|

市場調查報告書

商品編碼

1630183

剛性散裝包裝:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Rigid Bulk Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

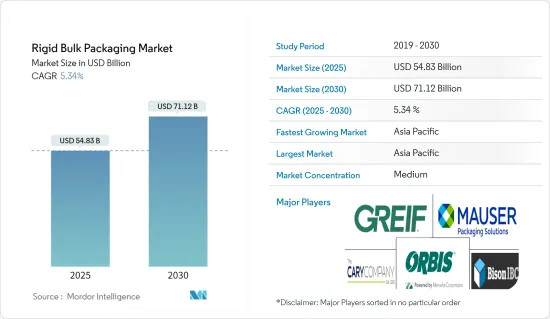

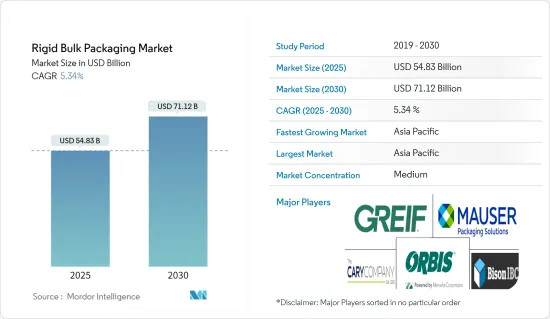

硬質散裝包裝市場規模預計到2025年為548.3億美元,預計到2030年將達到711.2億美元,預測期內(2025-2030年)複合年成長率為5.34%。

主要亮點

- 隨著地區之間運輸的資源和產品數量不斷增加,散裝包裝變得至關重要。剛性散裝包裝市場包括用於儲存和運輸散裝液體和顆粒材料的解決方案。這包括食品成分、溶劑、化學品、藥品,甚至是大量處理的工業設備。

- 硬質散裝包裝市場與全球進出口活動密切相關。重工業對桶和桶等產品表現出強勁的需求。另一方面,物流和短途運輸嚴重依賴物料輸送貨櫃和中型散貨箱(IBC)。

- 隨著各種最終用戶產業對化學品和石油潤滑劑的需求不斷增加,以及對加強供應鏈能力的重視,對工業鋼桶的需求預計將激增。根據 InfralineEnergy 的報告,印度是該地區第二大潤滑油消費國,也是美國和中國之後的世界第三大潤滑油消費國。

- 潤滑油在加工工業中發揮著重要作用,對於汽車零件(尤其是煞車和引擎)至關重要,可確保其平穩運行。由於活塞引擎潤滑油進出口的增加以及重視車輛性能的消費者數量的增加,該市場正在不斷成長。化工、採礦和非傳統能源等行業預計將成為工業潤滑油的最大消費者。這一趨勢增強了對工業潤滑油的需求,並標誌著市場上硬包裝的使用不斷增加。

- 塑膠污染極大地導致了環境退化,許多研究都強調了其有害影響。作為回應,歐洲與其他幾個國家一起頒布了法規來限制全球塑膠的使用。這些全球立法舉措迫使企業進行創新,並專注於工業包裝中的永續和可重複使用的產品。

剛性散裝包裝市場趨勢

工業容器桶市場預計將佔據主要佔有率

- 工業桶經常用於運輸和儲存危險和非危險材料。最常用於化工、化肥、石油和石油工業。支持工業滾筒市場成長的因素之一是這些細分市場的不斷擴張以及過去十年國際貿易活動的活性化。

- 傳統的藍色塑膠桶常見於倉儲設施、超級市場、倉庫等。許多工業產品都裝入藍色塑膠桶中。食品級塑膠桶是安全儲存和運輸食品的理想選擇。此外,在長期運輸和儲存消耗品之前,食品企業使用的塑膠桶必須經過適當的淨化並證明其安全。

