|

市場調查報告書

商品編碼

1689722

永續包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Sustainable Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

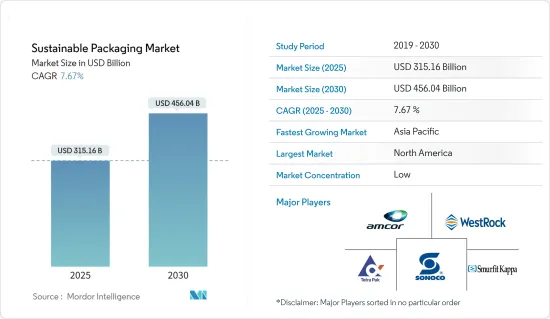

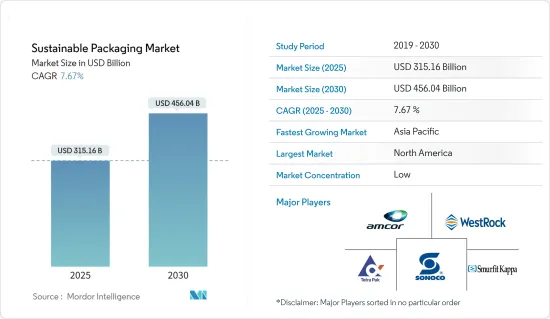

永續包裝市場規模預計在 2025 年為 3,151.6 億美元,預計到 2030 年將達到 4,560.4 億美元,預測期內(2025-2030 年)的複合年成長率為 7.67%。

關鍵亮點

- 永續包裝涉及開發和使用增強永續性的包裝解決方案。他們嚴重依賴生命週期評估和清單來指導決策並最大限度地減少環境影響。

- 近年來,消費者對永續性的興趣顯著增加。循環經濟的興起進一步凸顯了永續包裝的重要性。為了回應民眾對包裝廢棄物(尤其是一次性塑膠)的擔憂,世界各國政府正在製定嚴格的法規,以遏制環境破壞並改善廢棄物管理。

- 法國、德國和英國等國家處於領先地位,它們不僅在歐盟內部實施了強力的回收措施,而且還採用了生產者延伸責任制(EPR)。在亞洲,泰國從2020年1月1日起在全國範圍內禁止在主要商店使用一次性塑膠袋,最終目標是減少塑膠污染。

- 根據海洋保護協會的統計,每年有 800 萬噸塑膠進入海洋,而目前海洋中的塑膠總量約為 1.5 億噸。這是一個嚴重的問題。換個角度來看,這就相當於一年內每分鐘向海洋中傾倒一輛紐約市垃圾車的塑膠。調查顯示,2025年是環保包裝的關鍵一年,超過40%的受訪者計畫採用創新、永續的包裝技術。公司擴大轉向循環經濟,使用可堆肥和生物分解性的材料,並重新設計包裝以減少廢棄物。

- 然而,既不可回收又生物分解的塑膠包裝的使用正在增加,加劇了我們的碳排放。作為回應,亞馬遜、谷歌和利樂等大公司都設定了實現淨零碳排放的雄心勃勃的目標,預計此舉將需要大量的資本投入。

永續包裝市場的趨勢

再生包裝佔據了大部分市場佔有率

- 消費者對永續產品的需求不斷成長,推動了再生包裝的成長。隨著環保意識的增強,消費者正在積極尋找優先考慮永續性,尤其是在包裝選擇方面。這種消費者轉變促使各領域的企業轉向再生包裝,以滿足消費者的期望並增強企業的社會責任。同時,回收技術的進步正在簡化回收材料與包裝的結合,使製造商更具成本效益,進一步推動市場成長。

- 全球政府和監管機構在再生包裝市場的擴張中發揮著至關重要的作用。他們制定了嚴格的法規和政策,重點是控制塑膠廢棄物和促進回收。特別是,歐盟循環經濟行動計畫等措施以及美國和加拿大等國家減少塑膠廢棄物的授權正在引導企業投資永續包裝。這些指令不僅要求使用再生材料,還鼓勵包裝設計和材料科學的創新,旨在提高可回收性並最大限度地減少對環境的影響。

- 回收過程中的技術進步對於再生包裝市場的成長至關重要。化學回收等創新技術將塑膠分解成其原始單體,為包裝中的高品質再生材料鋪平了道路。這些進步解決了傳統機械回收的局限性,例如材料劣化和某些塑膠的可回收性有限。隨著技術的不斷進步,再生包裝的品質和功效正在提高,預計將進一步刺激市場需求。

