|

市場調查報告書

商品編碼

1549889

機器台虎鉗:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Machine Bench Vices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

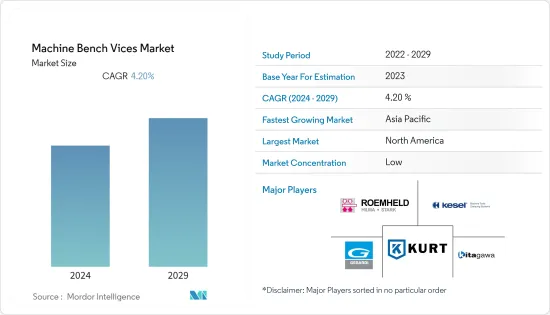

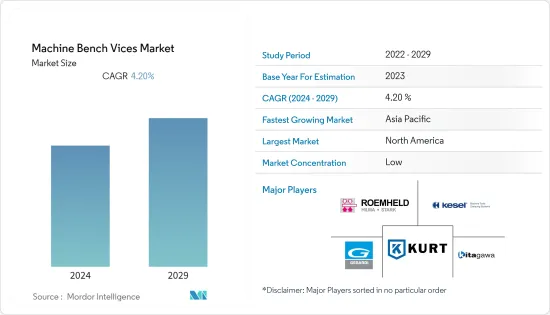

預計機器台虎鉗市場在預測期間內複合年成長率為 4.20%

主要亮點

- 機用虎鉗或台虎鉗與發明家的虎鉗類似,是用來夾住金屬而不是木材的工具。虎鉗的主要用途是在切割或打磨時固定金屬。機用虎鉗牢牢地固定住您正在加工的物體。它可以安裝在銑床或鑽床上。機用虎鉗通常由手搖曲柄或液壓系統操作,可以用適度的力道夾緊物體。

- 隨著越來越多的工作場所使用鑽床和銑床,工業部門的快速成長需要擴大機用台虎鉗的範圍。此外,許多製造工具機的公司都將中小型公司製造的虎鉗作為其標準設備的一部分。此外,小型企業在公開市場上從各個批發商購買這些虎鉗。因此,小企業的成長預計在不久的將來會非常高。

- 中國、印度和印尼等新興經濟體以及日本和韓國等已開發國家正在幫助亞太地區在製造業中佔據主導地位,特別是在金屬加工設備對機床台虎鉗的需求方面。

- 而且,中國還是全世界最大的汽車製造國。由於活性化以及國家的消費促進措施等其他因素對中國乘用車市場產品的貢獻,中國已成為最大的乘用車生產國之一。因此,汽車領域對工具機台虎鉗的需求不斷增加。例如,根據OICA的數據,2022年中國乘用車產量為238萬輛,較2021年成長11%。

- 金屬加工設備最廣泛應用於汽車及相關產業,製造業為第二大消費者。航太和國防等關鍵領域的工具機虎鉗金屬加工設備的需求和供應預計在預測期內將會增加。

- 俄羅斯和烏克蘭之間的衝突對該行業產生了重大影響。衝突加劇了已經影響該行業的供應鏈問題和材料短缺。此次中斷導致鎳、鈀、銅、鈦、鋁和鐵礦石等關鍵原料價格波動,導致材料短缺。從而影響了各種工具機台虎鉗的生產。

- 此外,根據烏克蘭投資局的數據,2022 年 3 月初銅價上漲至 10,845 美元/噸。俄烏戰爭、能源成本上漲以及歐洲更嚴格的廢氣標準被指出是銅持續短缺的主要原因。

機用台虎鉗市場趨勢

汽車領域顯著成長

- 由於汽車需求的增加,機器台虎鉗的使用正在增加。近年來,機器台虎鉗在汽車產業的使用顯著增加。從相似的晶粒零件到一體式車架製造,現代汽車中的大部分零件都由 CNC 設備和機械製造。因此,隨著汽車產業需求的不斷增加,所研究市場的需求未來可能會持續成長。

- 例如,全球道路上有超過 13 億輛汽車,預計到 2035 年將增加至 18 億輛。其中,乘用車約佔74%,輕型商用車、大型卡車、巴士、長途客車和小型客車佔其餘26%。

