|

市場調查報告書

商品編碼

1549957

電纜配線架:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Cable Tray - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

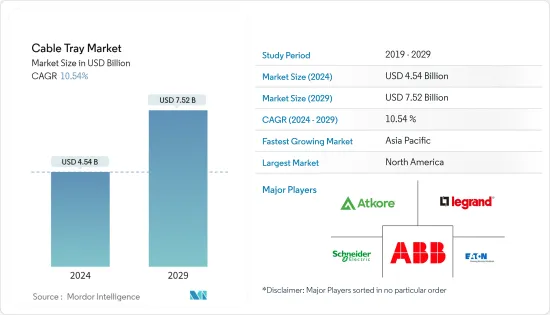

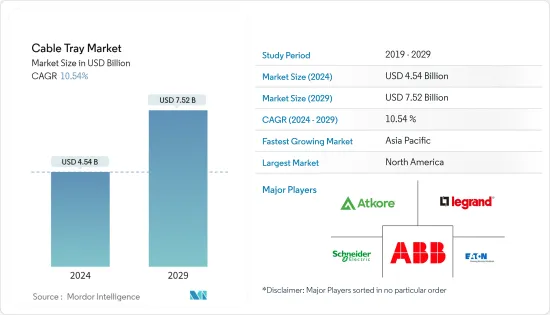

電纜配線架市場規模預計到 2024 年為 45.4 億美元,預計到 2029 年將達到 75.2 億美元,在預測期內(2024-2029 年)複合年成長率為 10.54%。

主要亮點

- 電纜配線架是一種結構系統,用於支撐和組織建築物和工業環境中的配電、通訊和控制電纜。隨著全球建築計劃的激增,對電纜配線架等高效能電纜管理的需求不斷增加。都市化和基礎設施進步進一步推動了這一需求。此外,我們也致力於透過促進遵守安全標準和法規來加強電纜配線架。

- 數位數位資料的成長刺激了對資料中心的需求激增。電纜配線架在這些中心發揮關鍵作用,為管理網路電纜、配電和光纖提供了有效的解決方案。隨著雲端處理服務的擴展和資料儲存需求的增加,資料中心越來越依賴這些廣泛的佈線解決方案。

- 根據仲量聯行 2023 年報告,全球有 314 個超大規模站點正在開發中,代表著資料中心技術的重大飛躍。到 2024年終,這一數字預計將超過 1,000 個,比五年前的約 500 個站點增加了一倍。預計美國將在超大規模發展方面保持領先地位,但中國、愛爾蘭、印度、西班牙、以色列、加拿大、義大利、澳洲和英國等國家也正在經歷顯著成長。

- 電纜配線架安裝需要專門的設備、熟練的勞動力、精確的測量和獨特的技術。這些系統需要輔助組件,例如腕帶、身體支架、壁掛支架、緊固件和支架,這增加了整體成本。此外,在核能發電廠、建築工地和大型計劃中,電纜配線架安裝需要專用的時間、設備和人員,這可能會導致施工延誤和額外成本,阻礙市場成長。

- 新冠肺炎 (COVID-19) 疫情之後,隨著向雲端平台的轉變,雲端服務不斷擴展,超大規模資料中心需要大規模佈線解決方案。此外,對數位服務的日益依賴和資料中心的加速成長正在推動對電纜配線架系統的需求,以支援大規模IT基礎設施。

電纜配線架市場趨勢

建築業佔有很大佔有率

- 建築業主導市場,政府資助的基礎設施計劃主要推動建設活動。建築的激增增加了對電纜配線架管理電力和通訊電纜的需求。此外,物聯網設備和智慧建築技術整合的日益成長的趨勢將改善能源管理、安全、維護和居住者舒適度。這一趨勢進一步推動了電纜配線架市場的成長。

- 配備物聯網感測器的智慧電纜配線架可即時監控電纜狀況,有助於提高維護和營運效率。我們還可以透過先進的軟體工具和機器人技術促進電纜配線架設計和安裝的自動化。

- 2023 年,蘇黎世贏得了世界最智慧城市的稱號,聲稱其成功歸功於其強大的基礎設施、對永續精神的承諾以及先進的交通網路。該市的努力範圍從智慧交通管理和自行車共享計劃到節能建築。 IBM 的評估強調了蘇黎世在數位安全和大眾交通工具的專業知識。 IBM 也注意到蘇黎世透過數位服務出色的公民參與度。

- 隨著永續和節能計劃的興起,電纜配線架系統必須使用永續的材料和設計。包含太陽能電池板等再生能源來源的計劃需要強大的電纜管理,以滿足額外的佈線要求。例如,在2024年中期預算中,印度政府撥款超過13.8億美元(約1150億印度盧比)用於加強可再生能源部門和對抗碳排放。該資金分配給太陽能發電(電網)、國家綠色氫能任務和風電(電網)計劃,涵蓋截至2025年3月的財政年度。

