|

市場調查報告書

商品編碼

1549890

有限元素分析軟體:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Finite Element Analysis Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

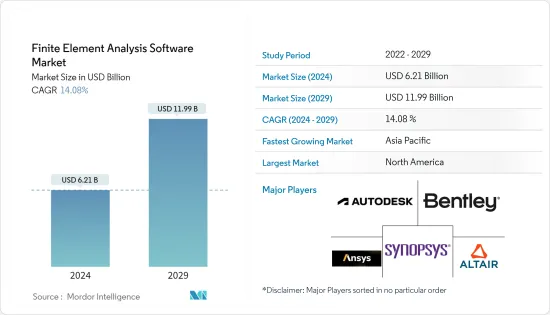

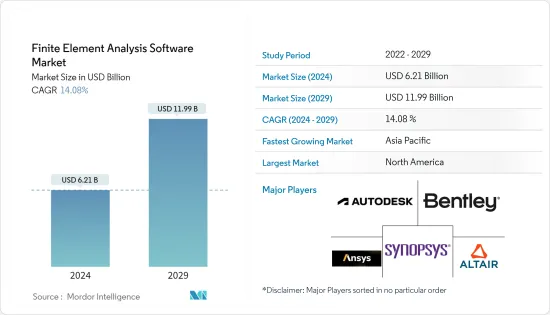

有限元素分析 (FEA) 軟體市場規模預計到 2024 年為 62.1 億美元,預計到 2029 年將達到 119.9 億美元,在預測期內(2024-2029 年)複合年成長率為 14.08。

主要亮點

- 全球有限元素分析軟體市場的成長是由虛擬原型製作的日益普及、現代車輛對安全性和舒適性的需求不斷成長以及最大限度地減少材料和時間的浪費以及縮短設計週期所推動的。產品的需求日益增加。對輕量化、節能設計的需求不斷成長以及產品設計日益複雜,進一步推動了這一趨勢。

- 隨著世界各國政府收緊監管標準,對確保安全性和可靠性的模擬技術的需求大幅增加,預示著積極的市場前景。

- FEA 軟體領域的技術進步(例如轉向基於雲端基礎的解決方案)正在進一步推動 FEA 軟體在世界各地各行業的採用。各行業的公司擴大在產品開發和創新方法上做出重大轉變,進一步推動市場成長。這種不斷成長的採用證實了 FEA 軟體在提高準確性、同時減少與實體原型製作相關的時間和成本方面發揮的重要作用。

- 電動和混合動力汽車的需求和生產不斷成長,加上燃料生產和消耗的增加,正在推動全球有限元素分析軟體市場的成長。電動和混合動力汽車汽車 (EHV) 因其環境效益和燃油效率而受到讚譽。

- 然而,車輛設計和性能也面臨挑戰,例如馬達、電池和動力傳動系統產生的振動和噪音。此類干擾會損害車輛的舒適性、安全性和零件壽命。為此,對模擬和改進車輛及其部件動態行為的 FEA 軟體的需求不斷增加,推動了市場成長。

- 由於 FEA 軟體的複雜性,有必要聘請能夠執行高級分析的高技能專業人員。招募此類專家需要投入大量時間和財力,這可能會阻礙公司採用 FEA 解決方案。對於預算有限的中小型企業以及缺乏經過 FEA 培訓的工程師的國家來說,這項挑戰尤其嚴峻。

- 選舉、兩極化以及國家內部和國家間衝突帶來的地緣政治風險對全球和國家經濟產生重大影響。持續的全球地緣政治擔憂,特別是俄羅斯-烏克蘭戰爭和中東危機,正在對全球有限元素分析軟體市場產生持久影響。

有限元素分析軟體市場趨勢

汽車應用領域佔據主要市場佔有率

- 汽車產業的快速成長可能會推動所研究市場的成長。例如,根據中國乘用車協會預測,中國新能源乘用車年銷量預計將從2021年的369萬輛增加到2028年的780萬輛。德國工業協會(VDA)強調,德國擁有世界上最大的汽車工業之一。 2022年德國乘用車銷量將達到約265萬輛,較2021年的262萬輛逐步成長。單位銷售量的成長正在推動微量元素分析軟體的採用。

- 安全仍然是汽車工程的重中之重,世界各地的監管機構都實施嚴格的規定。根據世界衛生組織2023年12月發布的報告,每年約有119萬人因交通事故死亡。大多數國家的道路交通事故損失國內生產總值的 3%。