- 此外,該國不斷擴大的農業部門預計將顯著增加對鋼桶的需求,特別是在化學品、糧食和化肥應用方面。根據國際穀物理事會(IGC)2024年4月發布的報告,全球糧食產量將從2020/2021年的22.27億噸持續成長至2023/2024年的23.01億噸,並且還在增加。預計這種需求成長趨勢將在預測期內持續下去,從而導致對剛性散裝包裝容器和桶的需求增加。

- 最常見的工業儲存類型之一是塑膠桶。大批量工業產品的長期儲存和運輸具有多種功能和許多好處。大多數塑膠桶為藍色,由 HDPE(高密度聚苯乙烯)製成。塑膠桶有多種尺寸,大多數尺寸從 30 公升到 220 公升不等。

- 此外,紙板桶由於能夠提高生產力和降低成本,在化學和肥料行業中越來越受到重視。各國之間化肥和化學品的運輸預計將擴大,加速各種工業桶的成長。

- 此外,各個最終用戶產業對化學品和石油潤滑劑的需求不斷增加,以及對加強供應鏈能力的大力關注,預計將推動對工業鋼桶的需求。據InfralineEnergy稱,印度是該地區第二大潤滑油消費國,也是僅次於美國和中國的全球第三大潤滑油消費國。

亞太地區佔最大市場佔有率

- 亞太地區的工業和製造業正在迅速發展,隨著製造地不斷擴大到中國、印度和印尼等新興經濟體,硬質散裝包裝的使用預計將會增加。中國紙板桶產量呈現樂觀成長態勢。就以金額為準,它令馬來西亞和新加坡等其他國家相形見絀。

- 當地和知名公司對複雜產品包裝解決方案的興趣日益濃厚,從而產生了更高品質的紙板桶。零售業的成長和對可回收紙板桶等輕質散裝容器的日益偏好是影響紙板桶市場的關鍵因素。使用紙板桶的主要優點是可回收,亞太地區硬質散裝市場前景廣闊。

- 二十多年來,在居民消費和資本投資、工業產值、進出口持續成長的拉力下,中國經濟維持了較高的成長速度。過去幾十年來,中國對工業包裝的需求也遵循著類似的趨勢。此外,預計未來十年生產和需求將繼續成長,這有望支持該國工業包裝市場的成長。

- 據印度品牌公平聯合會稱,印度是全球最大的學名藥供應國。印度製藥業供應全球一半以上的疫苗需求、美國40%的非專利藥需求和英國所有藥品的25%。在全球範圍內,印度的藥品產量排名第 3 位,金額排名第 14 位。隨著製藥業的發展,該國的藥品包裝業務也將成長,並有望推動該地區的剛性散裝包裝市場。

- 此外,亞洲國家化學品及相關工業出口的成長正在推動對硬質散裝包裝產品(如桶、容器、圓桶和提桶)的需求。根據印度儲備銀行和商業情報總局的資料,2023 會計年度印度有機和無機化學品出口額超過 24,353.6 億印度盧比(290.2 億美元)。這高於上一會計年度 21,890.7 億印度盧比(260.8 億美元)的估值。因此,化學品出口的激增預計將導致預測期內市場走強。

剛性散裝包裝產業概述

剛性散裝包裝市場已細分,主要參與者包括 Greif Inc.、FDL Packaging Group、Mondi PLC 和 BWAY Corporation。此外,包裝市場的其他主要企業正在採取收購和夥伴關係策略來進入市場並增加其產品。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 市場動態

- 市場促進因素

- 永續和可回收包裝材料的出現

- 化學和製藥業產量增加

- 市場限制因素

- 環境法規是市場成長的挑戰

- 市場促進因素

第5章市場區隔

- 按材質

- 塑膠

- 金屬

- 木頭

- 其他

- 依產品

- 工業散裝貨櫃

- 鼓罐

- 桶罐

- 盒子

- 其他散裝貨櫃

- 按最終用戶產業

- 食物

- 飲料

- 工業的

- 醫藥/化工

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞洲

- 印度

- 中國

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 北美洲

第6章 競爭狀況

- 公司簡介

- ORBIS Corporation

- FDL Packaging Group Ltd

- Bison IBC Ltd

- Wadpack Pvt Ltd

- Greif Inc.

