|

市場調查報告書

商品編碼

1549746

人工智慧管治:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)AI Governance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

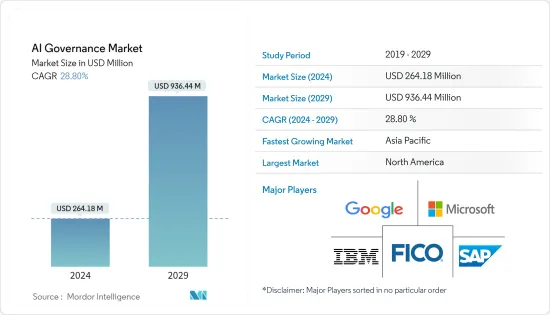

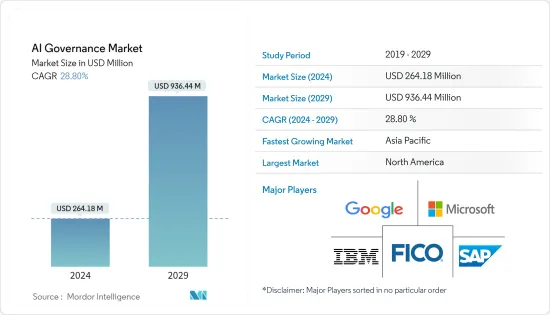

人工智慧管治市場規模預計到 2024 年為 2.6418 億美元,預計到 2029 年將達到 9.3644 億美元,在預測期內(2024-2029 年)複合年成長率為 28.80%。

主要亮點

- 消費者對隱私、濫用和偏見日益成長的擔憂正在推動對人工智慧 (AI)管治的需求。確保提供道德和透明的人工智慧是人工智慧管治的關鍵目標,旨在建立課責、監督和問責結構。

- 公司擴大在業務中利用人工智慧,透過自動化來提高效率並降低成本。

- 此外,消費者對隱私、濫用和偏見日益成長的擔憂正在推動道德和透明人工智慧的發展,並強調課責和監督的必要性。

- 人工智慧和機器學習作為再形成世界的關鍵技術脫穎而出。在當今嚴峻的經濟狀況下,世界各國政府都在努力應對預算緊張和公共資金有限的問題,而人工智慧最佳化資源和解決複雜問題的能力至關重要。

- 人工智慧開發人員、工程師、研究人員和資料科學家是這種情況下最受歡迎的人才。公司必須確定技能差距並確定需要加強的優先領域。

- 疫情帶來的數位化加速,使得人工智慧服務需求急劇增加,並刺激了人工智慧管治市場。據銷售團隊稱,疫情過後,對人工智慧和熟練人工智慧專業人員的需求增加。

人工智慧管治市場趨勢

零售業預計將大幅成長

- 隨著客戶(尤其是數位原民)改變通路偏好和購買行為,全球零售業正經歷重大變革時期。隨著這種數位化轉變,人們越來越關注資料,這對於數位轉型至關重要。

- 如今,有效的人工智慧管理已成為尋求提高績效、解決常見障礙並超越傳統零售競爭對手和敏捷的直接面對消費者品牌的零售商的基石。簡化資料存取的管治對於快速決策至關重要。

- 零售公司正在採用尖端技術,包括人工智慧 (AI) 和機器學習。然而,這些技術的整合必須與強大的道德框架同時進行。制定行為準則不僅可以促進良好的資料管理實踐,還可以指南更廣泛的公司活動。

- 一些零售商在人工智慧之旅的三個關鍵領域表現出色:快速改造和替換現有系統、遵守資料安全法規以及確定戰略優先事項和可用資源之間的微妙平衡。這些成功證實了擴大人工智慧採用的準備。

- 零售商也在增加勞動力,以在全球部署端到端人工智慧解決方案。這項策略舉措不僅提高了業務效率,也帶來了巨大的市場機會。例如,一家大型零售公司最近啟動了一項大規模培訓計劃,旨在提高 40,000 名員工的人工智慧革命技能。