- 此外,全球現代多用戶住宅的建設不斷增加,需要對網際網路、電視和智慧家庭系統進行全面的電纜管理。一些計劃也安裝太陽能電池板發電。因此,需要各種電纜來連接光伏組件、逆變器、充電控制器、電池等。電纜配線架有助於整理電纜,防止電纜纏結並確保安全安裝。例如,根據國際能源協會(IEA)的數據,到2027年,全球太陽能光電再生能源容量預計將達到3,329.5吉瓦。

亞太地區將顯著成長

- 預計亞太地區電纜配線架市場在未來幾年將出現成長,這主要是由強勁的建築業推動的。特別是在中國、印度和東南亞等國家,建築和基礎設施投資的增加正在推動對電纜管理系統的需求。

- 在亞太地區,多個市場已經開始建造 5G 基礎設施。韓國於 2019 年 4 月推出全國 5G 網路,為世界樹立了榜樣。澳洲、菲律賓、中國和紐西蘭也將效仿,預計每個國家都會改善其網路基礎設施並增加對結構化佈線的需求。根據 GSMA Intelligence 2023 年第二季資料,韓國、中國和日本已成為 5G 部署的領跑者,其中中國擁有 41.1% 的 5G 連線滲透率,高於本報告涵蓋的歐洲市場的連線比例。

- 此外,全部區域智慧城市計劃的投資預計將推動對先進電纜配線架系統的需求,以支援智慧基礎設施、物聯網設備和通訊網路。例如,2025年智慧城市高峰會博覽會(SCSE)計畫在台灣台北舉行。該活動是最大的混合智慧城市展覽會,將展示各種物聯網和智慧城市解決方案。這些措施正在推動市場對電纜配線架的需求。

- 亞太地區是製造中心,工廠中自動化、機器人技術和工業 4.0 技術的發展正在推動對支援電氣佈線的電纜配線架系統的需求。電纜配線架有助於保護電纜免受機械磨損和推理等環境因素造成的損壞,有助於自動化系統的安全。

- 公司越來越重視安全。他們正在投資電纜配線架系統,以保護關鍵基礎設施中的電纜免受火災。因此,需要開發防火電纜配線架,以確保資料中心和關鍵基礎設施的安全。

- 例如,2024年6月,材料製造商科思創宣布了其最新創新,其熱塑性聚氨酯(TPU)系列Desmopan FR(阻燃劑)。 TPU在該系列中又有了新的應用,專為高檔阻燃電纜護套量身定做。這些夾克在消防安全是關鍵因素的行業中極為重要,例如汽車充電和家用電器。

電纜配線架產業概況

電纜配線架市場高度分散,競爭對手眾多,技術競爭,導致企業之間競爭激烈。此外,我們預計大公司和新興企業之間將出現專注於技術創新的收購和合作。參與者包括 Atkore International Group Inc.、Legrand SA、Thomas & Betts (ABB)、Schneider Electric 和 Eaton Corporation。

- 2024 年 1 月 網路和電氣基礎設施解決方案供應商 Panduit 推出最新創新產品-線籃電纜橋架佈線系統。該系統旨在高效處理資料中心、互連建築和工業環境中的銅質資料電纜、光纖和電力電纜。與競爭產品相比,鋼絲籃具有創新的設計和卓越的強度重量比。最重要的是,它堅固耐用,安裝快速簡便,是一種經濟高效的選擇。

- 2023 年 12 月 全球能源和通訊電纜系統公司普睿司曼集團 (Prysmian Group) 宣布與德國-荷蘭電力傳輸系統營運商 TenneT 簽署了關鍵服務等級協定 (SLA)。根據協議,普睿司曼將為 TenneT 在北海的 HVDC 和 HVAC 海底電力電纜提供全面的近岸和海上電纜維護、檢查和維修服務。透過此次合作,N-Sea 將提供勘測、IMR、施工、海底電纜運作以及未爆炸彈藥識別和處置方面的專業知識。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 宏觀經濟趨勢影響概述

第5章市場動態

- 市場促進因素

- 新興地區持續的建築需求

- 可再生能源商業化的需求

- 資料中心和通訊基礎設施的成長

- 強調職業安全和合規性

- 市場挑戰

- 原料高成本

- 電纜配線架的種類及主要用途

- 梯子、實心底、絲網、單軌等

第6章 市場細分

- 按材料(市場估計/預測 | CAGR | 成長趨勢和其他市場動態)

- 鋁

- 鋼

- 纖維增強聚合物(FRP)

- 按最終用戶產業(市場估計/預測 | CAGR | 成長趨勢和其他市場動態)

- 電力/公共產業

- 建造

- 工業

- 其他最終用戶產業(IT/通訊、資料中心等)

- 按地區(市場估計/預測 | 複合年成長率 | 成長趨勢和其他市場動態)

- 北美洲

- 歐洲

- 亞洲

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Atkore International Group Inc.

