|

市場調查報告書

商品編碼

1628754

公共事業與能源分析:市場佔有率分析、產業趨勢、成長預測(2025-2030)Utility and Energy Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

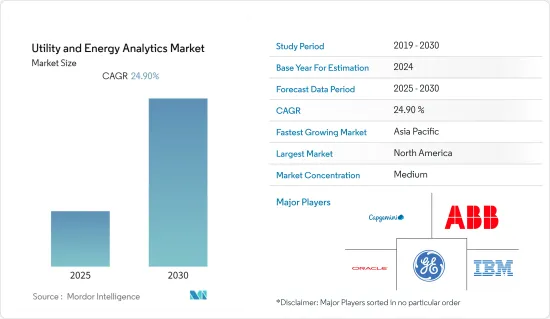

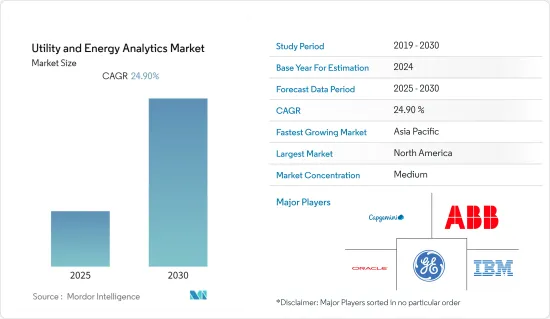

公共事業和能源分析市場預計在預測期內複合年成長率為 24.9%

主要亮點

- 巨量資料平台和雲端運算等先進分析工具和技術還有巨大的未開發潛力。隨著微電網控制系統和其他智慧電網系統的使用增加,這些系統可以從中央控制中心監控、控制和分析電網功能,公共產業和能源分析市場將顯著成長。此外,支持智慧電網解決方案的有利政府立法和智慧電錶使用的快速成長預計也將增加公共產業對巨量資料分析的需求。

- 另一個可以從巨量資料分析中受益的重要因素是可再生能源。利用可再生能源的技術在全球範圍內越來越受歡迎,特別是作為可靠的電力源。 IEA表示,預計未來五年可再生能源發電量將快速成長,到2026年將佔全球發電量成長的約95%。預計2020年至2026年間,全球可再生能源發電容量將成長60%以上,達到4,800GW以上。預計太陽能將在未來四年內主導可再生能源發電市場,發電量將遠遠超過水力發電或風力發電。

- 分析解決方案使能源公共事業公司能夠最佳化發電和發電規劃。可再生能源產業大力鼓勵採用分析技術。當用於可再生能源發電發電廠時,預測分析可以提供準確的能源生產預測。預測機械故障可以提高營運效率。例如,IBM 的混合可再生能源預測技術利用巨量資料、預測分析和天氣建模技術來估計太陽能和風能的可變資源。這將使可再生能源發電增加 10%,足以為 14,000 個家庭供電。

- 此外,由於微電網控制網路和其他高階晶格框架的使用不斷增加,尖端分析工具和技術(例如巨型資訊階段和分散式運算)存在巨大的未開發潛力。預計公共事業提供者對廣泛資訊分析的需求將受到促進智慧網路部署和快速擴大智慧電錶接受度的重要政府指導方針的推動。

- 世界各地的多個政府越來越限制人員流動,主要是為了減緩 COVID-19 的傳播。因此,公共事業和能源部門可能會預期電力需求將會改變。隨著人們待在家裡的時間更長,預計住宅消費和對水基礎設施的需求也會增加。分析解決方案的使用將主要幫助這些公司更好地預測需量反應並制定準確的配電計劃。

公共事業和能源分析市場趨勢

雲端基礎的部署模型有望快速成長。

- 在技術進步的幫助下,雲端基礎的部署模型預計將快速成長,從而實現高擴充性和成本效率。預計未來五年負載預測和需量反應市場將佔據重要佔有率。

- 預測分析在公共產業領域發揮重要作用,主要用於分析不斷成長的資料量、識別故障的有形資產以及增進對客戶行為的了解。公共產業公司依賴持續營運,包括各層面的舒適運作。因此,預測分析被廣泛採用,以避免大規模影響。

- 此外,2022 年 1 月,著名的工業智慧軟體即服務供應商 Uptake 宣布與領先的專業服務公司 Cognizant 建立合作夥伴關係,以公共產業統一的資料管理。 Uptake Fusion 收集、傳輸、組織和管理 Microsoft Azure 上的資料,並提供先進的工業分析和資產績效管理,該公司已與 Cognizant 合作提供行業諮詢、系統整合和應用服務。工業組織可以在企業雲端環境中使用 Uptake Fusion,為內部工業智慧和第三方資料消費者提供資料。您還可以使用開放 API 作為目前非專有工具的插件,用於儀表板、報告和監控,例如 Microsoft 的 Power BI、PowerApps 和 Azure Time Series Insights。