- 根據OICA(國際汽車工業協會)的數據,中國是全球最大的汽車市場:2023年中國汽車用戶將購買約2,606萬輛乘用車。印度是亞洲第二大乘用車市場。

- 此外,亞太地區是所有地區中人口最多的地區。不斷成長的城市人口和消費能力使亞太地區成為汽車行業最重要的市場之一。根據中國工業協會的數據,2022年4月中國乘用車銷量約96.5萬輛,商用車銷量約21.6萬輛,季減48%和42%。由於汽車銷量如此之大,所研究的市場也在成長。

- 隨著汽車製造的發展,許多製造商正在採用智慧工廠解決方案。例如,Kurt Workholding 將於 2022 年 3 月推出 DX8 虎鉗。這款全新 DX8 虎鉗作為全新 8 吋虎鉗平台,具有與 DX 系列虎鉗相同的關鍵功能。 Kurt 的 DX8 虎鉗是 DX CrossOver 虎鉗系列中最新、最廣泛的虎鉗。 DX8 虎鉗將 Kort D810 虎鉗和 Kort 3800V 虎鉗的最佳功能結合到一個虎鉗中,其尖端功能重新定義了精密平面度、平行度和重複性。

亞太市場成長顯著

- 亞太國家在各行業開展了製造和研發活動,佔該地區市場佔有率較高。此外,金屬加工和汽車業等行業加大力度確保工人安全也支持了該地區的市場成長。

- 在金屬加工中,機用台虎鉗最常用於高價數控機床上,並且需要連續操作。因此,最大限度地縮短設定時間至關重要。特別是在大量生產中,需要高度自動化來實現經濟高效的重複加工,用於固定物體的夾緊系統至關重要。液壓虎鉗是最重要的夾緊系統。液壓虎鉗可以快速且有力地緊固物體。您始終可以以相同的力度重複夾緊。

- 由於製造業和機械工業的快速發展,印度對工具機配件的需求量很大。印度政府實施了多項政策來幫助企業設立製造單位。其中包括旨在2025年將製造業佔GDP比重提高到25%的國家製造業政策,以及2022年推出的旨在使核心製造業達到國際標準的PLI計畫。

- 此外,勞動力的供應和零件價格的下降導致製造商將生產轉移到該地區,進一步促進了市場的發展。有幾個關鍵因素正在推動該地區的採用,包括靠近供需區域。

- 此外,亞太地區製造工廠的建立正在刺激電腦數值控制(CNC)的使用,以推動機器台虎鉗市場的發展。由於汽車製造的自動化程度不斷提高,汽車產業預計將成為未來幾年成長最快的領域之一。機器台虎鉗市場預計將受到汽車和製造業等金屬加工行業效率、時間效率、精度和精密度不斷提高的推動。

機器台虎鉗產業概述

機用台虎鉗市場較為分散,由許多公司組成。從市場佔有率來看,目前市場由其中一些重要供應商控制。這些擁有重要市場佔有率的主要企業正致力於擴大海外基本客群。研究市場中的公司不斷努力創新先進產品,以滿足消費者不斷變化的需求。

- 2023 年 11 月 - GEARWRENCH 擴大了其商店用品產品線,並宣佈為專業汽車機械師推出兩個落地式千斤頂和四個千斤頂支架。此外,三款台虎鉗型號和三款瓶子千斤頂產品計劃於 2024 年初發布。

- 2023 年 8 月-德國工具機商 Roemheld 宣布將於 9 月 18 日至 23 日在漢諾威舉行的 EMO 2023 金屬加工貿易展覽會上的展位(4 號館,E54)展示其新型機械定心(自定心)技術。新型 Hilma.UC 125 虎鉗採用模組化設計,適用於 3 至 5 軸棱鏡加工應用。該設計允許從各個方向輕鬆存取刀具,從而允許在單一設置中使用短刀具進行精密加工。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 金屬加工產業需求增加

- 擴大先進加工技術的採用

- 市場限制因素

- 增加使用替代夾持技術

第6章 市場細分

- 依產品類型

- 油壓機台虎鉗

- 氣動機台虎鉗

- 按分銷管道

- 線上

- 離線

- 按最終用戶產業

- 製造業

- 汽車工業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Gerardi SpA

- Kurt Manufacturing Company

- KITAGAWA

- Georg Kesel GmbH & Co KG

- Romheld GmbH Friedrichshutte

- Raptor Workholding Products

- Jergens Inc.