- 企業越來越意識到回收包裝的經濟效益。透過採用再生材料,公司可以減少對原始資源的依賴,降低生產成本並為供應鏈中斷做好準備。此外,採用再生包裝的品牌不僅能引起有環保意識的消費者的共鳴,還能使自己與競爭對手區分開來,並增加吸引力。因此,包裝領域的大小企業都在大力投資再生包裝解決方案,支持市場強勁的成長軌跡。

亞太地區:預計市場將大幅成長

- 中國各大電商和宅配服務都在積極致力於減少包裝材料。例如,順豐速運推出可回收包裝箱,每個包裝箱可回收約10次。順豐速運已在全國各大城市部署超過10萬個包裝箱,其中包括一線城市和多個二線城市。其主要用途是取代傳統的紙盒和塑膠袋,減少發泡塊和膠帶的使用。順豐強調,這些努力符合推動中國永續物流發展的目標。該公司還投資研發,以創造更耐用、更環保的包裝解決方案,確保其使用的材料能夠承受重複使用,而不會損害內容物的安全性和完整性。

- 印度中產階級的崛起、有組織的零售業的快速擴張、出口的成長以及電子商務產業的蓬勃發展都為所研究市場的成長鋪平了道路。但這種成長需要環保包裝,以確保一流的品質,同時最大限度地減少對環境的影響。因此,企業採用永續包裝方式正成為重中之重。越來越多的公司開始使用生物分解性的材料,減少塑膠的使用,並引入創新設計以最大程度地減少廢棄物。此外,政府法規和消費者意識正在推動向更環保的包裝解決方案轉變,許多公司設定了雄心勃勃的永續性目標以滿足這些新標準。

- Capgemini SA最近的一項研究深入探討了永續性和不斷變化的消費行為。調查顯示,79% 的消費者正在改變他們的購買模式,主要是出於社會責任、整體性和環境的考量。值得注意的是,53% 的消費者和 57% 的 18-24 歲年輕人被不太知名的品牌所吸引,因為它們是環保的。此外,超過一半的受訪者(52%)表示對優先考慮永續性的公司有情感連結。調查也強調,消費者願意為永續包裝的產品支付溢價,顯示市場對環保產品的需求強勁。適應這些偏好的品牌可以避免將市場佔有率拱手讓給更有環保意識的競爭對手。

- 該地區的主要企業處於創新的前沿,推動著永續包裝市場的成長。這些創新包括開發植物來源塑膠等新材料、先進的回收技術和智慧包裝解決方案,以延長產品保存期限,同時減少對環境的影響。產業領袖、新興企業和研究機構之間的合作努力也正在培養包裝產業持續改進和永續性的文化。

永續包裝產業概覽

永續包裝市場高度分散,主要企業包括 Amcor Limited、TetraPak International SA、WestRock Company、Smurfit Kappa Group PLC 和 Sonoco Products Company。

- 2024年5月,安姆可與化妝品主要企業雅芳宣佈在中國推出雅芳沐浴凝膠黑裙沐浴露填充用裝Amplima Plus。這項策略性舉措旨在減少碳排放和水消費量。

- 2024年3月,提供印刷包裝解決方案的全球公司TOPPAN推出了基於雙軸延伸聚丙烯(BOPP)的阻隔膜“GL-SP”,徹底改變了永續包裝。該新產品加入了 GL BARRIER 系列,該系列以其透明沉澱阻隔膜而聞名,擁有世界領先的市場佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭強度

- 替代品的威脅

- 評估微觀經濟因素對產業的影響

第5章市場動態

- 市場促進因素

- 政府推動永續包裝的舉措

- 縮小包裝尺寸

- 消費者偏好轉向可回收和環保材料

- 市場限制

- 製造工廠產能限制

- 原料高成本

第6章市場區隔

- 按工藝

- 可重複使用的包裝

- 可分解包裝

- 再生包裝

- 依材料類型

- 玻璃

- 塑膠

- 金屬

- 紙

- 按最終用戶

- 製藥和醫療

- 化妝品和個人護理

- 飲食

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Amcor Limited

- Westrock Company

- TetraPak International SA

- Sonoco Products Company

- Smurfit Kappa Group PLC

- Sealed Air Corporation

- Mondi PLC

- Huhtamaki OYJ

- BASF SE

- Ardagh Group SA

- Ball Corporation

- Crown Holdings Inc.