- Oracle超越了 2020 年房地產和設施使用 33%可再生能源的目標,並設定了 2025 年達到 100% 的新目標。 Oracle Cloud也設定了2025年使用100%永續能源的新目標。預計這些因素將在預測期內增加市場需求。

- IDC 預計,2022 年數位轉型 (DX) 總支出將達到 1.8 兆美國。到 2025 年,全球數位轉型支出預計將達到 2.8 兆美元。因此,隨著數位轉型支出的增加,預計市場在未來幾年將面臨各種利潤豐厚的成長機會。

北美將引領和開拓公共事業和能源分析解決方案市場

- 北美被認為是公共事業和能源分析的最大市場之一,也是分析解決方案的頂級採用者之一。該地區的大部分需求源於新興經濟體透過研發和技術改進更加重視創新。與加拿大相比,美國是該地區需求成長的主要因素。石油和天然氣、精製和發電行業的需求尤其增加。

- 該地區的製造商在市場上擁有強大的立足點。其中包括 SAS Institute Inc、Oracle Corporation、BuildingIQ、IBM Corporation 等。該地區也處於實施智慧電網技術的前沿。該地區能源和公共事業領域的大量公司已經完全採用或正在實施巨量資料分析。在美國市場,許多大型投資者擁有的公用事業公司正在向其客戶推出智慧電錶。

- 美國能源情報署預測,2016年至2040年全球能源消費量將增加5%。鑑於成長率較低,企業必須減少停機時間並有效保持盈利。這種情況推動了公共事業和能源領域資料分析市場的發展。為了減少能源使用,美國政府也對其能源系統進行現代化改造,並轉向先進計量基礎設施 (AMI)。例如,根據美國能源資訊管理局 (EIA) 的數據,住宅領域的 AMI 普及率是全國最高的。由於在人口最多的地區做出了雄心勃勃的努力,加拿大的智慧電錶普及率很高。預計大量小型市政和合作公用事業公司對於市場滲透也至關重要。

- 電力效率研究所預測,到 2024 年,美國智慧電錶的年出貨量將達到 9,000 萬台,高於 2015 年的 6,100 萬台。由於包括 Consolidated Edison、Duke Energy、Ameren、Entergy、PSEG、National Grid 和 Xcel Energy 在內的多家營運商部署智慧電錶,智慧電錶出貨量預計將在未來幾年增加。

- 此外,該地區的公用事業公司正在探索新技術,為期望高科技數位體驗的日益成熟的客戶提供服務。國內電力公司正在充分利用巨量資料來做出更好的決策。巴爾的摩天然氣和電力公司(Baltimore Gas & Electric)是一家天然氣和電力公司,正在進行一系列流程和組織變革,以支援集中式資料分析解決方案並從中獲取價值。

公共事業和能源分析產業概述

公共事業和能源分析市場競爭激烈,由多家大型企業組成。這些領先公司在市場上佔有重要地位,並專注於擴大跨細分市場的基本客群。公司正在利用策略聯合措施來擴大市場佔有率並提高盈利。在這個市場上營運的公司也在收購公共事業和能源分析技術領域的新興企業或與之合作,以增強產品功能並引入新功能。

- 2022 年 7 月 - 推動世界數位轉型的領先空間資料公司 Matterport 宣布與為關鍵基礎設施公司提供服務的工程、施工和建築公司 Barnes & McDonnell 建立合作夥伴關係。此次合作將使 Burns & McDonnell 的客戶能夠利用 Matterport 數位雙胞胎平台(包括軟體服務和硬體)來最佳化建築擴建和維護計劃。透過這種合作關係,能源、公共產業和製造公司將能夠獲得持續的數位視覺化文件解決方案,從而改善每個計劃階段的業務、加強協作並提高安全性。

- 2021 年 12 月 - Cerner 是一家為醫院和醫療保健組織提供數位資訊系統的供應商,被Oracle收購。 Cerner 使用巨量資料分析來儲存和處理患者資料。此外,此次收購將使醫療專業人員能夠為當地社區和特定個人提供更好的醫療保健服務。

- 2021 年 9 月 - 華盛頓州第二大公共電力公司斯諾霍米甚縣公共產業區 (Snohomish PUD) 將安裝西門子 EnergyIP 儀表資料管理解決方案,作為該區的Connect Up 計劃的一部分,用於實施、整合、和交貨。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 能源需求的增加和對環境的日益重視

- 消費者對能源消費模式分析的興趣日益濃厚

- 市場挑戰

- 相容性問題和技能差距

- 安全問題

第6章 市場細分

- 按發展

- 雲

- 本地

- 按類型

- 軟體

- 服務

- 按用途

- 儀表操作

- 負荷預測

- 需量反應

- 配電方案

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Oracle Corporation

- Capgemini SE

- ABB Corporation

- IBM Corporation

- General Electric Company

- SAS Institute Inc.

