|

市場調查報告書

商品編碼

1630173

DDI 解決方案:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)DDI Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

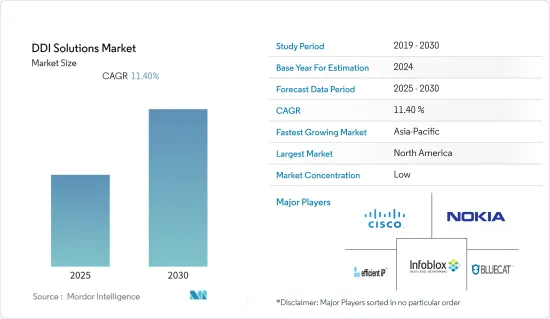

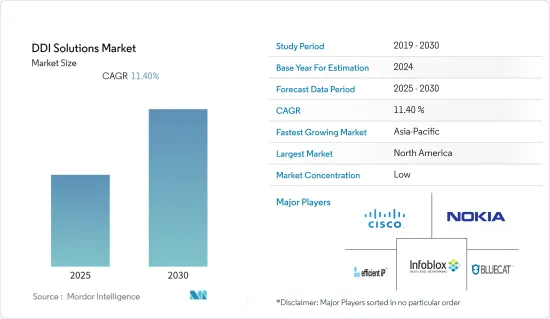

DDI 解決方案市場預計在預測期內複合年成長率為 11.4%

主要亮點

- 雲端和物聯網的採用推動了市場成長。隨著物聯網解決方案開始大規模部署,關鍵組織將面臨合作夥伴從傳統網路架構計劃到基於 IP 的網路的影響,包括自動化位址分配、管理和配置。為了有效解決這個問題,隨著需求的增加,使用 DNS-DHCP-IP 位址管理 (DDI) 的自動化將變得至關重要。

- 此外,對資料安全和隱私的日益擔憂也推動了市場的發展。透過部署高度安全的 DNS 系統作為安全隔離網閘,企業可以確保資料機密性,因為進階 DNS安全功能可以偵測並阻止可疑活動。此外,隨著 DNS 隧道和 DDoS 攻擊的盛行,企業逐漸意識到 DNS 保護的必要性和重要性。這些趨勢顯示供應商在IT基礎設施覆蓋率較高的國家銷售先進的 DDI 解決方案的空間很大,從而有助於預測期內的市場收益和預測。

- 此外,各個主要市場參與企業都致力於產品發布和創新。例如,DDI 安全性和自動化(DNS、DHCP、IPAM)專家 EfficientIP 去年 11 月宣布採用 Cloud Observer 和 Network Object Manager。 SOLIDserver 8.2 是 DDI(DNS、DHCP、IPAM)解決方案的最新版本,推出了這些新產品來幫助整合和追蹤多重雲端環境,實現自動化並為客戶提供更高的敏捷性和營運效率。

- 然而,管理和監控IP服務對於業務來說並不是立即至關重要的,而且IP基礎設施的複雜性使得市場成長變得困難。

- COVID-19 的爆發爆炸了連網型設備生態系統,DDI 已經證明了其在這個新興互聯產業中的價值。幾乎所有允許遠端工作人員的營業單位都需要其網路具有更強的彈性才能正確運行,這一事實推動了對有效 DDI 解決方案和服務的需求。因此,DDI產業受到物聯網平台成長的刺激。在後COVID-19場景下,企業正在加速數位轉型活動,特別是滿足需要連接到企業網路、從任何地方存取資源、應用程式等的員工的期望,這是主要的市場驅動力。

DDI(DNS、DHCP、IPAM)解決方案市場趨勢

IPv6 設備推動市場成長

- IPv6 旨在確保網際網路在連接的主機數量和承載的資料流量總量方面都能穩定成長。管理 IPv6 和雙堆疊環境的 DDI 應用程式可以輕鬆遷移、簡化大型複雜 IP 空間的管理,並節省時間和金錢。

- 組織的現有 IPv4 位址系統面臨著與安全性、可靠性和 IP 位址重複相關的問題。這就是 Verizon Wireless 等公司積極轉向 IPv6 的原因,因為他們現有的 IPv4 網路擁有 70 多個相同私有位址空間的內部實例。結果是網路效率低下,花費了公司大量的時間和金錢。此外,IPv6 適用於各種物聯網解決方案。許多對物聯網有用的新高級通訊協定正在開發中。 IPv6 路由器允許支援 IPv6 的裝置產生全域可路由位址,而不僅僅是本機位址,從而允許裝置存取更廣泛的網際網路。 6LowPAN(無線網路)、COAP(Web 服務傳輸)和 DTLS(安全資料)適用於裝置。

