|

市場調查報告書

商品編碼

1628843

電化學感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Electrochemical Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

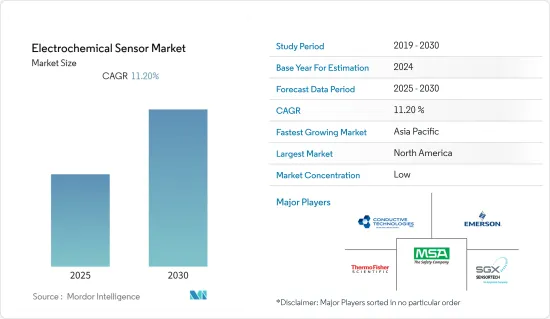

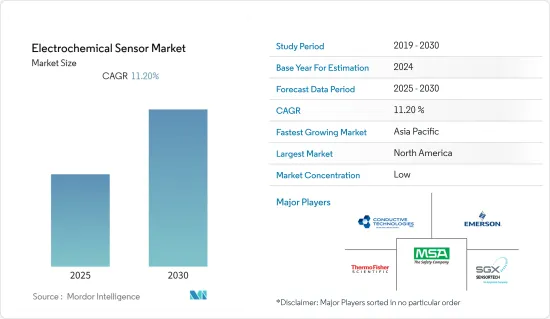

電化學感測器市場預計在預測期內複合年成長率為 11.2%

主要亮點

- 由於有毒和可燃性氣體的存在,製造和化學工業的極端環境中發生的爆炸事件越來越多,因此人們越來越關注危險區域的安全;為了實現更安全的工作環境,越來越多的人開始關注危險區域的安全。

- 汽車產業正在經歷強勁成長,主要受到車內空氣品質和燃油排放氣體偵測器等新興應用的推動。燃油效率提高和空氣品管等趨勢是電化學氣體感測器市場的主要驅動力。

- 此外,COSHH 和 OSHA 等政府法規對海上石油和天然氣探勘、生產和儲存活動中接觸一氧化碳和其他有毒氣體的情況有嚴格限制。這是採用基於電化學技術的氣體感測器的主要推動力。

- 醫療保健和診斷是一個利潤豐厚的細分市場,其驅動力是對快速現場護理測試和監測設備的濃厚興趣。此外,在預測期內,將生物感測器整合到多種診斷醫療設備中為市場提供了大量機會。

- 此外,所研究市場的供應商正在不斷創新並提供新的解決方案。例如,2021 年 7 月,萬通的 DropSens 宣布推出新功能,以促進客自訂電化學感測器的大規模生產。客自訂感測器採用高度擴充性且經濟高效的製造技術製造,幾乎沒有數量限制。從最初的概念到詳細的原型設計,萬通DropSens涵蓋了整個開發和製造過程。

- 此外,2021 年 3 月,DD-Scientific 推出了適用於工業安全應用的全新高性能電化學氣體感測器系列。 DceL 的解決方案套件不僅為危險氣體和氧氣監測提供業界領先的穩健性和性能,而且還具有超緊湊的設計,可實現更小的檢測器尺寸。 DceL 系列提供適用於最常規測量的危險氣體種類的感測器,例如硫化氫、一氧化碳、二氧化氮、氨和二氧化硫。

- 由新型嚴重急性呼吸症候群冠狀病毒2(SARS-CoV-2)引起的COVID-19大流行的爆發對全世界的公共衛生構成了威脅。因此,開發快速、準確且易於實施的病毒檢測診斷系統對於控制感染源和監測疾病進展至關重要。

- 2020 年 6 月,東北大學工程學院的 Nian Sun 教授授予新型 COVID-19 手持式氣體感測器 20 萬美元的 NSF津貼,該感測器用於對呼出氣中空氣傳播的SARS-CoV-2 病毒進行即時COVID- 19 診斷。與麻省大學醫學院 Jeremy Luban 教授的聯合計劃旨在簡化檢測和診斷 COVID-19 的過程。兩位教授利用各自的專業知識開發了一種手持式氣體感測器,用於檢測空氣中的 SARS-CoV-2 病毒。