- ALLMATIC-Jakob Spannsysteme

- OK-VISE

- LANG Technik GmbH

- 5th Axis Inc.

- SPREITZER GmbH & Co. KG

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 50002512

The Machine Bench Vices Market is expected to register a CAGR of 4.20% during the forecast period.

Key Highlights

- Machine vises and bench vises, like inventor's vises, are tools used to clamp metal instead of wood. The primary purpose of the vise is to hold metal while the cutting and filing process is going on. A machine vise holds the workpiece securely while the work is being done. It can be mounted on a milling or drilling machine. A machine vise is usually operated by a hand crank or a hydraulic system and can clamp the workpieces with moderate force.

- The rapid growth of the industrial sectors has increased the number of workshops utilizing drills and milling machines, thus necessitating an expansion of the machine bench vices. Furthermore, most companies manufacturing machine tools incorporate vices manufactured by small businesses as part of their standard equipment. Moreover, small-scale businesses also purchase these vices from various wholesalers in the open market. Consequently, the growth of small enterprises is expected to be exceptionally high in the near future.

- Developing economies, such as China, India, and Indonesia, among others, along with industrialized countries, such as Japan and South Korea, have assisted the Asia-Pacific (APAC) region to dominate the manufacturing industry in terms of demand, particularly with the demand for machine bench vices for metal fabrication equipment.

- Moreover, China is also the largest manufacturer of automobiles in the world. China is one of the largest producers of passenger cars due to the improving logistics and supply chains, increased business activity, and the country's raft of pro-consumption measures, among other factors contributing to the passenger car market products in the country. Therefore, this has increased demand for machine bench vices for the automotive segment. For instance, according to OICA, in 2022, passenger car production in China amounted to 2.38 million units, which showed an increase of 11% compared to 2021.

- Metal fabrication equipment is the most widely used in the automotive and related industries, with manufacturing companies being the next largest consumers. The demand and supply of machine bench vice metal fabrication equipment for critical sectors, including aerospace and defense, are projected to increase over the forecast period.

- The conflict between Russia and Ukraine significantly impacted this industry. The conflict exacerbated supply chain issues and material shortages that had affected the industry for some time. The disruption resulted in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, resulting in material shortages. This, in turn, impacted the manufacturing of various Machine Bench Vices.

- Further, according to UkraineInvest, copper prices escalated to USD 10,845/mt in early March 2022. The Russia-Ukraine War, high energy costs, and stricter emissions standards in Europe have been noted as the primary reasons for the continued shortage of copper.

Machine Bench Vices Market Trends

Automotive Segment to Register Significant Growth

- Machine bench vice usage has increased due to the increasing demand for Automobiles. In recent years, the automotive industry has seen a significant increase in the use of machine bench vices. From die-casting similar components to unibody frame manufacturing, CNC instruments and machines are responsible for most of the parts found in modern cars. Therefore, with the increasing demand in the automotive industry, the demand of the studied market will continue to grow in the years to come.

- For instance, over 1.3 billion motor cars are on the road worldwide, which is predicted to climb to 1.8 billion by 2035. Passenger automobiles account for around 74% of these figures, with light commercial vehicles and large trucks, buses, coaches, and minibusses accounting for the remaining 26%.

- According to OICA (International Organization of Motor Vehicle Manufacturers), China is the world's largest automotive market: Chinese motorists purchased around 26.06 million passenger cars in 2023. India was the second-largest market for passenger cars in Asia.

- Furthermore, Asia-Pacific has the most people of any region. Owing to an increase in urban population and spending power, Asia-Pacific is one of the most important markets for the automobile industry. According to the China Association of Automobile Manufacturers, approximately 965,000 passenger vehicles and 216,000 commercial automobiles were sold in China in April 2022, representing a 48% and 42% decrease from the previous month, respectively. Such massive vehicle sales will allow the studied market to grow.