北美佔最大市場佔有率

- 北美作為最早採用人工智慧技術的國家之一,預計將對該市場產生重大影響。例如,美國國家人工智慧研究和發展計畫正在實施人工智慧研究和開發,將道德考量納入研究和開發,同時不影響公眾參與或組織更好的行銷。

- 為了保持市場競爭力,北美的組織,尤其是美國的組織,正在利用人工智慧、機器學習和深度學習技術的所有優勢。該國的經濟十分成熟,使得人工智慧和管治供應商更容易投資新技術。此外,它被認為是創新中心,因為一些最重要的 IT 公司正在引入智慧設備並與人工智慧管治領域的其他公司合作。

- 由於對大規模技術及其對臉部辨識等技術的影響的擔憂,美國人工智慧監管的潛力最近受到了相當大的關注。美國的人工智慧戰略已成為學術界、政策制定者和工業界的重要議題。

- 加拿大的許多組織已經在使用機器學習技術來自動化關鍵業務、產生關鍵見解、升級客戶互動並為策略決策提供資訊。

人工智慧管治產業概況

預計在預測期內,市場競爭對手之間的敵意仍將很高。主要公司包括 IBM Corporation、Google LLC (Alphabet Inc.)、SAP SE、Microsoft Corporation 和 FICO Inc.。

- 2023 年 10 月,IBM 公司收購了 Manta Software Inc.,Manta 的資料處理歷程功能將有助於提高 Watsonx 內部的透明度。這將使公司能夠確定人工智慧模型和系統中使用的資料是否正確、資料來自哪裡、如何資料以及資料流是否存在不一致,支持信任和透明的原則。

- 2023 年 8 月,SAP SE 和 Google Cloud 宣佈建立合作關係,以改善企業利用資料和產生人工智慧的力量。兩家公司將把 Vertex AI 與由 SAP Datasphere 提供支援的整合開放資料雲結合,推出由生成式AI 提供支援的新工業解決方案(從汽車產業開始),並引入新功能來幫助客戶提高永續發展績效。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對人工智慧決策透明度的需求不斷成長

- 擴大政府利用人工智慧技術的舉措

- 市場限制因素

- 人工智慧專業知識和技能不足可能會成為阻礙因素

第6章 市場細分

- 按成分

- 解決方案

- 服務

- 按發展

- 本地

- 雲

- 按最終用戶產業

- 衛生保健

- 政府/國防

- 車

- 零售

- BFSI

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Google LLC(Alphabet Inc.)

- SAP SE

- Microsoft Corporation

- FICO Inc.

- Salesforce.com Inc.

- Pymetrics Inc.

- SAS Institute Inc.

- H2O.ai Inc.

- Integrate.ai Inc.

- Facebook Inc.(Meta Platforms Inc.)

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 69583

The AI Governance Market size is estimated at USD 264.18 million in 2024, and is expected to reach USD 936.44 million by 2029, growing at a CAGR of 28.80% during the forecast period (2024-2029).

Key Highlights

- Increasing consumer concerns over privacy, abuse, and bias are propelling the demand for artificial intelligence (AI) governance. Ensuring the delivery of ethical and transparent AI stands as a primary objective of AI governance, aiming to establish accountability, oversight, and responsibility.

- Businesses are increasingly leveraging AI in their operations to boost efficiency and cut costs through automation.

- Furthermore, the heightened consumer focus on privacy, misuse, and bias drives the push for ethical and transparent AI, emphasizing the need for accountability and oversight.

- Artificial intelligence and machine learning stand out as pivotal technologies reshaping the world. In today's challenging economic landscape, where governments globally grapple with tight budgets and limited public funding, AI's ability to optimize resources and tackle complex issues is paramount.

- AI developers, engineers, researchers, and data scientists are the most sought-after talents in this landscape. Enterprises must pinpoint skill gaps and prioritize areas for enhancement.

- The accelerated digitization due to the pandemic has spiked the demand for AI services, fueling the AI governance market. According to Salesforce, the need for AI and skilled AI professionals increased post-pandemic.