- 因此,為了防止此類交通事故,汽車公司使用FEA軟體。 FEA 軟體在確保車輛符合這些安全標準方面發揮關鍵作用。透過模擬碰撞測試、衝擊力和其他安全相關場景,FEA 使工程師能夠評估和加強車輛部件的結構完整性。此虛擬測試有助於識別潛在的弱點並最佳化設計,以提高碰撞安全性和乘客保護。

- 政府針對永續交通和增加對電動車新興企業的投資的多項舉措將推動電動車的需求和生產,從而推動全球有限元素分析軟體市場在預測期內的成長。例如,國際能源協會 (IEA) 估計,2023 年插電式電動車 (PEV) 的銷量約為 1,370 萬輛。

- 總之,汽車產業對有限元素分析軟體的需求不斷成長,反映出它在解決現代車輛設計和開發挑戰方面日益重要。 FEA 軟體提供了寶貴的見解,可以加速產品開發,同時提高安全性、最佳化效能並降低成本。隨著汽車產業不斷發展並融入新技術,FEA 在推動創新和效率方面的作用將變得更加重要。

預計北美將佔據較大市場佔有率

- 在技術進步和各行業需求不斷成長的推動下,美國有限元素分析 (FEA) 軟體市場正在經歷強勁成長。 FEA 軟體在複雜工程挑戰的模擬和分析、促進設計和流程最佳化方面發揮關鍵作用。

- 採用雲端基礎的FEA 解決方案的趨勢日益明顯,這些解決方案提供擴充性、靈活性和成本效益。雲端 FEA 軟體允許用戶運行重型模擬,而無需投資昂貴的本地硬體,因此可供包括中小企業 (SME) 在內的各種公司使用。

- 例如,2023 年 11 月,ANSYS 與 TSMC 和 Microsoft 合作,檢驗了用於分析多晶片 3D-IC 系統中機械應力的解決方案。這些系統採用台積電先進的封裝技術(稱為 3DFabric)製造。此聯合解決方案將增強客戶應對新的多物理場挑戰的信心,並增強利用台積電 3DFabric 套件的設計的功能可靠性。 Ansys Mechanical 是一流的有限元素分析軟體,能夠專業地模擬 3D-IC 中的機械應力,尤其是由熱梯度引起的機械應力。此外,該解決方案已在 Microsoft Azure 上證明了其效率,確保複雜 2.5D/3D-IC 系統的快速週轉時間。

- 將人工智慧 (AI) 和機器學習 (ML) 整合到有限元素分析 (FEA) 軟體中,可顯著提高管理複雜模擬的效率。這些進步實現了自動網格生成、最佳化和預測分析,使 FEA 軟體強大且易於使用。

- 在加拿大,由於各領域擴大採用複雜的工程解決方案,有限元素分析 (FEA) 軟體市場正在持續成長。 FEA 軟體對於產品和系統的設計、模擬和分析至關重要,可為工程師提供改進的性能、降低的成本和增強的安全性。

- 加拿大能源產業涵蓋石油、天然氣和可再生能源,依靠 FEA 軟體來設計和分析管道、風力發電機和海上平台等複雜結構。由於高效、安全的能源生產和供應系統的推廣,FEA 解決方案的採用不斷增加。加拿大正在大力投資石油和天然氣基礎設施。典型的例子是加拿大繁榮計劃,目前正處於公告階段,投資額為240億加元(約177.8億美元),目標於2030年開始營運。該計劃將監督全長 4,500 公里的加拿大繁榮管道的運作。

有限元素分析軟體產業概況

有限元素分析軟體市場有些分散,主要參與者包括 Ansys Inc.、Autodesk Inc.、Bentley Systems Inc.、Altair Engineering Inc. 和 Synopsys, Inc.。市場公司正在採取合作和收購等策略來增強其產品陣容並獲得永續的競爭優勢。

2024年3月-達梭系統和巴西航空工業公司宣布,達梭系統的模擬技術在Eve Air Mobility電動垂直起降(eVTOL)車輛的虛擬模擬、分析和測試中發揮了關鍵作用。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 技術簡介

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 替代品的威脅

- 競爭程度

- 新進入者的威脅

第5章市場動態

- 市場促進因素

- 電動和混合動力汽車的需求和產量增加

- 燃料產量和消耗量增加

- 市場限制因素

- 過程複雜且耗時

第6章 市場細分

- 按配置

- 本地

- 雲

- 按組織規模

- 中小企業 (SME)

- 主要企業

- 按用途

- 建造

- 電氣/電子製造

- 航太/國防

- 石油/天然氣/能源

- 架構和規劃

- 技術硬體和軟體

- 汽車工業

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 北歐的

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Ansys Inc.

