太地區主導全球市場,其中中國和印度等國家的消費量最高。

金屬塗料市場趨勢

水劑領域佔市場主導地位

- 水性塗料佔整個金屬塗料市場的大部分。水性塗料比溶劑型塗料具有優勢的主要原因是它們更環保,因為它們通常含有較少的會破壞環境的揮發性有機化合物(VOC)。低氣味、耐久性和抗粘連性等其他特性也使水性塗料更受歡迎。

- 水性塗料的環保性和多功能性導致全球需求的增加。

- 水性塗料主要用於汽車漆。因此,隨著全球汽車產量的增加,水性塗料的需求也預計會增加。

- REACH 是歐洲政府的一項舉措,旨在保護人類健康和環境免受化學品風險,同時增加歐洲化學工業的競爭。推廣評估物質危害的替代方案可以減少動物試驗。對低VOC含量塗料(例如水性塗料)的需求正在增加。

- 由於這些因素,它被廣泛應用於汽車行業。 OICA公佈的資料顯示,疫情後時期汽車產量大幅成長。

- 電動車產量也呈現快速成長。根據國際能源總署(IEA)預測,2022年全球電動車銷量將超過1,000萬輛,預計2023年將再成長35%,達到1,400萬輛。根據IEA預測,電動車佔整個汽車市場的佔有率將從2020年的約4%上升至2022年的14%,並在2023年進一步上升至18%。

- 近年來,終端用戶尋求具有低氣味、易於使用、易於清洗等特點的塗料已成為一種趨勢。水性塗料滿足這些要求,無需添加低分子單體即可降低黏度。

亞太地區主導市場

- 預計亞太地區將在預測期內主導金屬塗料消費市場。中國、日本、韓國和印度等國家對金屬塗料的需求正在增加。這是因為製造地位於這些國家。

- 金屬塗層也用於電氣和電子工業。亞洲地區是全球最大的電氣電子設備生產國,其中中國、日本、韓國、新加坡、馬來西亞等國家位居榜首。

- 根據中國工業協會統計,中國是全球最大的汽車生產基地,預計2022年汽車產量將達到2,700萬輛,比2021年的2,600萬輛增加3.4%。此外,中國電動車(EV)產業規模全球第一,佔全球電動車產量的64%。與 2021 年相比,2022 年中國新電動車銷量成長 82%。到2022年,它將佔全球電動車銷量的59%,鞏固其作為全球最大電動車市場的地位。

- 在印度,根據印度汽車工業協會(SIAM)的數據,該國汽車工業在2022-23會計年度(2022年4月至2023年3月)生產的汽車數量高於2021年4月至2022年3月。此外,印度電動車銷量僅佔汽車總銷量的不到1%。然而,它有潛力在幾年內成長到 5% 以上。印度道路上有超過 50 萬輛電動二輪車和數千輛電動車。產業銷售波動較大,很大程度取決於政府的獎勵。許多公司,包括 Hero Eco、Ather、Electrotherm、Avon、Lohia 和 Ampere,都在繼續他們的使命並做出積極的改變。這些因素可能會增加所研究市場的需求。

金屬塗裝業概況

金屬塗料市場得到部分完整。主要參與者包括阿克蘇諾貝爾公司、艾仕得塗料系統有限公司、PPG工業公司、宣偉公司和漢高公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 嚴格的VOC法規推動對水性直接金屬被覆劑的需求

- 其他司機

- 抑制因素

- 不適合惡劣環境

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 環氧樹脂

- 聚酯纖維

- 聚氨酯

- 其他樹脂類型

- 依技術

- 水性的

- LED固化

- 溶劑型

- 粉末

- 紫外線固化

- 按用途

- 建築學

- 車

- 海洋

- 保護

- 一般工業用途

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- AkzoNobel NV

- Axalta Coating Systems, LLC

- BASF SE

- Clean Diesel Technologies Inc.

- Hempel A/S

- Henkel AG & Co. KGaA

- Jotun

- Kansai Paint Co. Ltd

- Nippon Paint Holdings Co. Ltd

- PPG Industries, Inc.

- RPM International

- The Sherwin-Williams Company

第7章 市場機會及未來趨勢

The Metal Coatings Market is expected to register a CAGR of greater than 5% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- The major factor driving the market studied is stringent VOC regulation driving the demand for waterborne DTM coatings.