- Siemens AG

- Schneider Electric SE

- SAP SE

- Teradata Corporation

第8章投資分析

第9章市場的未來

The Utility and Energy Analytics Market is expected to register a CAGR of 24.9% during the forecast period.

Key Highlights

- There lies a huge untapped potential for advanced analytics tools and techniques, such as the big data platform and cloud computing. With the rise in the use of the microgrids control system and other smart grid systems, which enable businesses to monitor, control, and analyze grid functioning from a central control center, the market for utility and energy analytics will grow significantly. The need for big data analytics among utility providers is also anticipated to increase as a result of the favorable government legislation supporting smart grid solutions and the exponentially rising usage of smart meters.

- Another significant element that can profit from big data analytics is renewable energy. Technologies utilizing renewable energy are becoming more popular on a global scale, particularly as a dependable source of electricity. According to the IEA, renewable energy capacity is anticipated to grow at a rapid pace in the following five years, accounting for about 95% of the increase in global power capacity by 2026. The global renewable electricity capacity is anticipated to increase by more than 60% between 2020 and 2026, reaching more than 4 800 GW. Solar energy is expected to dominate the renewables market, generating far more electricity in the next four years than hydropower and wind.

- Energy utilities can optimize power generation and planning with analytics solutions. Analytics adoption is well encouraged by the renewable energy industry. When used in renewable energy power plants, predictive analytics can provide precise energy production forecasts. It anticipates mechanical glitches, thereby enhancing operational effectiveness. For instance, to estimate the variable resources for solar and wind power generation, IBM's hybrid renewable energy forecast technique makes use of big data, predictive analysis, and weather modeling technologies. This can provide 10% more renewable energy generation to the system, which is enough to power an additional 14,000 houses.

- Furthermore, there is a vast untapped potential for cutting-edge analytics tools and methods, like the huge information stage and distributed computing, as a result of the expansion in the use of the microgrids control network and other brilliant lattice frameworks, which enable organizations to screen, control, and examine network working from a focal control focus. The demand for extensive information analytics among utility merchants is anticipated to be driven by great government guidelines pushing savvy network arrangements and exponentially expanding reception of shrewd meters.

- Multiple governments across the world are increasingly limiting the movement of people primarily to slow down the spread of COVID-19. Due to this, the utilities and the energy sector may expect a shift in the demand for electricity. The residential consumption and demands on water infrastructure are also expected to witness an increase as people are at home for longer periods of time. The usage of analytics solutions will primarily help these companies better forecast the demand response and make accurate distribution planning.

Utility and Energy Analytics Market Trends

The cloud-based deployment model is expected to grow at a rapid pace.

- The cloud-based deployment model is anticipated to grow at a rapid rate, aided by technological advancements, leading to high levels of scalability and cost-effectiveness. The markets for load forecasting and demand response are expected to have significant shares of the market over the next five years.

- Predictive analytics plays a crucial role in the utility sector, mainly analyzing the growing data volumes, identifying failing physical assets, and improving customer behavior understanding. Utility companies rely on continuous operation, which includes pleasant functionality at every level. Hence, to avoid massive repercussions, predictive analytics is being widely adopted.

- Moreover, in January 2022, Uptake, a prominent provider of industrial intelligence software-as-a-service, announced a partnership with Cognizant, a significant player in professional services, to allow unified data management for the energy and utility industries. Uptake Fusion, which collects, transfers, organizes, and curates data in Microsoft Azure to provide advanced industrial analytics and asset performance management, has collaborated with Cognizant to provide industry consulting, systems integration, and application services. Industrial organizations can utilize Uptake Fusion in their enterprise cloud environment to supply data for industrial intelligence to internal and third-party data consumers. Users can also use its open APIs as plug-ins with current non-proprietary tools for dashboards, reporting, and monitoring, such as Microsoft Power BI, PowerApps, and Azure Time Series Insights.

- Oracle surpassed its 2020 objective of 33% renewable energy use in Real Estate and Facilities and established a new goal of 100% by 2025. Oracle Cloud also established a new aim of using 100% sustainable energy by 2025. These factors are thus expected to bolster the demand for the market during the forecast period.