- Autodesk Inc.

- Bentley Systems Inc.

- Altair Engineering Inc.

- Synopsys, Inc.

- Siemens AG

- PTC Inc.

- Dassault Systemes

- ESI Group(Keysight Technologies Inc.)

- Dlubal Software GmbH

第8章投資分析

第9章 市場機會及未來趨勢

The Finite Element Analysis Software Market size is estimated at USD 6.21 billion in 2024, and is expected to reach USD 11.99 billion by 2029, growing at a CAGR of 14.08% during the forecast period (2024-2029).

Key Highlights

- The global finite element analysis software market growth is governed by the increasing adoption of virtual prototyping, the rising demand for safety and comfort in modern automobiles, coupled with the growing need to create higher-quality products in a reduced design cycle, minimizing material and time waste. This trend is further fueled by a rising demand for lightweight, energy-efficient designs and the escalating complexity of product designs.

- As governments worldwide tighten regulatory standards, the demand for simulation techniques to ensure safety and reliability has seen a notable uptick, indicating a positive market outlook.

- Technological advancements in the FEA software landscape, such as the shift toward cloud-based solutions, are further augmenting the adoption of FEA software across industries worldwide. Businesses across diverse sectors are increasingly making substantial shifts in their approach to product development and innovation, further propelling market growth. This heightened adoption underscores the pivotal role of FEA software in boosting precision and simultaneously reducing the time and costs associated with physical prototypes.

- The rising demand and production of electric and hybrid vehicles, coupled with an increase in fuel production and consumption, drives the growth of the global finite element analysis software market. Electric and hybrid vehicles (EHVs) are lauded for their environmental benefits and fuel efficiency.

- However, they also introduce vehicle design and performance challenges, such as the vibration and noise generated by the electric motor, battery, and powertrain. Such disturbances can compromise the vehicle's comfort, safety, and the longevity of its components. In response, the demand for FEA software to simulate and refine the dynamic behavior of both the vehicle and its parts is growing, driving the growth of the market.

- The intricate nature of FEA software necessitates recruiting highly skilled professionals capable of conducting advanced analyses. Such recruitment demands a considerable investment of time and financial resources, potentially dissuading companies from embracing FEA solutions. This challenge is pronounced for smaller firms with limited budgets and countries lacking a robust pool of FEA-trained engineers.

- Geopolitical risks from elections, polarization, and conflicts within and between states significantly impact both global and national economies. The ongoing geopolitical concerns worldwide, notably the Russia-Ukraine War and Middle-East crisis, have a lasting impact on the global finite element analysis software market.

Finite Element Analysis Software Market Trends

Automotive Application Segment Holds Significant Market Share

- The surge in the automotive sector is likely to boost the growth of the market studied. For instance, according to the China Passenger Car Association, annual sales of new energy passenger vehicles in China are projected to rise from 3.69 million units in 2021 to 7.8 million units by 2028. The German Association of the Automotive Industry (VDA) highlights that Germany boasts one of the world's largest automobile industries. In 2022, Germany's passenger car sales reached approximately 2.65 million units, marking a modest increase from 2.62 million units in 2021. Such growth in sales drives the adoption of fine element analysis software.

- Safety remains a top priority in automotive engineering, with stringent regulations imposed by regulatory bodies worldwide. According to the report published by WHO in December 2023, approximately 1.19 million people die each year because of road traffic crashes. Road traffic crashes cost most countries 3% of their gross domestic product.

- Hence, to prevent such road accidents, automotive companies use FEA software, which plays a crucial role in ensuring that vehicles meet these safety standards. By simulating crash tests, impact forces, and other safety-related scenarios, FEA enables engineers to evaluate and enhance the structural integrity of vehicle components. This virtual testing helps identify potential weaknesses and optimize designs to improve crashworthiness and passenger protection.

- Several government initiatives towards sustainable mobility coupled with growing investments in e-mobility startups will drive the demand and production of electric vehicles, supporting the growth of the global finite element analysis software market over the forecast period. For instance, the International Energy Association (IEA) estimated that 2023 saw plug-in electric light vehicle (PEV) sales of around 13.7 million units.

