|

市場調查報告書

商品編碼

1627179

亞太地區 RFID 投資機會:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)RFID Investment Opportunities in APAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

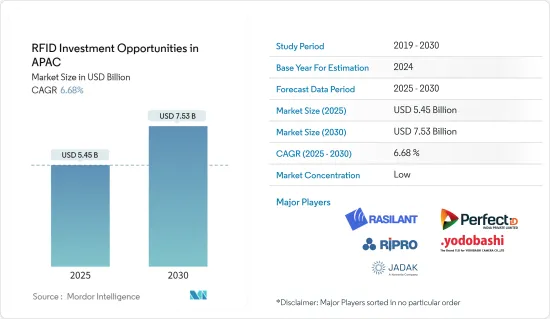

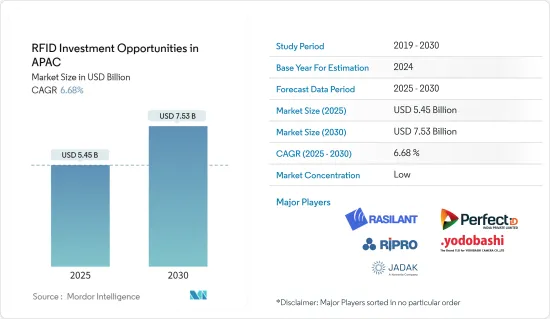

亞太地區 RFID 投資機會市場規模預計 2025 年為 54.5 億美元,預計到 2030 年將達到 75.3 億美元,預測期內(2025-2030 年)複合年成長率為 6.68%。

技術的進步正在引入新的 RFID 技術方法,例如用於智慧卡的帶有 5.8GHz 標籤的微處理器和無需矽晶片即可實現非接觸式通訊的無晶片 ID。

主要亮點

- RFID 技術正在成為 RFID 系統的低成本替代方案,並且由於矽 RFID 應答器與光學條碼相比成本較高,因此有潛力滲透到低成本物品標籤的大眾市場。

- 亞太地區是 RFID 技術的最大用戶,由於印度、中國、日本、韓國和台灣等國家的 RFID 應用機會不斷增加,預計 RFID收益將大幅成長。

- 例如,美國電子電機工程師學會(IEEE) 估計,到 2020 年,將有超過 500 億個物體聯網,其中許多物體使用無晶片 RFID。

- 除了政府對在國民身份證和交通等各個工業領域使用RFID(無線射頻識別)技術的支持和計劃外,私人公司對RFID技術的日益接受也是RFID市場的主要推動力。

- 許多替代標籤方法如線性條碼和2D資料矩陣條碼已經被開發出來,阻礙了RFID的發展。 GS1物流標籤是最新的範例,用於串行運輸集裝箱。

亞太地區RFID市場趨勢

汽車應用在亞太地區佔據主要佔有率

- 過去十年來,汽車產業經常發生創新。我們已經看到正在開發的產品被新的智慧數位和工程技術結合在一起。

- RFID 標籤為建築物和停車場提供了更高等級的安全性。在停車場,這些系統會進行相應的編程,並對進入停車場的所有車輛進行計數,並告訴您停車場是否有空間。此外,如果您要進入新家,系統會向您顯示車輛是否允許進入您的家。

- Smartrac 的工業應答器旨在滿足汽車行業的獨特要求。這些 RFID 感測器可以測量環境中的濕度、液體和溫度,並將這些資訊傳遞給讀取器。

- 除了亞太地區乘用車數量的增加外,政府對RFID(無線射頻識別)技術在自動化等各個工業領域使用的支援和舉措也增加了私人對RFID技術的需求。來了可能性。

醫療保健和醫療領域的應用推動市場成長

- 由於對改善患者照護的投資,預計亞太地區在預測期內將顯著成長。這些努力使印度醫療保健產業成為成長最快的產業之一,預計 2020 年將達到 2,800 億美元。該國還對先進診斷設施進行了大量資本投資,使其成為高階診斷解決方案的主要目的地之一。

- 此外,在新興國家,尤其是印度和中國,高血壓(HTN)的盛行率持續上升。據印度醫學研究委員會稱,印度 10.8% 的死亡歸因於高血壓。這導致對用於監測心率和血壓的 RFID 的投資增加。

- 此外,國際糖尿病聯合會報告稱,印度和中國預計未來將成為糖尿病患者數量最多的國家,這將增強該地區對經過臨床檢驗的追蹤設備的需求。

亞太地區RFID產業概況

亞太地區主要企業包括Yodobashi Camera Co Ltd、清華同旗、Chilitag Technology、Lynstan Engineering、Ceylon Technology、ThingMagic、EMW、Ripro Corporation、Perfect Corporation、Perfect RFID、Rasilant Technologies等。由於大公司之間的競爭,市場變得分散。因此,市場集中度可能較低。

- 2019年4月-意聯科技發表Higgs-9 IC,首款發表下一代Higgs RFID半導體積體電路。 Higgs-9 讓 RFID 部署能夠更快、更聰明地運行企業關鍵型應用程式,並帶來更快的投資回報。

- 2019 年 4 月 - 艾利丹尼森與套件 Check 合作,將 RFID 技術引入大型製藥公司。此次合作將使製藥公司能夠將 RFID 整合到藥品標籤中,使他們能夠追蹤每個產品從製造到到達醫院的整個過程。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 科技在各領域的快速採用

- 高投資收益率

- 市場限制因素

- 基礎設施不足

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依產品

- 無線射頻識別標籤

- 領導者

- 天線

- RFID軟體/中介軟體

- 按用途

- 零售/消費品

- 資產追蹤

- 銀行/金融

- 車

- 製造業

- 醫療保健

- 其他用途

第6章 競爭狀況

- 公司簡介

- Yodobashi Camera Co.,Ltd.