電化學感測器市場趨勢

醫療領域市場成長顯著

- 由於對現代診斷技術的需求和微加工技術的進步,該領域的市場正在擴大,這導致了用於臨床分析的高靈敏度、選擇性和有效電化學感測器市場的發展。數十億美元用於研發以改善醫療技術。

- 由於對自測血糖儀等即時護理應用的強勁需求,使用電化學感測器技術的生物感測器的普及正在獲得關注。

- 分子照護端(POC)診斷還使用電化學感測器來提高現有的近患者和快速測試的靈敏度和特異性,並提高現有的近患者和快速測試的靈敏度和特異性,有助於改善重症加護世界各地醫院的科室和診所,這有助於擴大門診診所等照護現場的診斷能力。

- 此外,在開發用於糖尿病治療的植入式葡萄糖感測器以及下一代醫療和診斷電化學生物感測器產品設計方面,精密印刷和加工技術的進步正在開發血管內和皮下應用。

北美佔據主要市場佔有率

- 北美是全球最大的高級研究產業市場之一。該地區的巨大需求主要歸因於生物醫學、汽車、建築自動化和其他垂直領域研發活動的擴大。此外,北美是世界上最大的先進電子和控制市場之一。這一巨大的市場佔有率是大規模國內製造業、政府針對顛覆性技術的舉措以及資訊技術創新的結果。

- 此外,北美智慧城市市場未來向節能和節能相關解決方案的成長可能會直接影響電化學感測器市場從早期採用階段到大規模採用階段。

- 預計該區域市場將進一步受益於輕型汽車產量的持續成長以及透過使用先進且高成本的通用廢氣氧氣感測器(UEGO)來提高燃油經濟性和性能。

- 此外,最近工業爆炸的增加促使美國安全機構加強監管,導致對用於監測和品管的電化學氣體感測器的需求增加。

- 住宅市場規模雖小,但卻是成長最快的市場領域之一。消費性應用正在推動新型電化學感測器的開發,透過 MEMS 技術降低成本、功耗和尺寸。醫學和臨床研究實驗室為該國帶來了許多現場護理應用的機會,並加強了該地區的患者安全監測。

電化學感測器產業概況

全球電化學感測器市場競爭激烈。市場高度集中,各種規模的公司林立。市場的一些重要參與者包括 Thermo Fisher Scientific, Inc.、MSA Safety、Emerson Electric Co.、Honeywell Analytics (Honeywell International Inc.)、Conductive Technologies Inc.、Delphian Corporation 和 SGX Sensortech Ltd.。公司建立多種夥伴關係並投資於新產品推出,以增加市場佔有率並獲得相對於其他公司的競爭優勢。

- 2022 年 8 月 - Thermo Fisher Scientific 與國家法醫學大學 (NFSU) 建立技術合作夥伴關係,在印度建立 DNA 法醫法醫學中心。 Thermo Fisher Scientific 安裝了配備整個 DNA 工作流程的設施,包括先進的萃取系統、即時PCR設備、DNA 定序儀/遺傳分析儀、下一代定序儀和快速 DNA 技術。多功能電化學 DNA/RNA 感測器是基於 PCR 的診斷的有前途的替代方案。

- 2022 年 2 月 - Thermo Fisher Scientific 與 Moderna 合作,在美國專門大規模生產 Moderna 的 COVID-19 疫苗、Spikevax 和其他臨床實驗mRNA 藥物。 Thermo Fisher 與 Moderna 合作,透過臨床研究和契約製造服務支援開發平臺。電化學感測器廣泛應用於藥物傳輸領域。 Thermo Fisher 繼續提供全系列產品,使 Moderna 能夠以前所未有的速度和規模提供創新藥物。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 對電化學感測器市場的影響

第5章市場動態

- 市場促進因素

- 基於奈米技術的感測器的出現

- 有關危險場所安全的政府規則和法規

- 市場挑戰

- 政府法規-認證和核准週期長

第6章 市場細分

- 按類型

- 電位感測器

- 電流感測器

- 電導感測器

- 按最終用戶產業

- 石油和天然氣

- 化工/石化

- 醫療保健

- 車

- 飲食

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Thermo Fisher Scientific, Inc.

