|

市場調查報告書

商品編碼

1629808

輸送機 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Conveyors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

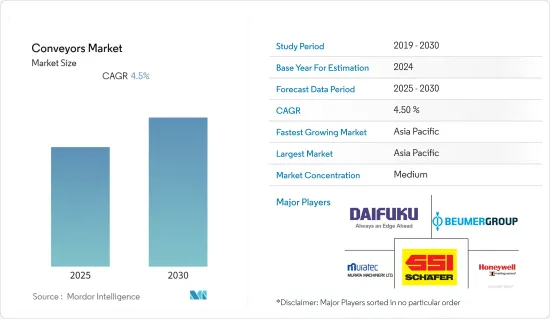

預計輸送機市場在預測期內複合年成長率為 4.5%

主要亮點

- 隨著庫存單位 (SKU) 的快速成長,批發商和經銷商需要協助做出明智的業務決策,這反過來意味著他們可以利用其勞動力、設備和技術來變得更具創新性。推動這些自動化物料輸送系統需求的關鍵因素是成本節約、勞動效率和空間限制。

- 影響輸送系統市場的因素有很多,包括工業成長、擴張、工業現代化以及產品和製程的特定條件。輸送機系統有助於簡化笨重物料輸送任務。它們透過減少和最大限度地減少生產週期時間和錯誤,在營運中發揮重要作用。

- 供應鏈和業務流程變得越來越複雜,客戶需求也不斷增加。同時,各國經濟和個人市場參與企業之間的競爭壓力日益增加。因此,對外包模式和自動化的需求不斷增加。

- 我們也看到對各種產品快速交付的需求不斷成長,這需要高效的庫存管理和逆向物流系統。汽車、零售、食品和飲料行業的新興市場發展也可能支持該市場的成長。

- COVID-19 的傳播對所研究的市場產生了積極影響,特別是在被視為基本服務的食品飲料和製藥領域。隨著這些領域的產品銷售不斷成長,製造設施正在全天候工作以運輸最終產品,而這只有透過輸送機等機械才能實現。

輸送機市場趨勢

零售業經歷了顯著成長。

- 自動化和基於 IT 的解決方案使零售業發生了巨大變化。零售商正在採用自動化倉儲和配送解決方案來最佳化商店空間的使用並保持利潤。零售業使用輸送機進行配送、倉儲、分揀和越庫作業。隨著網路購物的興起,亞太地區和拉丁美洲/中東/非洲市場條件有利。

- 線上零售的日益普及,加上消費行為的變化,可能會對輸送機和分類系統的實施產生正面影響。此外,許多已經投資分類設備的公司預計將增加產能,以應對不斷成長的需求。例如,2022 年 10 月,UPS 在米蘭貝加莫機場增設了新設施,擴大了運能。此外,新設施佔地 5,000平方公尺,包括分類設備,每小時可處理 3,800 個包裹,是先前建築的兩倍。

- 消費者購買力的增強、生活方式的改變、工人階級的壯大、外國直接投資等政府監管的放鬆。這些因素正在推動連鎖超級市場和配送中心的成長,並推動對新配送中心和倉庫的需求。

- 此外,根據美國商務部的數據,2021年美國倉儲業創造了近505億美元的收入,美國有超過19,000個倉庫。

預計亞太地區將佔據最大的市場佔有率

- 全球許多已開發國家的國際公司都在亞太地區設立了生產設施,特別是在印度和中國等新興國家。製造活動的成長導致該地區擴大採用輸送機系統。

- 此外,消費能力的增強、生活水準的提高和國內生產總值的成長正在推動對製成品的需求,這反過來又導致這些自動化系統的採用增加。例如,最初,印度製造工廠的大多數帶式輸送機都是低速類型。然而,隨著消費者對產品需求的增加而擴大設施,擴大採用高速帶式輸送機。

- 在預測期內,印度零售、機場、郵政和小包裹行業的需求將增加。零售市場主要是由電子市場的出現和網路購物的,這催生了履約中心和倉庫。由於通訊設備使用的增加,網際網路也正在推動電子商務和行動商務的成長。

- 總部位於東京的橡膠公司普利司通公司也報告稱,該公司 2021 年從中國和亞太地區創造了 3,869 億日圓(28.9 億美元)的收入,這兩個地區在輸送機製造中發揮著不可或缺的作用。

- 此外,經濟產業省 (METI) 預計,2021 年日本橡膠產業的橡膠基輸送機和電梯帶銷售額將比 2020 年增加 7 億日圓(520 萬美元)。

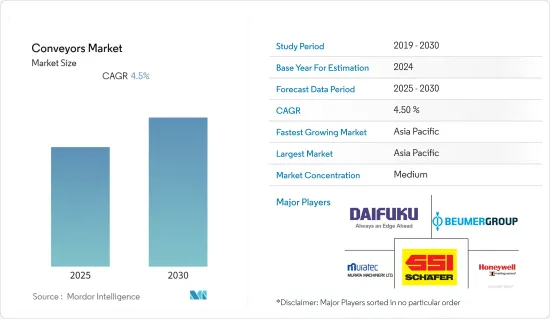

輸送機產業概況

由於有許多主要企業向國內和國際市場供應產品,輸送機市場競爭非常激烈。市場適度細分,主要企業採取產品創新、併購等策略。該市場的主要企業包括 Daifuku、SSI Schaefer AG 和 Murata Machinery Ltd。