- The Cary Company

- Hoover Container Solutions

- ITP Packaging

- Mauser Packaging Solutions

- Mondi PLC

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 60379

The Rigid Bulk Packaging Market size is estimated at USD 54.83 billion in 2025, and is expected to reach USD 71.12 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

Key Highlights

- As the volume of resources and products transported across regions continues to rise, the significance of bulk packaging has become paramount. The rigid bulk packaging market comprises solutions for storing and transporting bulk liquids and granulated substances. These include food ingredients, solvents, chemicals, pharmaceuticals, and even industrial equipment, all handled in large quantities.

- The rigid bulk packaging market is closely tied to global import and export activities. Heavy manufacturing industries show a strong demand for products like drums and pails. In contrast, logistics and short-distance transportation of goods heavily rely on materials handling containers and intermediate bulk containers (IBCs).

- With a growing demand for chemicals and petroleum lubricants across diverse end-user industries and a pronounced emphasis on bolstering supply chain capabilities, the need for industrial steel drums is set to surge. As reported by InfralineEnergy, India ranks as the second-largest lubricant consumer in its region and holds the third position globally, trailing only the United States and China.

- Lubricants play a crucial role in processing industries and are vital for automobile parts, especially brakes and engines, ensuring their smooth operation. The market is witnessing growth, fueled by rising imports and exports of piston engine lubricants and an increasing consumer emphasis on vehicle performance. Industries such as chemicals, mining, and unconventional energy are anticipated to be the largest consumers of industrial lubricants. This trend bolsters the demand for industrial lubricants and hints at a heightened use of rigid packaging in the market.

- Plastic pollution has significantly contributed to environmental degradation, with numerous studies highlighting its detrimental effects. In response, European regions, alongside several other nations, have enacted regulations to curb plastic usage globally. These worldwide legislative measures have forced companies to innovate, focusing on sustainable and reusable products in industrial packaging.

Rigid Bulk Packaging Market Trends

The Industrial Containers and Drums Segment is Expected to Hold a Significant Share

- Industrial drums are frequently used for transporting and storing hazardous and non-hazardous commodities. They are most commonly used in the chemical, fertilizer, oil, and petroleum industries. One factor supporting the growth of the industrial drum market is the continued expansion of these segments and rising international trade activities over the past 10 years.

- Traditional blue plastic drums are familiar in storage facilities, supermarkets, and warehouses. Many industrial objects fit in blue plastic drums. Food-grade plastic drums are ideal for securely storing and transporting food. Additionally, plastic drums used in the food business should be properly decontaminated and certified as safe before transporting and storing consumables over an extended period.

- Further, the expanding agricultural industry in the country is anticipated to generate considerable demand for steel drums, particularly in chemicals, food grains, and fertilizer applications within the region. According to the International Grains Council (IGC) report published in April 2024, global grain production has consistently increased from 2,227 million metric tons in FY 2020/2021 to 2,301 million metric tons in FY 2023/2024. This rising demand trend is expected to continue during the forecast period, leading to an increased demand for rigid bulk packaging containers and drums.

- One of the most common types of industrial storage is plastic drums. The long-term storage and transportation of large quantities of industrial commodities serve multiple functions and offer numerous advantages. Most plastic drums are blue and made of HDPE (high-density polyethylene), a robust type of plastic that can be molded easily and lasts for many years. Plastic drums come in a variety of sizes, often ranging from 30 to 220 liters.

- Moreover, fiber drums are becoming more prominent in the chemical and fertilizers industry because they improve productivity and reduce expenses. The expansion of fertilizer and chemical traffic between various countries is predicted to accelerate the growth of different industrial drums.