- On the flip side, as the metal coatings are unsuitable for the harsh operating environment, they will likely hinder the market.

- Asia-Pacific dominated the global market with the largest consumption in countries such as China, India, etc.

Metal Coatings Market Trends

Water-borne Segment to Dominate the Market

- Water-borne paints and coatings account for most of the overall metal coatings market. The major reason for its gain over solvent-borne is its environment-friendly nature, as it is generally lower in volatile organic compounds (VOCs), which degrade the environment. Other properties, such as low odor, durability, and block resistance, make water-borne paints preferable.

- Water-borne coatings' increasing environment-friendly nature and versatile properties are increasing global demand.

- Water-borne coatings are majorly required in automotive paints. Hence, with the increase in global automotive production, the demand for water-borne coatings is also expected to increase.

- REACH, a European government initiative, was adopted to protect human health and the environment from the risks of chemicals while enhancing competition in the European chemical industry. Promoting alternative methods for the hazard assessment of substances reduces tests on animals. It is increasing the demand for coatings with low VOC content, such as water-borne coatings.

- Because of these factors, these are widely used in the automotive industry. As per data published by OICA, vehicle production grew significantly in the post-pandemic period.

- Electric vehicle production is also witnessing exponential growth. As per International Energy Agency (IEA), more than 10 million electric cars were sold worldwide in 2022, and sales are expected to grow by another 35% in 2023 to reach 14 million. Electric cars' share of the overall car market rose from around 4% in 2020 to 14% in 2022 and is set to increase further to 18% in 2023, based on IEA projections.

- Recently, there is a propensity to seek coatings with low odor, usability, and water clean-up characteristics among the end-users. Water-borne coatings meet these requirements and facilitate low viscosity without adding low-molecular-weight monomers.

Asia Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for metal coatings consumption during the forecast period. The demand for metal coatings is increasing in countries like China, Japan, South Korea, and India. It is due to the presence of manufacturing bases in these countries.

- Metal Coating is also used in the electrical and electronics industry. The Asian region is the largest producer of electrical and electronics worldwide, with dominating countries such as China, Japan, South Korea, Singapore, and Malaysia.

- According to the China Association of Automobile Manufacturers (CAAM), China includes the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced in 2021. Further, China's electric vehicle (EV) industry is the largest globally, accounting for 64% of the global production of EVs. Sales of new EVs in China increased by 82% in 2022 compared to 2021. The country accounted for 59% of global EV sales in 2022, cementing its position as the world's largest electric vehicles market.

- In India, during FY 2022-23 (April 2022 to March 2023), according to the Society of Indian Automobile Manufacturers (SIAM), the country's automotive industry produced a total of 25,931,867 vehicles compared to 23,040,066 units from April 2021 to March 2022. Furthermore, electric vehicle sales in India are less than 1% of the total vehicle sales. However, it includes the potential to grow to more than 5% in a few years. There are more than 500 thousand electric two-wheelers and a few thousand electric cars on Indian roads. The industry volumes are fluctuating, mostly depending on the incentives offered by the government. Many players, such as Hero Eco, Ather, Electrotherm, Avon, Lohia, Ampere, etc., are continuing with the mission and trying to enforce positive change. Such factors are likely to increase the demand for the studied market.

Metal Coatings Industry Overview

The metal coatings market is partially consolidated. Some major players include AkzoNobel NV, Axalta Coating Systems, LLC, PPG Industries Inc., The Sherwin-Williams Company, and Henkel AG & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Stringent VOC Regulation is Driving the Demand for Water-borne Direct-To-Metal Coatings

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Not Suitable for Harsh Operating Environment

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Polyurethane

- 5.1.4 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 LED Curing

- 5.2.3 Solvent-borne

- 5.2.4 Powder

- 5.2.5 UV Cured

- 5.3 Application

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Marine

- 5.3.4 Protective

- 5.3.5 General Industrial

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel NV

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 BASF SE

- 6.4.4 Clean Diesel Technologies Inc.

- 6.4.5 Hempel A/S

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Jotun

- 6.4.8 Kansai Paint Co. Ltd

- 6.4.9 Nippon Paint Holdings Co. Ltd

- 6.4.10 PPG Industries, Inc.

- 6.4.11 RPM International

- 6.4.12 The Sherwin-Williams Company