- As per IDC, In 2022, the total spending on digital transformation (DX) is projected to reach 1.8 trillion U.S. dollars. By 2025, global digital transformation spending is forecasted to reach 2.8 trillion U.S. dollars. Hence with the rise in digital transformation spending, the market is expected to face various lucrative growth opportunities in the upcoming days.

North America to Lead and Pioneer Market for Utility and Energy Analytics Solutions

- North America is regarded as one of the greatest markets for utilities and energy analytics and is one of the top adopters of analytics solutions. The region's demand is mostly driven by developed economies' increased emphasis on innovations through R&D and technological improvement. When compared to Canada, the United States is a major factor in increasing the demand from the region. Demand in the nation has increased, particularly from the oil and gas, refining, and power generation sectors.

- The region has a strong foothold of manufacturers in the market. Some of them include SAS Institute Inc, Oracle Corporation, BuildingIQ, and IBM Corporation, among others. Also, the region has been at the forefront of adopting smart grid technology. A vast number of companies operating in the energy utility sector in the region have either fully deployed big data analytics or are in the process of implementation. Many large investor-owned utilities in the US market are still in the process of rolling out smart meters for their customers.

- The US Energy Information Administration predicts that between 2016 and 2040, global energy consumption will rise by 5%. Companies must cut downtime to sustain profitability effectively in light of the low growth rate. The market for data analytics in utilities and energy is fueled by this. In order to decrease energy use, the US government is also modernizing its energy systems and switching to Advanced Metering Infrastructure (AMI). For instance, the residential sector saw the highest rate of AMI adoption in the nation, according to the US Energy Information Administration (EIA). Canada has a high smart meter penetration rate as a result of the country's ambitious endeavors in its most populous regions. It is also expected that a large number of smaller municipal and cooperative utilities will be crucial to market penetration.

- The Institute for Electric Efficiency predicts that by 2024, there will be 90 million smart electricity meters shipped annually in the US, up from 61 million in 2015. The deployment of smart meters by several businesses, including Consolidated Edison, Duke Energy, Ameren, Entergy, PSEG, National Grid, and Xcel Energy, is anticipated to increase the number of smart meter shipments over the next years.

- Furthermore, the electric power companies in the region are exploring new technologies to serve increasingly sophisticated customers to expect a high-tech digital experience. Utilities in the country are highly using big data for better decision-making. Baltimore Gas & Electric, a gas and electric utility, makes numerous process and organizational changes to support and drive value from a centralized data analytics solution.

Utility and Energy Analytics Industry Overview

The utility and energy analytics market is extremely competitive and consists of several major players. These major players, with a prominent presence in the market, are focusing on expanding their customer base across the market segments. The companies are leveraging strategic collaborative initiatives to increase their market share and improve profitability. The companies functioning in the market are also acquiring or partnering with start-ups working on utility and energy analytics technologies to strengthen their product capabilities and introduce new features.

- July 2022 - Matterport, Inc., the leading spatial data company driving the digital transformation of the world, announced a partnership with Burns & McDonnell, an engineering, construction, and architecture firm providing services for critical infrastructure companies. Through the partnership, Burns & McDonnell customers can use the Matterport Digital Twin Platform, including software services and hardware, to optimize construction expansion and maintenance projects. The collaboration equips businesses in the energy, utilities, and manufacturing industries with a continuous digital, visual documentation solution that improves operations, enhances collaboration and increases safety in each project stage.

- December 2021 - The provider of digital information systems for hospitals and healthcare institutions, Cerner, was purchased by Oracle Corporation. Cerner utilizes big data analytics to store and process the patient's data. Additionally, this acquisition will make it possible for medical experts to provide both communities and specific individuals with improved healthcare.

- September 2021 - Snohomish County Public Utility District (Snohomish PUD), which is the second-largest publicly owned utility in Washington state, selected TRC Companies to implement, integrate and deliver its meter data management on the Siemens EnergyIP solution as a part of the utility's Connect Up program.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Energy and Increasing Emphasis on a Greener Environment

- 5.1.2 Growing Consumer Focus on Energy Consumption Pattern Analysis

- 5.2 Market Challenges

- 5.2.1 Compatibility Issues and Skill Gap

- 5.2.2 Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Type

- 6.2.1 Software

- 6.2.2 Services

- 6.3 By Application

- 6.3.1 Meter Operation

- 6.3.2 Load Forecasting

- 6.3.3 Demand Response

- 6.3.4 Distribution Planning

- 6.3.5 Other Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Capgemini SE

- 7.1.3 ABB Corporation

- 7.1.4 IBM Corporation

- 7.1.5 General Electric Company

- 7.1.6 SAS Institute Inc.

- 7.1.7 Siemens AG

- 7.1.8 Schneider Electric SE

- 7.1.9 SAP SE

- 7.1.10 Teradata Corporation