- 隨著上網設備數量不斷成長,對 IP 位址的整體需求也不斷成長。因此,網際網路目前正在從 IPv4 過渡到最新版本的網際網路通訊協定IPv6。近期,各大主要企業紛紛發表了支援IPv6的各種設備和解決方案。例如,2022年6月,KeyCDN宣布全面支援IPv6。這個新版本的網路通訊協定會自動加入到公司的所有區域。

- 此外,2022 年 5 月,支援物聯網 (IoT) 和低功率廣域網路(LPWAN) 開放 LoRaWAN 標準的全球公司協會 LoRa 聯盟宣佈 LoRaWAN 是一個端到端網際網路我們已宣布無縫支援通訊協定版本6 (IPv6)。 LoRaWAN 的可尋址物聯網市場也擴大了IPv6 設備到應用解決方案的整體範圍,這是各種智慧電力計量和智慧建築、工業、物流和家庭中的新應用所需的,將擴展到包括基於網際網路的標準。

- 思科系統公司預測,到 2022 年,拉丁美洲支援 IPv6 的設備總數將達到 8.03 億台,能夠支援更新的網際網路通訊協定版本。因此,該地區支援 IPv6 的設備的增加預計將有助於在預測期內創造巨大的市場擴張機會。

北美佔據主要市場佔有率

- 由於美國和加拿大廣泛採用 DDI 解決方案來實現安全網路連接,北美是 DDI 的強勁市場。此外,美國IPv4的消費量較高,對市場成長有正面影響。北美被認為擁有世界上最好的技術和基礎設施。

- BYOD 的興起正在影響對行動裝置的需求,並間接推動對更多 IP 位址的需求。因此,在預測期內,行動裝置的日益普及和 BYOD 在職場的接受度預計將推動對 DDI 解決方案的需求。

- 隨著企業轉向 SaaS 和雲端基礎的應用程式,分店網路必須改進其 DDI 基礎設施,以提供最佳的最終用戶體驗。此外,高度分散的組織必須重新考慮其網路架構,以解決遠端可見性、可靠性和管理問題。這為該地區的市場帶來了巨大的成長機會。

- 此外,該地區擁有強大的 DDI 供應商骨幹力量,為市場成長做出了貢獻。例如 Cisco Systems Inc.、Infoblox Inc.、EfficientIP、PC Network Inc.、BlueCat Networks Inc. 和 BT Global Services Limited。這些參與企業正在積極創新並推出各種產品。例如,2022 年 6 月,Adaptive DNS 的 BlueCat Networks 宣布了一項新的通路優先打入市場策略,並對其通路計畫進行了補充,以最大限度地提高DNS、DHCP 和IP 位址管理或DDI 解決方案的整體採用率。

- 據 GSMA Intelligence 稱,到 2025 年,北美消費者和工業物聯網 (IoT) 連接總數預計將成長至約 54 億。在此預測期內,市場將獲得大量成長和擴張機會。

DDI(DNS、DHCP、IPAM)解決方案產業概述

DDI(DNS、DHCP、IPAM)解決方案市場是細分的。市場參與企業正在採取措施,透過專注於產品多樣化並向具有雲端功能的智慧 DDI 發展來擴大其市場佔有率。該市場的主要企業包括思科系統公司、諾基亞公司、Infoblox 公司、Efficient IP SAS 和英國電信全球服務有限公司。我們將介紹市場的一些最新趨勢。

2022 年 6 月,中東首個企業 B2B 市場 AmiViz 宣布與 EfficientIP 建立新的夥伴關係。 AmiViz 列出了其埃及通路合作夥伴,可透過 www.amiviz.com 市場、行動應用程式和 AmiViz入口網站存取 EfficientIP 一流的 DNS、DHCP 和 IP 位址管理 (DDI) 解決方案。

2022 年 3 月,EfficientIP 發布了其 DDI 套件的最新版本 SOLIDserver。 SOLIDserver 記錄了各種混合雲端基礎架構的集中式 DNS 管理和網路安全。 SOLIDserver 8.1 具有許多功能,可協助客戶在敏捷性和營運效率至關重要的時代成為多重雲端組織。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場促進因素

- 擴大雲端運算和物聯網的採用

- 人們對資料安全和隱私的興趣日益濃厚

- 市場限制因素

- 由於複雜性和相關風險,預算有限,投資低

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章技術概況

第6章 市場細分

- 按成分

- 硬體

- 軟體

- 按發展

- 本地

- 雲

- 按最終用戶產業

- 製造業

- 零售

- 醫學生命科學

- 教育

- BFSI

- 資訊科技/通訊

- 政府/國防

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Infoblox Inc.