AI Governance Market Trends

The Retail Sector is Expected to Witness Significant Growth

- The global retail sector is undergoing a significant transformation as customers, especially digital natives, alter their channel preferences and purchasing behaviors. With this digital shift, the focus on data, crucial for digital transformation, has intensified.

- Effective AI management is now a cornerstone for retailers looking to enhance their performance, tackle common hurdles, and outpace both traditional retail rivals and agile direct-to-consumer brands. Governance, streamlining data access, is pivotal for swift decision-making.

- Retailers are embracing cutting-edge technologies, notably artificial intelligence (AI) and machine learning. However, as they integrate these technologies, they must do so alongside robust ethics frameworks. Crafting a code of conduct not only fosters good data management practices but also guides the broader spectrum of company activities.

- Some retailers have excelled in three critical areas on their AI journey: swiftly transforming and replacing existing systems, adhering to data security regulations, and finding the delicate balance between strategic priorities and available resources. These successes underscore their readiness for increased AI adoption.

- Retailers are also gearing up their workforce for the global deployment of end-to-end AI solutions. This strategic move not only enhances their operational efficiency but also opens up significant market opportunities. For instance, a major retailer recently launched an extensive training program to upskill its 40,000 employees for the AI revolution.

North America Holds Largest Market Share

- North America, one of the first countries to adopt artificial intelligence technologies, is expected to have an enormous impact on this market. For example, in order to help organizations across the country incorporate ethical considerations into research and development without compromising public involvement and better marketing of an organization, the US National Artificial Intelligence Research and Development Plan recommended the development of a framework for the implementation of AI research and development.

- In order to remain competitive in the market, North American organizations, especially those based in the United States, make use of all the benefits of AI, ML, and Deep Learning technology. The country's economy is well established, making it easier for AI and governance vendors to make investments in new technologies. Moreover, the fact that some of the most important IT firms are introducing intelligent devices and working together with others in the area of AI governance is considered to be a hub for innovation.

- The potential of AI regulation in the United States has been given considerable attention recently due to concerns regarding large tech, as well as impacts on technologies such as facial recognition. The US strategy for artificial intelligence has been an important topic for academics, policymakers, and industry.

- Many Canadian organizations are already using machine-learning tech to automate key operations, generate critical insights, upgrade customer interactions, and inform strategic decisions.

AI Governance Industry Overview

The intensity of competitive rivalry in the market is expected to remain high during the forecast period. Major players include IBM Corporation, Google LLC (Alphabet Inc.), SAP SE, Microsoft Corporation, and FICO Inc.

- October 2023: IBM Corporation acquired Manta Software Inc., with Manta's data lineage capabilities helping increase transparency within Watsonx. This will allow businesses to determine whether the right data was used for their AI models and systems, where it originated, how it has evolved, and any discrepancies in data flows and help deliver products that are built on principles of trust and transparency.

- August 2023: SAP SE and Google Cloud announced a partnership in order to improve the enterprises harness the power of data and generative AI, where the companies will combine their integrated open data cloud using SAP Datasphere with Vertex AI to launch new generative AI-powered industry solutions starting with automotive and introduce new capabilities to help customers improve sustainability performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Transparency in AI Decision Making

- 5.1.2 Expanding Government Initiatives to Leverage the AI Technology

- 5.2 Market Restraints

- 5.2.1 Inadequate AI Expertise and Skills can Act as a Restraint

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Service

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-user Vertical

- 6.3.1 Healthcare

- 6.3.2 Government and Defense

- 6.3.3 Automotive

- 6.3.4 Retail

- 6.3.5 BFSI

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 SAP SE

- 7.1.4 Microsoft Corporation

- 7.1.5 FICO Inc.

- 7.1.6 Salesforce.com Inc.

- 7.1.7 Pymetrics Inc.

- 7.1.8 SAS Institute Inc.

- 7.1.9 H2O.ai Inc.

- 7.1.10 Integrate.ai Inc.

- 7.1.11 Facebook Inc. (Meta Platforms Inc.)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219