- MSA Safety

- Emerson Electric Co.

- Conductive Technologies Inc.

- Delphian Corporation

- SGX Sensortech Ltd

- Ametek Inc.

- Figaro USA Inc.

- Dragerwerk AG

- Membrapor AG

- Alphasense

第8章投資分析

第9章市場的未來

The Electrochemical Sensor Market is expected to register a CAGR of 11.2% during the forecast period.

Key Highlights

- Increasing focus on the safety of hazardous locations due to the rise in the number of explosions occurring in the extreme environment of the manufacturing and chemical industries because of the presence of toxic and combustible gases has prompted an increased focus on explosion prevention through implicit monitoring across the hazardous zones of these end-user industries to achieve a safer working environment.

- The automotive sector has witnessed favorable gains, primarily driven by emerging applications such as cabin air quality and fuel emission detectors. Aligning trends such as improving fuel efficiency and air quality control has been a significant driver for the electrochemical-based gas sensor market.

- Furthermore, government regulations, such as COSHH and OSHA regulations, toward offshore oil and gas exploration and production, and storage activities, impose strict limits on the exposure to carbon monoxide and other toxic gases fumes. This has been a significant driver for the adoption of electrochemical technology-based gas sensors.

- Medical and diagnostics are lucrative market segments driven by a strong interest in fast point-of-care testing and monitoring devices. Furthermore, the integration of bio-sensors into multiple diagnostic medical equipment is set to offer a plethora of opportunities for the market over the forecast period.

- Further, the vendors in the studied market are constantly innovating and offering new solutions. For instance, in July 2021, DropSens, a Metrohm company, unveiled new capabilities that will make mass production of customized electrochemical sensors easier. Custom sensors are made using a highly scalable and cost-effective manufacturing technique that has almost no quantity restrictions. From original concept to in-depth prototype design, Metrohm DropSens covers the whole development and manufacturing process.

- Moreover, in March 2021, for industrial safety applications, DD-Scientific introduced a new line of high-performance electrochemical gas sensors. The DceL suite of solutions not only provides industry-leading robustness and performance for dangerous gas and oxygen monitoring, but they also come in an ultra-compact design that allows for detector size reduction. Sensors for the most routinely measured hazardous species, such as hydrogen sulfide, carbon monoxide, nitrogen dioxide, ammonia, and Sulphur dioxide, are available in the DceL range.

- The outbreak of the COVID-19 pandemic caused by a novel severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) posed a threat to public health worldwide. Thus, the development of a rapid, accurate, and easy-to-implement diagnostic system for virus detection became crucial for controlling the infection sources and monitoring the illness progression.

- In June 2020, the Northeastern University College of Engineering Professor Nian Sun was awarded a USD 200,000 NSF RAPID grant for the COVID-19 new handheld gas sensor for Airborne SARS-CoV-2 Virus instant COVID-19 diagnosis from exhaled breath. In collaboration with Jeremy Luban from UMass Medical School, the project aims to streamline the COVID-19 detection and diagnosis process. Both professors developed a handheld gas sensor for the SARS-CoV-2 virus in air detection, using each of their fields of expertise.

Electrochemical Sensor Market Trends

Medical Sector to Witness Significant Market Growth

- The market in this segment has been augmented by the demand for modern methods for diagnosis and the advances in microfabrication methodology that have led to the development of sensitive, selective, and effective electrochemical sensors for clinical analysis. Billions of dollars are spent on research & development to improve medical technology.

- The proliferation of bio-sensors employing electrochemical sensing technology has been gaining traction owing to strong demand for point-of-care applications, such as self-monitoring blood glucose meters.

- Also, molecular point-of-care (POC) diagnostics use electrochemical sensors, which helped improve the sensitivity and specificity of existing near-patient and rapid tests and expand the diagnostic capabilities at points of care such as hospital critical care units, physician offices, and outpatient clinics across the world.