- Further, the rise in the demand for chemicals and petroleum lubricants from various end-user industries and a significant focus on strengthening the supply chain capability is expected to drive the need for industrial steel drums. According to InfralineEnergy, India is the second-largest lubricant consumer in the region and the third-largest globally, after the United States and China.

Asia-Pacific to Hold the Largest Market Share

- The rapidly evolving industrial and manufacturing industry in Asia-Pacific is expected to increase the usage of rigid bulk packaging as manufacturers continue expanding their manufacturing bases to emerging economies like China, India, and Indonesia. China has shown optimistic growth in the production of fiber drums. In terms of value, it has a strong hold over other countries such as Malaysia and Singapore.

- The rising concerns for sophisticated product packaging solutions by local and renowned players have translated into better quality fiber drums. The growing retail industry and the increasing preference for lightweight bulk containers such as recyclable fiber drums are key factors affecting the fiber drums market. The primary benefit of utilizing fiber drums is their recyclability, leading to a positive outlook for the rigid bulk market in Asia-Pacific.

- The Chinese economy maintains a high speed of growth, which has been stimulated by consecutive increases in consumer consumption and capital investment, industrial output, and import and export for over two decades. The demand for industrial packaging in China has followed a similar trend in the past few decades. Also, both production and demand are expected to continue to grow in the next decade, which is expected to support the growth of the industrial packaging market in the country.

- India is the world's top supplier of generic pharmaceuticals, according to the Indian Brand Equity Federation. The Indian pharmaceutical industry supplies more than half of the global demand for vaccines, 40% of the generic demand in the United States, and 25% of all pharmaceuticals in the United Kingdom. Globally, India ranks third in terms of pharmaceutical production by volume and 14th by value. The country's pharmaceutical packaging business will grow as the pharmaceutical industry grows, driving the rigid bulk packaging market in the region.

- Also, the growth of chemical and allied industry exports from Asian countries is driving the demand for rigid bulk packaging products like drums, containers, drums, and pails. Data from the Reserve Bank of India and the Directorate General of Commercial Intelligence reveal that in fiscal year 2023, India exported organic and inorganic chemicals worth over INR 2435.36 billion (USD 29.02 billion). This marked an uptick from the prior fiscal year's valuation of INR 2189.07 billion (USD 26.08 billion). As a result, this surge in chemical exports is poised to strengthen the market during the forecast period.

Rigid Bulk Packaging Industry Overview

The rigid bulk packaging market is fragmented, with many major players like Greif Inc., FDL Packaging Group, Mondi PLC, and BWAY Corporation. Additionally, the other major players in the packaging market are adopting acquisition and partnership strategies to enter the market and grow offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Dynamics

- 4.4.1 Market Drivers

- 4.4.1.1 Emergence of Sustainable and Recyclable Packaging Materials

- 4.4.1.2 Growing Production Volume of Chemical and Pharmaceutical Industries

- 4.4.2 Market Restraint

- 4.4.2.1 Environmental Legislations Challenge the Market Growth

- 4.4.1 Market Drivers

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Pastic

- 5.1.2 Metal

- 5.1.3 Wood

- 5.1.4 Other Materials

- 5.2 By Product

- 5.2.1 Industrial Bulk Containers

- 5.2.2 Drums

- 5.2.3 Pails

- 5.2.4 Boxes

- 5.2.5 Other Bulk Containers

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Industrial

- 5.3.4 Pharmaceutical and Chemical

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.3 Asia

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia and New Zealand

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ORBIS Corporation

- 6.1.2 FDL Packaging Group Ltd

- 6.1.3 Bison IBC Ltd

- 6.1.4 Wadpack Pvt Ltd

- 6.1.5 Greif Inc.

- 6.1.6 The Cary Company

- 6.1.7 Hoover Container Solutions

- 6.1.8 ITP Packaging

- 6.1.9 Mauser Packaging Solutions

- 6.1.10 Mondi PLC

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219