- DS Smith PLC

- Genpak LLC

- International Paper Company

第8章投資分析

第9章 市場展望

The Sustainable Packaging Market size is estimated at USD 315.16 billion in 2025, and is expected to reach USD 456.04 billion by 2030, at a CAGR of 7.67% during the forecast period (2025-2030).

Key Highlights

- Sustainable packaging involves developing and utilizing packaging solutions that enhance sustainability. It relies heavily on life cycle assessments and inventories to guide decisions and minimize environmental impact.

- In recent years, consumer interest in sustainability has surged significantly. The rise of circular economics has further underscored the importance of sustainable packaging. Governments worldwide, responding to public concerns over packaging waste, particularly single-use plastics, are enacting stringent regulations to curb environmental harm and bolster waste management.

- Leading the charge, countries like France, Germany, and the United Kingdom are not only enforcing robust recycling measures within the European Union but are also adopting extended producer responsibilities (EPRs). In Asia, Thailand implemented a nationwide ban on single-use plastic bags in major stores starting January 1, 2020, with the ultimate goal of reducing plastic pollution.

- According to the Ocean Conservancy statistics, 8 million metric tons of plastic enter the oceans annually, adding to the estimated 150 million metric tons already present. This is a critical issue. To put this in perspective, it is akin to dumping a New York City garbage truck's load of plastic into the ocean every minute for a year. The survey identifies 2025 as a pivotal year for eco-friendly packaging, with over 40% of respondents planning to adopt innovative and sustainable packaging techniques. Companies are increasingly pivoting toward a circular economy, utilizing compostable materials and biodegradables and rethinking container designs to reduce waste.

- However, the use of non-recyclable, non-biodegradable plastic packaging is on the rise, exacerbating carbon emissions. In response, major corporations like Amazon, Google, and Tetrapak are setting ambitious targets, aiming for net-zero carbon emissions, a move expected to entail significant capital investments.

Sustainable Packaging Market Trends

The Recycled Packaging Segment to Hold Significant Share in Market

- Increasing consumer demand for sustainable products is driving the growth of recycled packaging. As environmental awareness rises, consumers are actively seeking brands that prioritize sustainability, particularly in their packaging choices. This consumer shift is compelling companies across sectors to pivot toward recycled packaging, aligning with both consumer expectations and bolstering their corporate social responsibility standings. Simultaneously, advancements in recycling technologies are streamlining the incorporation of recycled materials into packaging, enhancing cost-effectiveness for manufacturers, and further amplifying market growth.

- Global governments and regulatory bodies are pivotal in expanding the recycled packaging market. They are enacting stringent regulations and policies, with a primary focus on curbing plastic waste and promoting recycling. Notably, initiatives like the European Union's Circular Economy Action Plan and plastic waste reduction mandates in countries like the United States and Canada are nudging companies toward sustainable packaging investments. These directives not only mandate the use of recycled materials but also foster innovation in packaging design and material science, aiming to bolster recyclability and minimize environmental footprints.

- Technological strides in recycling processes are pivotal for the growth of the recycled packaging market. Innovations like chemical recycling, which breaks down plastics into their original monomers, are paving the way for high-quality recycled materials in packaging. These advancements are addressing limitations seen in traditional mechanical recycling, like material degradation and the restricted recyclability of certain plastics. With ongoing technological evolution, the quality and efficacy of recycled packaging are poised to elevate, further stoking market demand.

- Businesses are increasingly recognizing the economic merits of recycled packaging. By embracing recycled materials, companies can diminish their dependence on virgin resources, trim production costs, and buffer themselves against supply chain disruptions. Moreover, brands adopting recycled packaging not only resonate with environmentally conscious consumers but also carve out a distinct niche from their competitors, bolstering their market appeal. Consequently, both major players and smaller enterprises in the packaging realm are channeling substantial investments into recycled packaging solutions, underpinning the market's robust growth trajectory.

Asia-Pacific Expected to Register Significant Market Growth

- Chinese e-commerce giants and express delivery services are actively cutting down on packaging materials. For example, SF Express introduced recyclable packaging boxes, each capable of being recycled approximately ten times. In major cities, including first-tier and several second-tier ones, the company deployed over 100,000 of these boxes. Its primary aim is to replace traditional paper boxes and plastic bags, thereby reducing the usage of foam blocks and tape. SF Express emphasized that these efforts align with China's push for sustainable logistics growth. The company has also invested in research and development to create more durable and eco-friendly packaging solutions, ensuring that the materials used can withstand multiple cycles of use without compromising the safety and integrity of the contents.