- Many manufacturers are embracing intelligent factory solutions as the automotive manufacturing landscape evolves. Kurt Workholding, for example, will be introduced to the DX8 vise in March 2022. This new DX8 vise has the same key features as the DX-series vise as the new 8-inch vise platform. The DX8 vise from Kurt is the most recent and most extensive vise in the family of DX CrossOver vise. The DX8 vise combines the top features of the Kort D810 vise and the Kort 3800V vise into one vise with cutting-edge features that redefine precision flatness, parallelism, and repeatability.

Asia Pacific Market to Grow Significantly

- Due to the growing development in manufacturing and R&D activities in various industries across the Asia Pacific countries, the region holds a high market share. Further, the rising number of initiatives taken to ensure the safety of the workers in industries such as metalworking and automotive also support the market growth in the region.

- In metalworking, machine bench vices are most commonly used in high-priced CNC machines, which must operate continuously. As a result, it is essential to minimize setup time. In this context, the clamping system used to secure the workpieces is of the utmost importance, particularly in series production, where the highest degree of automation is required to produce repetitive processing operations cost-effectively. Hydraulic vices are the most essential type of clamping system. They can fix the workpiece in place quickly and with great strength. The constant repetition of clamping can always be accomplished with the same strength.

- India is a rapidly expanding nation in manufacturing industries and machinery, resulting in a high demand for machine bench accessories. The Indian government has implemented various policies to assist companies in establishing manufacturing units. These include the National Manufacturing Policy, which seeks to increase the manufacturing sector's share of GDP to 25% by 2025, and the PLI Scheme for Manufacturing, initiated in 2022 to bring the core manufacturing sector up to international standards.

- Furthermore, the easy availability of labor and the declining prices of components have resulted in manufacturers shifting their production units in this region, further promoting the market. Several critical factors drive adoption in this region, including its proximity to supply and demand regions.

- In addition, setting up manufacturing plants in the Asia-Pacific region has stimulated the use of computer numerical control (CNC), which drives the machine bench vice market. The automotive industry is expected to be one of the fastest-growing segments in the next few years due to the growing automation of automobile manufacturing. The machine bench vice market is expected to be driven by increased efficiency, time efficiency, accuracy, and precision across metalworking industries like the automotive and manufacturing industries.

Machine Bench Vices Industry Overview

The machine bench vices market is fragmented and consists of many players. Regarding market share, some of these important vendors currently manage the market. These influential players with a noticeable share in the market are concentrating on expanding their customer base across foreign countries. The players in the studied market are striving to constantly innovate advanced products to cater to consumers' evolving needs.

- November 2023 - GEARWRENCH expanded their shop equipment product offering, announcing the launch of two new Floor Jacks and four new Jack Stands available now for the professional Automotive Mechanic. In addition, three models of Bench Vises and three Bottle Jack products will be launched at the beginning of 2024.

- August 2023 - German workholding equipment manufacturer Roemheld announced that it will launch a new, mechanically operated, centric (self-centering) machine vice on its stand (E54 in hall 4) at the forthcoming EMO 2023 metalworking trade show in Hannover, 18th - 23rd September. The new Hilma.UC 125 vice is of modular build, intended for 3 to 5-axis prismatic machining applications. The design ensures easy tool access to the workpiece from all sides, allowing the use of short tools for high-precision machining in a single set-up.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the Metalworking Industry

- 5.1.2 Growing Adoption of Advanced Machining Technologies

- 5.2 Market Restraint

- 5.2.1 Increasing Use of Alternative Clamping Technologies

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hydraulic Machine Bench Vices

- 6.1.2 Pneumatic Machine Bench Vices

- 6.2 By Distribution Channel

- 6.2.1 Online

- 6.2.2 Offline

- 6.3 By End-User Industry

- 6.3.1 Manufacturing

- 6.3.2 Automotive

- 6.3.3 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gerardi S.p.A.

- 7.1.2 Kurt Manufacturing Company

- 7.1.3 KITAGAWA

- 7.1.4 Georg Kesel GmbH & Co KG

- 7.1.5 Romheld GmbH Friedrichshutte

- 7.1.6 Raptor Workholding Products

- 7.1.7 Jergens Inc.

- 7.1.8 ALLMATIC-Jakob Spannsysteme

- 7.1.9 OK-VISE

- 7.1.10 LANG Technik GmbH

- 7.1.11 5th Axis Inc.

- 7.1.12 SPREITZER GmbH & Co. KG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219