|

市場調查報告書

商品編碼

1626877

紙漿和造紙化學品:市場佔有率分析、產業趨勢、成長預測(2025-2030)Pulp & Paper Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

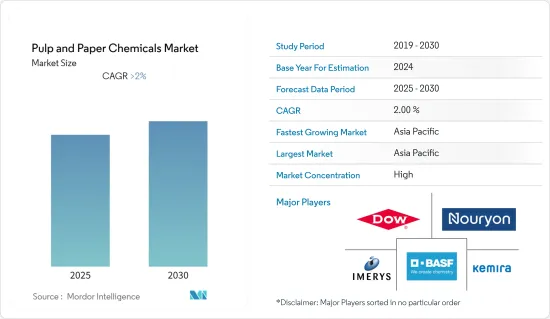

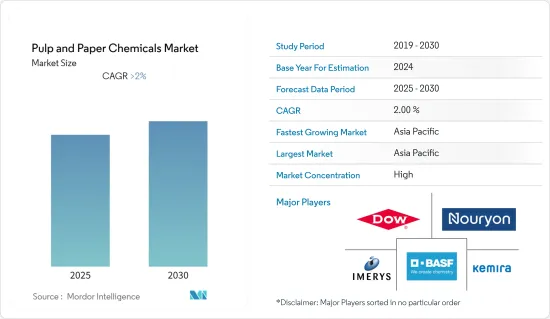

紙漿和造紙化學品市場預計在預測期內複合年成長率將超過 2%

主要亮點

- 新興國家紙漿和造紙工業的成長以及紙張回收的增加正在推動市場的成長。

- 製漿造紙業造成的環境破壞以及嚴格的水處理法規可能會阻礙市場成長。

- 對紙張品質改進的廣泛研究預計將成為未來市場的機會。

製漿造紙化學品市場趨勢

包裝和工業用紙的需求增加

- 紙包裝包括硬質和軟包裝形式,如紙袋和袋子、瓦楞紙箱、包裝紙、紙箱、展示包裝、杯子和托盤、插入物和分隔物、膠帶和標籤以及翻蓋。紙包裝在重量、配送效率和原料投入方面具有顯著優勢。

- 包裝具有保護商品從製造到最終消費者的整個過程中免受損壞的重要功能。防止貨物和能源的浪費。包裝符合嚴格的安全、技術和衛生要求。

- 由於消費者對塑膠對環境的有害影響的認知不斷提高,以及紙包裝的環保性和經濟形式,對軟紙包裝的需求不斷增加,正在推動紙漿和造紙化學品市場的成長。

- 使用再生紙包裝的一大優點是可以降低高達40%的包裝材料成本。政府對環境問題的嚴格監管和減少碳排放也是預計推動最終用戶產業再生紙包裝消費的重要因素。

- 美國是北美最大的包裝市場之一。美國包裝產量將增加,2022年達到6.762億噸,而2021年為6.461億噸。該國的包裝工業由紙和紙板包裝驅動,約佔包裝市場的40%。

- 隨著環保意識的增強,對永續、環保包裝的需求也不斷增加,進一步拉動了紙包裝的需求。同樣,隨著世界對環境問題的日益關注以及減少有毒排放的需求不斷成長,再生紙包裝正在醫療保健、個人護理以及食品和飲料行業中使用。

- 因此,隨著包裝和工業用紙需求的增加,紙漿和造紙化學品市場預計在預測期內也將出現顯著的需求成長。

中國主導亞太地區

- 在亞太地區,中國預計將引領紙包裝市場,其應用遍及醫療保健、個人護理、家庭護理、零售等行業。因此,它將在未來幾年推動紙漿和造紙化學品市場的需求。

- 中國的紙和紙板包裝工業是世界第二大工業,預計將繼續成長,以滿足大眾消費者的高需求。然而,永續和環保包裝可能會增加,從而推動全國紙漿和造紙化學品市場的發展。

- COVID-19 的影響增加了零售電子商務銷售的需求。 2020年中國電子商務銷售額成長44%。此外,2021年,它以15,426億美元的營業額成為最大的電子商務市場,從而增加了該國對紙和紙板包裝的需求。

- 2022年中國紙及紙板製造業市場規模將成長5%,達到2,180億美元。 2017年至2022年,中國紙及紙板製造市場年均成長5.4%。預計將在預測期內推動紙漿和造紙化學品市場的需求。

- 食品和飲料行業對食品安全的日益關注推動了對高品質食品服務板材和液體包裝板材的需求。除此之外,中國電子商務的發展促進了快遞的增加,進一步增加了對包裝紙的需求,並在預測期內帶動了製漿造紙化學品市場的需求。

- 上述因素可能導致預測期內中國對製漿造紙化學品的需求增加。

製漿造紙化學品產業概述

製漿造紙化學品市場本質上是部分一體化的。該市場的主要企業(排名不分先後)包括 Nouryon、 BASF SE、DowDuPont、Imerys 和 Kemira。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 新興國家製漿造紙工業的成長

- 增加紙張回收利用

- 抑制因素

- 製漿造紙工業造成的環境破壞

- 嚴格的水處理法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 粘合劑

- 漂白

- 填料

- 製漿

- 漿紗

- 其他

- 按用途

- 報紙紙張

- 包裝/工業用紙

- 列印/書寫紙

- 紙漿廠/飲料廠

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率**/排名分析

- 主要企業策略

- 公司簡介

- Arkema

- Ashland Inc.