- In conclusion, the rising demand for finite element analysis software in the automotive sector reflects its growing importance in addressing the challenges of modern vehicle design and development. FEA software provides valuable insights that enhance safety, optimize performance, and accelerate product development while reducing costs. As the automotive industry continues to evolve and embrace new technologies, the role of FEA in driving innovation and efficiency will become even more crucial.

North America is Expected to Hold Significant Market Share

- The US finite element analysis (FEA) software market is witnessing robust growth fueled by technological advancements and heightened demand across diverse industries. FEA software plays a crucial role in simulating and analyzing intricate engineering challenges, facilitating the optimization of designs and processes.

- There is a growing trend toward the adoption of cloud-based FEA solutions, which provide scalability, flexibility, and cost-effectiveness. With cloud FEA software, users can conduct high-computation simulations without investing in costly on-premises hardware, broadening accessibility to a wider array of companies, including small and medium-sized enterprises (SMEs).

- For instance, in November 2023, Ansys, in partnership with TSMC and Microsoft, validated a solution aimed at analyzing mechanical stresses in multi-die 3D-IC systems. These systems are produced using TSMC's advanced packaging technologies, known as 3DFabric. This joint solution enhances customer confidence in tackling new multiphysics challenges, thereby bolstering the functional reliability of designs leveraging TSMC's 3DFabric suite. Ansys Mechanical, the premier finite element analysis software, adeptly simulates mechanical stresses in 3D-ICs, particularly those induced by thermal gradients. Furthermore, this solution has demonstrated its efficiency on Microsoft Azure, ensuring swift turn-around times for intricate 2.5D/3D-IC systems.

- Integrating artificial intelligence (AI) and machine learning (ML) with finite element analysis (FEA) software significantly boosts its efficiency in managing intricate simulations. These advancements enable automated mesh generation, optimization, and predictive analytics, rendering FEA software both robust and user-friendly.

- In Canada, the market for finite element analysis (FEA) software is witnessing consistent growth, fueled by the rising embrace of sophisticated engineering solutions across diverse sectors. FEA software is pivotal in product and system design, simulation, and analysis, empowering engineers to enhance performance, cut costs, and bolster safety.

- Canada's energy sector, encompassing both oil and gas and renewable energy, utilizes FEA software to design and analyze intricate structures, including pipelines, wind turbines, and offshore platforms. The push for efficient and safe energy production and distribution systems drives the growing adoption of FEA solutions. Canada is making significant investments in its oil and gas infrastructure. A prime example is The Canadian Prosperity Project, currently in the announced stage, which is set to commence operations in 2030, with an estimated cost of CAD 24 billion (approximately USD 17.78 billion). This project will oversee the operation of the 4,500 km-long Canadian Prosperity Pipeline.

Finite Element Analysis Software Industry Overview

The Finite Element Analysis Software Market is semi-fragmented with the presence of major players like Ansys Inc., Autodesk Inc., Bentley Systems Inc., Altair Engineering Inc., and Synopsys, Inc. Market players are adopting strategies, including partnerships and acquisitions, to enhance their product offerings and gain sustainable competitive advantage.

March 2024 - Dassault Systemes and Embraer declared that Dassault Systemes' simulation technology played a pivotal role in virtually simulating, analyzing, and testing Eve Air Mobility's electric vertical take-off and landing (eVTOL) aircraft.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technology Snapshot

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of Substitute Products and Services

- 4.4.4 Degree of Competition

- 4.4.5 Threat of New Entrants

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand and Production of Electric and Hybrid Vehicles

- 5.1.2 Increase in Fuel Production and Consumption

- 5.2 Market Restraints

- 5.2.1 Complex and Time Consuming Process

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By Application

- 6.3.1 Construction

- 6.3.2 Electrical and Electronic Manufacturing

- 6.3.3 Aerospace and Defense

- 6.3.4 Oil, Gas, and Energy

- 6.3.5 Architecture and Planning

- 6.3.6 Technology Hardware and Software

- 6.3.7 Automotive

- 6.3.8 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Nordics

- 6.4.2.2 Germany

- 6.4.2.3 United Kingdom

- 6.4.2.4 France

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ansys Inc.

- 7.1.2 Autodesk Inc.

- 7.1.3 Bentley Systems Inc.

- 7.1.4 Altair Engineering Inc.

- 7.1.5 Synopsys, Inc.

- 7.1.6 Siemens AG

- 7.1.7 PTC Inc.

- 7.1.8 Dassault Systemes

- 7.1.9 ESI Group (Keysight Technologies Inc.)

- 7.1.10 Dlubal Software GmbH