- Further, advancements in precise printing and processing technology and next-generation medical and diagnostic electrochemical biosensor product designs in developing implantable glucose sensors for treating diabetes have been developed for intravascular and subcutaneous applications.

North America to Account for a Significant Market Share

- North America is one of the largest markets for advanced research industries, globally. The huge demand in the region is mainly due to growing R&D activities in biomedical, automotive, building automation, and other verticals.Additionally, North America is one of the largest markets for advanced electronic devices and control, globally. This significant market share is a result of large-scale domestic manufacturing, government initiative toward disruptive technologies, and technological innovation in information technology.

- Moreover, the future growth in the smart cities market to move on for energy-efficient and conservation-related solutions in North America will possibly directly influence the market of electrochemical sensors from the early adoption phase to mass-adoption.

- The market in the region will further benefit from the continued growth of light vehicle production, coupled with advancements towards fuel efficiency and performance with the usage of advanced, high-cost universal exhaust gas oxygen sensors (UEGO).

- Moreover, with the incidences of industrial explosions increasing in recent times, US safety organizations are trying to implement the regulations strictly, contributing to the increased demand for electrochemical gas sensors for monitoring and quality control.

- The consumer segment is small, but one of the fastest-growing market segments. Consumer applications are driving the development of new electrochemical sensors to reduce cost, power consumption, and size with MEMS technologies. The medical and clinical research laboratories present a plethora of opportunity in the country for point of care applications and enhance safety monitors of patients.in the region.

Electrochemical Sensor Industry Overview

The Global Electrochemical Sensor Market is very competitive in nature. The market is highly concentrated due to the presence of various small and large players. Some of the significant players in the market are Thermo Fisher Scientific, Inc., MSA Safety, Emerson Electric Co., Honeywell Analytics (Honeywell International Inc.), Conductive Technologies Inc., Delphian Corporation, SGX Sensortech Ltd, among others. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge over other players.

- August 2022 - Thermo Fisher Scientific, in technical collaboration with National Forensic Sciences University (NFSU), has set up the Centre of Excellence for DNA Forensics in India. Thermo Fisher Scientific has equipped the facility with the entire DNA workflow, including sophisticated extraction systems, real-time PCR instruments, DNA sequencers/ genetic analyzers, next-generation sequencers, and rapid DNA technologies. Versatile electrochemical DNA/RNA sensors are a promising technological alternative for PCR-based diagnosis.

- February 2022 - Thermo Fischer Scientific and Moderna partnered to enable dedicated large-scale manufacturing in the U.S. of Spikevax, Moderna's COVID-19 vaccine, and other investigational mRNA medicines in the pipeline. Thermo Fisher has partnered with Moderna to support the development pipeline with clinical research and contract manufacturing services. Electrochemical sensors are widely used in the fields of drug delivery. Thermo Fisher continues to bring a full range of products that have enabled Moderna to deliver innovative medicines at an unprecedented speed and scale.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Electrochemical Sensor Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Nanotechnology-based Sensors

- 5.1.2 Government Rules and Regulations for Safety in Hazardous Places

- 5.2 Market Challenges

- 5.2.1 Government Regulations-Long Certification and Approval Cycles

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Potentiometric Sensors

- 6.1.2 Amperometric Sensors

- 6.1.3 Conductometric Sensors

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemicals

- 6.2.3 Medical

- 6.2.4 Automotive

- 6.2.5 Food & Beverage

- 6.2.6 Other End-user Industry

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thermo Fisher Scientific, Inc.

- 7.1.2 MSA Safety

- 7.1.3 Emerson Electric Co.

- 7.1.4 Conductive Technologies Inc.

- 7.1.5 Delphian Corporation

- 7.1.6 SGX Sensortech Ltd

- 7.1.7 Ametek Inc.

- 7.1.8 Figaro USA Inc.

- 7.1.9 Dragerwerk AG

- 7.1.10 Membrapor AG

- 7.1.11 Alphasense