- 2022 年3 月- 霍尼韋爾宣布與Clearpath Robotics 旗下部門OTTO Motors 合作,在日益稀缺的就業市場中為北美各地的倉庫和配送中心提供一些勞動力最密集的職位。這一問題。此次合作將使Honeywell客戶能夠透過在其設施中安裝 OTTO 的自主移動機器人 (AMR) 來提高效率、減少錯誤並提高安全性。這些 AMR 還描述了一種靈活而強大的托盤運輸方法,通常主要透過堆高機和輸送機系統來完成。

- 2022 年 5 月 - Viastrore Systems GmbH 宣布 Interroll 和 Viastore 同意在輸送機技術領域進行更密切的合作。在德國斯圖加特舉辦的國際物流展覽會LogiMAT上,兩家公司的代表握手並鞏固了相應的合作。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對處理大量產品和提高生產力的需求不斷成長

- 電子商務快速成長

- 市場限制因素

- 初始投資高

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 依產品類型

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 按地區

- 北美洲

- 按最終用戶

- 飛機場

- 零售

- 車

- 製造業

- 飲食

- 藥品

- 採礦*(請注意,我們涵蓋所有其他地區的類似最終用戶細分)

- 按國家/地區

- 美國

- 加拿大

- 歐洲

- 按最終用戶

- 按國家/地區

- 法國

- 德國

- 義大利

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 按最終用戶

- 按國家/地區

- 澳洲

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 按最終用戶

- 按國家/地區

- 阿根廷

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 按最終用戶

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- Daifuku Co. Ltd

- SSI Schaefer AG

- Murata Machinery Ltd

- Mecalux SA

- BEUMER Group GmbH & Co. KG

- KNAPP AG

- KUKA AG(Swisslog AG)

- Honeywell Intelligrated Inc.

- Kardex Group

- Viastrore Systems GmbH

- Bastian Solutions Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 57250

The Conveyors Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- With the rapidly increasing growth in Stock-Keeping Units (SKUs), wholesalers and distributors need help to make informed decisions about their operations, which drives the need for the more innovative use of labor, equipment, and technology. The main factors driving the need for these automated material handling systems are cost savings, labor efficiency, and space constraints.

- Various factors, such as industrial growth, expansions, modernization of industries, and product and process-specific conditions, influence the conveyor systems market. Conveyor systems help simplify the task of handling bulky materials. It plays a vital role in operations by reducing and minimizing production cycle time and errors.

- Supply chains and business processes are becoming increasingly complex, and customers are demanding more. At the same time, competitive pressure is also growing among national economies and individual market players. Therefore, outsourcing models and automation are gaining demand.

- It has also been observed that there is an increasing need for delivering various products in small time frames that require efficient inventory management and reverse logistic systems. The developing automotive, retail, and food and beverage industries are also likely to fuel the growth of the market studied.

- The spread of COVID-19 has positively affected the market studied, especially in the food & beverage and pharmaceutical sectors, which have been deemed under essential services. Due to increased sales of the products under these segments, manufacturing facilities have been working round the clock to deliver the end products, which was only possible with the usage of conveyor belts, among other machines.

Conveyor Market Trends

Retail Segment to Witness Significant Growth

- The retail industry has transformed significantly with automation and IT-based solutions. Retailers are adopting automated warehousing and distribution solutions to optimize store space utilization and stay profitable. The retail sector utilizes conveyors for distribution, warehousing, sorting, and cross-docking. Growth in shopping through online mode in the Asia-Pacific and LAMEA regions has created a conducive market environment.

- The increasing usage of online retailing, coupled with changing consumer behavior toward goods purchasing, is likely to positively impact the adoption of conveyor and sortation systems. In addition, many companies already invested in the sortation facility are expected to increase their capacity, owing to the rising demand. For instance, in October 2022, UPS expanded its presence at Milan Bergamo Airport by adding a new facility to expand capacity. Moreover, the new facility measures 5,000 sq. meters and has sorting facilities, processing 3,800 packages per hour - twice as many as the previous building.

- The increasing purchasing power of consumers, changing lifestyles, growing working-class segment, and relaxation in government regulations such as Foreign Direct Investment. These factors have boosted the growth of supermarket chains and distribution centers, driving the demand for new distribution centers and warehouses, which is then expected to drive the conveyor market.

- Furthermore, According to the US Department of Commerce, the warehousing and storage industry in the US generated almost USD 50.5 billion in the year 2021, and there were over 19,000 warehouses in the united states, which will drive the market for conveyors in the US.