- Legrand SA

- Thomas & Betts(ABB)

- Schneider Electric

- Eaton Corporation

- Chalfant Manufacturing Co.

- OBO Bettermann GmbH & Co. KG

- Hubbell Inc.

- Panduit Corporation

- OGLAEND Group Holding AS(Hilti)

- Prysmian Group

第8章 市場機會及未來趨勢

The Cable Tray Market size is estimated at USD 4.54 billion in 2024, and is expected to reach USD 7.52 billion by 2029, growing at a CAGR of 10.54% during the forecast period (2024-2029).

Key Highlights

- Cable trays are structural systems that support and organize cables for power distribution, communication, and control in buildings and industrial settings. With the global surge in construction projects, the need for efficient cable management, like cable trays, is increasing. This demand is further fueled by urbanization and infrastructure advancements. Moreover, the push for adherence to safety standards and regulations focuses on the enhancement of cable trays.

- The growth of digital data is fueling a surge in demand for data centers. Within these centers, cable trays play a crucial role, providing efficient solutions for managing networking cables, power distribution, and fiber optics. As cloud computing services expand and the demand for data storage grows, data centers increasingly rely on these extensive cabling solutions.

- According to the JLL Report of 2023, the global count of hyperscale sites under development stands at 314, marking a substantial leap in data center technology. By the close of 2024, this tally is projected to exceed 1,000, doubling from approximately 500 sites just five years ago. While the United States is anticipated to retain its lead in hyperscale advancements, countries such as China, Ireland, India, Spain, Israel, Canada, Italy, Australia, and the United Kingdom are also experiencing notable growth.

- Installing cable trays demands specialized equipment, skilled labor, precise measurements, and unique techniques. These systems necessitate supplementary components like wrist straps, body mounts, wall mounts, fasteners, and supports, which increase the overall cost. Moreover, setting up cable trays in nuclear plants, construction sites, and sizable projects demands dedicated time, equipment, and personnel, potentially leading to construction delays and added expenses that hamper the market's growth.

- After COVID-19, cloud services experienced expansion as migration to cloud platforms increased, which involved ensuring extensive cabling solutions in hyperscale data centers. Moreover, there is an increased reliance on digital services, which is accelerating the growth of data centers and driving the demand for cable tray systems to support large-scale IT infrastructure.

Cable Tray Market Trends

Construction Segment Holds a Major Share

- The construction sector dominates the market, primarily driven by government-funded infrastructure projects that boost construction activities. This surge in construction, in turn, increases the need for cable trays to manage electrical and communication cabling. Additionally, a rising inclination toward integrating IoT devices and smart building technologies enhances energy management, security, maintenance, and occupant comfort. This trend is further propelling the growth of the cable tray market.

- Smart cable trays equipped with IoT sensors ensure real-time monitoring of cable conditions, which helps enhance maintenance and operational efficiency. It can also facilitate automation in the design and installation of cable trays through advanced software tools and robotics.

- In 2023, Zurich claimed the world's smartest city title, attributing its success to robust infrastructure, commitment to sustainability ethos, and an advanced transportation network. The city's initiatives span from smart traffic management and bike-sharing programs to energy-efficient structures. IBM's assessment highlighted Zurich's digital security and public transit expertise. IBM also highlighted Zurich's exceptional citizen engagement with its digital offerings.

- There is growth in sustainable and energy-efficient projects, which necessitates the use of sustainable materials and designs in the cable tray systems. Projects that incorporate renewable energy sources, such as solar panels, require robust cable management to handle additional wiring requirements. For instance, the Indian government, in its Interim Budget for 2024, allocated more than USD 1.38 billion (approximately INR 11,500 crore) to bolster the renewable energy sector and combat carbon emissions. This funding is allocated for Solar Power (Grid), the National Green Hydrogen Mission, and Wind Power (Grid) projects, covering the financial year until March 2025.

- In addition, there is an increase in the construction of modern residential complexes globally, which require comprehensive cable management for internet, television, and smart home systems. Some of the projects involve solar panel installations for electricity purposes. Thus, various cables are required to connect photovoltaic modules, inverters, charge controllers, batteries, etc. Cable trays help with the organization of the cables to prevent tangling and ensure safe installation. For instance, as per the International Energy Association (IEA), the solar renewable electricity capacity is expected to reach 3329.5 gigawatts by 2027 globally.

Asia-Pacific to Witness Major Growth

- The cable tray market in Asia-Pacific is expected to witness growth in the coming years, primarily driven by a robust construction sector. Rising investments in construction and infrastructure, particularly in nations like China, India, and Southeast Asia, fuel the demand for cable management systems.