- Efficient IP SAS

- BlueCat Networks Inc.

- Men & Mice

- Nokia Corporation

- Cisco Systems Inc.

- TCPWave Inc.

- FusionLayer Inc.

- 6connect Inc.

- BT Global Services Limited

- PC Network Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The DDI Solutions Market is expected to register a CAGR of 11.4% during the forecast period.

Key Highlights

- Cloud and IoT adoption is propelling market growth. As IoT solutions begin to be deployed at a large scale, significant organizations face the impact of their partners' migration projects from traditional network architectures to IP-based networks, which include address assignment, management, and configuration automation. To cope effectively, automation using DNS-DHCP-IP Address Management (DDI) will become vital with the growth in demand.

- Further, increasing concern about data security and privacy is also driving the market. By implementing a highly secure DNS system to act as a gatekeeper, organizations can help ensure data confidentiality, as advanced DNS security features are able to detect and block suspicious activity. Moreover, enterprises recognize the need for and importance of protecting DNS, owing to the large number of DNS tunneling and DDoS attacks. Such trends indicate the vendors' scope to pitch their advanced DDI solutions in nations with a high IT infrastructure presence, thus contributing to market revenues during the forecast period.

- Furthermore, various key market players are involved in product launches and innovations. For instance, in November last year, EfficientIP, the DDI security and automation specialist (DNS, DHCP, IPAM), announced the introduction of its Cloud Observer and Network Object Manager. The latest version of its DDI (DNS, DHCP, and IPAM) solution, SOLIDserver 8.2, introduces these new products to assist organizations in consolidating and tracking their multi-cloud environments to allow automation and provide customers agility as well as operational efficiency.

- But managing and keeping an eye on IP services are not important to the business right away, and the complexity of IP infrastructure makes it hard for the market to grow.

- The COVID-19 epidemic caused a spike in the ecosystem of connected devices, and DDI proved its worth in this rising connected industry. The necessity for effective DDI solutions and services was fueled by the fact that almost all entities that allow remote workers require networks to be more resilient to operate correctly. As a result, the DDI industry was stimulated by the growth of IoT platforms. In the post-COVID-19 scenario, companies are speeding up their digital transformation activities, in particular, to meet the expectations of their employees, who need to be able to connect to an enterprise network, access resources, and apps from any location, etc., driving the market significantly.

DDI (DNS, DHCP, & IPAM) Solutions Market Trends

IPv6 Devices to Drive the Market Growth

- IPv6 is an evolutionary version of the Internet Protocol (IP) that is being reviewed by IETF standards committees to replace IPv4.IPv6 is designed to allow the Internet to grow steadily, both in terms of the number of hosts connected and the total amount of data traffic transmitted. DDI applications that manage IPv6 and dual-stacked environments ease the transition and make the administration of large, complex IP spaces easier, saving time and money.

- Organizations are faced with the problem of the existing IPv4 addressing system related to security, reliability, and duplication of IP addresses. For this reason, a company like Verizon Wireless proactively switched to IPv6 because, in the existing IPv4 network, there were more than 70 internal instances of the same private address space. The resulting network inefficiency costs the company a lot of time and money. Moreover, IPv6 is suitable for various IoT solutions. Many new, higher-level protocols have been developed that are useful for the IoT. If an IPv6 router is present, any IPv6-capable device can generate not only a local address but a globally routable address, allowing access to the wider Internet between the devices. 6LowPAN (wireless nets), COAP (transport with web services), and DTLS (secured datagrams) are well suited for the devices.

- As the number of devices connecting online continues to grow, the overall need for IP addresses is also growing. As a result, the Internet is currently migrating from IPv4 to the most recent version of the Internet Protocol, IPv6.In recent times, various key players have launched various IPv6-supported devices and solutions. For instance, in June 2022, KeyCDN declared that it fully supported IPv6. This new version of the Internet protocol has been automatically added to all its zones.

