|

市場調查報告書

商品編碼

1629786

馬來西亞石油和天然氣中游 -市場佔有率分析、行業趨勢、成長預測(2025-2030)Malaysia Oil and Gas Midstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

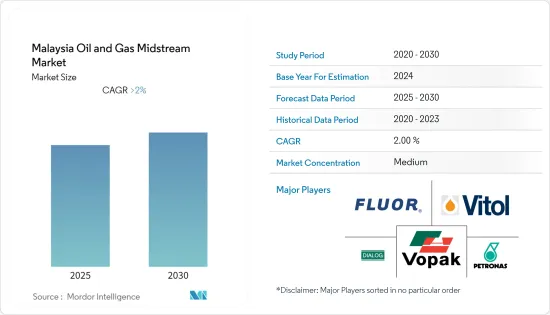

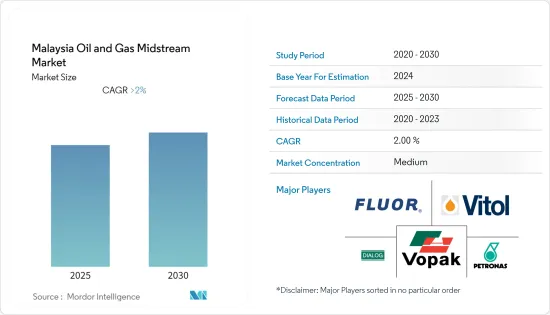

馬來西亞石油和天然氣中游市場預計在預測期內複合年成長率將超過2%

COVID-19 對 2020 年市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,石油和天然氣需求的上升以及管道計劃數量的增加預計將推動市場。

- 另一方面,石油和天然氣產量下降預計將阻礙市場成長。

- 與亞洲的天然氣貿易增加促使鄰國向馬來西亞尋求儲存。馬來西亞公司可以滿足不斷成長的儲存需求。預計這將為馬來西亞石油和天然氣中游市場創造重大機會。

馬來西亞石油和天然氣市場趨勢

LNG接收站接收站預計主導市場

- 由於馬來西亞及周邊地區對天然氣的需求不斷增加,液化天然氣(LNG)終端預計將主導馬來西亞中游市場。大多數國家希望減少二氧化碳排放以管理環境空氣質量,這增加了各個最終用戶領域的天然氣消耗。

- 薩圖馬來西亞終端是位於馬來西亞沙撈越州的LNG接收站。它擁有3條液化天然氣生產線,產能為每年810萬噸(MTPA)。它是馬來西亞液化天然氣綜合設施的一部分,也稱為國油民都魯液化天然氣綜合設施。

- 截至2021年,馬來西亞天然氣進口量約為每天25億立方公尺。與2020年相比,2021年進口量下降。進口量的減少意味著新LNG接收站的運作。

- 例如,2022 年 1 月,馬來西亞沙巴州和馬來西亞國家石油公司宣布計劃建造一座年產 200 萬噸 (mmty) 的液化天然氣 (LNG) 終端。該新設施計劃建於西皮丹石油和天然氣工業,是馬來西亞國家石油公司與沙巴州合作夥伴關係的一部分,旨在擴大清潔能源向該州工業和商業企業的供應。

- 此外,2021 年 8 月,印度石油公司 (IOC) 與馬來西亞國營國家石油公司 (Petronas) 成立合資企業,包括建造液化天然氣 (LNG) 終端、燃料零售和天然氣發行,推動該領域的成長。 。

天然氣產量下降抑制市場

- 馬來西亞嚴重依賴石油和天然氣作為其主要能源來源。根據BP統計,2021年,石油和天然氣在各國初級能源消耗中的比重達到近70%。這顯示了馬來西亞對石油和天然氣的依賴。該國已採取措施減少對能源的依賴,並在短期內實現其他能源來源多元化,預計這一趨勢將持續下去。

- 此外,從2015年到2020年,馬來西亞國內天然氣產量將下降,從2015年的767億立方公尺下降到2020年的687億立方公尺。然而,儘管2021年產量大幅增加至742億立方米,但預計未來幾年產量將下降。

- 馬來西亞產量下降的原因是油田老化,特別是位於馬來西亞半島淺水區的大量資源,限制了該國的中游市場。

- 此外,馬來西亞的石油管線網路可能規模不大。該國主要依靠油輪和車輛進行中游石油產品的陸上運輸。該管道將石油產品從印尼杜邁煉油廠輸送到馬來西亞馬六甲煉油廠。

- 馬來西亞的石油和天然氣中游業務受到天然氣消費量和產量下降以及管道網路有限的限制。然而,石油和天然氣消費量的增加以及該領域投資的增加預計將在預測期內推動市場。

馬來西亞石油和天然氣產業概況

馬來西亞的石油和天然氣中游市場適度整合。主要企業(排名不分先後)包括福爾陸公司、國家石油公司 (PETRONAS)、Dialog Group Berhad、Vitol Group 和 Royal Vopak NV。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 類型