Asia Pacific is Expected to Hold the Largest Market Share

- Many international corporations from developed countries across the globe have set up their production facilities in the APAC region, especially in developing countries such as India and China, because of the availability of cheaper factors of production (labor, raw material, and equipment). The growth of manufacturing activities has increased the adoption of conveyor systems in this region.

- Moreover, increasing spending power, improving the standard of living, and higher GDP, among other factors, are increasing the demand for manufactured goods, which in turn is leading to the increased adoption of these automated systems. For example, the majority of belt conveyors in Indian manufacturing facilities were initially of the low-speed type. The expansion of these facilities, fueled by increased public demand for goods, led to the adoption of high-speed belt conveyors.

- In India, demand will increase from the retail, airport, and post and parcel industries during the forecast period. The retail market is primarily driven by the emergence of the e-market and customers shopping online, which gave rise to fulfillment centers and warehouses. Also, with the increased usage of communication devices, the internet is helping the growth of e-commerce and m-commerce.

- Also, the Tokoyo-based rubber company Bridgestone Corporation reported that the company was able to generate JPY 386.9 billion (USD 2.89 billion) in 2021 from China and Asia-Pacific, which play an essential part in the making of conveyors.

- Furthermore, the Ministry of Economy, Trade, and Industry (METI) stated that the sales value of conveyor and elevator beltings made from rubber in the rubber industry in Japan increased by JPY 700 million (USD 5.2 million) in 2021, compared to 2020, which was an increase of 4.58% of the sales.

Conveyor Industry Overview

The Conveyor Market is highly competitive owing to the presence of many prominent players supplying their products in domestic and international markets. The market appears to be moderately fragmented, with the major players adopting strategies like product innovation and mergers and acquisitions. Some of the major players in the market are Daifuku Co. Ltd, SSI Schaefer AG, and Murata Machinery Ltd, among others.

- March 2022 - Honeywell announced a collaboration with OTTO Motors, a division of Clearpath Robotics, giving warehouses and distribution centers throughout North America an automated option to address some of the most labor-intensive roles in an increasingly scarce job market. The collaboration also allows Honeywell customers to increase efficiency, reduce errors and enhance safety by installing OTTO's autonomous mobile robots (AMRs) in their facilities. These AMRs also provide a flexible and powerful way to transport pallets, typically accomplished primarily with forklifts and conveyor systems.

- May 2022 - Viastrore Systems GmbH announced that Interroll and Viastore had agreed to work more closely together in the field of conveyor technology in the future. The managing directors locked the corresponding cooperation with a handshake at LogiMAT, the international trade fair for intralogistics solutions, in Stuttgart, Germany.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Handling Larger Volumes of Goods and Improving Productivity

- 4.2.2 Rapid Growth of E-commerce

- 4.3 Market Restraints

- 4.3.1 High Initial Investments

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Belt

- 5.1.2 Roller

- 5.1.3 Pallet

- 5.1.4 Overhead

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 By End User

- 5.2.1.1.1 Airport

- 5.2.1.1.2 Retail

- 5.2.1.1.3 Automotive

- 5.2.1.1.4 Manufacturing

- 5.2.1.1.5 Food and Beverage

- 5.2.1.1.6 Pharmaceuticals

- 5.2.1.1.7 Mining *(Kindly note that similar end-user segment coverage is provided for all other regions in the scope)

- 5.2.1.2 By Country

- 5.2.1.2.1 United States

- 5.2.1.2.2 Canada

- 5.2.2 Europe

- 5.2.2.1 By End User

- 5.2.2.2 By Country

- 5.2.2.2.1 France

- 5.2.2.2.2 Germany

- 5.2.2.2.3 Italy

- 5.2.2.2.4 Netherlands

- 5.2.2.2.5 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 By End User

- 5.2.3.2 By Country

- 5.2.3.2.1 Australia

- 5.2.3.2.2 China

- 5.2.3.2.3 India

- 5.2.3.2.4 Japan

- 5.2.3.2.5 South Korea

- 5.2.3.2.6 Rest of APAC

- 5.2.4 Latin America

- 5.2.4.1 By End User

- 5.2.4.2 By Country

- 5.2.4.2.1 Argentina

- 5.2.4.2.2 Brazil

- 5.2.4.2.3 Mexico

- 5.2.4.2.4 Rest of Latin America

- 5.2.5 Middle East & Africa

- 5.2.5.1 By End User

- 5.2.5.2 By Country

- 5.2.5.2.1 United Arab Emirates

- 5.2.5.2.2 Saudi Arabia

- 5.2.5.2.3 South Africa

- 5.2.5.2.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Daifuku Co. Ltd

- 6.1.2 SSI Schaefer AG

- 6.1.3 Murata Machinery Ltd

- 6.1.4 Mecalux SA

- 6.1.5 BEUMER Group GmbH & Co. KG

- 6.1.6 KNAPP AG

- 6.1.7 KUKA AG (Swisslog AG)

- 6.1.8 Honeywell Intelligrated Inc.

- 6.1.9 Kardex Group

- 6.1.10 Viastrore Systems GmbH

- 6.1.11 Bastian Solutions Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219