- The rise of India's middle class, the rapid expansion of organized retail, increasing exports, and the booming e-commerce industry are all paving the way for the growth of the market studied. This growth, however, necessitates environmentally friendly packaging that ensures top-notch quality with minimal environmental repercussions. Consequently, the adoption of sustainable packaging practices by companies is gaining paramount importance. Companies are increasingly focusing on biodegradable materials, reducing plastic usage, and implementing innovative designs that minimize waste. Additionally, government regulations and consumer awareness are driving the shift toward greener packaging solutions, with many firms setting ambitious sustainability targets to meet these new standards.

- A recent survey by Capgemini delved into sustainability and changing consumer behavior. It revealed that 79% of consumers are altering their buying patterns, primarily driven by social responsibility, inclusivity, and environmental concerns. Notably, 53% of all consumers and a significant 57% of those aged 18 to 24 are gravitating toward lesser-known brands due to their eco-friendliness. Moreover, over half (52%) of respondents expressed an emotional connection with businesses prioritizing sustainability. The survey also highlighted that consumers are willing to pay a premium for sustainably packaged products, indicating a strong market demand for eco-friendly options. Brands that adapt to these preferences avoid losing market share to more environmentally conscious competitors.

- Key players in the region are spearheading innovations, propelling the growth of the sustainable packaging market. These innovations include the development of new materials such as plant-based plastics, advanced recycling technologies, and smart packaging solutions that enhance product shelf life while reducing environmental impact. Collaborative efforts between industry leaders, startups, and research institutions are also fostering a culture of continuous improvement and sustainability in the packaging industry.

Sustainable Packaging Industry Overview

The sustainable packaging market exhibits a high degree of fragmentation, with prominent players such as Amcor Limited, TetraPak International SA, WestRock Company, Smurfit Kappa Group PLC, and Sonoco Products Company. These companies are actively engaged in developing innovative and eco-friendly packaging solutions to meet the growing demand for sustainable practices. They invest significantly in research and development to enhance the recyclability and biodegradability of their products, striving to reduce the environmental impact of packaging materials. Additionally, these key players often collaborate with other stakeholders in the supply chain to encourage sustainability and adhere to stringent regulatory standards.

- May 2024: Amcor and AVON, a leading cosmetics company, announced the launch of the AmPrima Plus refill pouch for AVON's Little Black Dress shower gels in China. This strategic initiative aims to reduce both carbon footprint and water consumption.

- March 2024: TOPPAN, a global player in printing and packaging solutions, revolutionized sustainable packaging with the launch of GL-SP, a barrier film utilizing biaxially oriented polypropylene (BOPP) as the substrate. This new product has been added to the GL BARRIER series, renowned for its transparent vapor-deposited barrier films, which hold a leading share in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness: Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of Microeconomic Factors on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Initiatives Toward Sustainable Packaging

- 5.1.2 Downsizing of Packaging

- 5.1.3 Shift in Consumer Preferences Toward Recyclable and Eco-friendly Materials

- 5.2 Market Restraints

- 5.2.1 Capacity Constraint of Manufacturing Plants

- 5.2.2 High Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 Reusable Packaging

- 6.1.2 Degradable Packaging

- 6.1.3 Recycled Packaging

- 6.2 By Material Type

- 6.2.1 Glass

- 6.2.2 Plastic

- 6.2.3 Metal

- 6.2.4 Paper

- 6.3 By End User

- 6.3.1 Pharmaceutical and Healthcare

- 6.3.2 Cosmetics and Personal Care

- 6.3.3 Food and Beverage

- 6.3.4 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Westrock Company

- 7.1.3 TetraPak International SA

- 7.1.4 Sonoco Products Company

- 7.1.5 Smurfit Kappa Group PLC

- 7.1.6 Sealed Air Corporation

- 7.1.7 Mondi PLC

- 7.1.8 Huhtamaki OYJ

- 7.1.9 BASF SE

- 7.1.10 Ardagh Group SA

- 7.1.11 Ball Corporation

- 7.1.12 Crown Holdings Inc.

- 7.1.13 DS Smith PLC

- 7.1.14 Genpak LLC

- 7.1.15 International Paper Company