- In the Asia-Pacific region, several markets have started building 5G infrastructure. South Korea set the global pace by launching a nationwide 5G network in April 2019. Subsequently, Australia, the Philippines, China, and New Zealand followed it, and every country is expected to improve its network infrastructure, driving the need for structured cabling. According to the Q2 2023 data from GSMA Intelligence, South Korea, China, and Japan emerged as frontrunners in 5G adoption, with China having a 41.1% penetration rate in 5G connections, signifying a higher percentage of 5G connections than the European markets highlighted in this report.

- Moreover, investments in smart city projects across the region are expected to drive the demand for advanced cable tray systems to support smart infrastructure, IoT devices, and communication networks. For instance, Smart City Summit Expo (SCSE) 2025 is scheduled to take place in Taipei, Taiwan. This event marks the largest hybrid smart city tradeshow, featuring a range of IoT and smart city solutions. These initiatives drive the demand for cable trays in the market.

- Asia-Pacific is a hub for manufacturing industries, and the growth of automation, robotics, and Industry 4.0 technologies in factories drives the demand for the cable tray system to support electrical wirings. Cable trays help protect the cable from damage due to environmental factors such as mechanical wear and inference, which is helpful in the safety of automated systems.

- Companies are more focused on safety features. They make investments in cable tray systems to protect cables from fire in critical infrastructure facilities. Thus, there is a need to develop fire-resistant cable trays to ensure safety in data centers and critical infrastructure facilities.

- For instance, in June 2024, Covestro, a materials manufacturer, unveiled its latest innovation, which is the Desmopan FR (Flame Retardant) thermoplastic polyurethane (TPU) series. TPUs have a new application in this series, tailored for premium flame-retardant cable jackets. These jackets are crucial in industries like automotive charging and consumer electronics, where fire safety is a crucial factor.

Cable Tray Industry Overview

The cable tray market is fragmented, with numerous competitors and competing technologies that provide intense rivalry among the players. Furthermore, acquisitions and collaborations of large companies with startups are expected, focusing on innovation. Some of the players include Atkore International Group Inc., Legrand SA, Thomas & Betts (ABB), Schneider Electric, and Eaton Corporation.

- January 2024: Panduit, a network and electrical infrastructure solutions player, unveiled its latest innovation: the Wire Basket Cable Tray Routing System. This system is tailored to efficiently handle copper data cables, fiber optics, and power cables in data centers, interlinked buildings, and industrial settings. The Wire Basket features an innovative design and a superior strength-to-weight ratio over its competitors. Notably, it is robust and offers a swift and straightforward installation, making it a cost-effective choice.

- December 2023: The Prysmian Group, a global energy and telecom cable system player, announced a pivotal service level agreement (SLA) with TenneT, the German-Dutch transmission system operator. Under this agreement, Prysmian provides comprehensive nearshore and offshore cable maintenance, inspection, and repair services for TenneT's HVDC and HVAC submarine power cables in the North Sea. This collaboration will see N-Sea providing expertise in surveying, IMR, construction, subsea cable operations, and even UXO identification and disposal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Overview of the Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing Demand for Construction-based Activity in Emerging Regions

- 5.1.2 Demand in Renewable Energy Commercialization

- 5.1.3 Growth in Data Centers and Telecommunications Infrastructure

- 5.1.4 Emphasis on Workplace Safety and Compliance

- 5.2 Market Challenges

- 5.2.1 High Cost of Raw Materials

- 5.3 Types of Cable Trays and their Key Applications

- 5.3.1 Including Ladder, Solid Bottom, Wire Mesh, Single Rail, etc.

6 MARKET SEGMENTATION

- 6.1 By Material (Market Estimates and Forecast | CAGR| Growth Trends and Other Market Dynamics)

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.1.3 Fiber-reinforced Polymers (FRP)

- 6.2 By End-user Industry (Market Estimates and Forecast | CAGR| Growth Trends and Other Market Dynamics)

- 6.2.1 Power and Utilities

- 6.2.2 Construction

- 6.2.3 Industrial

- 6.2.4 Other End-user Industries (IT & telecom, Data Centers, etc.)

- 6.3 By Region (Market Estimates and Forecast | CAGR| Growth Trends and Other Market Dynamics)

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Middle East and Africa

- 6.3.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atkore International Group Inc.

- 7.1.2 Legrand SA

- 7.1.3 Thomas & Betts (ABB)

- 7.1.4 Schneider Electric

- 7.1.5 Eaton Corporation

- 7.1.6 Chalfant Manufacturing Co.

- 7.1.7 OBO Bettermann GmbH & Co. KG

- 7.1.8 Hubbell Inc.

- 7.1.9 Panduit Corporation

- 7.1.10 OGLAEND Group Holding AS (Hilti)

- 7.1.11 Prysmian Group