- Tsinghua Tongfang Co.,Ltd.

- CHILITAG Technology

- Ceyon Technology

- Jadaktech

- EMW Co Ltd.

- Ripro Corporation

- Perfect RFID

- Rasilant Technologies

第7章 投資分析

第8章 市場機會及未來趨勢

The RFID Investment Opportunities in APAC Market size is estimated at USD 5.45 billion in 2025, and is expected to reach USD 7.53 billion by 2030, at a CAGR of 6.68% during the forecast period (2025-2030).

Technological advancements have led to new approaches within the RFID technology like microprocessors with 5.8 GHz tags for smart cards and chipless IDs that enable contactless communication even in the absence of a silicon chip.

Key Highlights

- The RFID technology has emerged as a low-cost alternative for RFID system and has the potential to penetrate mass markets for low-cost item tagging, considering the high cost of silicon RFID transponders compared to optical barcodes.

- The APAC region is forecasted to be the greatest user of RFID technology and will witness strong growth in RFID revenues owing to increasing opportunities of RFID applications in countries such as India, China, Japan, South Korea and Taiwan.

- For instance, The Institute of Electrical and Electronics Engineers (IEEE) estimated that by 2020, more than 50 billion objects would be networked, of which many will use chipless RFID.

- The government support and initiatives for the use of Radio Frequency Identification (RFID) technology across various industrial verticals such as national ID cards and transportation, in addition increasing acceptance of RFID technology by private players has also added strong potential to RFID market.

- Many alternate labelling methods are being developed like linear barcoding and 2D data matrix barcoding, which hamper the growth of RFID. GS1 logistics label is the latest example which is used in the serial shipping container.

APAC RFID Market Trends

Application in Automotive to Account for a Significant Share in APAC

- The innovative things are happening regularly in the automotive industry during the closing decade. Also, we are witnessing the products that are being developed have already been blended on by new smart new digital and engineering technology.

- The RFID tag provides a building or parking lot an intensified level of security. These systems are programmed accordingly when in parking, it keeps the counting of all vehicles that have entered and tell if there is space available in the parking or not. Furthermore, for the new entrants in the house, it already shows if the vehicles are authorised or not, then they give access to homes.

- Smartrac industry transponders are designed to accommodate the specific requirements of the automotive industry. These RFID sensors can measure moisture, liquid or temperature in their environment and pass the information to a reader.

- The government support and initiatives for the use of Radio Frequency Identification (RFID) technology across various industrial verticals such as automation, besides the increase in passenger cars in the APAC, will in increase the demand of RFID technology by private players, has also added strong potential to RFID market.

Application in Healthcare & Medical Share to Drive the Market Growth

- Asia-Pacific is expected to witness a significant growth rate over the forecast period owing to the investments in improving patient care. Owing to these initiatives, India's healthcare industry is one of the fastest growing sectors and it is expected to reach USD 280 billion by 2020. The country has also become one of the leading destinations for high-end diagnostic solutions with tremendous capital investment for advanced diagnostic facilities, thus catering to a greater proportion of the population.

- Moreover, the prevalence of hypertension (HTN) continues to increase in developing countries particularly in India and China. According to the Indian Council of Medical Research, hypertension is attributable to 10.8% of all deaths in India. This has resulted in increased investments in RFID to monitor heart rate and blood pressure.

- Besides, India and China are expected to be the countries with the most number of diabetics in the future, reported the International Diabetes Federation which has bolstered the demand for clinically validated tracking devices in the region.

APAC RFID Industry Overview

The major players in APAC include Yodobashi Camera Co. Ltd., Tsinghua Tongflag Co. Ltd., Chilitag Technology, Lynstan Engineering, Ceylon Technology, ThingMagic, EMW Co. Ltd., Ripro Corporation, Perfect Corporation, Perfect RFID, Rasilant Technologies, among others. The market is fragmented since there's is competition among major players. Therefore, the market concentration will be low.

- April 2019 -Alien Technology,announced the Higgs-9 IC, the first release of its next-generation of Higgs RFID semiconductor integrated circuits.Higgs-9 enables enterprise-critical applications to run faster, smarter and with quicker ROI in RFID deployments.

- April 2019 -Avery Dennison, in a partnership with Kit Checkaimed for implementation of RFID technology for Big Pharma. This collaborationwillhelppharmaceutical companies to build into their medication labels, thereby enabling the tracking of each product from the point of manufacture until after it arrives at a hospital.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rapid Adoption Of The Technology In Various Sectors

- 4.3.2 High Return On Investment

- 4.4 Market Restraints

- 4.4.1 Inadequate Infrastructure

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 RFID Tags

- 5.1.2 Readers

- 5.1.3 Readers

- 5.1.4 Antennas

- 5.1.5 RFID Software and Middleware Services

- 5.2 By Application

- 5.2.1 Retail & Consumer Goods

- 5.2.2 Asset Tracking

- 5.2.3 Banking and Finance

- 5.2.4 Automotive

- 5.2.5 Manufacturing

- 5.2.6 Healthcare & Medical

- 5.2.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Yodobashi Camera Co.,Ltd.

- 6.1.2 Tsinghua Tongfang Co.,Ltd.

- 6.1.3 CHILITAG Technology

- 6.1.4 Ceyon Technology

- 6.1.5 Jadaktech

- 6.1.6 EMW Co Ltd.

- 6.1.7 Ripro Corporation

- 6.1.8 Perfect RFID

- 6.1.9 Rasilant Technologies