- BASF SE

- Buckman

- Cargill Incorporated

- Clariant

- DowDuPont

- Ecolab

- ERCO Worldwide

- FMC Corporation

- GE Corporation

- Georgia-Pacific

- Kemira

- Nouryon

- Solvay

- Sonoco Products Company

- Stora Enso

第7章 市場機會及未來趨勢

- 紙張品質改進的廣泛研究

簡介目錄

Product Code: 48186

The Pulp & Paper Chemicals Market is expected to register a CAGR of greater than 2% during the forecast period.

Key Highlights

- The growing pulp & paper industry in emerging economies and increasing paper recycling are augmenting the market's growth.

- Environmental hazards from the pulp and paper industry and stringent water treatment regulations will likely hinder the market's growth.

- Extensive research on paper quality improvements is projected to act as an opportunity for the market in the future.

Pulp and Paper Chemicals Market Trends

Increasing Demand from the Packaging and Industrial Papers

- Paper packaging includes rigid and flexible paper packaging formats, such as paper sacks and bags, corrugated boxes, wrapping paper, cartons, display packaging, cups and trays, inserts and dividers, tapes and labels, and clamshells. Significant weight advantages of paper packaging ensure benefits in terms of distribution efficiencies and raw material inputs.

- Packaging performs an essential function by protecting goods from damage, from the point of manufacture to the final consumer. It prevents the wastage of goods and energy. Packaging meets stringent safety, technical, and hygienic requirements.

- A rise in the demand for flexible paper packaging, owing to growing consumer awareness regarding the harmful effects of plastic on the environment, along with the eco-friendly nature and economical form of paper packaging, is expected to propel pulp and paper chemicals market growth.

- The significant advantage of using recycled paper packaging is the associated reduction in the cost of packaging material by up to 40%. Stringent government regulations about environmental concerns and reduction in carbon emissions are also significant factors expected to fuel the consumption of recycled paper packaging across the end-user industries.

- The United States is one of the largest packaging markets in North America. Packaging production in the United States increased, reaching 676.2 million tons in 2022 compared to 646.1 million tons in 2021. The packaging industry is driven by the country's paper and paperboard packaging, which nearly accounts for around 40% of the packaging market.

- With the increasing environmental awareness, the demand for sustainable and eco-friendly packaging is also increasing, further boosting the demand for paper packaging. Similarly, owing to increasing global environmental concerns and the rising need to reduce toxic emissions, recycled paper packaging is used by the healthcare, personal care, and food and beverages industries.

- Hence, with the increasing demand for packaging and industrial papers, the pulp & paper chemicals market is also expected to register a noticeable growth in demand during the forecast period.

China to Dominate the Asia-Pacific Region

- In the Asia-Pacific region, China is expected to drive the market for the paper packaging segment, with applications across industries like healthcare, personal care, home care, retail, and others. It, in turn, is driving the demand for the pulp and paper chemicals market in the coming years.

- The Chinese paper and paperboard packaging industry is the second-largest in the world and will showcase continuous growth owing to meet the higher demand from mass consumers. However, sustainable and eco-friendly packaging is likely to increase, thereby driving the market for Pulp & Paper Chemicals across the country.

- Due to the COVID-19 impact, the demand for retail e-commerce sales increased. E-commerce sales rose by 44% in China in 2020. It further registered as the largest e-commerce market in 2021, with a revenue of USD 1,542.6 billion, thereby increasing the demand for paper and board packaging across the country.

- The market size for the Chinese paper and paperboard manufacturing industry grew by 5% in 2022 to USD 218 billion. China's paper and paperboard manufacturing market increased by an average of 5.4% per year between 2017 and 2022. It is expected to drive the pulp and paper chemicals market demand during the forecast period.

- Increasing concern over food safety in the food and beverages sector propelled the need for high-quality food service boards and liquid packaging boards. Besides this, the development of e-commerce in China promoted the increase in express delivery, further driving the demand for packaging paper, thereby driving the demand for the pulp and paper chemicals market during the forecast period.

- The factors above may contribute to the increasing demand for pulp and paper chemicals in china during the forecast period.

Pulp and Paper Chemicals Industry Overview

The pulp & paper chemicals market is partially consolidated in nature. The major players in this market (not in a particular order) include Nouryon, BASF SE, DowDuPont, Imerys, and Kemira.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Pulp and Paper Industry in Emerging Economies

- 4.1.2 Increasing Paper Recycling

- 4.2 Restraints

- 4.2.1 Environmental Hazards from the Pulp and Paper Industry

- 4.2.2 Stringent Water Treatment Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Binders

- 5.1.2 Bleaching Agents

- 5.1.3 Fillers

- 5.1.4 Pulping

- 5.1.5 Sizing

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Newsprint

- 5.2.2 Packaging and Industrial Papers

- 5.2.3 Printing and Writing Papers

- 5.2.4 Pulp Mills and Drinking Plants

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Ashland Inc.

- 6.4.3 BASF SE

- 6.4.4 Buckman

- 6.4.5 Cargill Incorporated

- 6.4.6 Clariant

- 6.4.7 DowDuPont

- 6.4.8 Ecolab

- 6.4.9 ERCO Worldwide

- 6.4.10 FMC Corporation

- 6.4.11 GE Corporation

- 6.4.12 Georgia-Pacific

- 6.4.13 Kemira

- 6.4.14 Nouryon

- 6.4.15 Solvay

- 6.4.16 Sonoco Products Company

- 6.4.17 Stora Enso

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Extensive Research on Paper Quality Improvements

02-2729-4219

+886-2-2729-4219