- Also, in May 2022, the LoRa Alliance, the global association of companies backing the open LoRaWAN standard for the Internet of Things (IoT) and low-power wide-area networks (LPWANs), declared that LoRaWAN seamlessly supports Internet Protocol version 6 (IPv6) from end-to-end. LoRaWAN's addressable IoT market is also expanded to include Internet-based standards required in various smart electricity metering and new applications in smart buildings, industries, logistics, and homes by extending the overall breadth of device-to-application solutions with IPv6.

- As per Cisco Systems, the forecast projects that by 2022, the total number of IPv6-capable devices in Latin America, a total of 803 million devices, would be able to support the newer Internet Protocol version. Hence, the rise in a large number of IPv6-capable devices in the region will assist the market in creating immense opportunities for the market to expand throughout the forecast period.

North America to Hold a Significant Market Share

- North America is a prominent market for DDI, owing to the high adoption of DDI solutions for secure network connectivity in the United States and Canada. Moreover, in the United States, the high consumption of IPv4 is impacting market growth positively. North America is thought to have some of the best technology and infrastructure in the world.

- The rise in BYOD is impacting the demand for mobile devices, indirectly fueling the need for more IP addresses. As a result, increasing mobile device adoption and workplace acceptance of BYOD are expected to drive demand for DDI solutions over the forecast period.

- As enterprises move toward SaaS and cloud-based applications, branch office networks must evolve their DDI infrastructure to provide an optimal end-user experience. Highly distributed organizations also need to rethink their network architecture to deal with the visibility, reliability, and management problems of their remote locations. This creates a huge growth opportunity for the entire market in the region.

- Moreover, the region has a strong foothold among DDI vendors, contributing to the market's growth. Some include Cisco Systems Inc., Infoblox Inc., EfficientIP, PC Network Inc., BlueCat Networks Inc., BT Global Services Limited, and many others. These players are very much involved in various product innovations and launches. For instance, in June 2022, BlueCat Networks, the Adaptive DNS company, declared its new channel-first, go-to-market strategy and additional channel program investments to maximize the overall adoption of DNS, DHCP, and IP address management, i.e., DDI solutions.

- As per GSMA Intelligence, by 2025, the overall number of consumer and industrial Internet of Things (IoT) connections in North America is forecast to grow to around 5.4 billion. During the forecast period, this will give the market a lot of good chances to grow and expand.

DDI (DNS, DHCP, & IPAM) Solutions Industry Overview

The DDI (DNS, DHCP, and IPAM) solutions market is fragmented. Players in the market are taking steps to raise their market footprint by concentrating on product diversification and development towards smart DDI through cloud functionality. Some of the key players in the market are Cisco Systems Inc., Nokia Corporation, Infoblox Inc., Efficient IP SAS, and BT Global Services Limited, among others. Some of the recent developments in the market are:

In June 2022, AmiViz, the first enterprise B2B marketplace in the Middle East region, declared it had signed a new partnership with EfficientIP. AmiViz gives its channel partners in Egypt access to EfficientIP's best-in-class DNS, DHCP, and IP address management (DDI) solutions through its marketplace at www.amiviz.com, the mobile app, and the AmiViz web portal.

In March 2022, EfficientIP introduced the latest version of its DDI suite, SOLIDserver, which provides centralized DNS management and network security for various hybrid cloud infrastructures. SOLIDserver 8.1 has a lot of features that help customers become multi-cloud organizations at a time when agility and operational efficiency are very important.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Cloud Computing and IoT

- 4.2.2 Increasing Concern About Security and Privacy of Data

- 4.3 Market Restraints

- 4.3.1 Limited Budgets and Low Investments owing to Complexities and Associated Risks.

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Retail

- 6.3.3 Healthcare and Life Sciences

- 6.3.4 Education

- 6.3.5 BFSI

- 6.3.6 IT & Telecom

- 6.3.7 Government & Defense

- 6.3.8 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infoblox Inc.

- 7.1.2 Efficient IP SAS

- 7.1.3 BlueCat Networks Inc.

- 7.1.4 Men & Mice

- 7.1.5 Nokia Corporation

- 7.1.6 Cisco Systems Inc.

- 7.1.7 TCPWave Inc.

- 7.1.8 FusionLayer Inc.

- 7.1.9 6connect Inc.

- 7.1.10 BT Global Services Limited

- 7.1.11 PC Network Inc.