- 運輸

- 貯存

- LNG接收站

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Petroliam Nasional Berhad(PETRONAS)

- Dialog Group Berhad

- Vitol Group

- Royal Vopak NV

- Fluor Corporation

- Gas Malaysia Berhad

- MISC Berhad

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 56682

The Malaysia Oil and Gas Midstream Market is expected to register a CAGR of greater than 2% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing demand for oil and gas and increasing pipeline projects are expected to drive the market.

- On the other hand, the country's decreasing oil and gas production is expected to hinder the market's growth.

- Nevertheless, increasing gas trading with Asia has resulted in neighboring countries turning to Malaysia for storage. Companies in Malaysia can meet the rising storage demands. This is expected to create enormous opportunities for the Malaysia oil and gas midstream market.

Oil and Gas in Malaysia Market Trends

LNG Terminals Segment is Expected to Dominate the Market

- The Liquefied natural gas (LNG) terminals segment is expected to dominate the midstream market of Malaysia due to the increasing demand for natural gas in the country and neighboring regions. The majority of countries want to reduce their carbon emissions to control the air quality in the environment, which has increased the consumption of natural gas in various end-user segments.

- Satu Malaysia Terminal is an LNG terminal in Sarawak, Malaysia. It constitutes three LNG trains and has a capacity of 8.1 million metric tons per annum (MTPA). It is a part of the Malaysia LNG Complex, also known as the Petronas Bintulu LNG Complex.

- As of 2021, the natural gas imports in the country were around 2.5 billion cubic meters per day. The imports were less in 2021 compared to 2020. This decrease in imports signifies the operation of new LNG terminals.

- For instance, in January 2022, the Malaysian State of Sabah and Petronas announced plans for a two million metric tons/year (mmty) liquefied natural gas (LNG) terminal. The new facility planned for the Sipitang Oil and Gas Industrial Park is a part of Petronas's collaboration with the state to expand Sabah's distribution of cleaner energy to industrial and commercial businesses.

- Furthermore, in August 2021, the Indian Oil Corporation (IOC) entered a joint venture with Malaysia's state-run Petronas to include building liquefied natural gas (LNG) terminals, fuel retailing, and gas distribution, driving the growth of the segment.

Decreasing Production of Gas to Restrain the Market

- Malaysia heavily relies on oil and gas as its primary energy source. According to BP statistics, in 2021, the share of oil and gas in countries' primary energy consumption was close to 70%. This signifies the dependency on oil and gas in Malaysia. Although the country has been taking steps to reduce its dependency and diversify to other sources for the short term, the trend is expected to continue.

- Moreover, between 2015 to 2020, the country noticed a decline in domestic natural gas production, reducing to 68.7 billion cubic meters in 2020 compared to 76.7 billion cubic meters in 2015. However, a sharp rise was recorded in 2021 at 74.2 billion cubic meters, but the production is expected to decline in the coming years.

- Malaysia's diminishing output is due to aging fields, notably its larger resources in the shallow waters offshore of Peninsular Malaysia, which constrain the country's midstream market.

- Furthermore, Malaysia's oil pipeline network could be more modest. The country primarily relies on tankers and vehicles to transfer midstream petroleum products onshore. The pipeline transports oil products from Indonesia's Dumai oil refinery to Malaysia's Melaka oil refinery.

- As a result of lower natural gas consumption and production and a limited pipeline network, Malaysia's oil and gas midstream business is constrained. However, an increase in oil and gas consumption, as well as increased investment in the sector, is going to drive the market over the projected period.

Oil and Gas in Malaysia Industry Overview

The Malaysian oil and gas midstream market is moderately consolidated. A few major companies (in no particular order) include Fluor Corporation, Petroliam Nasional Berhad (PETRONAS), Dialog Group Berhad, Vitol Group, and Royal Vopak N.V., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Transportation

- 5.1.2 Storage

- 5.1.3 LNG Terminals

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Petroliam Nasional Berhad (PETRONAS)

- 6.3.2 Dialog Group Berhad

- 6.3.3 Vitol Group

- 6.3.4 Royal Vopak NV

- 6.3.5 Fluor Corporation

- 6.3.6 Gas Malaysia Berhad

- 6.3.7 MISC Berhad

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219